When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

If Your Employer Is Small

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

However, it may be more cost-effective in this situation to drop the employer coverage and pick up Medigap and a Part D plan or, alternatively, an Advantage Plan instead of keeping the work plan as secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,470, according to the Kaiser Family Foundation. However, employees contribute an average of $1,243 or about 17% with their company covering the remainder.

At small firms, the employee’s share might be far higher. For example, 28% are in a plan that requires them to contribute more than half of the premium for family coverage, compared with 4% of covered workers at large firms.

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Read Also: Does Medicare Cover Vitamin D Testing

Can You Have Medicare And Medicaid

The short answer is yes. If you receive coverage from both Medicaid and Medicare, youre a dually eligible beneficiary. If you are dual eligible, you may be enrolled in Medicare and then qualify for Medicaid, or enroll first in Medicaid but later qualify for Medicare. Medicaid assists seniors with limited income and people with disabilities also enrolled in Medicare.

How does dual eligibility work?

Dual-eligible beneficiaries can have:

- Medicare Part AMedicare Part A, also called hospital insurance, covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services. Medicare Part A is part of Original Medicare.

- Medicare Part BMedicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called medical insurance, Part B helps pay for the Medicare-approved services you receive.

- Both Part A and Part B

- Full Medicaid benefits

- State Medicare Savings Programs

Medicare benefits always pay first, and Medicaid benefits assist with costs not fully covered by Medicare.

Medicaid will pay premiums and out-of-pocket expenses for dual-eligible Medicare beneficiaries. Medicare and Medicaid work together to cover costs, including long-term services. If you do not have full Medicaid benefits, Medicare Savings Programs may help cover some of those costs:

Are you eligible for cost-saving Medicare subsidies?

Read Also: Does Md Anderson Take Medicaid

Are Any Parts Of Medicare Mandatory

Home / FAQs / General Medicare / Are Any Parts of Medicare Mandatory

Medicare isnt mandatory. There are options to delay coverage if youre not ready when you first become eligible. But, if you dont have creditable coverage, youll get stuck with penalties. If youre not quite ready to join Medicare when you turn 65, there are some options to help delay your coverage. Find out when Medicare is and is not mandatory below.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: Does Medicare Pay For Urgent Care

If My Spouse Is 65 And Im 62 How Can That Affect My Spouses Medicare Costs

Traditional Medicare refers to Part A and Part B. Almost everyone has to pay a Part B monthly premium. But most people donât have to pay a Part A monthly premium.

For Medicare Part A, your monthly premium amount depends on how long you or your spouse worked and paid taxes.

If youâve worked at least 10 years while paying Medicare taxes, you donât pay a monthly premium for your Medicare Part A benefits. But if you havenât worked, or worked less than 10 years, you may pay a premium.

Hereâs where your spouse might benefit from your work history, or vice versa. Say youâre age 62 or older, and your spouse is 65. Your Medicare-eligible spouse has worked for less than 10 years. You, on the other hand, arenât eligible for Medicare yet at age 62, but youâve worked at least 10 years while paying taxes.

Well, tell your spouse he or she owes you a grand night out on the town. Because of your work history, your spouse will qualify for premium-free Part A.

So, to summarize with an example:

- Bob is 65 years old. Heâs on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

What Are My Choices Of Medigap Policies

The federal government has standardized Medicare Supplement plans. You receive the same coverage no matter which insurance company sells you the Medigap plan. Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary.

There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries. You can find the specific benefits that each plan covers in this comparative chart.

Once you decide how much coverage you want, you can check online or contact an insurance agent or broker for quotes.

Recommended Reading: What Medications Are Covered By Medicare

Also Check: Who To Talk To About Medicare

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

A Late Enrollment Penalty

You’d only be subject to a Part A late enrollment penalty if you’re not eligible for premium-free Part A coverage. Most Americans don’t have to worry about this, as they have at least ten years of work history, or are/were married to someone who does. But if you’d have to pay a premium to buy Part A coverage, there’s a penalty if you delay your enrollment.

The penalty is a 10% increase in your monthly premium. In 2020, the Part A premium is $458/month for people with 0-29 quarters of work history, and $252/month for people with 30-39 quarters of work history. So those premium amounts would increase to $504/month and $277/month, respectively, if you’re subject to the late enrollment penalty.

But unlike the penalties for Part B and Part D, the penalty for late enrollment in Part A does not last forever. Instead, you’d pay it for twice as long as the amount of time you delayed your enrollment. So if you were eligible for Medicare for three years before enrolling, you’d have to pay the extra Part A premiums for six years. Keep in mind that the Part A premium changes each year , so the actual amount you’d be paying would vary for each of those six years.

Read Also: What Does Medicare Supplement Plan N Cover

Do I Need To Enroll At 65 If I Work For A Large Company

As long as you have health insurance from a company that employs 20 or more people where you or your spouse actively works, you can delay enrolling in Medicare until the employment ends or the coverage stops, whichever happens first. Youre entitled to a special enrollment period to sign up for Medicare before or within eight months of losing that job-based coverage to avoid a late-enrollment penalty.

The law. Large employers with at least 20 employees must offer you and your spouse the same benefits they offer younger employees and their spouses. You not the employer can decide whether to:

- Accept the employer health plan and delay Medicare enrollment

- and rely wholly on Medicare

- Have employer coverage and Medicare at the same time

Many people enroll in Medicare Part A at 65, even though they have employer coverage, because its free unless they or their spouse has paid fewer than 40 quarters of Medicare taxes. However, they may decide to wait if they want to continue contributing pretax dollars to a health savings account . More on that later.

Those who have access to employer-based health insurance often delay signing up for Part B while theyre still working. That way, they dont have to pay premiums for both Medicare and the employer coverage.

Be aware. If you choose to enroll in both an employer group plan and Medicare Part B, the employer insurance is always primary when a large company provides it. That means it pays your medical bills first.

How To Enroll In Medicare

You can enroll in Original Medicare, Medicare Advantage, Medicare Part D, or Medigap during their respective enrollment periods, as outlined in the previous sections. This can be done online, over the phone, or with a trusted insurance agent. No matter what type of Medicare plan you enroll in, you will likely need to provide the following:

- Your date and place of birth, usually verified through your birth certificate or Permanent Resident Card if you are not a U.S. citizen

- Your Social Security number, verified with your Social Security card

- Tax and income forms, such as W-2s

- Your Medicaid number, along with start and end dates for coverage

- Your current health insurance, including start and end dates for both coverage and your employment if its a group health plan

Recommended Reading: When Do You Stop Paying For Medicare

Why You May Consider Signing Up For Medicare At 65

If youre approaching age 65 and any of the following situations apply to you, then you need to enroll during what’s known as your Medicare Initial Enrollment Period .

If you dont enroll during your IEP, you could face financial premium penalties for enrolling late.

Your IEP is a 7-month window that generally includes the month of your 65thbirthday, the 3 months before and the 3 months after For example, if your 65thbirthday is on June 20, then your IEP starts on March 1 and ends on September 30.

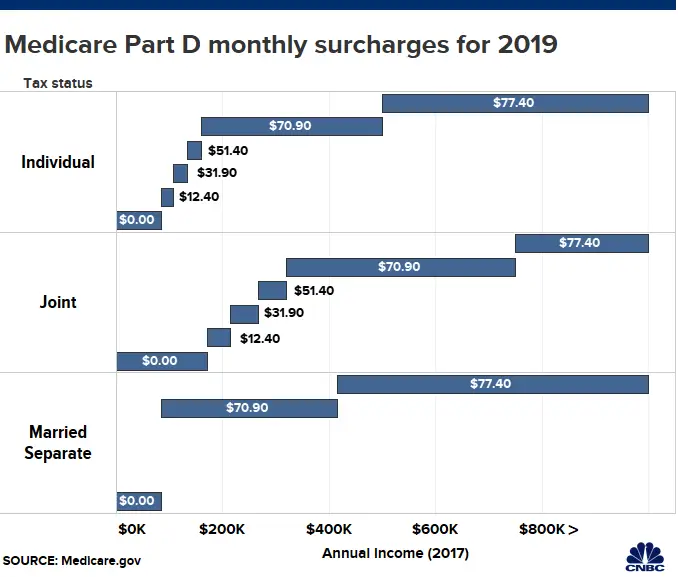

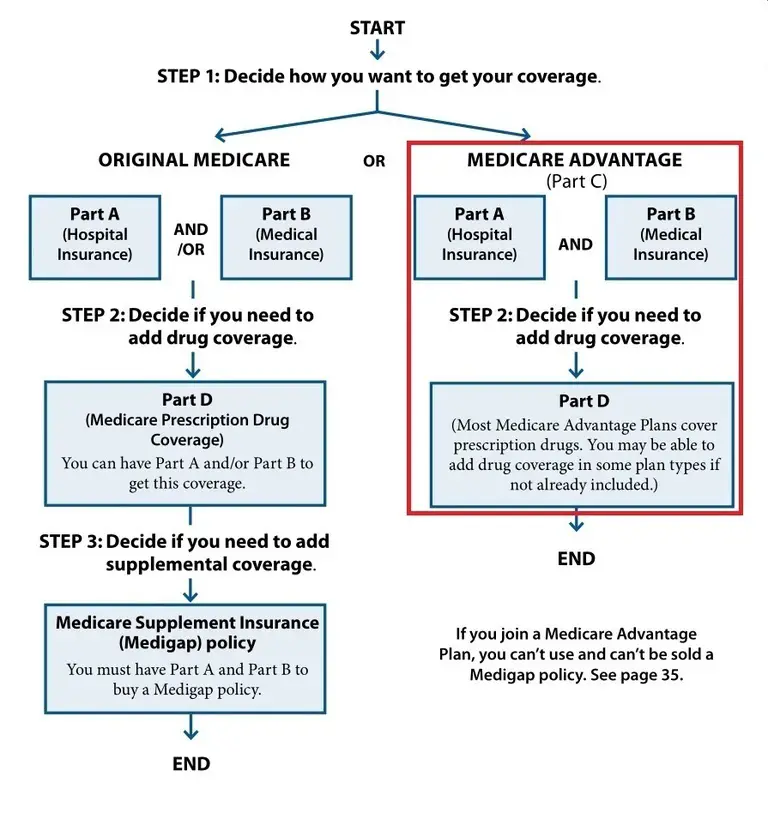

This is the time to learn about yourMedicare coverage options and get what you do or dont need coverage for. Most who have to get Medicare at age 65 will get Part A , Part B and some form of prescription drug coverage through either a stand-alone Part D plan or a Medicare Advantage plan.

Here are some helpful resources to learn how to avoid the Part B and Part D late penalties:

If I’m 65 And Older And Get Health Insurance From Work Do I Have To Enroll In Medicare

No. If you’re still working, your company employs more than 20 people and you have work-based health insurance, you do not need to enroll in Medicare until your existing health insurance expires. When you stop working or your employer discontinues its group insurance plan, you have eight months to sign up for Medicare, regardless of whether you have COBRA or another health insurance plan.

If you do enroll in Medicare and also have work-based insurance, your work insurance will pay first and Medicare will pay second.

If you work for a company that employs fewer than 20 people, you’ll need to contact your company’s HR department for the specifics of your health insurance program. It’s likely that you can delay Medicare enrollment, but some employers require that people 65 and older must enroll in Medicare to receive company health insurance benefits.

For these smaller companies with less employees, Medicare pays first, and work-based insurance pays second.

If you turn 65 and don’t have work-based health insurance, you’ll need to enroll in Medicare within your seven-month initial enrollment period or pay a penalty that will make your premium more expensive.

If you want to completely opt out of Medicare Part A, it is possible, but you’ll have to give up your Social Security benefits entirely, and pay back any benefits that you’ve already received.

Also Check: How Old Before I Can Get Medicare

What Types Of Medicare Advantage Plans Are Available

Medicare Advantage plans can come in a variety of types:

- Private Fee-For-Service

- Medical Savings Accounts

- Special Needs Plans

The available selection of plan types may differ from one county and state to another. The different types of Medicare Advantage plans that are available in your area may include one or more of these plan types.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Read Also: Does Medicare Part B Cover Durable Medical Equipment

Options For Employees With Large Employer Coverage

The first, and possibly the most favored option is delaying Medicare enrollment. The reason you can do this is that your employee group plan acts as your creditable coverage. When you have , you are able to delay signing up for Medicare until you lose that creditable coverage.

There are no penalties because your employer coverage is primary, and Medicare is secondary. Many people enroll in Part A and delay Parts B and D until they retire.

However, you may not want to delay Medicare. Your answer to the fourth and final question will help you determine whether you want to enroll in Medicare and let it coordinate with your employer coverage or delay Medicare to save yourself from paying unnecessary Part B and D premiums while you are still working.

Tricare And Medicare Turning Age 65 Brochure

This brochure provides information on how to remain TRICARE-eligible after becoming entitled to Medicare at age 65. It includes details on how Medicare affects TRICARE coverage, signing up for Medicare, provider options, prescription drug coverage, and more.

Audience: TRICARE beneficiaries eligible for Medicare Part A at age 65

- May be available in print at your local military hospital or clinic

- Date last updated: October 2021

Read Also: When Do You Have To Enroll In Medicare