Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage.. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

How Medicare Advantage Plans Work

First, it will help to review a few basics. Medicare comes in four parts, with Part A covering inpatient hospital care, and skilled nursing. Theres no premium if you or your spouse have earned at least 40 Social Security credits.

Part B covers doctor services and outpatient hospital care. You have to pay a monthly premium for this coverage, which is $170.10 in 2022, with a deductible of $233. High earners pay more.

The other parts of MedicarePart C, aka Medicare Advantage, and Part D, prescription drug coverageare optional and offered by private insurers.

Medicare Advantage is an all-in-one managed care plan, typically an HMO or PPO. Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.

If you opt for Medicare Advantage, you typically continue to pay your Part B premium as usual, but you will pay little or no additional premiums for your coverage. You generally have copays or coinsurance, but once you reach your out-of-pocket limit, the plan will pay 100 percent of your medical costs covered under Medicare for the rest of the year. The out-of-pocket limit does not apply to prescription drugs or extra benefits.

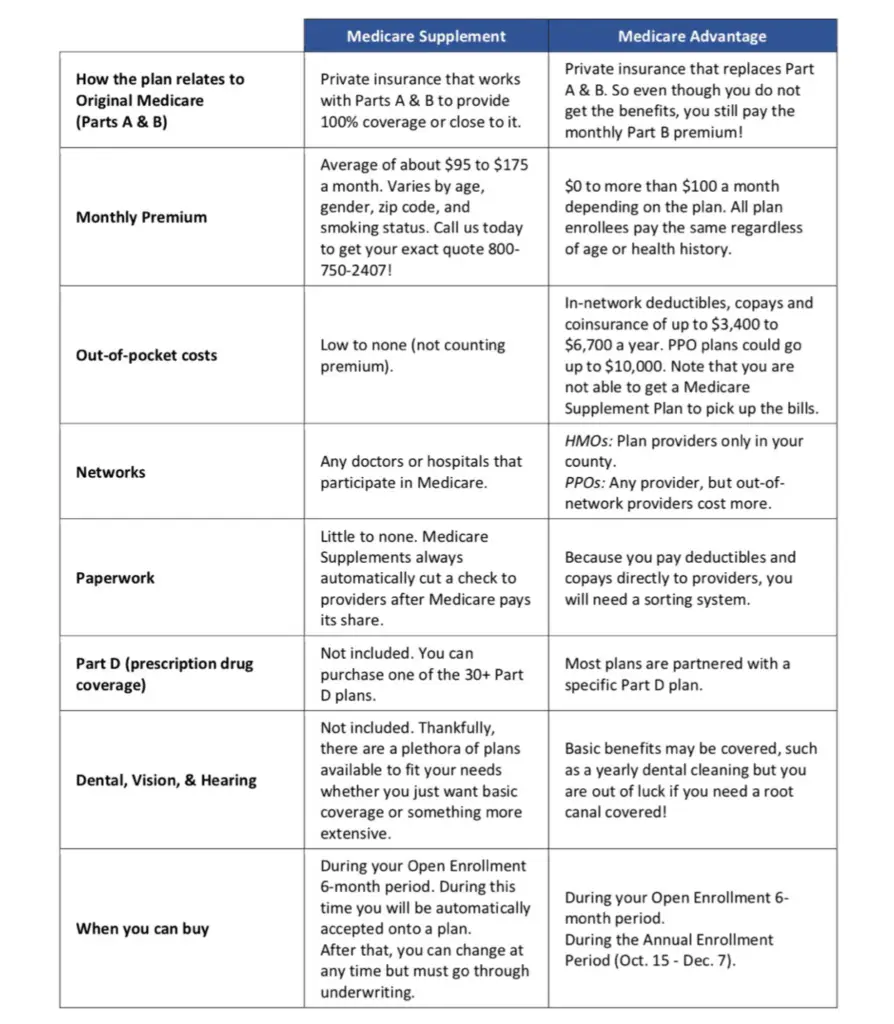

With Medigap, youll pay more in monthly premiums compared with Advantage plans . Youll also have a bit more work choosing your Part D plan.

Switching To A Medicare Advantage Plan

Summary:

Medicare Advantage plans can be full of extra benefits like prescription drug coverage, dental, hearing, and vision coverage. Another advantage of a Medicare Advantage plan is a mandatory out-of-pocket maximum. A possible disadvantage of a Medicare Advantage plan is you canât have a Medicare Supplement plan with it. You may be limited to provider networks.

The Medicare Advantage program, also known as Medicare Part C, provides a way you can get your Original Medicare benefits through a private, Medicare-approved insurance company instead of directly from the government. If youâre thinking of switching to a Medicare Advantage plan, you may find this article useful.

Also Check: Does Medicare Advantage Cover Chiropractic Care

What Are The Pros And Cons Of Medicare Supplement Insurance

Medicare Supplement Insurance plans can help cover certain Medicare deductibles, coinsurance, copayments and other out-of-pocket expenses faced by Medicare beneficiaries.

One advantage of Medigap plans is that all 10 standardized Medigap plans that are sold in most states cover Medicare Part B coinsurance or copayments, at least partially.

Depending on the types of Part B services you receive and how often you need them in a year, this could help save you money.

Another advantage of Medigap plans is that they are accepted by every doctor and health care provider who accepts Medicare.

One disadvantage of Medicare Supplement insurance is that insurance companies arent required to sell Medigap policies to people younger than 65.

Some states do require insurance companies to sell Medigap to people under 65, but even in those cases, you could pay higher premiums if you are younger than 65. Check with your states department of insurance to learn more about Medigap rules where you live.

Covered Services In Medicare Advantage Plans

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs and some vision, hearing, and dental services . Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

Read Also: Can I Change From Medicare Supplement To Medicare Advantage

What Are The Advantages Of Medicare Advantage Over Medicare Supplement Insurance

The biggest advantage of Part C plans over Medicare Supplement insurance is cost. Every Medigap plan has a monthly premium. This premium will tend to rise over time. Medicare Advantage plans have lower premiums. In fact, they often have no premium requirement at all.

Medicare Advantage plans also outperform Medigap when it comes to extra benefits provided. Medigap policies only cover what Original Medicare covers. Therefore, they do not cover things like:

- Vision

- Transportation

- Meal delivery programs

It is true that many Medigap plans have savings programs for some of these things. However, they do not offer anything like comprehensive coverage. The extra benefits often found in Part C plans are much more complete than the discount programs available from Medigap plans.

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Need Help With Medicare?

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

You May Like: Does Medicare Pay For Stem Cell Treatment

Bottom Line For Medicare Advantage

It is very affordable, usually includes Rx coverage and caps your total annual risk to as high as $7,550. Just know that you will be limited to a smaller network and you will still usually have to pay deductible and copay fees that can add up . The biggest complant from our clients about Medicare Advantage is its smaller network and needing referals to see specialist. Those who do want a larger network of doctors should check out Medigap Pros and Cons.

If you are still not sure about Medicare Advantage, there are 3 hints that Medicare Advantage is right for you.

This is definitely a lot to take in. Your next step is to see which MA plans are available in your area and how much they cost. Then give us a call at 800-930-7956 and we can help you understand your options and enroll over the phone. There is no cost for our services.

Reason : Hospitalization Costs More Not Less

In many cases and with many plans, this is true.

In fact, a recent Kaiser Family Foundation study shows that half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage. for a 5-day hospital stay. Thats shocking, but given the rising cost of hospitalization, its also understandable.

This fact also underscores the need to carefully scrutinize Medicare Advantage plans annually so you are not surprised by the bills. Ambulance, emergency room, diagnostic, hospitalization, and inpatient medication copays add up very fast.

IMPORTANT: If you are getting your Medicare benefits for the first time, and you have a chronic health condition that necessitates frequent care, pay careful attention to Medicare Advantage hospitalization costs. If you can get a Medicare supplement during your Medicare supplement guaranteed-issue rights period, your hospitalization costs over time will generally be lower.

You May Like: Does Medicare Cover Refraction Test

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the pros and cons of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for your personal situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

MA Plan ProsLearn more in this article.

Report: Medicare Advantage Plans Can Be Too Good To Be True

- May 10th, 2007

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits. Medicare Advantage plans are provided by private insurers, unlike original Medicare, which is provided by the government. The government pays Medicare Advantage plans a fixed monthly fee to provide services to each Medicare beneficiary under their care. The plans often look attractive because they the offer the same basic coverage as original Medicare plus some additional benefits and services that original Medicare doesn’t offer.

The idea behind the plans is to provide better services and lower out-of-pocket costs. However, it doesn’t always work that way, according to the Medicare Rights Center. While the plans must provide a benefit package that is at least as good as original Medicare’s and cover everything Medicare covers, the plans do not have to cover every benefit in the same way. For example, plans may pay less for some benefits, like skilled nursing facility care, and offset this by offering lower copayments for doctor visits.

Local Elder Law Attorneys in Your City

City, State

The report, based on thousands of beneficiary calls to the Medicare Rights Center, lists nine common problems with Medicare Advantage plans. The problems include the following:

To read the full report, .

Don’t Miss: How To Become A Medicare Provider In Florida

Medicare Annual Election Period

The Medicare Advantage Annual Election Period , also called Medicare Open EnrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions., is the period when beneficiaries can enroll in a Medicare Advantage plan, switch plans, add prescription drug coverage, or disenroll from a Medicare Advantage plan and return to Original Medicare. It occurs every Fall from October 15 to December 7. Youll know its coming up when you start seeing Medicare commercials on TV.

Con: Plans Vary From State To State

Regular Medicare is universal across the United States. However, since Medicare Advantage plans are private plans, they vary depending on your state. For example, the above chart is specific to a plan in Florida.

As we mentioned earlier, Medicare Advantage plans vary depending on your ZIP. If you live in a rural area, you may not have the best network included in your plan. If you move to another state or even a different area, your Medicare Advantage plan may be unavailable. You can switch your plan outside of open enrollment, but the process can be quite tedious in many cases.

If you travel often, you may not receive coverage everywhere you visit. This is extremely challenging if you get hurt out of your home state.

Read Also: Where Do You Sign Up For Medicare

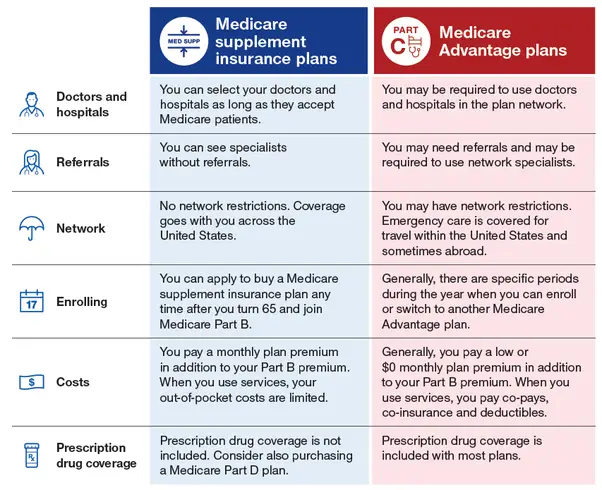

Medicare Supplement Vs Medicare Advantage: 6 Facts You Should Know

Knowing the difference between Medicare Supplement and Medicare Advantage is not as hard as it seems. The main issue is that âOriginal Medicareâ provides incomplete health coverage, leaving you exposed to many out-of-pocket expenses. There are two different solutions to this coverage problem: Medicare Supplement and Medicare Advantage. You can have one or the other, but not both. Here are the facts you should know about Medicare Supplement vs. Medicare Advantage, according to the official U.S. government website for Medicare.

Holes In Medicare Advantage Plan Benefits

Medicare Advantage plans often offer extra benefits that you wonât find on a Medicare Supplement plan. These benefits include dental, vision, and hearing care, prescription drug coverage, and more. However, these additional benefits can cause issues when paying for the services.

Often, beneficiaries face disappointment when they pay more than they budgeted for when utilizing the additional benefits. Even though their Medicare Advantage plan offers coverage, they are almost always met with high out-of-pocket copays and a low maximum benefit amount. Once you exceed a certain amount of coverage, you are responsible for 100% of your costs.

However, Medicare Advantage plans might work in certain situations. If you are on a limited budget and cannot afford the monthly premiums for a Medicare Supplement plan, then a Medicare Advantage plan with sufficient coverage for your health needs is a good deal.

Don’t Miss: Can An Immigrant Get Medicare

Is Medicare Advantage Good Or Bad

Whether a Medicare Advantage plan is good for you will depend on your needs. If you are healthy and only visit the doctor for routine checkups, it may be a good idea. However, it may not be the best choice if you often travel outside of your providers coverage area or require frequent medical care.

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

In addition to the fact that Medicare Advantage insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan . These are valuable benefits that Original Medicare does not cover. For healthy people, these extras make a Medicare Advantage plan a very good deal.

Many of the extra benefits that some insurance plans offer look very enticing, but they often come with limits or high out-of-pocket costs. For example, a plan may have excellent healthcare benefits and a poor Part D plan .

Also, it is important to understand that the extra benefits, including Part D prescriptions, are not included in the plans maximum out-of-pocket limit. So, lets say you use the plans dental coverage and pay $1,500 in copays for restoration work, that $1,500 is not included in your MOOP, nor are your Part D medications. This is why so many people feel that traditional Medicare, plus a supplement plan, dental plan, and a stand-alone Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan are the best way to go.

Find Plansin your areawith your ZIP Code

Don’t Miss: What Is The Difference Medicare Part A And B

Medicare Advantage Plan Faqs

At first glance, a Medicare Advantage plan may seem like the best choice, but understanding its pros and cons is crucial to making the right decision for your needs. After all, you dont want to get stuck with high out-of-pocket health care costs. Review the most commonly asked questions about Medicare Advantage plans below to see if it is right for you.

Is A Medicare Advantage Plan Worth It

A Medicare Advantage plan may be worth it to some beneficiaries and perhaps not worth it to others. A Medicare Advantage plan may be worth it if:

- You have a health condition and may benefit from a more customized benefit package.

- You want coverage for benefits like prescription drugs, dental, hearing, vision and other services, all under one single plan.

- You want a better sense of how much money you may have to spend on health care over the course of a year and value the peace of mind that an out-of-pocket limit can provide.

- You prefer the coordinated care strategy used by many Medicare Advantage plans.

Also Check: Is Silver Sneakers Available To Anyone On Medicare