How Much Does A Medigap Plan Cost In Florida

A Medigap plan in Florida may cost between $46 and $884 per month, with the biggest pricing factors being your age and the plan you choose.

| Medigap plan | |

|---|---|

| $73 | – |

Rates are based on a 65-year-old female nonsmoker in Florida. Enrollment does not total 100% because of discontinued, waivered and pre-standardized plans that are not shown here. Enrollment in high-deductible plans is grouped together with their standard plan letter.

Find Cheap Medicare Plans in Your Area

Specifically, the cost in Florida averages $262 per month for Medigap Plan F and $176 per month for Medigap Plan N for a 65-year-old female nonsmoker.

Medicare Supplement plans in Florida have some of the most expensive rates in the country. A 65-year-old in Florida can expect to pay about 50% more for Medigap Plan G than the national average.

While many different plans are available, the most popular plans in Florida are the ones that have the most coverage: Plans F, G and N.

What Colonial Penn Medicare Supplement Plans Are Offered In 2021

at a glance

- Colonial Penn offers 12 Medicare supplement plan options in most states throughout the country.

- Medigap plans through Colonial Penn cover some of your out-of-pocket medical costs after original Medicare has paid its portion.

- The best time to buy a Medigap plan is when you turn 65 years old and enroll in Medicare Part B

The Colonial Penn Life Insurance Company is a private insurer that sells Medicare supplement plans. Colonial Penn is an affiliate of the Bankers Life and Casualty Company.

In this article, well go over what each Colonial Penn plan offers and what it may cost.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: Do I Need To Keep Medicare Summary Notices

Colonial Penn Life Insurance Review 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Bottom line: With more complaints than expected for a company of its size and relatively low coverage limits, Colonial Penn is unlikely to be the best option available to you.

» MORE:Compare life insurance quotes

Why you can trust NerdWallet: Our writers and editors follow strict editorial guidelines to ensure the content on our site is accurate and fair, so you can make financial decisions with confidence and choose the products that work best for you. Here is a list of our partners and heres how we make money.

What Are Colonial Penn Medigap Plans

For starters, itll be helpful to quickly go over what a Medigap plan even is. A Medigap plan is a standardized health coverage that fills in the gaps Original Medicare leaves behind. In total, there are 12 Medigap plans, though if youre new to Medicare, only 10 of these options are available to you. While not all companies offer all 12 plans, Colonial Penn likely carries every single one where you live.

Because the plans are standardized, their care is the same no matter who you are or where you live. Well, unless you live in Massachusetts, Minnesota, or Wisconsin, in which case your state has its own regulations and plans. But the other 47 states offer the same coverage for the same letter plan. So, for example, if you have Plan D and live in California, you have the exact same coverage as a person with Plan D who lives in Louisiana.

The only difference between the standardized coverage plans will be the price. Monthly rates will vary quite a bit depending on where you live. As a general rule, the higher the cost of living where you live, the higher your monthly premiums will be.

Also Check: What Is The Best Medicare Advantage Plan In Texas

How Much Are Colonial Penn’s Life Insurance Rates

For a 50-year-old man, rates for term life insurance from Colonial Penn can range from $13 to $57 per month. Guaranteed acceptance policies ran between $10 and $80 per month, while whole life insurance was the most expensive at $30 to $133. Ultimately, the cost of your life insurance will depend on your age, gender and the amount of coverage you select.

Living Insurance From Colonial Penn

When you apply for their whole life product with health questions, they allow you to add two different living benefit riders.

These riders cost extra, and you can only choose one. You cannot have both added to your policy.

- Critical Illness: This allows you to access up to 50% of your death benefit if you suffer a heart attack, stroke, or are diagnosed with a terminal illness.

- Cancer: Allows you to receive up to 50% of your death benefit if you are diagnosed with cancer or a terminal illness.

Essentially, they provide an additional layer of protection if youre ever diagnosed with a chronic illness or major health event.

If you opt to purchase their whole life policy with health questions, adding one of these riders would be a good idea.

Read Also: How To Win A Medicare Appeal

Colonial Penn Life Insurance Coverage Types

Colonial Penn Life Insurance only offers renewable term life, guaranteed acceptance life insurance and whole life insurance, which may make it a competitive option for shoppers over age 50 who are looking for life insurance. Whole life policies are available to those between the ages of 40 and 75 in most states, with the maximum coverage amount being $50,000. Colonial Penns whole life coverage limit is considerably low compared to some other life insurance companies.

For Colonial Penns guaranteed acceptance policies, the maximum coverage amount depends on your age and state. If youre wondering how much life insurance you need, a life insurance calculator may help you figure out an amount best fit to your financial goals.

Colonial Penn Life Insurance policyholders have the option to add an accelerated death benefit rider, which will pay out up to 50% of your death benefit while still living if you are diagnosed with a covered illness, such as a heart attack, stroke, cancer or chronic illness.

For a closer look, Colonial Penn offers the following coverage types:

Read Also: Best Fat Loss Supplements For Women

Colonial Penn Medicare Supplement Plans

Medigap plans are available in all 50 United States and the District of Columbia. Medicare Supplement plans are secondary coverage to your Original Medicare benefits and pay portions of your Medicare cost-share.

Medicare Supplement insurance plans have a fixed monthly premium. You pay little or nothing when you use your healthcare coverage for coinsurance. When you select a Medigap policy, you retain all of your benefits from Medicare. These include the freedom of healthcare providers.

You May Like: Types Of Medicare Supplement Plans

You May Like: Does Medicare Pay For Dexcom

Not Sure If Colonial Penn Is Right For You Consider These Alternatives

Colonial Penn Life Insurance may not be right for everyone, especially if youre looking for universal life or variable universal life. It may also be helpful to look into the different types of life insurance and consult a life insurance guide to learn which policy or coverage types are best for your situation.

Once youve determined your life insurance policy needs, insurance experts typically suggest you get a life insurance quote from a few insurers. The carriers below may be a helpful starting place for your search.

What Services Do Colonial Penn Medicare Supplement Plans Cover

Medigap plans offer standardized coverage in most states and must follow specific state regulations. The exceptions are Massachusetts, Minnesota, and Wisconsin, which have their own regulations and plan names.

In the rest of the country, each Medicare supplement plan of a certain letter must offer the same level of coverage, no matter which insurer is selling it or where its being sold. For example, Plan A in New York must cover the same services as Plan A in California.

Lets take a look at what each plan offered by Colonial Penn covers.

| Plan A |

|---|

Plan availability and costs, however, may differ based on your location, age, and other factors. Some plans may also come with extra benefits beyond the standard coverage.

Next, well go over the specifics of what each Colonial Penn Medigap plan covers.

Colonial Penn Medigap plan costs vary from location to location. You can search these plans by ZIP code using Medicares plan comparison tool.

The table below provides some price ranges around the country for the Medigap plans Colonial Penn sells.

| Location | |

|---|---|

| attained-age pricing | $100$236 |

The type of pricing indicated above can affect your costs over time. Heres what each type means:

Not every plan offered is available in every state, county, or ZIP code. To see if Colonial Penn offers a specific Medigap plan in your area and how much it will cost for you, visit the companys website here.

Recommended Reading: How Old Do You Have To Be For Medicare

Colonial Penn Life Insurance Policies

Life insurance options from Colonial Penn include:

Whole life. From $10,000 to $50,000 of whole life insurance is available for applicants ages 40 to 75 . The application asks health questions, but there isnt a medical exam. The price is based on age and gender and will stay the same throughout the life of the policy.

Guaranteed acceptance whole life. People ages 50 to 85 can apply, and acceptance is guaranteed. There are no health questions or medical exam. Coverage amounts are generally small and depend on the applicant. The full death benefit isnt paid out if the insured person dies during the first two years.

No life insurance medical exam is required for any of the companys policies. Healthy people can generally get better prices from companies that consider more medical information when setting rates.

Colonial Penns whole life policies are also available under its “Living Insurance” option that allows you to receive part of your death benefit if youre diagnosed with a specific health condition. This option isn’t available for guaranteed acceptance policies.

You can choose Living Insurance coverage for heart attack or stroke, certain cancers or a debilitating chronic illness. If you develop the condition you chose, or if youre diagnosed as terminally ill , you can get 25% to 50% of the death benefit while youre still alive. The chronic illness option isn’t available to applicants ages 65 to 75.

Colonial Penn Life Insurance Customer And Claims Satisfaction

With a financial strength rating of A from AM Best, Colonial Penn Life Insurance has proven its historic ability to pay out claims. However, consumers have filed more complaints than normal against Colonial Penn, according to the NAIC, which shows that a significant proportion of policyholders have had issues with the company. Colonial Penn is currently unrated by J.D. Power.

Don’t Miss: When Do I Receive Medicare

Colonial Penn Medicare Supplement Plan N

Colonial Penns Medicare Supplement Plan N is popular because it is one of the most affordable plans available. However, it still provides coverage for primary benefits included in Original Medicare. For example, it covers hospital stays up to 365 days after Medicare coverage ends, the Part A deductible, and skilled nursing facility care. It also covers Part B coinsurance, but you have to pay $20 copayments for doctor visits and $50 copayments for emergency room visits.

How Does Age Affect Medigap Prices In Florida

In Florida, insurance companies are allowed to use age to determine prices. That means you’ll get the best prices at age 65, and you may see price increases each year. For example, a 90-year-old pays an average of $144 more per month for Plan G than a 65-year-old.

Across all plans in Florida, you can expect the monthly cost of a Medigap plan to increase by about $5 each year as you age. That’s about a 20% increase each decade.

Read Also: What Is The Average Cost For Medicare Part B

Colonial Penn Life Insurance Products By Type

Colonial Penn specializes in life insurance products with smaller death benefits and limited underwriting. Often referred to as final-expense insurance, these products make the most sense for people who want to have coverage in place quickly.

For instance, someone in poor health may only need a small payout to cover funeral expenses, a loan or another limited financial obligation.

Depending on your financial needs, Colonial Penn offers three types of life insurance policies:

| Term life |

|---|

You can apply for all of Colonial Penn’s life insurance products online, and none require a medical exam. This is convenient for consumers who want to quickly purchase coverage. While Colonial Penn also advertises a 30-day money-back guarantee, this feature isn’t unique and shouldn’t be a reason you decide to purchase from them.

Most states have “free look” laws requiring insurers to provide a full refund, if requested, for 10 to 30 days after purchase.

Should I Buy Colonial Penn Medicare Supplement Insurance

Colonial Penn may not offer the most affordable Medigap policies. Therefore, it may be better to compare quotes from multiple companies to ensure that youre getting the best rates. However, if you decide to move forward with Colonial Penn, certain plans may better suit your specific situation.

Seniors who dont visit the doctor often or have a limited budget may opt for Medigap Plan N. It is the most affordable plan but covers some basic costs. Unfortunately, you will still need to pay some copays and out-of-pocket expenses.

Seniors who want to ensure their basic healthcare needs are covered may choose Medigap Plan A or Plan B. These plans cover hospital care, hospice care, and home health care costs. However, you would not be covered for skilled nursing facility care.

Seniors who have a lot of doctors appointments or who have been diagnosed with a chronic illness may want to buy a plan that will offer a higher level of coverage, such as Medigap Plan F or G. These typically cover all or most of your out-of-pocket expenses, but is only worth the cost if you plan on using the benefits.

If you would like to compare the plans available from the Colonial Penn Medicare Supplement insurance company to other similar policies, enter your ZIP code into our free quote comparison tool below to see which Medigap policies are available in your area.

You May Like: How Can A Provider Check Medicare Eligibility

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but itâs also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Colonial Penn Medigap Plans

Colonial Penn administer 10 Medigap plans, with high deductible versions of two plans. The following designations identify the plans: A, B, C, D, F, high-deductible F, G, high-deductible G, K, L, M, and N.

The plans are standardized, meaning the features of Medigap Plan A in one state are identical to its features in another state. The exceptions are for programs in Massachusetts, Minnesota, and Wisconsin, where these states standardize Medigap plans differently.

The table below shows the deductible and copays or coinsurance for certain Colonial Penn plans in Philadelphia, Chicago, and San Francisco for 2021.

| Location |

|---|

| $45202 |

However, Medigap plans administered to new enrollees on or after January 1, 2020, may not cover the Part B deductible. Due to this ruling, people who are first eligible for Medicare on or after January 1, 2020, may not buy Plan C, Plan F, or the high-deductible Plan F.

However, if a person became eligible for Medicare before this date and did not enroll, they may be able to enroll in one of the three plans.

Medicare is the federal health insurance program for older adults and younger people with disabilities. It comprises the four parts below.

Read Also: Can I Receive Medicare And Medicaid

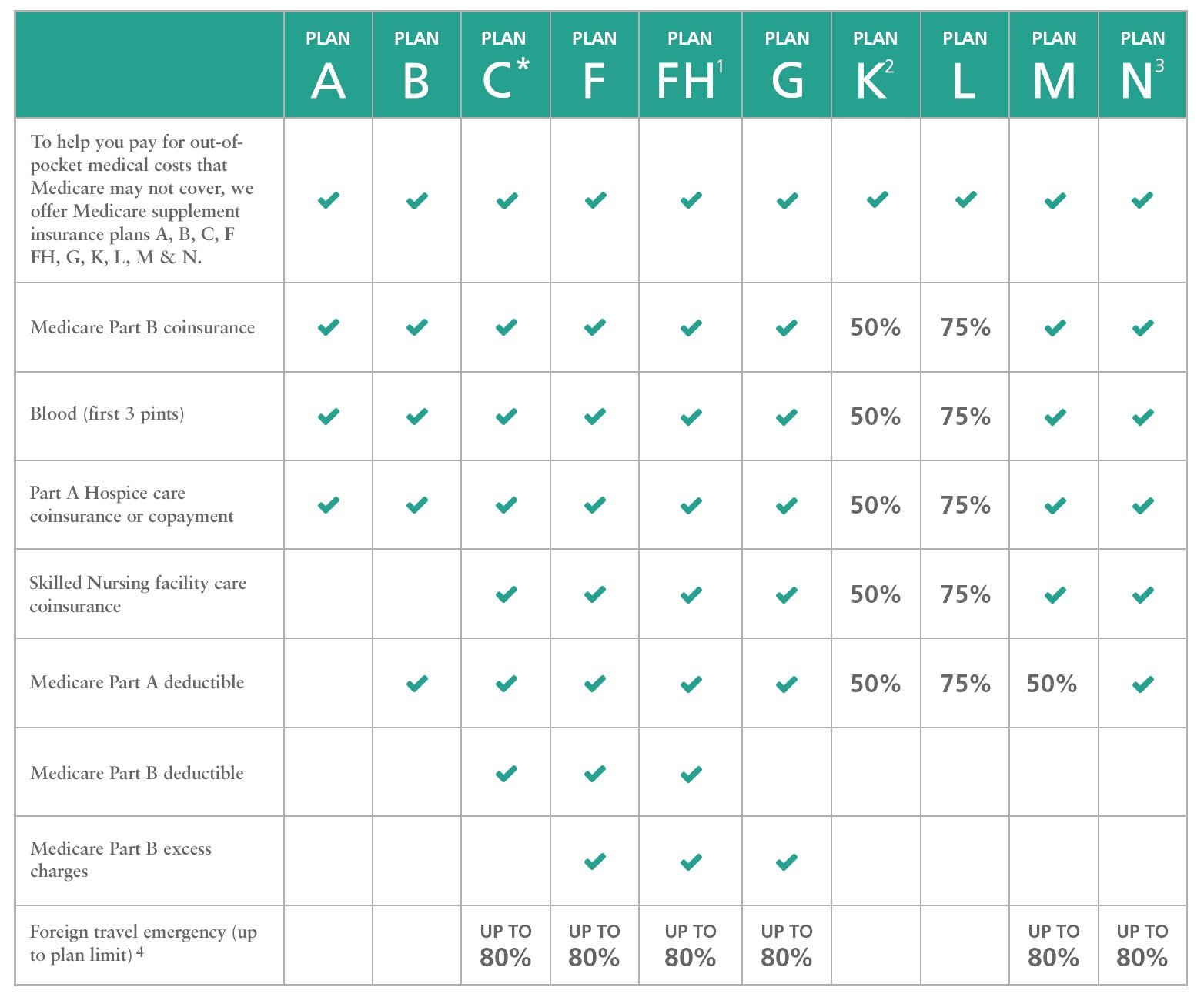

Compare The Features Of Colonial Penn’s Medicare Supplement Insurance Plans

To help you pay for out-of-pocket medical costs that Medicare may not cover, we offer Medicare Supplement insurance plans A, B, C¹, D², F, F with high deductible, G, G with high deductible, K, L, M and N. Our knowledgeable agents/producers can help explain how each plan works and answer your questions related to Medicare or Medicare Supplement insurance.

| Plan | PLANN | |

|---|---|---|

| To help you pay for out-of-pocket medical costs that Medicare may not cover, we offer Medicare supplement insurance plans A, B, C, D, F, FH, G, GH, K, L, M, & N. | ||

| Medicare Part B coinsurance | ||

| Parts A Hospice care coinsurance or copayment | 50% | |

| Skilled Nursing facility care coinsurance | ||

| Medicare Part B deductible | ||

| Medicare Part B excess charges | ||

| Foreign travel emergency | UP TO80% |

¹Plan C is offered in: Arizona, Delaware, Georgia, Iowa, Illinois, Maryland, Nebraska, Nevada, New Jersey, Ohio and South Carolina

² Plan D is not offered in: Connecticut, Florida, Maine, Minnesota, New York, Pennsylvania, Vermont, and Wisconsin.

³ The High-Deductible Plan F and the High-Deductible Plan G pay the same benefits as Plan F and Plan G after one has paid a calendar year deductible . Benefits from the High-Deductible Plan F and the High-Deductible Plan G will not begin until out-of-pocket expenses exceed this calendar-year deductible.

Plan N requires a copayment of up to $20 for doctors visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.