Delaying Enrollment In Medicare When Youre Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

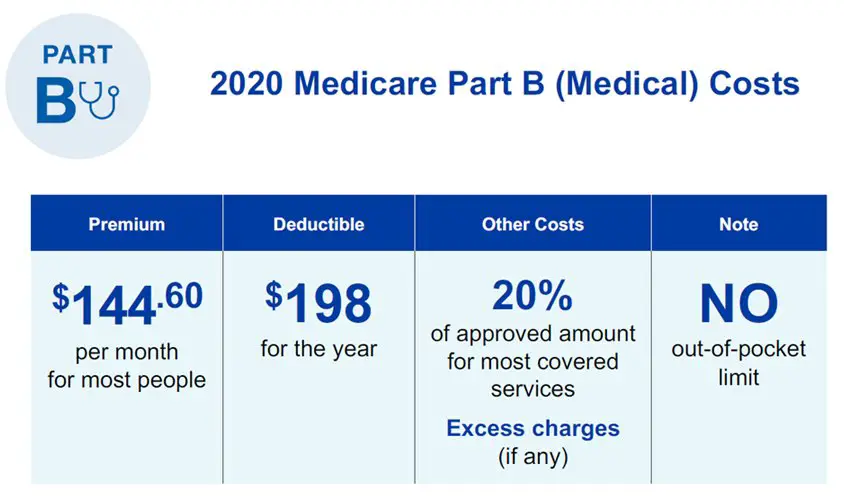

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Read Also: What Weight Loss Programs Are Covered By Medicare

Medicare Part B Costs By Income Level

Medicare Part B premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount .

The 2022 Medicare Part B premium costs by income level are as follows:

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2022 Part B deductible is $233 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What Does Medicare Cover

Original Medicare, which is made up of Parts A and B, will cover inpatient care and hospital stays, as well as doctor visits, treatments, services and outpatient care.

Medicare typically covers things that fall under the umbrella of medically necessary care. This means that services like cosmetic surgery or non-medical procedures are rarely covered.

What Medicare Covers

Also Check: Does Humana Advantage Replace Medicare

Eligibility For Part B

As part of the Original Medicare health insurance package, there are several ways you can be eligible for Part B. First, if you qualify for premium-free Part A, you can pay a monthly premium for Part B. On the other hand, if you do not qualify for premium-free Part A, you must be at least 65 years old and a United States citizen.

There are medical conditions that qualify you for Medicare Part B even if you are not 65 years old. If you meet these conditions, you can be covered under Part B

-

You receive disability benefits through the Social Security Board or Railroad Retirement Board and have had a disability for 24 months

-

You have kidney failure

-

You have ALS or Lou Gehrig’s Disease

If you meet any of these conditions or are in the age group for Medicare Part B, you need to make sure you enroll either through a Medicare Part B Florida agency or another agency.

What Is The Maximum Cost Of Medicare Part B

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B deductible. After your deductible is paid, youll need to pay coinsurance for each visit or service. This is often 20% of the Medicare-approved cost. Original Medicare does not have an out-of-pocket maximum, so theres no limit to how much you could end up paying for Medicare Part B.

Your cost may go up even more if you dont sign up for Medicare when youre first eligible Medicare Part B has a 10% penalty for every 12-month period you werent enrolled in Medicare but were eligible. Youll pay this enrollment penalty as long as youre enrolled in Part B.

There are options for lowering the overall cost of Medicare Part B. Medicare Supplement Insurance has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs. Medicare Advantage is Medicare coverage offered by private insurance companies and often has different costs for Part B coverage than Original Medicare.

Are you eligible for cost-saving Medicare subsidies?

Recommended Reading: Is Pennsaid Covered By Medicare

Medicare Part B Premiums

Some Medicare beneficiaries might pay more or less than the standard Part B premium in 2022 due to a few factors.

- The hold harmless provisionThe hold harmless provision limits the Part B premium for certain beneficiaries. It means that any increase in the Part B premium in one year can be no greater than the increase in a beneficiarys Social Security benefits from the year prior.

- Income-Related Monthly Adjustment Amount The Income-Related Monthly Adjustment Amount is the adjusted amount that higher income earners must pay for their Part B premium.The adjustment is based on your reported income from two years prior, and beneficiaries with higher incomes must pay more for their coverage.

The chart below outlines the 2022 Part B premiums for beneficiaries affected by IRMAA based on their 2020 income.

Medicare Part B IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

Medicare Part B Deductible In 2022

In 2022, the Medicare Part B deductible is $233.

So you’ll pay in full for the first $233 of your outpatient care before the cost-sharing begins. After you meet the deductible, you’ll typically pay 20% of the cost for doctor appointments, diagnostics and other outpatient care.

Like the Medicare Part A deductible, the Medicare Part B deductible increases slightly every year.

But unlike the Part A deductible, the Part B deductible is an annual deductible based on the calendar year. You only have to meet the Part B deductible once a year, and a new deductible takes effect on Jan. 1.

Don’t Miss: Does Medicare Cover Toenail Removal

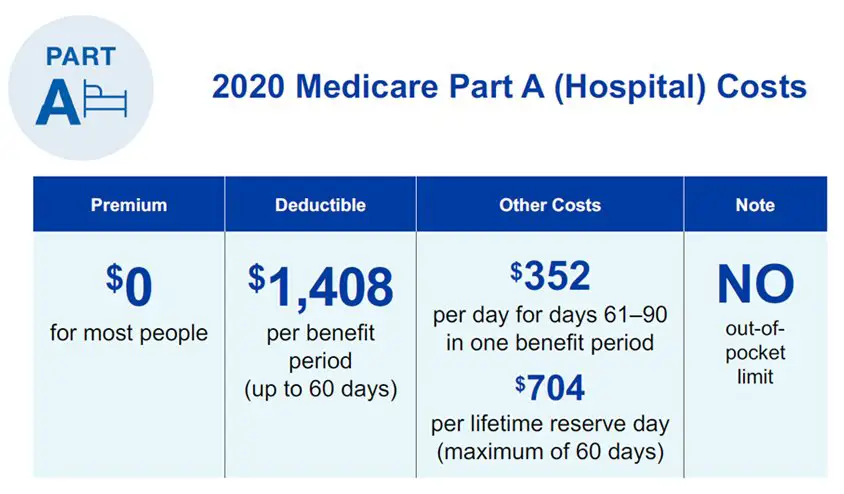

Medicare Part A Costs And Coverage

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care and hospice care. Long-term care is not covered under Part A.

If you receive Social Security for at least four months before your 65th birthday, you will be automatically enrolled in Part A and Part B. If you dont receive Social Security before turning 65, youll need to sign up with Social Security to receive coverage.

What Medicare Part A Covers

- Inpatient care

- Home health care

- Skilled nursing facility care

Part A charges no monthly premium to anyone who paid Medicare taxes through their employer for at least ten years. Those who havent worked that long have to pay premiums for Part A coverage. Most beneficiaries do not have to pay the premium.

2022 Medicare Part A Out-of-Pocket Costs and Increases

| Income Level for Individual Taxpayer | Income Level for Joint Tax Filers | Monthly Medicare Part B Premium |

|---|---|---|

| $91,000 or less |

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Recommended Reading: How To Get Prescription Coverage With Medicare

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

Most Medicare Advantage Plans Offer Prescription Drug Coverage

Medicare Advantage plans are an alternative to Original Medicare .

Medicare Advantage plans provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesnt cover.

Some of these additional benefits can include things like:

- Routine dental, vision and hearing care

- Membership to health and wellness programs like SilverSneakers

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

You May Like: How Old Before You Qualify For Medicare

Also Check: Do You Need Additional Insurance With Medicare

Who Pays More For Medicare Part B

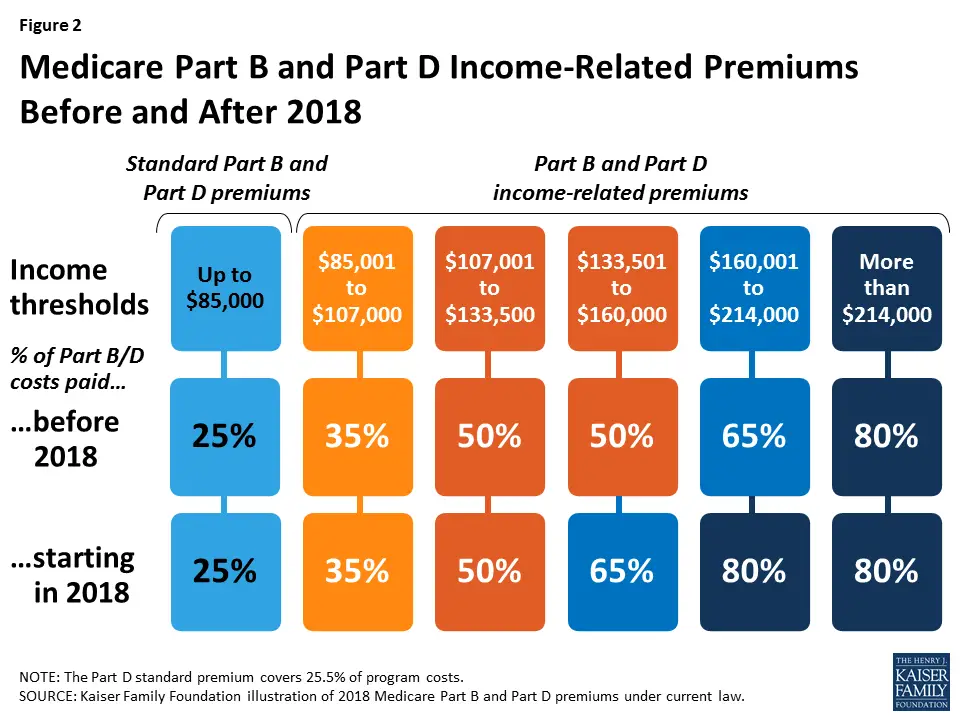

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

If your income is above those levels, the government shifts more of the premium cost to your personal balance sheet. Instead of covering 75% of the premium cost, the government pays anywhere from 65% to as little as 15% of the premium, based on your IRMAA.

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Read Also: When Is The Medicare Supplement Open Enrollment Period

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Medicare Advantage Deductible In 2022

The deductible of a Medicare Advantage plan can range from $0 to more than $1,000 dollars.

Medicare Advantage, also called Medicare Part C, is sold by private insurance companies so the annual deductible varies by insurer and plan.

However, many Medicare Advantage plans charge separate deductibles for medical and prescription drug coverage, requiring beneficiaries to meet two separate deductibles that can each average more than $300.

Enrollees in a Medicare Advantage plan do not also have to pay the deductible for Part A or a Part B.

For example, if you were admitted to the hospital with a Medicare Advantage plan, you wouldn’t pay the Part A deductible or copays. Instead, you’d pay the Medicare Advantage plan’s deductible and the plan’s daily copays for hospital care. This can average $100 to $500 per day, depending on the plan. After the first several days of hospitalizations, many Advantage plans charge nothing.

Read Also: Are Hearing Aid Batteries Covered By Medicare

Medicare Part B Coverage & Enrollment

When it comes to Medicare, Part B is a big part of what comes to mind when older Americans think about their medical coverage. Medicare Part B covers the medical services you need and, along with Part A , provides the foundation of Original Medicare.

But Part B coverage isnt exclusive to Original Medicare youll receive at least the same benefits with Medicare Advantage . It replaces Original Medicare , but offers the same Part A and B benefits or coverage as Original Medicare. Along with receiving Part A and B benefits, Medicare Part C often bundles additional services like dental, hearing, vision and prescription drug coverage.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Recommended Reading: Does Humana Offer A Medicare Supplement Plan

Medicare Part D Costs And Coverage

Medicare Part D, which is provided through private insurers like Medicare Advantage, covers prescription drugs. All Part D drug plans must provide a minimum coverage level set by Medicare. However, the type of drugs covered depends on the formulary, which is a list of prescription drugs covered. Formularies vary from plan to plan.

Formularies are broken into tiers. Each tier has a different cost-sharing amount. For example, Tier I drugs may include low-cost generic medications while Tier III drugs may include non-preferred name-brand medications. Part D coverage is often included in Medicare Advantage plans.

The cost of a Part D plan varies depending on cost and which drugs it covers. If you live in a high-income household, you may have to pay an extra cost to your standard Part D premium due to the income-related monthly adjustment amount .

If you do not sign up for Part D coverage when you first enroll in Medicare, you can still sign up later. But you will pay an ever-increasing penalty unless you have other creditable prescription drug coverage or you receive certain other assistance from the state or federal government.

The penalty, which applies if you dont have some form of drug coverage 63 days after your initial Medicare enrollment period ends, is based on how long you waited to enroll in a prescription drug plan. It adds a cost for each month you went without enrolling on to all future monthly premium payments.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Also Check: What Is Traditional Medicare Coverage