Best Cheap Medicare Supplement Plan: Plan K

If you are interested in the cheapest Medigap policy that still provides some coverage on top of Original Medicare, you may want to look into Plan K.

Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible. Many other Medigap plans, such as Plan G, provide full reimbursements for these types of health care.

This is crucial to consider if you need health insurance coverage for skilled nursing. In this case, if you were to get Plan K, only 50% of such costs would be covered.

On the other hand, your monthly premiums with Plan K will be much cheaper. Policyholders can expect to pay about $77 per month, making it the best Medicare Supplement plan for low-income seniors.

Medicare Advantage Out Of Pocket Costs

There can be out of pocket costs with Medicare Advantage. These costs will be in the form of copays or a coinsurance percentage that youll pay for your medical care. Theres an annual maximum out of pocket on each plan. This puts a cap on the total amount you can be billed each year.

Most Medicare Advantage plans include Part D prescription drug coverage. Sometimes theres extra benefits included in the plan such as dental, vision, health and wellness products, and gym memberships. You may also be able to find a Medicare Advantage plan that has a 0 dollar premium, depending on the area where you live.

Its important for you to know that benefits can vary from Plan to Plan and also by the county where you live, so not all types of plans may be available in your area. This is something that we can help you with, we have access to all the plan options in your area.

Most Popular Medigap Plans

The most popular Medigap plan is Plan F, which is the only plan to provide maximum coverage in each benefit area.

Because Plan F is not available for new beneficiaries who became eligible for Medicare after January 1, 2020, Plan G will likely become the most popular Medigap plan for new Medicare beneficiaries.

Plan G covers more Medigap benefit areas than any other Medigap plan .

Read Also: Do I Need Medicare Part B If I Have Tricare

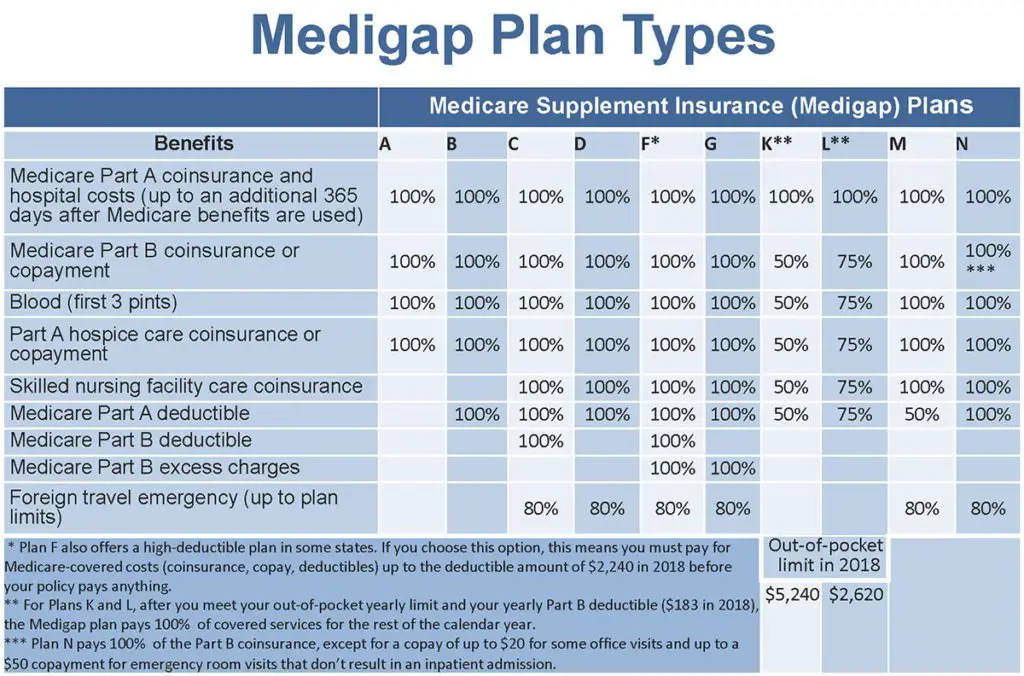

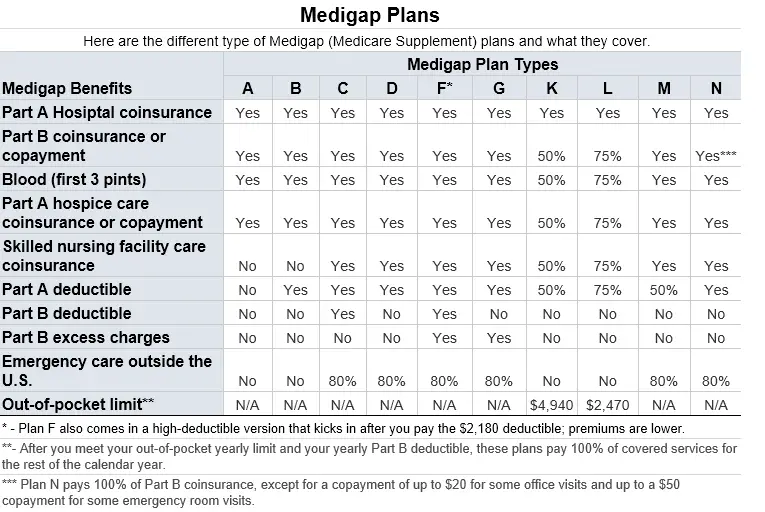

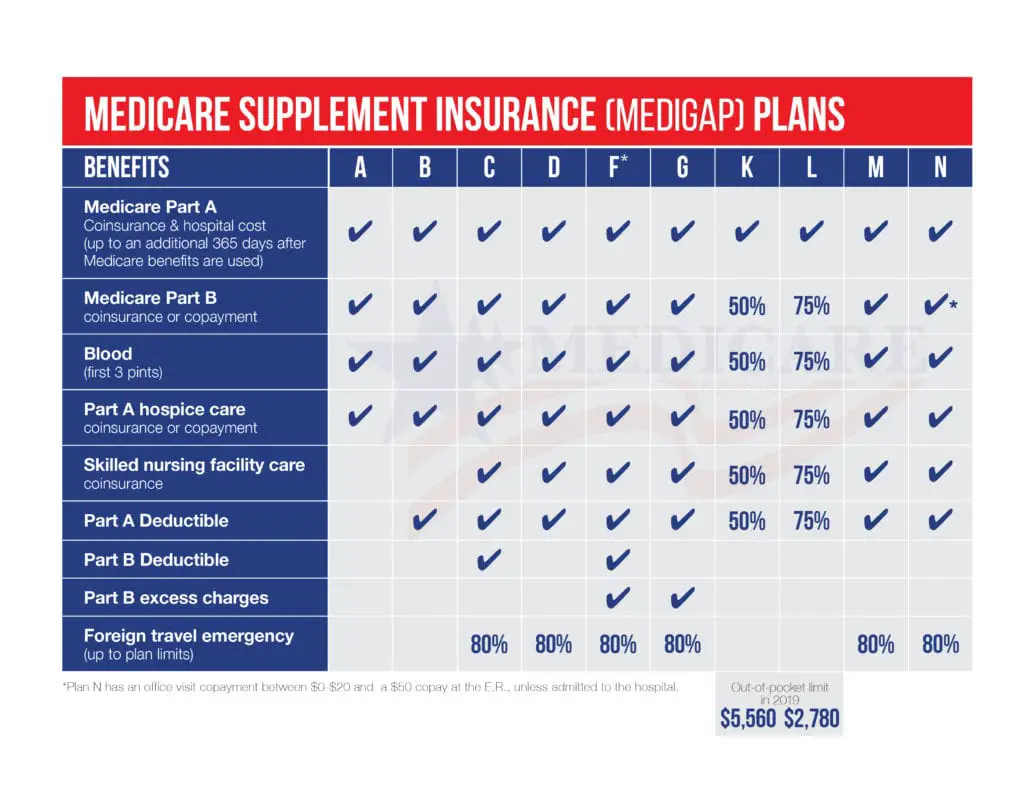

Medicare Supplement Insurance Plan Comparison Chart

This comparison chart lists the 10 standardized Medicare Supplement insurance plans available in most states. Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement Insurance plans.

| Medigap Benefits |

Yes = the plan covers 100% of this benefit

No = the policy doesnât cover this benefit

% = the plan covers a percentage of this benefit

N/A = not applicable

* Plan F and Plan G also offer a high-deductible plan. If you decide on the high-deductible option, you pay for Medicare-covered costs up to the deductible amount. After you reach that amount, your plan may pay your out-of-pocket medical costs listed above.

As of January 1, 2020 people new to Medicare could no longer buy plans that cover the Medicare Part B deductible. This means that Medicare Supplement Plans C and F are no longer available to new Medicare enrollees. However, if you already have a Plan C, Plan F, or high-deductible Plan F, you can keep it. If you were eligible for Medicare before January 1, 2020, you also may be able to buy Medicare Supplement Plan C, F, or high-deductible Plan F.

** If you meet your annual out-of-pocket limit and Part B deductible, the plan generally pays 100% of covered services for the rest of the calendar year.

*** Plan N may pay 100% of the Part B coinsurance. For certain office visits, youâll have to pay up to $20, and up to $50 for emergency room visits that donât result in inpatient admission.

Best Overall Medicare Supplement Plan For New Enrollees: Plan G

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible â $233 for 2022 â before insurance benefits will begin to pay for your health care.

Plan G is the most popular Medicare Supplement for new enrollees. However, rates can be expensive, averaging $190 per month. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

Also Check: How Much Does Medicare Pay For Funeral Expenses

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

What Are The Six Types Of Medicare Advantage Plans

Types of Medicare Advantage plans

| Health Maintenance Organization | These plans cover care and services by providers within a defined network. For care outside the network, you usually have to pay the entire bill. |

| Preferred Provider Organization | These plans charge you less for using health providers within the network than they do when you go out of network. They may or may not impose an annual deductible. |

| Private Fee-For-Service | Relatively uncommon, these plans may or may not be network-based and require non-network providers to accept both Medicare reimbursement and the plans terms and conditions. Most dont include prescription drugs. |

| Special Needs Plan | Tailored to individuals with chronic conditions like diabetes and to people who qualify for both Medicare and Medicaid, these plans are often recommended by healthcare providers or social workers. |

| Medical Savings Account | These rarely offered plans combine a high-deductible plan with a dedicated savings account. Money for medical care is deposited into the account monthly. MSAs dont include prescription drugs. |

| HMO Point-of-Service | These hybrid HMOs allow you to go outside your network for treatment, provided youre willing to pay more for that care. There are separate deductibles for in-network and out-of-network charges. |

Most Medicare beneficiaries who get an Advantage plan enroll in one of two types:

-

HMO plans

-

PPO plans

Recommended Reading: Why Choose Medicare Advantage Over Medigap

Best Overall Medicare Supplement Plan Pre

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor’s office visit. The monthly premium for Plan F averages $231, which makes this plan even more expensive than Plan G. Unfortunately, Plan F is not available to new Medicare enrollees who become eligible after Jan. 1, 2020. Anyone who currently has Plan F will be able to keep their coverage.

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

Recommended Reading: Does Aetna Follow Medicare Guidelines

Plans C1 F1 And G: Higher Benefit Level Higher Premium

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

1 You may only apply for plans C and F if you were first eligible for Medicare before 2020.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best. While prices vary by person and location, here are three top insurance providers to consider as you start your search for the best plan for you. Each of them offers coverage nationwide and holds an A.M. Best rating of A- or higher.

Recommended Reading: Will Medicare Pay For A Power Lift Chair

Who Should Get A Medicare Supplement Insurance Plan

A Medicare Supplement Insurance plan may be a good choice for you if you:

- Turn 65 and want to cover as much of your health care costs as possible while on Original Medicare.

- Are already on Original Medicare but want help paying for your portion of costs for services received moving forward.

- Want peace of mind that your health insurance policies will pay for the majority of your Medicare-covered health care costs without constraints of networks or need for referrals.

- Dont mind purchasing a standalone Medicare Part D plan for prescription drug coverage.

Medigap Plan Comparison In Massachusetts Minnesota And Wisconsin

In 47 of 50 states nationwide plus Washington, D.C. Medigap plans are standardized using the lettered naming convention we describe above. However, that is not the case in Massachusetts, Minnesota, and Wisconsin. These three states have unique Medigap plans that are only available in each.

Even though the plans are only available in their respective state, they still offer comparable benefits to the most popular Medigap plans and beneficiaries can use them with Medicare-accepting practitioners nationwide, just like a standardized Medigap plan in any other state.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Recommended Reading: How To Learn Medicare Billing

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

Overview Of Medigap Plans

Medigap plans, sometimes also called Medicare supplement plans, are optional plans you can add to your Medicare coverage to help pay for some of the out-of-pocket costs of Medicare.

The plans work alongside original Medicare. Original Medicare is made up of Medicare Part A and Medicare Part B . Medigap plans are specifically designed to cover the costs of original Medicare that normally fall to you.

Some costs that Medigap plans often cover include:

- coinsurance

- extra fees

- healthcare while you travel

There are 10 different Medigap plans. The plans are standardized so no matter what you state you live in or what company you purchase a plan from, your coverage will always be the same.

Here is an overview of each of the Medigap plans:

If youre new to Medicare as of 2020, you actually have only 8 Medigap plan choices.

Due to recent changes to Medicare regulations, Plan C and Plan F are no longer available to new Medicare enrollees. This change applies only if you became eligible for Medicare starting on January 1, 2020, or later.

If you were eligible for Medicare in 2019 or earlier, you can still buy plans C and F.

You May Like: Does Medicare Help Pay For Dementia Care

Why Is Plan F Popular

Medigap Plan F covers more out-of-pocket Medicare costs than any other standardized type of Medigap plan. In exchange for their monthly premium, Plan F beneficiaries know that all of their Medicare deductibles, coinsurance, copays and other out-of-pocket costs will be covered.

For many Medicare Supplement beneficiaries, this piece of mind and ease of use are the reasons they chose to enroll in Plan F.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Medicare Cover Nerve Blocks

What Are The Different Medicare Supplement Plans

As you can see from the chart above, there are 10 types of standardized Medicare Supplement Insurance plans available in most states, each identified by a letter: A, B, C, D, F, G, K, L, M and N.

Plan F and Plan G also offer a high-deductible version. High deductible Plan F and high deductible Plan G typically offer lower monthly premiums in exchange for having a high deductible that must be met before plan coverage kicks in.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Read Also: What Does Medicare Cover Australia

Is It Better To Have Medicare Advantage Or Medicare Supplement

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

- Do you prefer to have all your coverage rolled into one plan? If so, a Medicare Advantage Plan may be the way to go. Many include Part D drug coverage, as well as vision, dental, and hearing, depending on the plan.

- Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesnt cover.

- Do you need a plan that provides coverage for disabilities or long term care facilities? If so, Medicare Advantage offers Special Needs Plans that provide this type of coverage.

- Do you want the freedom to see any doctors you choose? If so, Medicare Supplement plans have no required network and you can see any doctor that accepts Medicare, even if youre away from home or traveling. Some Medicare Advantage plans may also allow you to see doctors and hospitals that are not in the plans network, giving you additional freedom to choose your doctors.

Top 4 Medicare Supplement Plans And Which One Is Right For You

UPDATE: The content of this article was updated from the Top 5 Medicare Supplement Plans to the Top 4 Medicare Supplement Plans to reflect changes in plan offerings following Jan. 1, 2020.

Choosing the right Medicare Supplement Insurance Plan for you may help ease the stress of dealing with health care in retirement. When you turn 65, you become eligible for Original Medicare and Medigap another name for Medicare Supplement Insurance. Knowing the top 4 Medicare Supplement Plans & based on your specific needs will help you determine your options.

Every beneficiary has a different set of needs, so weve narrowed down the top 4 Medicare Supplement plans based on varying health care situations. That way, you can decide which one will work best for you.

There are 10 Medicap policies available with standardized benefits, however not all plans are available to all Medicare Supplement enrollees or in specific states. Medicare Supplement Plan C and Plan F are only available for those who were eligible for Medicare before Jan. 1, 2020. Also, Massachusetts, Minnesota and Wisconsin have their own state-specific standardized plans.

Keep in mind theres no right Medigap Plan or one-size-fits-all option. It all comes down to personal preference and specific health care needs. Were basing our recommendations on the plans beneficiaries are most likely to choose.

Read Also: Does Medicare Cover Diagnostic Mammograms