How Are Medicare Advantage And Medigap Different

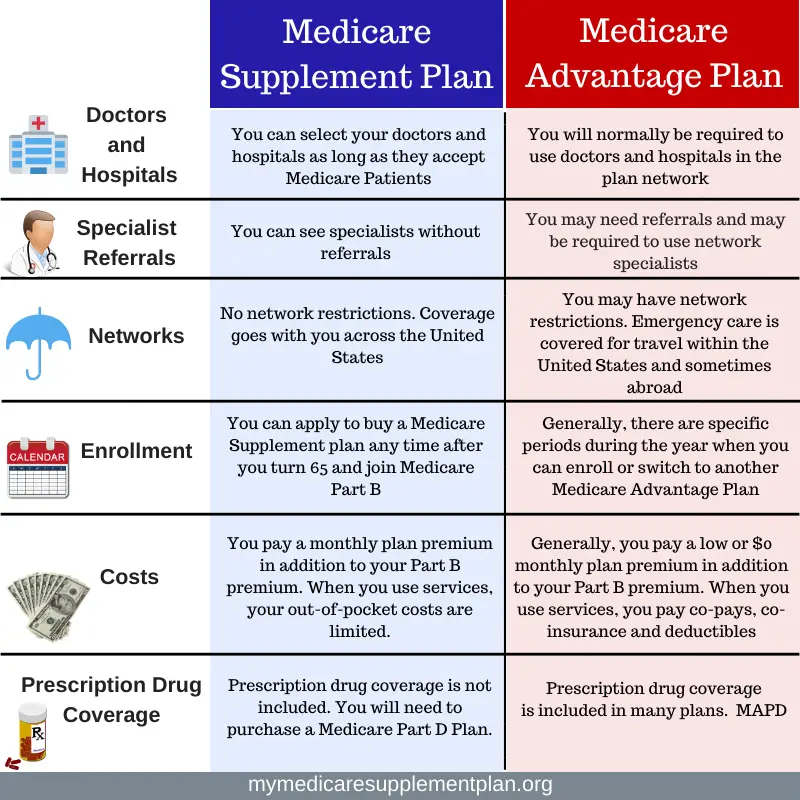

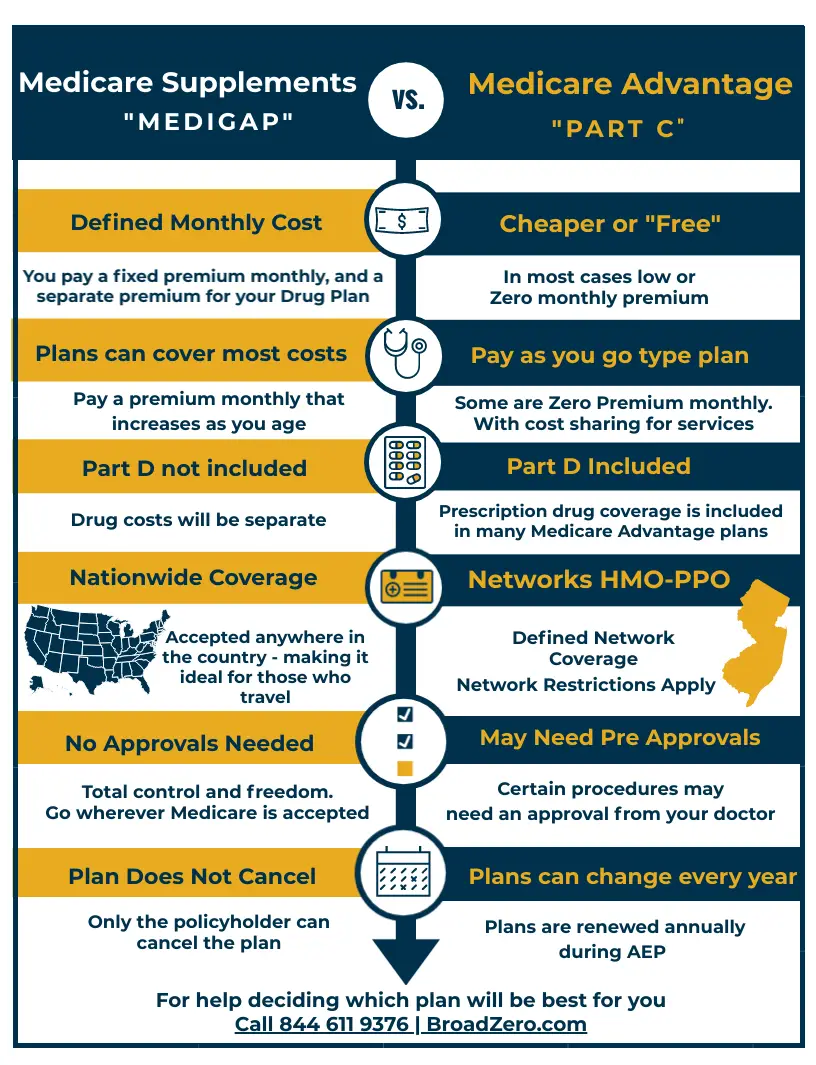

The biggest difference between Medicare Advantage and Medicare supplemental insurance is the way they work.

Medigap is intended simply to cover some of the gaps that Original Medicare doesnt pay for coinsurance, copayments and deductibles, for instance. Original Medicare only pays 80 percent for Medicare-covered services such as doctors services and outpatient medical services and supplies.

Medicare Advantage plans are an alternative to Original Medicare. Sold by private insurers, these plans cover everything that Original Medicare does but may offer extra benefits for things that Medicare doesnt, including dental and vision care.

You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

Legally, you cannot have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans.

Biggest Differences Between Medicare Advantage and MedigapDon’t Leave Your Health to Chance

When You Can Switch To A Medicare Advantage Plan

If youâre thinking about switching to a Medicare Advantage plan, be aware that you can generally make this change only during certain time periods.

You can enroll during your Initial Coverage Election Period , which is generally the same seven-month time period as your Medicare Initial Enrollment Period â when youâre first eligible for Medicare. However, your Initial Coverage Election Period will be different if you chose to delay enrollment in Medicare Part B. In this case, your Initial Coverage Election Period would start three months before you enroll in Part B, and end the last day of the month before your Part B coverage starts.

Another opportunity to enroll in a Medicare Advantage plan is during Fall Open Enrollment , which runs from October 15 to December 7 every year. If you already have a Medicare Advantage plan, you can also use this period to change plans or disenroll from your plan and go back to Original Medicare.

In some situations you may qualify for a Special Election Period â for example, if you had health coverage through an employer and the coverage ended. Learn more about Special Election Periods here.

If youâd like to start looking at Medicare Advantage plans in your vicinity, just enter your zip code where indicated on this page to get started. You can also use the contact information below to talk to a licensed insurance agent at eHealth.

eHealth makes it easier for everyone to find affordable, quality health insurance, every day.

Is It Better To Have Medicare Advantage Or Medicare Supplement

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

- Do you prefer to have all your coverage rolled into one plan? If so, a Medicare Advantage Plan may be the way to go. Many include Part D drug coverage, as well as vision, dental, and hearing, depending on the plan.

- Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesnt cover.

- Do you need a plan that provides coverage for disabilities or long term care facilities? If so, Medicare Advantage offers Special Needs Plans that provide this type of coverage.

- Do you want the freedom to see any doctors you choose? If so, Medicare Supplement plans have no required network and you can see any doctor that accepts Medicare, even if youre away from home or traveling. Some Medicare Advantage plans may also allow you to see doctors and hospitals that are not in the plans network, giving you additional freedom to choose your doctors.

Recommended Reading: Do Medicare Advantage Plans Cover Cataract Surgery

Just What Are Medicare Supplement Plans Anyhow

The first thing to do is understand the different options available to you. Medicare is available for people over 65, or who have certain types of conditions and receive Social Security Disability Insurance. Theyâre divided into three parts: A, B, and C. Part A covers approved inpatient costs, and Part B focuses on providing approximately 80% of your outpatient costs. Part C , isnât really separate health insurance, but rather allows private health insurance companies to provide Medicare benefits.

Medicare Supplement Plans or Medigap were created to complement Original Medicare by addressing the places where its coverage falls short. Though these are private insurance plans and charge premiums, they are regulated by the government, and therefore must follow strict guidelines regarding coverage. Though you may have Medicare already, Medigap is only a guaranteed right for people over 65, within six months of enrolling in Medicare Part B. However, 27 states do currently require that insurers sell some sort of Medigap policy to beneficiaries under the age of 65.

How many Medicare Supplement Plans are there? And how are they different from each other?

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Read Also: Where To Apply For Medicare Part D

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

How Much Does A Medigap Plan Cost

You pay a premium each month for your Medigap policy on top of what Original Medicare costs. This premium varies depending on benefits offered, when you purchase your policy, how it is priced, and in which zip code and state you reside. Because Medigap plans are offered through private insurers, the companies set their premiums. Premium costs may increase each year based on age, inflation, or other factors. You should also compare the health care costs of medicare advantage vs. a medigap policy to figure out which route is best.

With high-deductible supplement Medigap plans, you will pay the full amount of any Medicare-covered costs, including coinsurance, copayments and deductibles, up to the set deductible amount for that year. In 2022, the high deductible amount for Medigap supplement plans is $2,490.

See how pricing and availability compare for three different Medigap Medicare supplement coverage plans for a 65 year old female in Chicago, Illinois who doesnt use tobacco in 2021:

| Plan |

*Attained age pricing: Premiums are low for younger buyers but go up as you get older and can eventually become the most expensive.

^Community pricing: Premiums are the same no matter how old you are. Premiums may go up because of inflation and other factors.

~Issue age pricing: Premiums are low for younger buyers and wont change as you get older.

Read Also: What Is Original Medicare Mean

Medicare Advantage Insurers Are Offering More Benefits

As a reminder, Medicare Advantage plans are offered by private insurers but are required to offer at least the same level of coverage as Original Medicare. They charge their own premiums , impose their own networks, and set their own rules. In other words, theyre less standardized than Original Medicare, where enrollees can see almost any doctor in the United States.

These days, however, theres a new incentive to sign up for a Medicare Advantage plan. Thats because insurers offering Advantage plans now have the flexibility to include more supplemental benefits services that Original Medicare does not cover.

Some of these new benefits relate to quality of life more so than treating an actual medical condition. For example, Medicare Advantage plans can now pay for these relatively new services for qualifying enrollees:

- Non-emergency medical transportation

- Meal delivery

- Cooking classes designed to improve beneficiaries diets

- Air purifiers for the home

- Home carpet cleanings

- Limited home improvements and fixtures that promote safety

The best part? Theres a good chance that if you qualify for these benefits, youll snag them at no additional cost. The reason? Insurers can now be directly reimbursed by CMS for offering these benefits.

How Original Medicare Works

Original Medicare does not include coverage for prescription drugs or routine dental, vision and hearing care. If you choose Original Medicare, you can pay for those things out of pocket, or you can purchase a stand-alone prescription drug plan and a Medicare Supplement plan to beef up your coverage. These added plans help reduce your out-of-pocket costs, although youll pay a separate premium for each.

- Medicare Part A helps cover hospital care, skilled nursing facilities, and some home health services. Most people who paid Medicare taxes while working dont have to pay a monthly premium for Part A.

- Medicare Part B helps cover medical services including doctors visits and preventive services. The 2021 monthly premium for Part B is $148.50, which can be deducted from your Social Security payments.

- Medicare Part D helps cover prescription drug costs. Costs for Part D depend on things like the plan you choose and what type of prescription drugs you require.

- Medicare Supplement plans can help pay out-of-pocket costs that Medicare doesnt, including copays, deductibles and co-insurance.*

Read Also: How Can I Pay My Medicare Bill Online

Medigap Helps Pay Your Part B Bills

In most Medigap policies, the Medigap insurance company will get your Part B

information directly from Medicare. Then, they pay the doctor directly. Some Medigap insurance companies also provide this service for Part A claims.

If your Medigap insurance company doesn’t provide this service, ask your doctors if they “participate” in Medicare. This means that they “accept

” for all Medicare patients. If your doctor participates, the Medigap insurance company is required to pay the doctor directly if you request it.

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time, and you arent happy with the plan, youll have special rights under federal law to buy a Medigap policy. You have these rights if you return to Original Medicare within 12 months of joining.

| Note |

|---|

| If you dont drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. |

Read Also: Who Pays For Assisted Living Facilities Does Medicare

Pros To Medicare Advantage Vs Medigap

Medicare Advantage

First, lets go over the benefits of Advantage plans. Part C plans look like an all-in-one option. Most policies are $0 a month. Many Part C plan options include Part D, dental, vision, and more. At first glance, Part C seems like a dream come true. Also, many Medicare Advantage plans include over the counter medications.

Medicare Supplements

Now, we can take a look at the perks of Medigap. Supplement policies give you the freedom to choose any doctor in America that accepts Medicare assignment. Youll never need a referral with a Medigap plan. Further, Medigap covers foreign travel emergencies, extra days in the hospital, and the coinsurances youd otherwise pay. When a severe condition develops, or emergency takes place, Medigap is the safety net you want.

The Pros And Cons Of Medicare Advantage

These popular plans may carry hidden risks. Heres what to know.

If youre one of the 63 million Americans enrolled in Medicare, youre probably being deluged by marketing pitches for Medicare Advantage plans, which offer managed care with low or zero premiums.

Medicares fall open enrollment season starts Oct. 15 and runs through Dec. 7, when you can switch your coverage between Original Medicare and Medicare Advantage, change Medicare Advantage plans, or make changes to your prescription drug plan.

All that marketing seems to be working. Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation. Those numbers include 50 percent of Black and 54 percent of Hispanic enrollees vs. 36 percent of whites in 2018. By 2025, half of Americans are expected to be in Advantage plans.

Its easy to see the appeal of Advantage. Original Medicare doesnt cover all your medical expenses, while Advantage plans have cost-sharing requirements but then cap your out-of-pocket costs. Plus, you have low premiums and the simplicity of all-in-one coverage.

But there can be hidden risks to Advantage plans, especially for those with major health issues.

Some people in Medicare Advantage end up paying unexpectedly high costs when they become ill or find their network lacks the providers they need, says Tricia Neuman, senior vice president at Kaiser.

Don’t Miss: What Is Medicare Payer Id Number

So Far Relatively Few Plans Offer Special Supplemental Benefits For The Chronically Ill

Supplemental benefits may be particularly helpful for plans as they develop strategies to better manage the care of high-cost, high-need beneficiaries, including those with chronic diseases. Plans now have the flexibility to offer a combination of primarily health-related supplemental benefits and SSBCI to certain enrollees . However, a relatively small number of plans offered SSBCI in the first year these services were permitted .

Because 2020 was the first year SSBCI were offered, beneficiaries may have had limited knowledge of them as a result, enrollment in plans providing SSBCI was relatively low. While plans can notify enrollees of these benefits availability, marketing materials must note that they are not guaranteed to everyone, as only beneficiaries with certain chronic conditions can access them.

A slightly higher percentage of beneficiaries were enrolled in Special Needs Plans providing SSBCI. Therefore, compared to typical MA plans, a greater portion of beneficiaries in SNPs may have unmet needs that could be addressed through SSBCI. See the boxes below to learn more about SNPs meal and transportation supplement benefits.

Medicare Supplement Plans: Standardized Benefits

Every private insurance company that offers Medicare Supplement plans must follow federal and state laws designed to protect consumers. The policy must be clearly identified as Medicare Supplement Insurance. Insurance companies in most states can sell only standardized Medicare Supplement plans, identified by letter. You can find coverage details about all 10 standardized Medicare Supplement plans using the Medicare Supplement Plan Comparison Chart.

You May Like: When Is The Next Medicare Open Enrollment

How Medicare Advantage Plans Are Structured

Medicare Advantage replaces your Medicare Part A and Part B services. Most of the time it replaces your Part D coverage, as well. A Medicare Advantage plan combines them into one coverage with a private insurance company. This is what is known as Part C of Medicare. If you have a Medicare Advantage plan, you do not even have to carry your Medicare card around with you because all your care is determined by and paid for by the insurance company you choose to go with. You must still pay the Part B premium .

Here is a very important note. If you enroll in a Medicare Advantage plan, you are giving up your rights as a Medicare beneficiary and handing them over to an HMO or PPO.

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

Read Also: Are Knee Scooters Covered By Medicare