If I Give Away My House And All My Money

Not anymore. There is a 5-year look-back law now. Uncle Sam government will find your money and make you pay it back. You should consult an Elderlaw attorney specializing in Medicaid to understand the acceptable ways to spend-down assets to qualify for Medicaid as a low-income senior.

You can gift away some assets within limits to a beneficiary, but you should remember that these assets will no longer be in your control. Also remember that the leading type of elder abuse is financial, many times by a family member. Spousal poverty protection laws have been passed to allow the spouse of a senior who needs long-term nursing home care to maintain usually up to 50% of the couples assets.

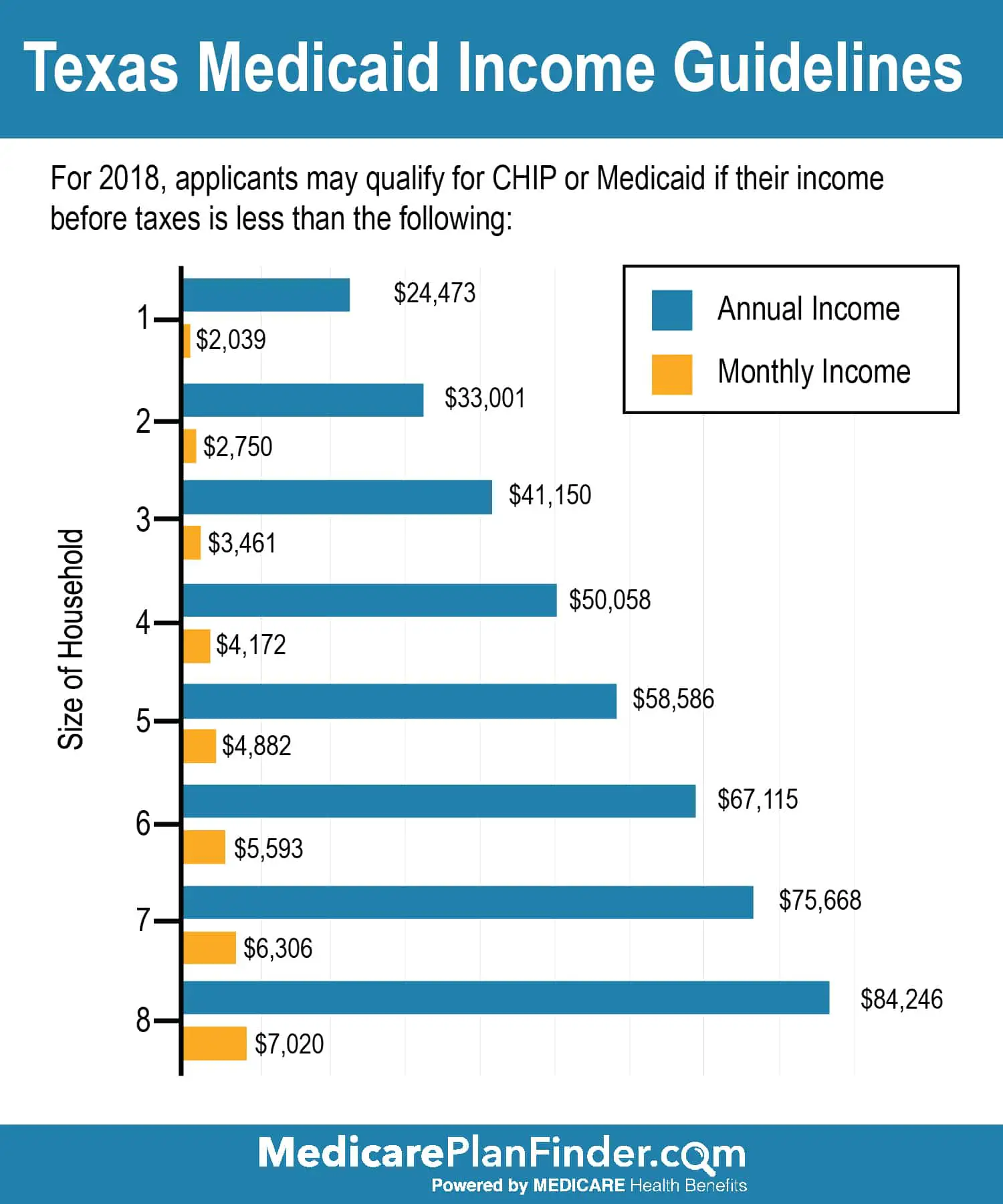

To qualify for Medicaid in Texas, any interested individual must be an American Citizen, or an immigrant with legal and permanent residency status, and who is currently residing in the State of Texas.

Coverage can possibly begin from 3-months prior to the applications approval. Applications sometimes take longer than expected. You should ask about the usual approval timeframe when you submit your initial application for Medicaid coverage.

Follow these guidelines on how you qualify for Medicaid in Texas:

- Chose the sub-program of the Texas Medicaid as applicable to your health needs. CHIP for Children Medicaid, STAR Medicaid Managed Care Program, STAR Plus Program and Womens Health Program are among the many sub-programs you can choose from.

Read Also: Does Medicare Cover Hiv Medication

What Does Medicare Cover In Texas

Original Medicare in Texas helps reduce your out-of-pocket costs for hospital stays and doctor visits and related expenses . Optional Medicare plans in Texas help with prescription costs .

All Medicare in TX is required to offer 10 Essential Health Benefits, including:

Table reflects the latest Beneficiary Demographics Data: Medicare Geographic Variation by National, State & County

Average HCC Score:The Hierarchical Condition Category score gauges a populations overall health. The score is based on a value of 1.0. Populations with an HCC score of less than 1.0 are considered relatively healthy. The score can be used to estimate health costs.

How Long Do You Have To Pay Medicare Taxes

you are age 65 or older and you or your spouse worked and have paid Medicare taxes for at least 40 quarters during your lifetime. you are under age 65 and receive benefits from Social Security or from the Railroad Retirement Board, and have received those benefits for at least 24 consecutive months.

Recommended Reading: How Do You Qualify For Medicare In Texas

Effects Of The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act of 2010 made a number of changes to the Medicare program. Several provisions of the law were designed to reduce the cost of Medicare. The most substantial provisions slowed the growth rate of payments to hospitals and skilled nursing facilities under Parts A of Medicare, through a variety of methods .

PPACA also slightly reduced annual increases in payments to physicians and to hospitals that serve a disproportionate share of low-income patients. Along with other minor adjustments, these changes reduced Medicare’s projected cost over the next decade by $455 billion.

Additionally, the PPACA created the Independent Payment Advisory Board , which was empowered to submit legislative proposals to reduce the cost of Medicare if the program’s per-capita spending grows faster than per-capita GDP plus one percent. The IPAB was never formed and was formally repealed by the Balanced Budget Act of 2018.

Meanwhile, Medicare Part B and D premiums were restructured in ways that reduced costs for most people while raising contributions from the wealthiest people with Medicare. The law also expanded coverage of or eliminated co-pays for some preventive services.

How To Apply For Medicaid In Tx

How to Apply for Texas Medicaid. Texas seniors can apply online for Medicaid at Your Texas Benefits or submit a completed paper application, which can be found here. For assistance with the application process or to request a paper application be mailed to you, call Texas Health and Human Services at 1-877-541-7905.

Recommended Reading: Does Medicare Pay For Shower Chairs

Medicaid And Long Term Care Planning

In addition to the above benefits, Medicaid can help cover the costs of long-term care, such as nursing homes. With the cost of long-term care rising quickly, this can be a major concern for many Texans as they, and their family members get older. Because Medicaid eligibility is means-based, many people who cannot afford long-term care may find that they are nonetheless ineligible for Medicaid.

Estate planning attorneys often work with clients to create ways around this problem. Using trusts and other devices, they can often work out ways to maintain a clients eligibility for Medicaid without completely losing access to their assets.

Also Check: What Are The 3 Medicaid Plans

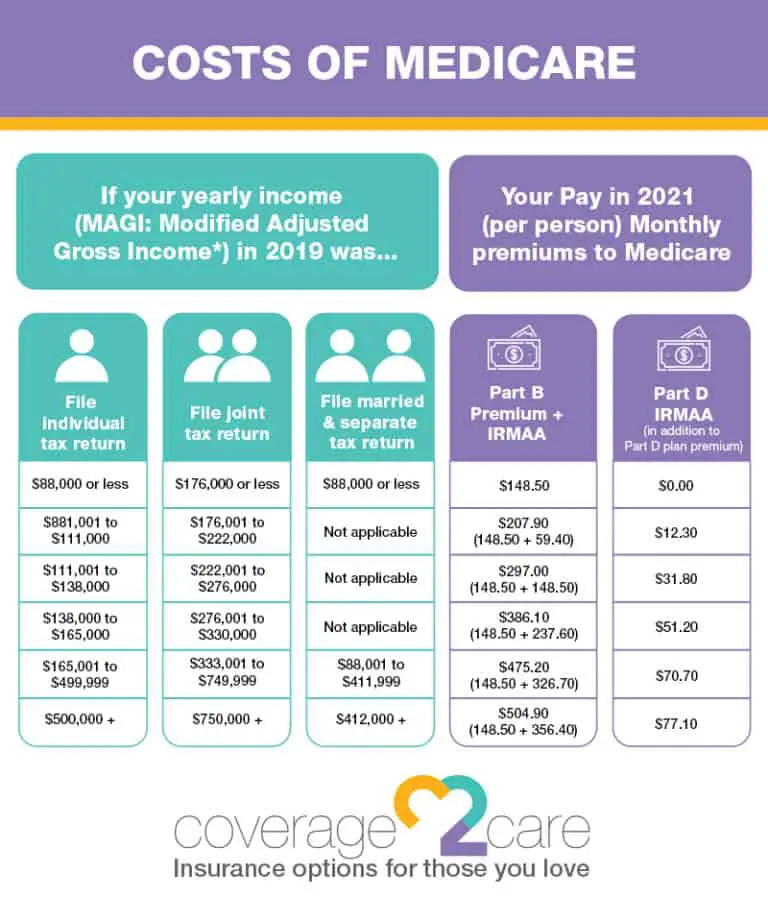

Learn More With Coverage2care

The Medicare application process can be complicated, but enrolling in Medicare is worth the trouble. If you have a family member who is eligible for Medicare, or if youre about to qualify yourself, you should explore all the options on the market.

Luckily, you dont need to tackle this process alone. Coverage2Care can help you find an affordable Medicare plan with great coverage.

Recommended Reading: How To Get Medicare Without Social Security

Can I Use Goodrx If I Have Medicare Part D In Texas

You cannot use GoodRx in combination with Medicare Part D or a Medicare Advantage Prescription Drug Plan. GoodRx can be used to purchase prescriptions as an alternative to using your Medicare coverage.

You may want to use GoodRx instead of going through Medicare for your prescription if the medication isnt covered by Medicare, the GoodRx prices are lower than the Medicare copay, when you wont reach your annual deductible, or when youre in the coverage gap phase of your plan or when youre nearing the donut hole.

Eligibility For Medicare In Texas

You are eligible for Medicare in Texas based on your age or eligible disabilities by the Social Security Administration.

Who Qualifies for Medicare in Texas?

In Texas, along with the rest of the country, you are eligible for Medicare if you meet one of the following criteria:

- Youre aged 65 or older.

- Youre younger than 65 with eligible disabilities by the Social Security Administration.

- You have End-Stage Renal Disease or Amyotrophic Lateral Sclerosis .

Also Check: What Is Oep For Medicare

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Texas Medicare Part A Hospital Coverage

Texas Medicare Part A covers hospital visits and other services such as stays in a long-term skilled nursing facility, home health care, and hospice services. This was the first form of Medicare offered by the government. You might also hear it called traditional or original Medicare.

If youre wondering who is eligible for Medicare Part A, youll be happy to know that most Texas seniors qualify. You can enroll in Part A once you turn 65. Coverage is free if you or your spouse paid Medicare taxes through your job for ten years or longer. If you dont have this work history, you can often purchase coverage for a small monthly fee.

Read Also: Where To Get Medicare Information

How Much Is Medicare Texas

While Medicare Part A doesnt have a monthly premium for most Texans age 65 or older, Medicare Part B usually carries a monthly premiumA premium is a fee you pay to your insurance company for health plan coverage. This is usually a monthly cost. and other standardized costs. If you have Parts A and B, Part D and Medigap are options for you, but each has a monthly premium.

If you need the type of medical coverage that Part B covers, Medicare Advantage plans also feature the benefits of Part D and Medigap . Some Medicare Advantage plans have a benefit that can reduce the Part B premium. A GoHealth licensed insurance agent who is knowledgeable about Medicare in TX can help you weigh your options.

Medicare Health Insurance Options

In most areas of the country, Medicare beneficiaries can choose Original Medicare or a Medicare Advantage plan.

Original Medicare is provided directly by the federal government and includes Medicare Parts A and B. Medicare Part A, also called hospital insurance, helps to pay for inpatient stays at a hospital, skilled nursing facility, or hospice center.

Part B, also called medical insurance, helps pay for outpatient care like physician services, kidney dialysis, preventive care, durable medical equipment, etc.

Medicare Advantage plans are administered by private insurance companies that have contracts with the federal government. Medicare Advantage plans include all of the benefits of Original Medicare , and they typically have additional benefits, such coverage for prescription drugs, dental, and vision.

But provider networks are often limited with Medicare Advantage plans, and out-of-pocket costs are typically higher than a person would have if they opted for Original Medicare plus a Medigap plan. In short, there are pros and cons either way, and no one-size-fits-all solution.

Medicare beneficiaries can switch between Medicare Advantage enrollment and Original Medicare during the Medicare annual election period, which runs from October 15 to December 7 each year. Medicare Advantage enrollees also have the option to switch to a different Advantage plan or to Original Medicare during the Medicare Advantage open enrollment period, which runs from January 1 to March 31.

You May Like: Is Coolief Covered By Medicare

What Medicaid Helps Pay For

If you have Medicare and qualify for full Medicaid coverage:

- Your state will pay your Medicare Part B monthly premiums.

- Depending on the level of Medicaid you qualify for, your state might pay for:

- Your share of Medicare costs, like deductibles, coinsurance, and copayments.

- Part A premiums, if you have to pay a premium for that coverage.

Medically Needy Medicaid Texas

If you dont meet Texas Medicaid eligibility requirements based on your income level, you can still qualify based on spend down. This means that if you spend enough money on health care to put you below the qualifying limit, you can still qualify. However, that money that puts you below the line has to be going towards your healthcare costs.

Don’t Miss: What Does Humana Medicare Advantage Cover

How To Check Medicare Eligibility Online For Free

Systems for Checking Medicare Eligibility

- Eligibility information is available 24 hours a day, 7 days a week .

- Requires a signed Electronic Data Interchange Enrollment Agreement with CGS.

- One agency representative registers as the Provider Administrator, and they may grant access to additional users. …

How Does Medicare Work In Texas

Medicare is a United States federal health insurance program designed to provide and reduce the cost of healthcare services for those who are Medicare eligible.

Although you apply for Medicare in Texas, the system is regulated by the Centers for Medicare & Medicaid Services , a federal program. Even though youre in Texas, youll find that Medicare functions the same across the United States.

As of 2020, approximately 4.3 million Texans are enrolled in Medicare. Thats 14% of Texans! As of 2019, 86% of Medicare beneficiaries were eligible due to age, while 14% had a Social Security Administration-approved disability that made them eligible .

Continue reading to discover if youre eligible for Medicare in Texas.

You May Like: How To Compare Medicare Drug Plans

Where Can I Apply For Medicaid In Texas

Texass Medicaid program is overseen Texas Health and Human Services Commission . You can apply for Medicaid ABD benefits or an MSP using this website.

This page contains more information about applying for Medicaid.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked on Medicare and Medicaid related client projects.

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Don’t Miss: Is Aarp Medicare Part D

Prescription Drugs And Supplement Coverage

- Medicare Part D is drug coverage, administered by private insurance companies under federal guidance.

- Medigap is Medicare Supplement Insurance, also administered by private insurance companies, that helps control out-of-pocketThe maximum amount of money an individual will pay towards out of pocket expenses like deductibles, copayments, and coinsurance. costs for people with Parts A and B. Medigap plans have a monthly premium.

Medicare Trends In Texas

There are 4,355,781 Texans enrolled in Medicare in 2022. Here are a few notable trends:

- The average Medicare Advantage monthly premium is $10.68, lowering about 3 percent from 2021 averages.

- There are 337 Medicare Advantage plans available in Texas in 2022, about 16 percent more plan options than in 2021.

- 100 percent of people with Medicare will have access to a Medicare Advantage plan with a $0 monthly premium.

- $0 is the lowest monthly premium available for a Medicare Advantage plan.

- When it comes to Medicare Part D, there are 28 stand-alone Medicare prescription drug plans available in 2022. All individuals enrolled in Medicare have access to a Medicare prescription drug plan.

- There are 8 stand-alone Medicare Part D prescription drug plans and 94 Medicare Advantage plans with prescription coverage that will offer lower out-of-pocket insulin costs through the Part D Senior Savings Model.

- 100 percent of people with Medicare Part D prescription drug plans have access to a plan with a lower monthly premium than they had paid for in 2021.

- The lowest available monthly premium for a stand-alone Medicare prescription drug plan is $6.90.

You May Like: Which Glucose Meters Are Covered By Medicare

I’m On Disability When Will I Be Eligible For Medicare

You may be eligible for Medicare before age 65 if you have a qualifying disability. Eligibility usually starts after you’ve received disability benefits for 24 months. You will be automatically enrolled in Medicare Parts A and B. You may make other coverage choices during your IEP. Your 7-month IEP includes the month you receive your 25th disability check plus the 3 months before and the 3 months after.

Does Medicare Cover Auto Accident Injuries In Texas

Medicare may cover the medical costs for auto accident injuries depending on what type of injury.

Medicare Part A will cover your stay if you are admitted to the hospital and your surgery if it is performed as an inpatient.

The Medicare Part A deductible is $1,556 per benefit period in 2022. The first 60 days have free coinsurance for each benefit period in 2022. It is a $389 coinsurance for days 61-90. After the first 90 days, it is a $778 coinsurance in 2022.

Medicare Part B will cover ambulance transportation, emergency room treatment for evaluating your injuries, and surgery if performed as an outpatient. The Medicare Part B deductible is $233 per year in 2022. For the Medicare Part B coinsurance, you would pay 20% of the Medicare-approved amount after meeting the deductible.

Also Check: What Medicare Coverage Do I Need