Medicare Part D Costs By Income Level

Like Medicare Part B, Medicare Part D prescription drug plans use the IRMAA to determine plan premium costs by income level.

2022 Medicare Part D plan premiums, based on income level from 2020, are as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Are you looking for Medicare prescription drug coverage?

You can compare Medicare drug plans available where you live and if you’re eligible enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Income Limits Per Medicare

There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage.

In 2022, Medicare beneficiaries with a modified adjusted gross income above $91,000 may have an income-related monthly adjustment added to their Medicare Part B premiums.

For couples who file a joint tax return, that threshold is $182,000 per year.

Note: that the government looks at your income for two years before determining the IRMAA amount.

An IRMAA is a surcharge for those Medicare beneficiaries with a higher gross income.

Dont Miss: Is Tresiba Covered By Medicare

Seniors With Higher Incomes

If your income exceeds the income limits above, you will have to pay extra money for your medical coverage costs. If you make more than $85,000 per year if you are a couple or single, the additional amount that you need to pay is $339.50 per month if you have a premium plan and $242.00 if you are under a deductible-based plan . These amounts refer to individual seniors, while married couples will have to pay an extra charge of $435 per month in case they have premium plans and $322 in case they have deductible-based plans.

Read Also: How To Choose A Medicare Supplement Plan

How Your Income May Affect Your Medicare Costs

The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D . If your income is below certain limits, you might qualify for programs that reduce your Medicare costs. On the other hand, if your income is higher than a certain level, you might have to pay a higher Medicare Part B premium and a higher Medicare Part D premium .

Medicare Part A and Medicare Part B make up Original Medicare. If youre automatically enrolled in Medicare, as many Americans are when they turn 65, Original Medicare is the type of insurance you get. You can add to this insurance by enrolling in prescription drug coverage through Medicare Part D and/or buying a Medicare Supplement plan to help with Original Medicare costs or you can get your Medicare coverage through a Medicare Advantage plan.

Do Medicare Premiums Change Yearly Based On Income

Yes, your Medicare Part B premium will change based on your MAGI.

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2023, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

Finding the Medicare plan thatâs right for your life and budget doesnât have to be overwhelming â eHealth is here to help. Get started now.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Don’t Miss: Does Aetna Medicare Advantage Cover Acupuncture

How To Apply For Extra Help

To apply for the Extra Help program:

-

Apply online at www.ssa.gov/extrahelp.

-

Head to your local Social Security office to apply in person.

The SSA further noted that, upon qualification, youll be able to choose a Medicare prescription drug plan: If you do not select a plan, the Centers for Medicare & Medicaid Services will do it for you. The sooner you join a plan, the sooner you begin receiving benefits. You can see all eligible plans at Medicare.gov.

More: Medicaid Access Could Be Lost to Millions Come April Heres Why

Medicare Interactive also indicated that if you are currently enrolled or newly enrolled in Medicaid, a Medicare Savings Program or have Supplemental Security Income benefits, you automatically qualify for Extra Help regardless of whether you meet Extra Helps eligibility requirements.

More From GOBankingRates

Does Income Affect Medicare Part A Premiums

Medicare Part A, also known as hospital insurance, covers inpatient care. The vast majority of Medicare beneficiaries paid payroll taxes for the required 40 quarters to qualify for premium-free Part A. Even if you do have a Medicare Part A premium, though, you won’t pay more based on your income.

If you or your spouse did not work and pay Medicare taxes for the required 40 quarters, the standard Part A premium is $506 per month in 2023.

Also Check: Does Medicare Cover Mammograms After Age 65

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

What Are Medicare Income Limits

Medicare income limits ensure that beneficiaries with the means to do so are required to pay a larger share of the cost of their coverage.

Our guide to financial assistance for Medicare enrollees includes information about HCBS, Medicaid spend-down, Medicaid for the aged, blind and disabled and more.

You May Like: What Is Medicare Part A And B

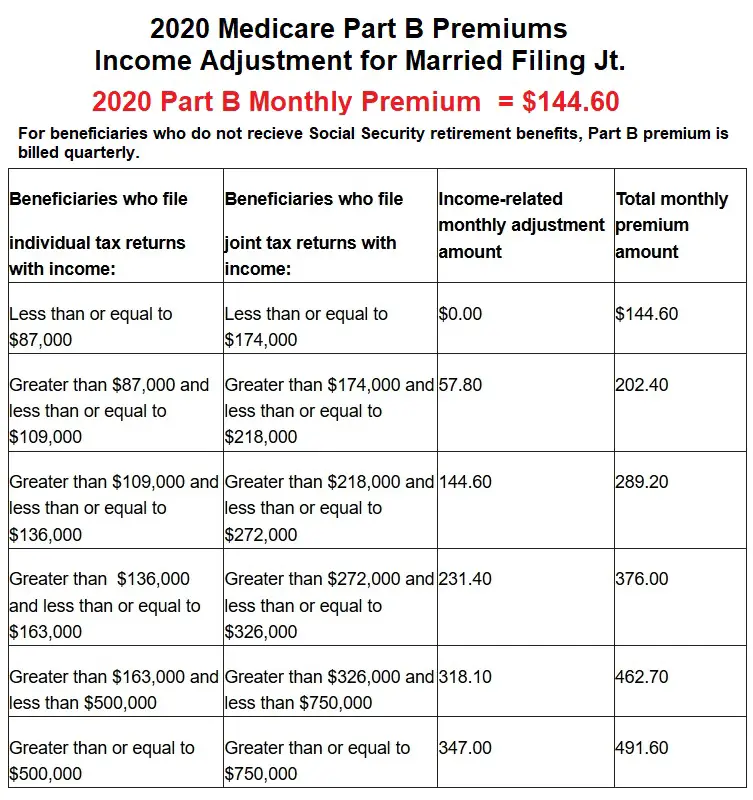

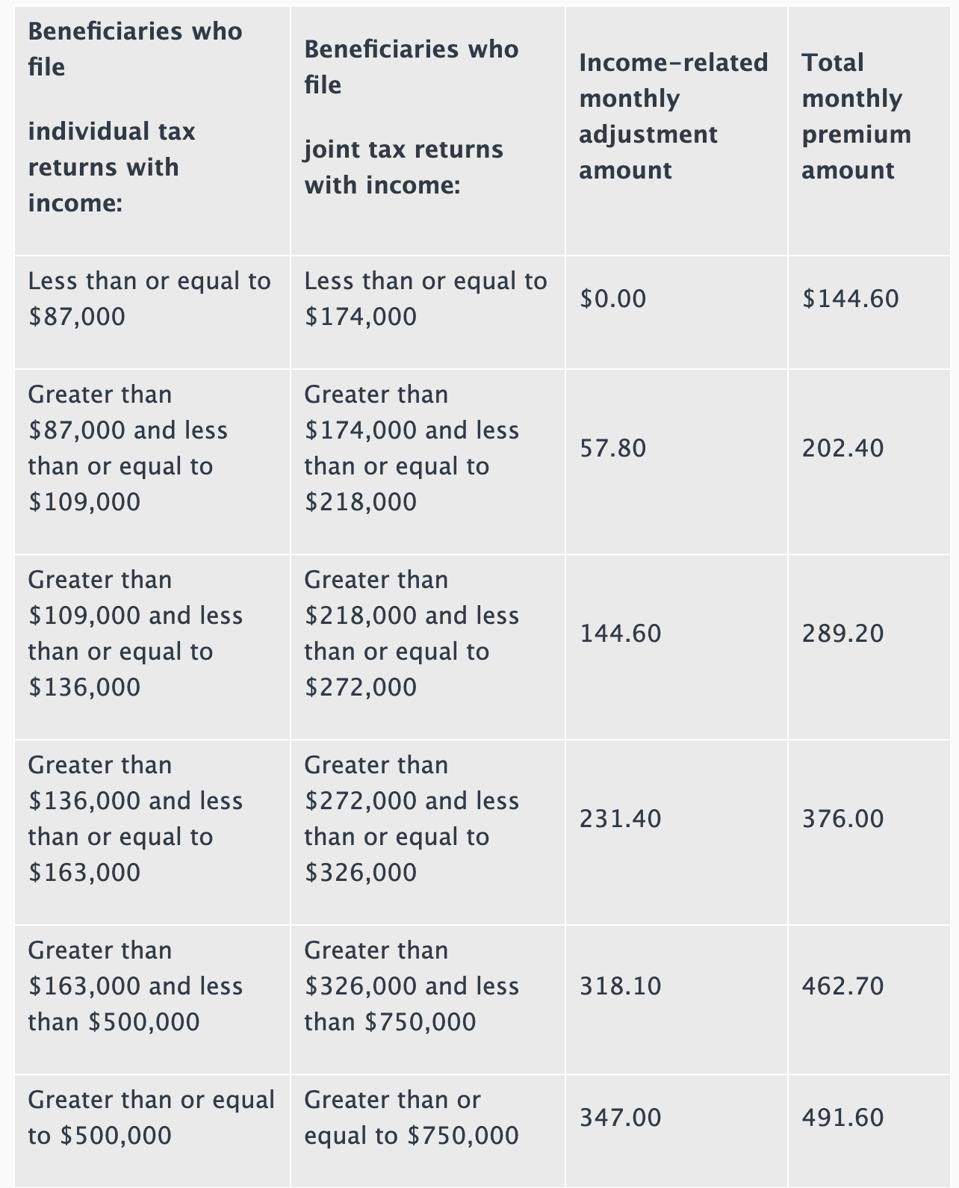

Medicare Part B Costs By Income Level

Medicare Part B premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount .

The 2022 Medicare Part B premium costs by income level are as follows:

Medicare Part B IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2022 Part B deductible is $233 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

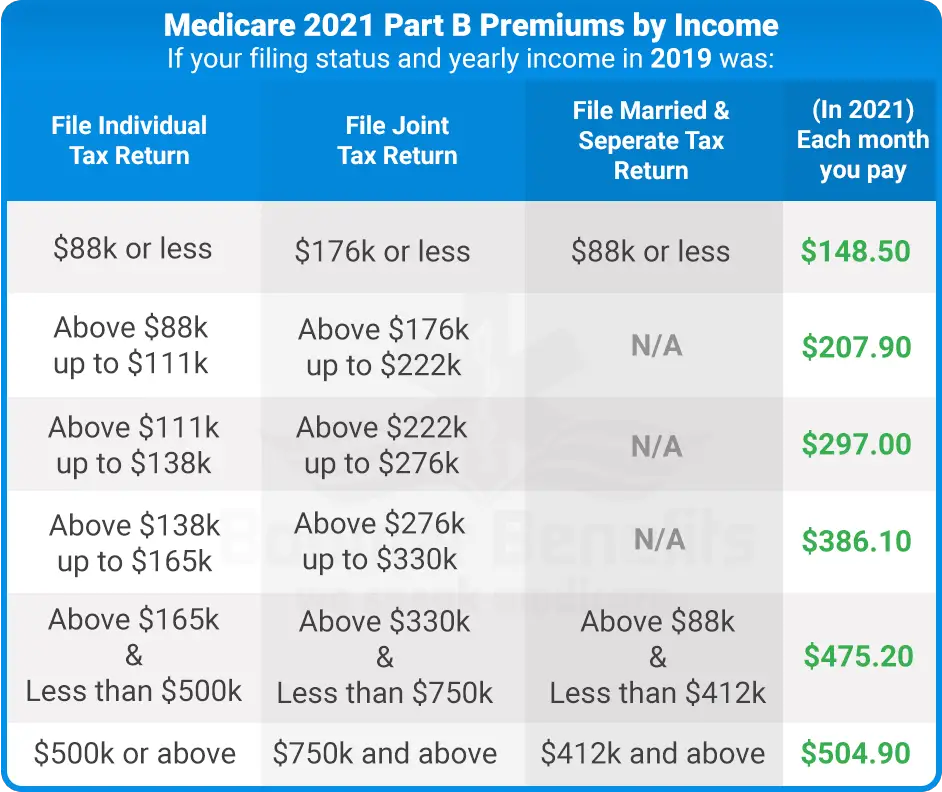

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Recommended Reading: What Is Gap Coverage For Medicare

What Medicaid Covers For Medicare Enrollees

Medicare has four basic forms of coverage:

- Part A: Pays for hospitalization costs

- Part B: Pays for physician services, lab and x-ray services, durable medical equipment, and outpatient and other services

- Part C: Medicare Advantage Plan offered by private companies approved by Medicare

- Part D: Assists with the cost of prescription drugs

Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses from Medicaid . Medicaid also covers additional services beyond those provided under Medicare, including nursing facility care beyond the 100-day limit or skilled nursing facility care that Medicare covers, prescription drugs, eyeglasses, and hearing aids. Services covered by both programs are first paid by Medicare with Medicaid filling in the difference up to the state’s payment limit.

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: Where To Get Medicare Part D

What Are The Medicare Extra Help Income Limits For 2023

With 2023 fully underway, there are new costing guidelines associated with Medicare that went into effect Jan. 1. CNBC noted that copays and deductibles for Medicare Part A are going up, while Part B premiums and deductibles are down. Part D premiums are also typically trending down, and new caps on insulin and vaccine prices have come into effect.

Find: 6 Shakeups to Social Security Expected in the New Year

But, if your Medicare costs have become unmanageable especially when it comes to prescriptions and you dont qualify for Medicaid, there is another option that may provide financial help.

The Extra Help provision offers assistance in paying premiums, deductibles and copayments that are part of a Medicare prescription drug plan and the savings can be substantial. Also known as the Part D Low-Income Subsidy, the extra value is worth about $5,300 every year, according to the Social Security Administration . The SSA also stated that many eligible Americans are unaware of the program: Many people qualify for these big savings and dont know it.

There are some parameters to qualify for the program, mostly related to income and assets. The government has updated the income limits for 2023, which per Medicare Interactive are now:

-

up to $1,719 monthly income for individuals.

-

up to $2,309 monthly income for married couples.

The value of assets also have caps in order to be eligible for the Extra Help program. As noted by the SSA, those caps are:

Medicare Income Limits 2023

Find Cheap Medicare Plans in Your Area

If your income is above a specific limit, you pay higher monthly rates for both Medicare Part B and Medicare Part D. Medicare Part A and Part C rates are not based on income.

The prices you’ll pay for Medicare Part B and Part D in 2023 are based on income reported on your 2021 tax return. Individuals who earned $97,000 or less and joint filers who earned $194,000 or less won’t pay extra for Part B or Part D.

Medicare prices are tiered for higher incomes. For example, individual tax filers who made between $97,000 and $123,000 pay about 40% more for Medicare Part B, while rates increase by 240% for people earning more than $500,000.

If your income and other financial resources fall below certain levels, you might qualify for programs that reduce your Medicare costs including monthly premiums, deductibles and coinsurance. These programs set their own income limits.

Recommended Reading: Does Medicare Cover Organ Transplants

Medicare Extra Help 2023 Income Limits

Medicare Extra Help 2023 income limits are not yet available but are due to be released soon.

Income limits for 2022 are $20,385 for an individual or $27,465 for a married couple living together. There also are limits on your other financial resources: Your combined savings, investments and real estate can’t be worth more than $15,510 if you’re single or $30,950 if you are married and live with your spouse. You must meet each of these requirements to qualify for Extra Help.

| 2022 income limit |

|---|

|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

The Medicare Extra Help program assists with monthly Part D costs including monthly premiums, annual drug deductibles and prescription copayments. In 2023, youâll pay a maximum of $4.15 for each generic or $10.35 for each brand-name prescription. Extra Help is estimated to save enrollees about $425 every month.

You can apply for Medicare Extra Help online, at your local Social Security office or over the phone by calling 800-772-1213 .

Extra Help is only available if you’re on Original Medicare and a separate Part D prescription plan. You can’t use Extra Help to reduce drug costs on a Medicare Advantage plan.

D Late Enrollment Penalty

- Generally, you wont have to pay a Part D penalty if:

- You qualify for Extra Help

Also Check: Do Any Medicare Supplement Plans Cover Dental And Vision

Will There Be A Part B Rate Increase In 2023

We dont yet have concrete details from CMS the final number often isnt published until November, just weeks before the start of the year. But the Medicare Trustees Report, which was published in June 2022, projects that the standard Part B premium will remain unchanged at $170.10/month in 2023 . The lower-than-expected costs for Aduhelm, a new Alzheiemers drug, are resulting in savings that the federal government plans to use to keep part B premium increases modest or non-existent in 2023.

CMS has projected that the average Part D premium will decrease slightly, to $31.50/month, in 2023. But there is always significant variation in Part D premiums from one plan to another, so there are a wide range of options for enrollees. And as is the case for Part B, beneficiaries subject to IRMAA pay more for their Part D coverage.

More Resources For Low

If youre disabled or have a low income, you might qualify for financial help through Medicaid, an assistance program run jointly through the federal government and individual states. You might qualify for other financial assistance programs.

Some Medicare policies that are offered by Medicare-approved private insurance companies may save you money, depending on your situation. If you have questions about Medicare plan options, you can contact eHealth to speak with a licensed insurance agent and learn more about your coverage options.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

Read Also: Is Medicare Considered Health Insurance

What Are The Income Limits For Medicare

Summary:

There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage.

In 2023,Medicare beneficiaries with a modified adjusted gross income above $97,000 may have an income-related monthly adjustment added to their Medicare Part B premiums. For couples who file a joint tax return, that threshold is $194,000 per year.

Note that the government looks at your income from two years prior to determine the IRMAA amount. An IRMAA is a surcharge for those Medicare beneficiaries with a higher gross income.

Avoid Late Enrollment Penalties

Its important to sign up for Medicare coverage during your Initial Enrollment Period, unless you have other coverage thats similar in value to Medicare . If you dont, you may have to pay an extra amount, called a late enrollment penalty.

Late enrollment penalties:

- Are added to your monthly premium.

- Are not a one-time late fee.

- Are usually charged for as long as you have that type of coverage . The Part A penalty is different.

- Go up the longer you wait to sign up theyre based on how long you go without coverage similar to Medicare. Find out when you should sign up to avoid penalties.

Read Also: How Much Does Medicare Cover For Knee Replacement

What Income Is Used To Determine Medicare Premiums

Your modified adjusted gross income as reported 2 years ago on your IRS tax returns are what is used to determine your Medicare Part B premium. You also may see modified adjusted gross income as MAGI.

Your MAGI is determined after taking certain allowable deductions and tax penalties into account. For many taxpayers, your MAGI and your adjusted gross income are the same.

Your MAGI includes any income you earned during the year including

Will Social Security Get A $200 Raise In 2021

In order for a 5.9% increase to result in an extra $200 per month in benefits, you would have needed to have received at least $3,389 per month in 2021. … This figure changes from year to year to adjust for inflation and is the the amount on which the SSA calculates the maximum Social Security benefit.

Also Check: How To Get Medicare Id Number