What Does Medicare Advantage Pay For

Part C providers are required by law to offer all of the benefits enrollees would otherwise have with Original Medicare Parts A and B. All of the same inpatient and outpatient services are included in any Part C package, though insurers may offer extra services some seniors are willing to shop for.

Services not covered by Original Medicare include routine dental and vision benefits, hearing aid services and routine foot care. Some MA plans do offer some or all of these services, though they may potentially charge a higher monthly premium or larger coinsurance/copays.

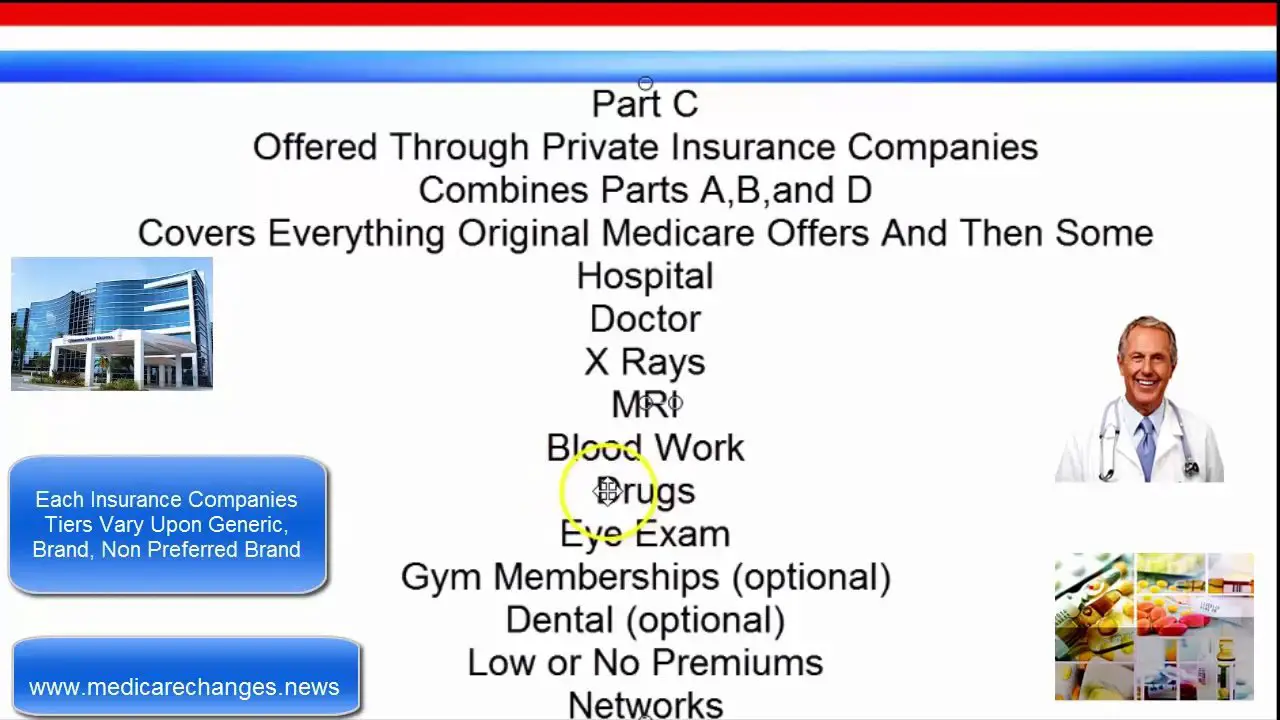

What Is Part C

Before getting into Part C costs, its important to understand what Part C is. Part C, also known as Medicare Advantage, is a way of getting your Medicare benefits through a health insurance plan from a private insurance company. Unlike other parts of Medicare, Part C doesnt refer to a specific type of care. Medicare Part A covers inpatient care, and Part B covers outpatient care, but Part C will cover both of these, as well as prescription drugs in some cases.

Although Medicare Part C plans are heavily regulated by the government, they will essentially function the same way that other private insurance plans do. You will have a provider network, the plan can change each year, and the cost will vary depending on coverage and other conditions.

All Part C plans have to cover at least the same things that Original Medicare cover. This means that Part C plans will cover inpatient services like hospital stays and hospice care, but also outpatient services like doctor visits and medical equipment. If a specific service is covered under Original Medicare, it will be covered by Part C plans as well.

This coverage can be limited by provider networks. On the other hand, most Medicare Advantage plans will offer more than Original Medicare does. This can include things like dental and vision plans, as well as specialized care for specific health conditions, fitness plans, and more.

Medicare Plus Medigap Supplemental Insurance Policies

About 58% of the 62 million older adults and people with disabilities who receive Medicare benefits choose Original Medicare, Parts A and B, which cover hospitals, doctors, and medical procedures. About 81% of these beneficiaries supplement their insurance with Medigap , Medicaid, or employer-sponsored insurance, and 48 million also pay for a stand-alone Medicare Part D prescription drug policy.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program.

While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare, and the great majority do. There is no need for prior authorization or a referral from a primary care doctor. Coverage includes the entire U.S., which may be important for anyone who travels frequently or spends part of the year in a different locale. This option is also attractive to those who have particular physicians and hospitals they want to use.

Also Check: Does Humana Medicare Cover Incontinence Supplies

What Types Of Plans Are There

Although private insurance plans are typically either an HMO or a PPO, Part C actually has more options than this. Depending on which type of plan you have, your costs can be lower or higher. There are also more complex possibilities, like lower premiums but an overall higher yearly cost. Lets take a look at these options one by one.

HMO plans usually have lower premiums, but a smaller network. The idea is that your options for fully covered health care are limited, but as a result, you pay less. In general, out-of-pocket fees will be similar to other types of plans. Your plan may have a high deductible, which translates to lower premiums. Although premiums are usually lower for HMO plans, this isnt always the case.

PPO plans usually have somewhat higher premiums, but give you more flexibility. Although there will still be a provider network, you will be able to visit physicians and healthcare providers that arent part of that network. This will usually cost more but still be covered to a large degree. PPO plans are good for those who want a bit more flexibility. Although they will typically cost more than HMO plans, in many cases the difference isnt huge.

SNP are plans that are restricted to only individuals with certain conditions. These can be health conditions, such as Alzheimers, or specific situations and living conditions, like skilled nursing facility patients.

Medical Savings Account Plans

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan paired with a health savings account . With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

Deductibles vary by plan, but can be thousands of dollars. If you spend all of the money in your MSA before reaching your deductible, you will need to pay expenses out of pocket until you hit your deductible. Make sure to take the high deductible into account before getting an MSA.

You May Like: Does Medicare Cover Pill Pack

What Does Medicare Advantage Cover

Medicare Advantage plans must cover everything that Original Medicare covers, including inpatient hospital and skilled nursing facility care, emergency and urgent care, doctor visits, surgery, preventive care, certain vaccines and medical equipment such as wheelchairs and walkers. 2

Medicare Advantage plans may also cover additional services not included in Part A and Part B. Most plans include Part D prescription drug coverage. Many offer some coverage for dental and vision care, hearing aids, and fitness centers. Plans recently have been permitted to provide other benefits, including adult daycare, in-home support services, and home safety modifications, such as grab bars and wheelchair ramps. Traditional Medicare does generally not cover those services.3

About Humana Medicare Supplement Plan N

The Medicare Supplemental Plan N was first offered in 2010, when Medicare introduced the modernization act. During that time, some plans, like Medigap Plan J were phased out, while new plan, like Medigap Plan N , were introduced.

At Senior HealthCare Solutions, we noticed our clients enrollment rate for Plan N increased by nearly 50% from 2019 to 2021. This brings the overall enrollment rate for Medigap Plan N to 24% of our total enrollees . Other the Medigap Plan G, the Medigap Plan N provides the most value for the dollar.

With that said, a Humana Medicare Supplement Plan N might not be for everyone. The most important question we use to determine if a Humana Plan N is suitable is the frequency of doctors office visits .

If you decide to enroll in a Humana Plan N, you can expect to pay lower premium, in comparison to a Humana Plan G.

Also Check: Is Medicare Running Out Of Money

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

You May Like: What Is The Penalty For Not Enrolling In Medicare

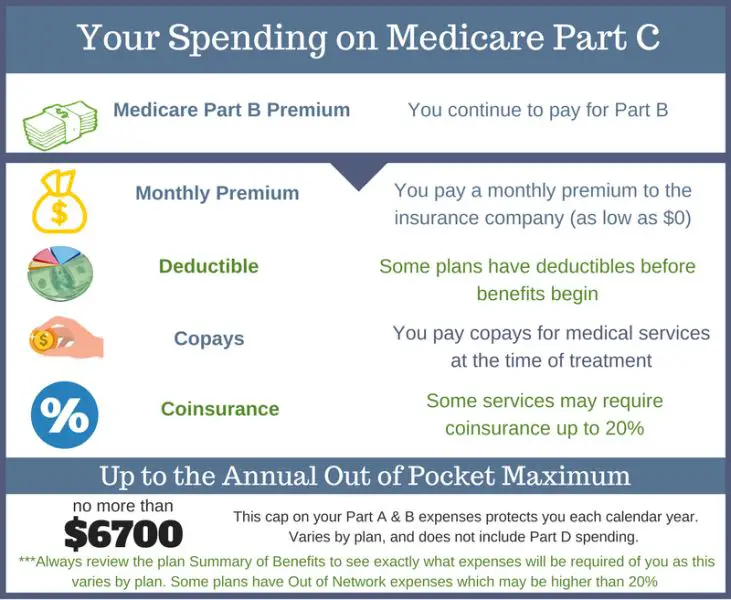

What Costs Do I Pay With Medicare Part C

Your costs with a Medicare Advantage plan can vary based on things like how often you visit your doctor, if your primary doctor is in-network or out-of-network, and your prescription drug needs. When its time to compare your options, consider these tips:

- Part C does have a provider network. You can contact a GoHealth licensed insurance agent or the plan to find out if your doctor is in-network. Receiving care out-of-network may not be covered thus increasing your cost considerably.

- Deductibles and copays can add up if you anticipate frequent doctor visits or the need for specialty care. It may be helpful to compare your Medicare Advantage plan costs alongside Original Medicare and Medicare Supplement coverage.

- Prescription drugs are usually covered with a Medicare Advantage Plan. Original Medicare requires members to add Part D coverage, which has its own monthly premium. Either way, you should make sure your prescriptions are covered by any Part D plan you choose.

If youre looking for quick plan comparisons and straightforward answers to your Medicare questions, GoHealth can help. A GoHealth licensed insurance agent can compare all the plans available to you side-by-side and find the plan that meets your needs.

What extra benefits and savings do you qualify for?

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Don’t Miss: Does Medicare Cover Depends For Incontinence

Why Do I Need Medicare Part C

Medicare Part C is an alternative to traditional Medicare. Some people may choose a Medicare Part C plan for the following reasons:

- They have a medical condition that requires specific services and medications. Medicare Part C offers Special Needs Plans for people with specific conditions, such as congestive heart failure or diabetes. These targeted plans may provide cost savings to a person.

- They need additional services that Medicare does not offer, such as hearing or vision care.

- They receive benefits under a group plan. Some employers and unions offer their retired employees a group plan under Medicare Advantage. These firms may provide additional services at a lower cost to their former employees. An estimated 19% of all Part C enrollees are part of an employer- or union-sponsored group plan, according to the KFF.

People tend to choose Part C over traditional Medicare if they are seeking greater cost savings, expanded coverage, or both.

What Medicare Part C Covers

Medicare Part C plans offer all the benefits of Medicare Part A and Part B, with a few exceptions:

-

Clinical trials .

-

Hospice services .

-

Some new Medicare benefits, which temporarily are covered by Original Medicare.

Most Medicare Advantage plans include Medicare Part D prescription drug coverage. And the majority offer additional benefits that Original Medicare doesnt offer, such as cost help with dental and vision care, fitness benefits, transportation to doctor visits and over-the-counter drug allowances.

Medicare Part C isnt required to cover services that arent deemed medically necessary under Medicare.

Read Also: Will Medicare Pay For Electric Scooter

What Does Medicare Part C Cost

The cost of Part C plans varies based on several factors. Location, carrier, gender, tobacco use, and age are just some of the factors that go into setting a rate for Part C. Some MA plans come at no cost to the member.

If youre considering a Part C plan, definitely talk to one of our trained agents.

About Humana Part D Plans In 2022

Humana Part D Plans are designed to help cover and reduce the cost of your prescriptions . There are two ways to obtain Humana Part D benefits:

A Humana Part D Plan can also be called a Humana Rx Plan or Humana Drug Plan. Technically, all are correct, but if you ask Medicare, its Medicare Part D.

Every Humana Drug Plan has a formulary, which provides a list of covered drugs and the tier of the drug. A tier is set by the company and can vary from plan to plan and company to company. Simply put, the tier of the drug impacts the cost you pay. The higher the tier, the more you pay.

Humana Part D plans allow you to fill prescriptions at your local pharmacy or have them delivered in the mail, your choice!

You May Like: Does Medicare Part A Or B Cover Prescriptions

Do Medicare Part C Plans Have Deductibles

A deductible is the amount you must pay out of your own pocket toward the costs of covered services and items before your plan coverage kicks in. Plans that include prescription drug coverage may have two separate deductibles: one for medical care costs and one for drug coverage costs.

Some Medicare Advantage plans may include $0 deductibles.

In 2022, the average drug deductible for Medicare Advantage plans is $301.94 per year. Medicare plan drug deductibles can be as high as $480 per year in 2022.

In some states such as Illinois, the drug deductible can be around $400 or higher in 2022. On the other side of the spectrum, Utah’s average Medicare plan drug deductible is $182.18.

How To Choose The Right Humana Supplemental Insurance Plan

There are some questions to consider, such as:

- How often to you visit a doctor each year?

- Are you ok with paying a deductible?

- Are you ok with paying $20 copays?

- Would you prefer to pay a monthly premium to know your out-of-pocket cost will be zero? Or would you prefer to spend less monthly premium and ok with having some out-of-pocket cost when you go to the doctor or hospital.

We have licensed agents that can help guide you through some of these questions, and more, to help determine if a Humana Medigap Plan F, Humana Medigap Plan G or Humana Medigap Plan N is suitable for you .

Our agents can also help determine if you may be a candidate for a Humana Medicare Advantage Plan. We discuss Humana Advantage Plans is more detail below. Call today, 866-MEDIGAP .

You May Like: How Much Does Medicare Pay For A Doctors Office Visit

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

How To Apply For Medicare Part C

First, enroll in Original Medicare . You cannot enroll in Medicare Part C until you do this. If youâre on federal retirement benefits, meaning you have paid Medicare tax through your payroll taxes for at least 10 years, youâre automatically enrolled in Medicare on the first day of the month you turn 65. Youâre also automatically enrolled once youâve been receiving federal disability payments for 24 months regardless of your age.

If youâre 65, but not receiving federal retirement benefits, you have to enroll for Medicare by visiting your local Social Security office, calling 1-800-772-1213, or filling out an online application through the Social Security Administration website at ssa.gov.

Once youâre enrolled in Original Medicare, then you can shop for a Medicare Advantage plan. You can search for plans on the Medicare website and purchase the one you want directly from the insurer.

However, you can only enroll within a designated time period each year. New Medicare recipients have seven months to buy coverage, starting three months before the month you turn 65. This is your initial enrollment period. Outside of initial enrollment, these are the times you can purchase or make changes to a Medicare Advantage plan:

Learn more about how to apply for Medicare.

Don’t Miss: Are Legal Residents Eligible For Medicare

Beneficiaries’ Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries’ choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans’ mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans’ availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .