Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

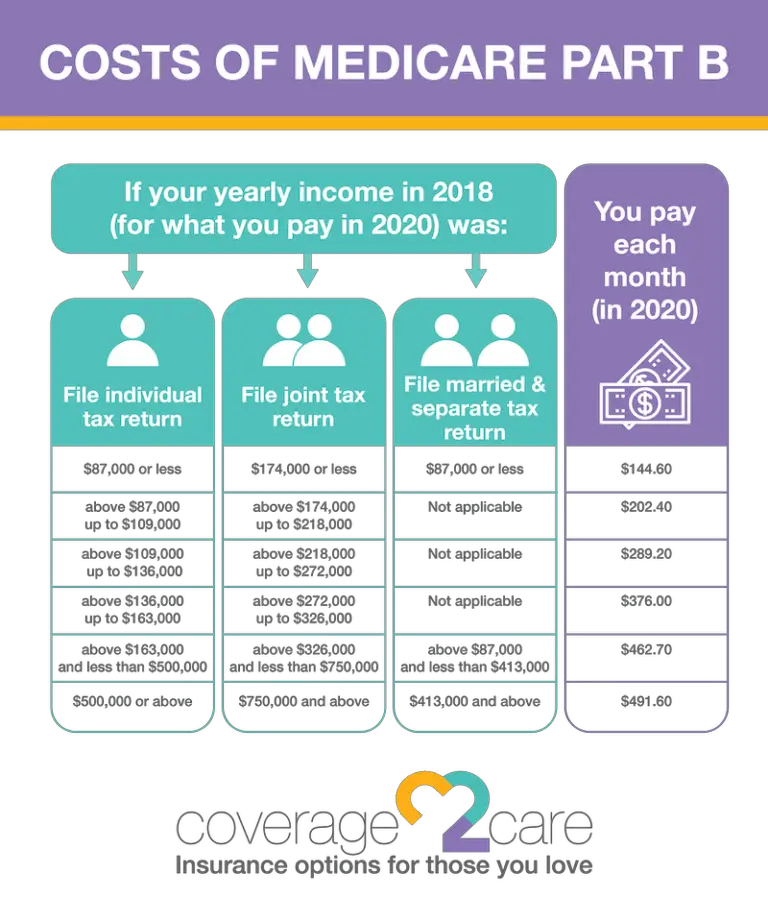

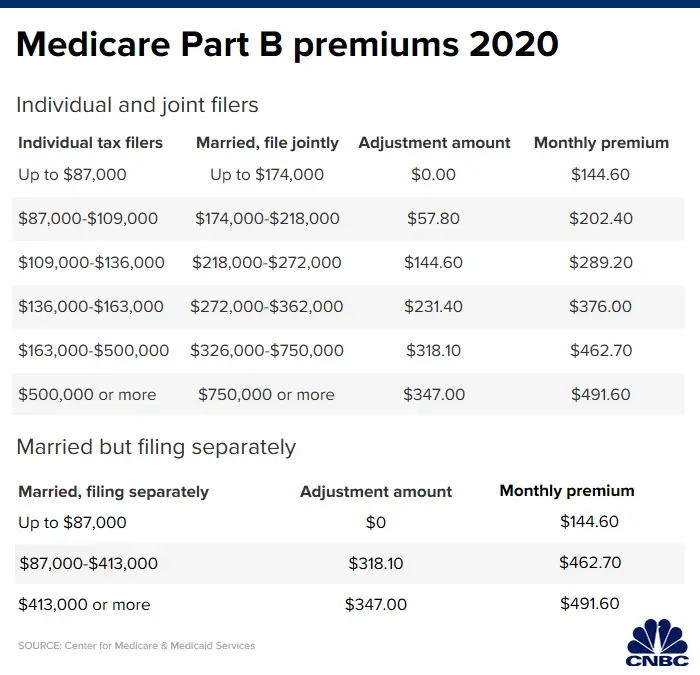

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Total monthly Part B premium by tax return| Filing individual tax returns | Total monthly Part B premium |

|---|---|

|

$91,000 or less |

|

|

$750,000 or more |

$578.30 |

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.1

Total Part B monthly premiums by tax return for married filing separately| Total monthly Part B premium |

|---|

|

$91,000 or less |

|

$578.30 |

Is Medicare Part B Free

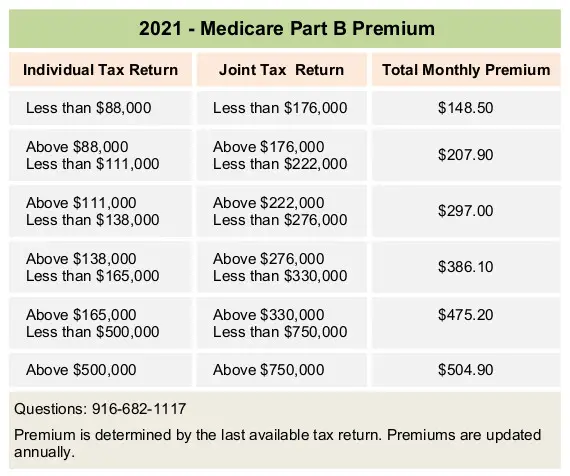

Medicare Part B premiums may change from one year to another contingent upon your financial circumstances. For some individuals, the premium is consequently deducted from their Social Security benefits. The standard month-to-month Part B premium: $148.50 in 2021. Moreover, in the event that your pay surpasses a specific sum, your premium could be higher than the standard premium, as there are diverse premiums for various pay levels.

In case you are getting Social Security, Railroad Retirement Board, or government retirement benefits, your Part B premium will be deducted straightforwardly from your month-to-month benefit. If not, you will be sent a bill at regular intervals. The tables given above show the Medicare Part B month-to-month premium sums, in view of your detailed pay. These sums might change every year. A late enrollment penalty might be appropriate on the off chance that you didnt pursue Medicare Part B when you were first qualified. In addition to this, your month-to-month premium might be 10% higher for every year-long time frame that you were qualified in but didnt try out Part B.

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

Also Check: Is Medicare A And B Free

What Do Medicare Parts A And B Cover

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation and some home health care services.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

Medicare Part D helps cover prescription drug costs.

For more information, here’s what to know about signing up for an Affordable Care Act plan.

Get the So Money by CNET newsletter

The Medicare Part B Penalty

Its extremely important to sign up for Medicare Part B on time. If you decide not to sign up for Part B at age 65 when you become eligible and later change your mind, youll pay an extra 10% above the standard premium cost for every 12-month period you delayed

If you have additional questions about Medicare, visit Medicare.gov or call 800-MEDICARE .

If youre already receiving Social Security or Railroad Retirement Board benefits, youll automatically start receiving Original Medicare, Part A and Part B, the month you turn 65.

Everyone else must choose among these enrollment period options:

-

Initial enrollment period: This is the seven-month period starting three months before the month you turn 65, including your birthday month and ending three months after your birthday month. So if you turn 65 in July, youll have from April 1 to Oct. 31 to enroll.

-

Special enrollment period: This is when youre allowed to join Medicare or make changes to your coverage based on specific life events, such as leaving a job or moving out of your plans coverage area.

-

General enrollment period: This runs from Jan. 1 through March 31 every year and is the time when people who are already receiving Medicare benefits can make limited changes to their coverage. Its also when people who miss the deadline for initial enrollment can sign up.

That said, not all providers accept Medicare as full payment. Medicare classifies health care providers three ways:

Recommended Reading: Can A Person Get Medicare At Age 62

Medicare Price Changes In 202: Part B Premiums Are Getting Cheaper

Medicare premium costs are changing next year. We’ll explain how much.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

In 2023, Medicare Part B premium prices will be cheaper, while Part A premiums and deductibles are getting slightly more expensive. This is because the Social Security Administration each year adjusts costs associated with the Medicare program by raising or lowering premiums and deductibles using rules set out in the Social Security Act.

The income brackets and amounts for adjustments to Part D prescription drug coverage have also been slightly revised. Additionally, if you receive Social Security payments, the cost-of-living benefits increase for 2023 has been announced. “This means that seniors will have a chance to get ahead of inflation, due to the rare combination of rising benefits and falling premiums,” press secretary Karine Jean-Pierre said during a White House briefing.

Here’s how much the prices will go down for those who receive Medicare Part B and what the new costs will be next year. Note: The open enrollment period for Medicare ends Dec. 7.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Read Also: What Is A Medicare Supplement Insurance Plan

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

How To Apply For Medicare Part B

If youre already receiving Social Security benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65.

Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65. You can also sign up for Medicare during Medicare Open Enrollment, which lasts from October 15th until December 7th.

You can apply by visiting your local Social Security office, calling Medicare at 1-800-772-1213, or simply filling out an application online at the Social Security Administration website. Here is a step-by-step guide to applying for Medicare.

Read Also: How To Pay For Medicare Without Social Security

Medicare Part B Eligibility

To enroll in Medicare Part B, you must meet specific criteria by the Center for Medicare and Medicaid Services .

If you receive Medicare Part A, you are eligible for Medicare Part B by enrolling and paying the monthly premium.

However, if you are new to Medicare, you must meet the following criteria:

- Must be a U.S. citizen for at least five years

AND one of the following

- Age 65 or older

- Under 65 and receiving Social Security disability benefits for at least 24 months

- Diagnosed with Amyotrophic Lateral Sclerosis

- Diagnosed with End-Stage Renal Disease

If you meet the above requirements, you are eligible to enroll in Medicare Part B.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Listen to this Podcast Episode Now!

What Costs Are Not Covered By Medicare Part A

Depending on the circumstances, a private room in a skilled nursing facility or a hospital may be available. It is the responsibility of the individual to provide nursing care in their own home. Unless a skilled nursing facility or hospital provides these free of charge, you must have a television or telephone in your room, as well as personal items such as razors or slipper socks.

Also Check: Why Have I Not Received My Medicare Card

When Can I Enroll In Plan A And Plan B

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period The Initial Enrollment Period is the seven-month period around your 65th birthday when most people are eligible for the first time to enroll in Medicare.. To figure out your IEP, follow the seven-month rule your enrollment window includes the three full calendar months before the month you turn 65. It remains open during your birth month, and the three months after. For example: If your birthday is in June, your seven-month window will open Mar. 1 and close Sept. 30.

3 months before your 65th birthday: May, April, MarchYour birth month: 3 months after you turn 65: July, August, September

If you missed your IEP, there are other enrollment periods available. You may be eligible for a Special Enrollment Period due to a Qualifying Life Event Qualifying Life Events are life changes that allow you to enroll in a new health insurance plan during a Special Enrollment Period. These include having or adopting a child, losing other coverage, marriage, a change of income and moving.. There is also a designated time to change your Medicare plan. Learn all about Medicares different enrollment periods and how GoHealth can help you.

Does Medicare Part A And B Cover 100 Percent

Most medically necessary inpatient care is covered by Medicare Part A. There is generally no Medicare reimbursement once youve exhausted your lifetime reserve days you may pay 100% of the charges. Medicare reimbursement is also not available for long-term care or custodial care in a nursing facility.

What kinds of expenses Does Medicare Part B Cover?

Part B covers things like:

- Clinical research.

- Mental health. Inpatient. Outpatient. Partial hospitalization.

- Limited outpatient prescription drugs.

Does Medicare Part A and B cover all medical expenses?

Specifically, all Medicare Parts A, B, and D services and all Medi-Cal services, including long-term care services and supports, are covered by one plan. Vision and transportation benefits will are included.

Don’t Miss: What Does Medicare A And B Not Cover

Where Do I Find A List Of Drugs Covered By Medicare Part D

Medicare Part D drug coverage can vary from one plan to another. The list of drugs covered by a Part D plan is called a formulary.

Part D plans typically cover a wide range of drugs. And while the formularies can vary by plan, there are certain drugs that must be covered by every Part D plan, such as cancer drugs or HIV/AIDS medications.

Part D plans cover both generic and name brand drugs and typically do so at different tiers. Common generic drugs are typically placed into a lower tier and typically covered at a lower cost, while rare or brand name drugs are placed into a higher tier and may require more costs to the beneficiary.

Each plans formulary can usually be found along with its summary of benefits. When shopping for a Part D plan , the drug formulary should be listed alongside the other plan details.

Its important to note that a plans formulary can change every year as drugs may be added to or dropped from a particular plans benefits, or a drug may be moved to a different coverage tier.

If there is a specific drug you want to obtain coverage for, contact a licensed insurance agent and they will be able to gather up the plans available in your area that provide coverage for your medication.

Medicare Part B Coinsurance

Once you meet your deductible, youll pay 20% of all Medicare-approved services you receive. Services can include doctor services, outpatient therapy and durable medical equipment.

For example: If your doctor charges $100 for visits, youll pay 20% after youve met your deductible.

Are you eligible for cost-saving Medicare subsidies?

You May Like: When Is The Special Enrollment Period For Medicare

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

What Are Medicare Costs

It’s not just about premiums. Many Americans find that qualifying for Medicare eases some financial stress, as its possible to pay less and get more. However, there are still expenses you should be aware of.

Take a moment to familiarize yourself with the out-of-pocket costs associated with Medicare Parts A, B, C, and D, so that you can select a plan that is best suited for the type of retirement youre planning on. All costs listed here apply for 2022.

Don’t Miss: Is Skyrizi Covered By Medicare

What Does Original Medicare Part B Cover

While Original Medicare Part A, with its coverage for hospital visits and skilled nursing care, can help you manage the big stuff, thats only part of the picture. Original Medicare Part B helps you get the care you need for a lot of the other stuff that requires a doctors care. And you can receive care from any doctor who accepts Medicare patients.

Original Medicare Part B helps cover:

- Medically necessary doctors services

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage or get Extra Help, youll likely pay a late enrollment penalty if you join a plan later. Generally, youll pay this penalty for as long as you have Medicare prescription drug coverage. To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

There are two ways to get Medicare prescription drug coverage:

- Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service plans, and Medicare Medical Savings Account plans. You must have Part A and/or Part B to join a Medicare Prescription Drug Plan.

- Medicare Advantage Plans or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called MA-PDs. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

Also Check: What Is Medicare Part F Supplemental Insurance

Does Medicare Cover Back Braces

High quality braces can be costly, but Medicare may help cover the cost of a back brace. Medicare Part B Coverage for Back Braces Medicare Part B covers medically necessary back braces under the durable medical equipment prefabricated orthotics benefit.

What does Medicare cover for back surgery?

Original Medicare Part A, also known as hospital insurance, provides coverage for inpatient hospital procedures, but Part B may also contribute to covering certain costs associated with back surgery.

Does Medicare Part B cover knee replacement?

Your plan may cover an alternative to knee replacement like therapy, using a brace, or injections. Part B covers 80% of the approved amount for Durable Medical Equipment, vaccinations, and therapeutic services. A prescription from your doctor is generally adequate for coverage.

Read Also: Does Medicare Pay For Someone To Help At Home

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Don’t Miss: Are Visiting Angels Covered By Medicare