Cms Announces 2022 Medicare Part B Premiums

Today, the Centers for Medicare & Medicaid Services released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts. Most people with Medicare will see a 5.9 percent cost-of-living adjustment in their 2022 Social Security benefitsthe largest COLA in 30 years. This significant COLA increase will more than cover the increase in the Medicare Part B monthly premium.

Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

CMS is committed to ensuring high quality care and affordable coverage for those who rely on Medicare today, while protecting Medicares sustainability for future generations,” said CMS Administrator Chiquita Brooks-LaSure. The increase in the Part B premium for 2022 is continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program. The Biden-Harris Administration is working to make drug prices more affordable and equitable for all Americans, and to advance drug pricing reform through competition, innovation, and transparency.

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Medicare Part D Prescription Drug Plans

2022 Part D Monthly Premiums:

- The average monthly premium on a basic Part D plan is expected to be $31.47. Enhanced plans will be about $43 per month.

- High-income beneficiaries pay a higher Part D premium.

2022 Medicare Part D Deductible:

- The maximum Part D deductible in 2022 is $480.

2022 Medicare Part D Out-of-Pocket Costs:

- Not to exceed 25 percent of the cost of brand-name and generic costs.

- The dreaded donut hole is finally gone at the pharmacy. However, a gap still exists when it comes to planning copays and coinsurance that affects how total drug costs are calculated and who covers the bulk of the cost of the drugs .

- The catastrophic coverage threshold is $7,050.

- Additional out-of-pocket costs in catastrophic coverage are capped at the greater of 5 percent of the cost of the drug or a copay of $3.95 for generics and

- $9.85 for brand-name drugs.

- All plans now cover a broad range of insulin for $35 or less per month.

You May Like: How To Choose Best Medicare Part D Plan

Premiums For Medicare Advantage Plans With Prescription Drug Coverage

In 2021, the average monthly premium for plans that include Medicare Part D prescription drug benefits is $21 according to the Kaiser Family Foundation.3 The average monthly premium is weighted by enrollment. That means most people are selecting the lower-priced plans on an overall basis.

Below are the average 2021 monthly premiums for some of the different types of plans .3

| Plan Type |

|---|

| $25 |

When Does Medicare Start Your Coverage If You Sign Up For A Medicare Advantage Plan

If you sign up during your Medicare Initial Enrollment Period, your Medicare Advantage coverage usually starts at the same time your Original Medicare coverage would start, as described above. For example, if you enroll in Medicare Advantage during the three-month period before you turn 65, your plan would start coverage the first day of your birthday month.

If you sign up for a Medicare Advantage plan during the Annual Election Period , your plan coverage usually starts January 1 of the next year. The same is true if you change plans.

If you switch from one Medicare Advantage plan to another during the Medicare Advantage Open Enrollment Period , generally your new coverage starts the first of the month after the plan gets your request.

When does Medicare start? Your coverage if you sign up for a stand-alone Medicare Part D prescription drug plan

Your coverage start date will generally be the same as for a Medicare Advantage plan as described above. However, the Medicare Advantage Open Enrollment Period doesnt always apply to stand-alone Medicare Part D prescription drugs plans.

Don’t Miss: How To Get Medicare For Free

What You Cant Do During Medicares Open Enrollment Period

Medicares Annual Enrollment Period only applies to Medicare Advantage and Medicare Part D plans. Medicare Supplement plans, which in most states, only have guaranteed-issue rights during your initial enrollment periodThe Initial Enrollment Period is a seven-month period when new beneficiaries can enroll in Medicare without a penalty. Most people enroll in Medicare at age 65…. and special enrollment periodsEnrollment periods are designated time periods to enroll or disenroll from the various parts of Medicare. There are six Medicare enrollment periods…..

This simply means that if you failed to get enrolled when you were first eligible for Medicare, you wont be able to enroll in the fall during open enrollment. However, you can use Medicares general enrollment periodThe General Enrollment Period allows beneficiaries to enroll in Medicare Part A and Part B from January 1 to March 31 if they missed their Initial Enrollment Period. Beneficiaries can also enroll in a…, which begins 1 January 1 and ends on 31 March.

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Recommended Reading: Who Must Enroll In Medicare

Getting Enrolled In Medicare Part D

As soon as you are eligible for Medicare you should have creditable prescription drug coverage. If you dont have coverage as soon as you are eligible, and then later need it, Medicare can charge you a late penalty. For most of us, its best to enroll in a Part D plan as soon as were eligible.

There are three ways to get creditable prescription drug coverage. You can get it as part of a Medicare Advantage plan, through a Medicare Part D plan, or if available, you can get it through an employer group plan.

You can enroll in a Medicare Part D Plan during your Initial Enrollment Period or during the Annual Election Period . Also, if you drop a Medicare Advantage plan and return to Original Medicare during the Medicare Annual Disenrollment Period you can join a Part D Plan at that time.

As a reminder, your IEP is the seven-month period beginning three months before the month you turn 65, or during the seven-month period beginning three months before your 25th month of disability. Eligibility rules are different if you are enrolling in Medicare after being diagnosed with ALS or end-stage renal disease.

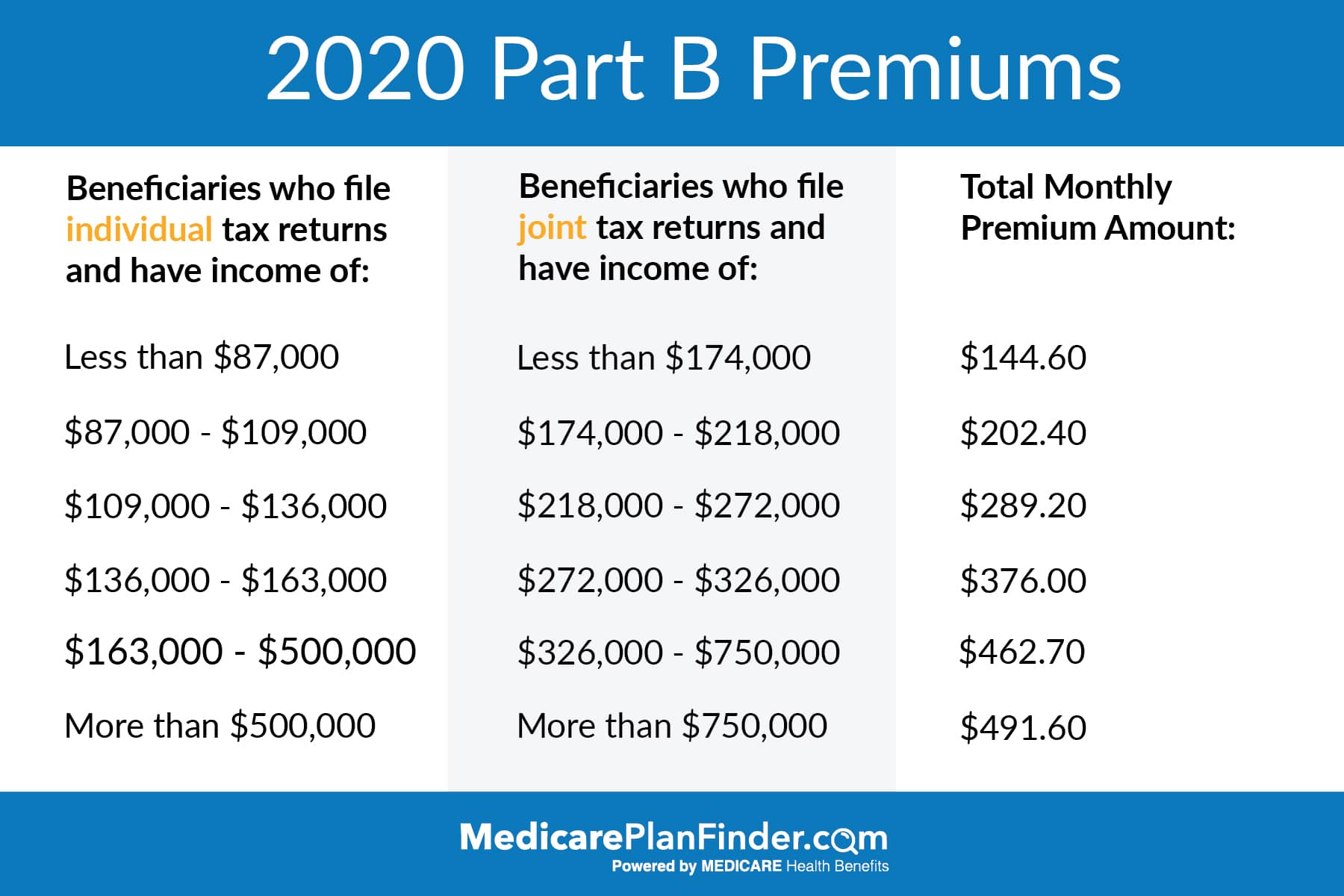

To 2016 Medicare Part B Premiums

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase. The 2013 to 2015 premiums started at $104.90 per month and increased for single or married individuals who filed separately with MAGIs over $85,000 and married taxpayers who filed jointly with MAGIs over $170,000.

In 2016, the premium rate of $104.90 from the previous three years applied to about 70% of beneficiaries due to COLA. The other 30% paid a Medicare Part B premium that was not based on COLA. The premium was $121.80 in 2016, which was a 16% increase from the $104.90 paid in 2015.

Also Check: Does Medicare Pay For Blood Pressure Cuffs

Original Medicare And Part D Irmaa

If you receive a Medicare bill for Part B premium and Part D IRMAA costs, you may pay it in these ways:

- Medicares Easy Pay system lets you pay your Part A or Part B premium electronically. You can pay manually or set up automatic payments to be taken directly from a checking or savings account.

- You can pay with a debit card or credit card by writing your card number directly on your bill and mailing it in.

- You can pay with a check or money order.

How Much Will The Part B Deductible Increase For 2022

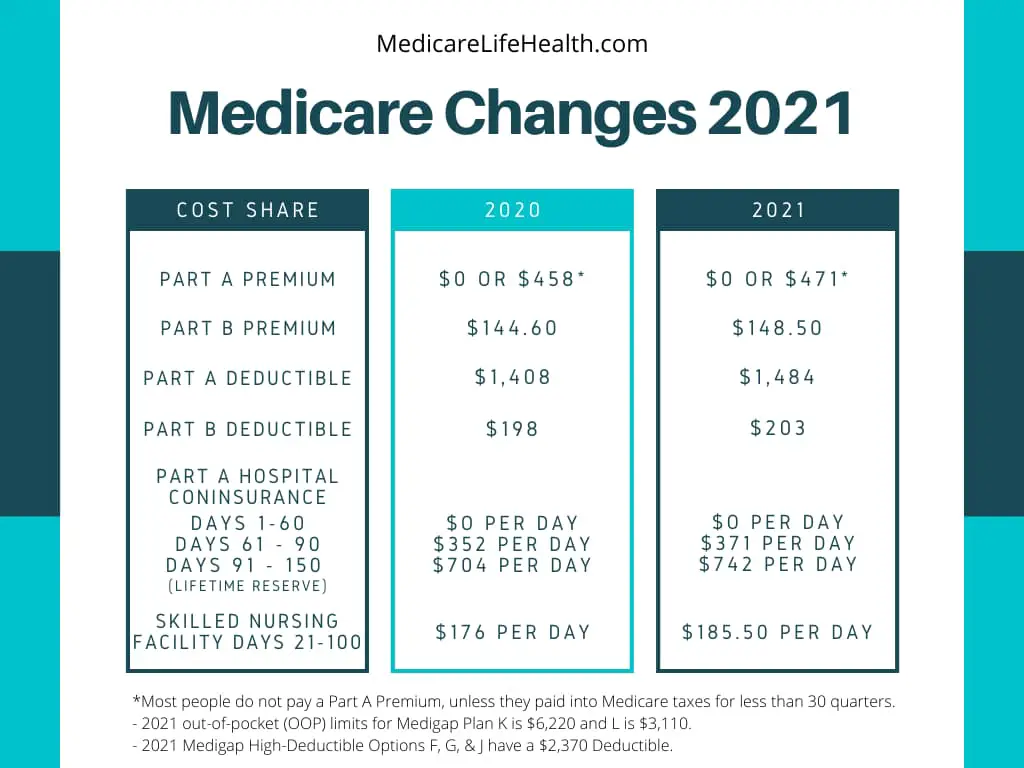

The Part B deductible for 2022 is $233. Thats an increase from $203 in 2021, and a much more significant increase than normal.

Some enrollees have supplemental coverage that pays their Part B deductible. This includes Medicaid, employer-sponsored plans, and Medigap plans C and F. But Medigap plans C and F can no longer be sold to newly-eligible enrollees as of 2020 . The ban on the sale of Medigap plans that cover the Part B deductible for new enrollees was part of the Medicare Access and CHIP Reauthorization Act of 2015 . Its an effort to curb utilization by ensuring that enrollees incur some out-of-pocket costs when they receive medical care.

Many Medicare Advantage plans have low copays and deductibles that dont necessarily increase in lockstep with the Part B deductible, so their benefits designs have had different fluctuations over the last few years.

Read Also: What Age Does Medicare Eligibility Start

When To Pay For Original Medicare

If you have original Medicare and arent yet collecting Social Security, youll receive a bill from Medicare either monthly or once every 3 months in these cases:

- If you dont have premium-free Part A, youll receive a monthly bill for your Part A premium.

- If your income exceeds a certain amount, youll receive a monthly bill for your Part D income-related monthly adjustment amount surcharge.

- If you have only Part B, the bill for your Part B premium will be sent quarterly and will include the cost of 3 months worth of premiums.

These bills are paid in advance of coverage. For example, if you applied for Medicare to start in August, youll receive a bill in July for your August, September, and October Part B premiums.

If you also pay for Part A or a Part D IRMAA surcharge, the bill you receive in July will be for Augusts premium.

If youre already collecting Social Security or RRB benefits, your monthly Medicare premium will be automatically deducted from your benefit amount.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

You May Like: What Is The Penalty For Not Enrolling In Medicare

How Are Medicare Advantage Premiums Changing For 2021

According to CMS, the average Medicare Advantage premiums for 2022 is about $19/month , which is down from about $21/month for 2021, and $23/month in 2020. Average Advantage premiums have been .

The average premiums described above account for all Medicare Advantage plans, including those that dont include Part D coverage. And the overall average is driven down due to the fact that the majority of Advantage enrollees actually have no premiums other than the cost of Part B . If we only consider the Advantage premiums for plans that do include Part D and that do have a premium in addition to the cost of Part B, the average premium is quite a bit higher.

Almost 27 million people had Medicare Advantage plans in 2021, and CMS projects that it will grow to 29.5 million in 2022. Enrollment in these plans has been steadily growing for the last 15 years. The total number of Medicare beneficiaries has been steadily growing as well, but the growth in Medicare Advantage enrollment has far outpaced overall Medicare enrollment growth. In 2004, just 13% of Medicare beneficiaries had Medicare Advantage plans. That had grown to more than 43% by 2021.

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Don’t Miss: How Much Does Medicare Pay For A Doctors Office Visit

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Us Announces Big Hike In Medicare Premiums

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey and controversial new Alzheimers drug.

The 14.5% increase in Part B premiums will take monthly payments for those in the lowest income bracket from $148.50 a month this year to $170.10 in 2022. Medicare Part B covers physician services, outpatient hospital services, certain home health services, medical equipment, and certain other medical and health services not covered by Medicare Part A, including medications given in doctors offices.

The Centers for Medicare and Medicaid Services played down the spike, pointing out that most beneficiaries also collect Social Security benefits and will see a cost-of-living adjustment of 5.9% in their 2022 monthly payments, the agency said in a statement. Thats the largest bump in 30 years.

This significant COLA increase will more than cover the increase in the Medicare Part B monthly premium, CMS said. Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

The actual spike the largest since 2016 could hurt some seniors financially.

This story has been updated with additional details Friday.

Also Check: What Age Do You Register For Medicare