Mutual Of Omaha Has You Covered

Since 1909, weve existed as a Mutual company serving for the benefit and protection of our customers. Which means we dont answer to Wall Street, we answer to you.

Medicare Supplement insurance is offered to protect our customers health and wallets. Its a great option to add to your existing Medicare Part A and B plans, as Medicare supplement insurance helps cover some out-of-pocket costs that Part A and Part B may leave you with. These include expenses like copays, coinsurance, and deductibles. Medicare Supplement plans also make traveling – even internationally – easy, while being a steady monthly bill you can budget for. Check out Medicare Supplement Insurance Basics for the information you need to make the decision thats right for you.

What Are The Eligibility Requirements For Aarp Medicare Supplement Plan G

You must be enrolled in Medicare Part A and Part B before you can apply for Medicare Supplement Insurance Plan G. And you must be at least 65 years old to purchase Medigap in some but not all states. Lastly, you must live in the area that is serviced by the plan. While Medigap can be used anywhere that Original Medicare is accepted, it can only be purchased in the county or zip code in which you reside.

To apply for AARP Medicare Supplement Plan G or any other Medigap plan from AARP, you must be an AARP member. Memberships are $16 per year in 2021 and include a number of savings and discounts on travel, dining, shopping and more.

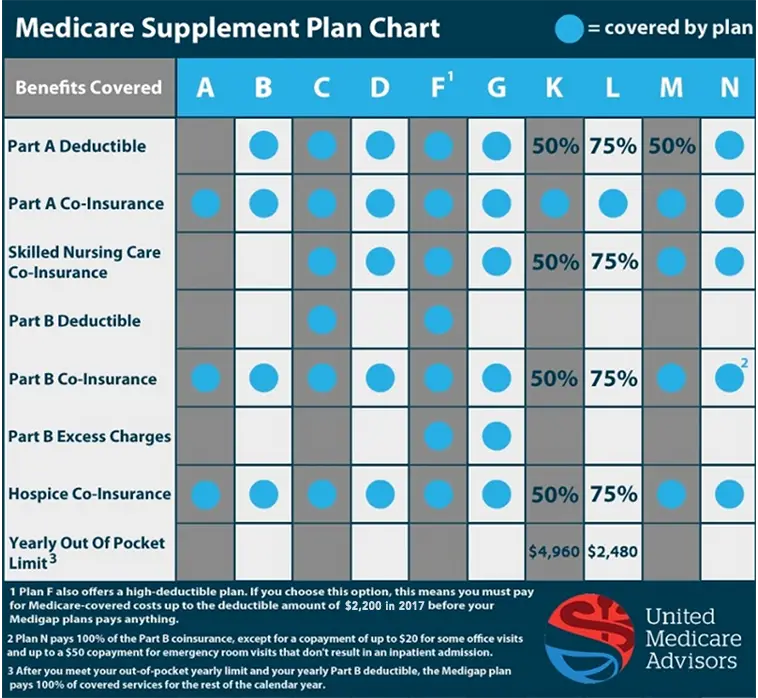

Compare Medicare Supplement Insurance Plans

View or print this helpful chart showing all of our Medicare Supplement insurance plans side by side.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company.

Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected. Depending on the insurance plan chosen, you may be responsible for deductibles and coinsurance before benefits are payable. These policies have exclusions and limitations please call your agent/producer or Humana for complete details of coverage and costs.

GNHL7EUEN

Also Check: Can You Only Have Medicare Part B

What Do Medicare Plan F And Plan G Cover

Medicare Plan F and Plan G are similar and offer the same basic coverage benefits, which include:1

- Part A coinsurance and hospital costs.

- Part B coinsurance or copayment.

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Up to 80% of medical emergency costs during foreign travel.

- No out-of-pocket limit.

Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. While Plan G pays for expenses related to Medicare Part B excess charges, Plan N does not. This difference would be paid for you out of pocket if you had Plan N. However, the rates for Plan N are less than Plan G. For 2022, Plan N costs between $102 and $302 per month about 18% less than Plan G. One thing they have in common: neither Plan N nor Plan G cover the Medicare Part B Deductible.

Read Also: What Is The Monthly Premium For Medicare Plan G

Are Medsup Plans Sold In Massachusetts Minnesota And Wisconsin Different

Insurance companies dont sell MedSup Plan G policies in Massachusetts, Minnesota or Wisconsin. If you live in one of these states, youll have to choose a different kind of Medicare Supplement plan.

These states only offer a few MedSup plans, so you won’t have to do much homework before you settle on one of them.

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and itâs important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay for your drugs until you reach your planâs deductible

If your plan doesnât have a deductible, your coverage starts with the first prescription you fill.

Initial Coverage

You pay a small copay or coinsurance amount.

You stay in this stage for the rest of the plan year.

- Total drug costs: the amount you and your plan pay for your covered prescription drugs. Your plan premium payments arenot included in this amount.

- Out-of-pocket costs: The amount you pay for your covered prescription drugs plus the amount of the discount that drug manufacturers provide on brand-name drugs when youre in the third coverage stage â the coverage gap . Your plan premiums are not included in this amount.

*If you get Extra Help from Medicare, the coverage gap doesnât apply to you.

You May Like: Does Medicare Cover Aba Therapy

Don’t Miss: Does Medicare Pay For Insulin Pumps

How Do I Enroll In A Medigap Plan G

In general, you will get the best price for Medicare Supplemental Insurance if you purchase a plan as soon as you are eligible for Medicare and enrolled in Parts A and B. Medigap Open Enrollment starts on the first day of the month that you turn 65 and are enrolled in both Parts A and B and lasts for six months. An insurance company is not allowed to use medical underwriting to decide whether to accept your application or change the price during this time.

To enroll in a Medigap Plan G, contact the insurance company to make sure you are in your open enrollment period or have guaranteed issue rights. Complete the application and determine when you want your policy to start.

Do All Medicare Supplements Cover The Same

Medicare Supplement insurance plans are sold by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

Don’t Miss: Does Aarp Medicare Supplement Plan Cover Silver Sneakers

Benefits Available With A Medigap Plan G

- Part A coinsurance and hospital costs

- Part B copays and insurance

- First three pints of blood

- 80% of foreign travel emergencies

| Advantages of Medigap Plan G | Disadvantages of Medigap Plan G |

|

| N/A | N/A |

Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs up to the deductible amount of$2,490 in 2022 before your policy pays anything. ** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that dont result in inpatient admission.

Why Should I Choose Medicare Supplement Plan G Over Plan F

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees.

Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers cant sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

Dont worry, if youre already enrolled in Plan F, youll be able to keep it. If you dont have MedSup coverage and you want to buy Plan F now, though, you won’t be able to do so. The same is true if youre enrolled in a different MedSup plan and you want to switch to Plan F.

Long story short: if you want MedSup Plan F but can no longer enroll in it, Plan G may be the best Medicare Supplement policy for you.

Recommended Reading: How Do I Find My Medicare Card Number Online

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Should I Change From Plan F To Plan G

If you’re considering switching from your grandfathered Medicare Plan F to Plan G, it can feel like a constant game of tug-of-war. Some Medicare Supplement plans are guaranteed issue, which means you cant be refused for pre-existing conditions. But, its important to note that you might be required to undergo underwriting when switching Medicare Supplement plans. That means a plan carrier can increase your rate based on age and health factors or decide not to sell you the plan at all.

Don’t Miss: Does Medicare Cover Speech Therapy

Does Medigap Plan G Cover Prescriptions

Prescription medications effectively treat illnesses and diseases, assist with rehabilitation, and prevent the development of certain conditions. Your doctor may prescribe certain medications to help you avoid invasive treatments or more intense therapies.

Many name-brand prescription drugs come at a high price. The cost of drugs varies and depends on many factors. This includes the medications availability, the amount of research money spent on it, and the availability of generic drug versions.

Continue reading to learn all about Medicare Supplement, AKA Medigap plans including what it is and what it covers.

Medicare Benefits Solutions

What Does Medicare Part B Not Cover

Medicare Part B does not generally cover healthcare outside of the U.S. You may find this publication, Medicare Coverage Outside the US, helpful for specific examples of when Medicare covers healthcare outside the US.

If Original Medicare doesnt cover something, no Medicare Supplement plan will cover it. Medicare does not cover:

You May Like: How Many Medicare Plans Are There

Where To Purchase Medicare Supplement Plan G

Once you decide that Medicare Supplement Plan G is suitable for you, purchasing your plan through a top carrier is crucial. Working with a brokerage with access to all the top carriers in your area is the best way to ensure that you are enrolling in the best plan possible.

If you contact a carrier directly, you only receive that carrierâs Medigap Plan G option. So, by working with a broker you will receive Plan G options from various carriers.Thus, you can decide which carrier and plan are right for you.

- Was this article helpful ?

What Are Part B Excess Charges

Medicare Part B excess charges happen when theres a difference between what Medicare will pay for medical services and what your doctor decides to charge for that same service.

Medicare sets approved payment amounts for covered medical services. Some doctors accept this rate for full payment, whereas others dont.

If your doctor doesnt accept the rate in the Medicare fee schedule as full payment, they are allowed under federal law to charge up to 15 percent more than the approved rate. The amount above the Medicare-approved rate is the excess charge.

With Medicare, you are responsible for paying any excess charges. Some people choose Medigap Plan G to assure that these fees are covered and avoid any unexpected costs after receiving medical care.

Recommended Reading: What Is The Average Cost Of Medicare Supplement Plan F

Are All Medsup Plan G Policies The Same

Once you know all the above, youre set. Why? Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are standardized.

That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.

Given that, shop around and carefully compare quotes and plans before you settle on one. And dont just consider their premiums. Look at their deductibles, copayments and coinsurance costs, too. Do that, and youll get the best Plan G bang for your buck.

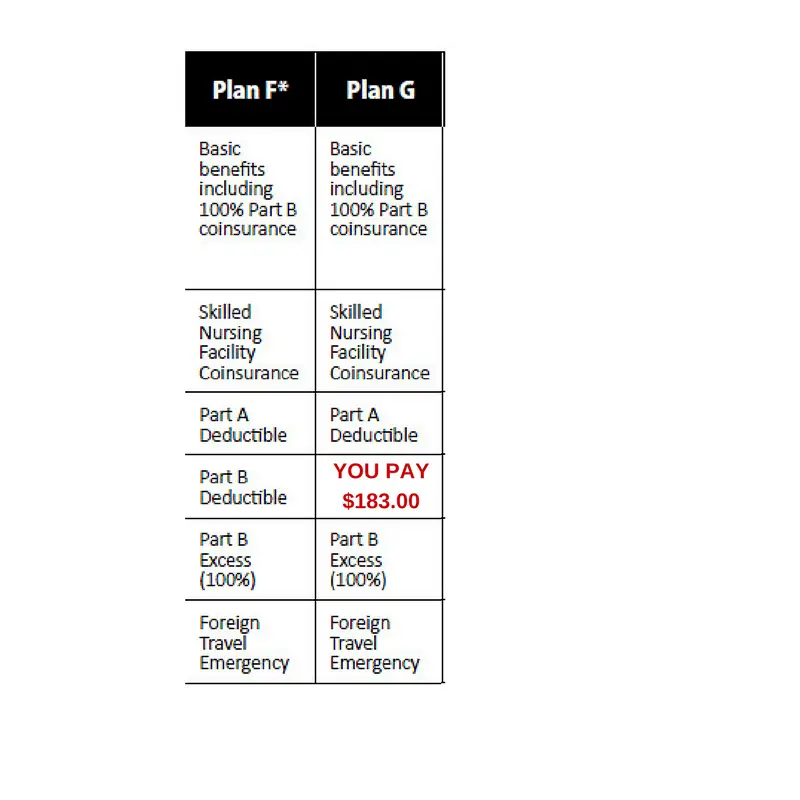

Medicare Supplement Plan F Vs Plan G

If you have a Plan F, then in most cases a Plan G will save you money. Even though Plan F covers the Part B deductible, its usually at a much higher cost each month for Plan F premiums. The insurance company charges you much more to pay that deductible for you.

The rate increases on plan F are also historically higher than Plan G. So Plan G is a better value than plan F.

Theres another plan that may save you even more than the plan G and thats Plan N. We talk about plan N in another video, so be sure to watch that one.

Recommended Reading: Are Synvisc Injections Covered By Medicare

Is Medigap Plan G Right For You

If youre comfortable paying a small annual deductible, Plan G offers incredible value. Plan G is a great alternative to Plan Fs full comprehensive coverage, making it a sensible option for people that have serious health issues or those that have high medical bills.

Medigap Plan G is also beneficial for people that worry about serious health issues as they age. just because youre in good health today, doesnt mean something cant happen tomorrow.

Its better to have insurance when you need it. Of course, if a lower premium and more out-of-pocket costs are something that you would prefer, consider looking at Medigap Plan N or the High Deductible Plan G.

Overall, the best Medigap policy for you is the one that provides you with the most value.

Switching From Medicare Advantage

If you currently have a Medicare Advantage plan and want to go with a Medigap policy, when can you switch to Plan G? You can switch to Original Medicare during the Annual Election Period from October 15 to December 7, or the Medicare Advantage OEP from January 1 to March 31. Then you can apply for a Medicare Supplement plan.

In most states you will not have guaranteed-issue rights when you switch, meaning you might face medical underwriting and higher premiums. Some states do allow it. To see what the Medigap rules are where you live, check with your state insurance department.

Don’t Miss: Does Medicare Part B Cover Chiropractic Services

What Plan G Doesnt Cover

As we already stated, Plan G does not cover the Part B deductible.

Plan G will cover the coinsurance on any medications covered by Part B, which are usually drugs that are administered in a clinical setting, such as a doctors office or outpatient chemotherapy or infusion center. It does not cover outpatient retail prescriptions, which are covered by Medicare Part D prescription drug plans.

Am I Eligible For Medigap Plan G

If youre in your Medigap Open Enrollment Period, then you are eligible for Medigap Plan G. Outside of that, the Insurance company could charge more or deny the policy.

In most cases, when you go through underwriting there is no issue with getting you approved.

For those with health issues or concerns about underwriting approval, its best to work with an insurance agent because they can help identify the company most likely to approve your application.

If you qualify for a Special Enrollment Period, you may be entitled to Guaranteed Issue rights, meaning you get to avoid underwriting.

Also Check: What Is Medicare Plan C

The Best Medicare Plan For You: Plan G +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

What Does Plan G Cover

Plan F is considered the top-of-the-line Medigap policy. It covers 100% of the gaps in Medicare. Plan Gs coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $233 in 2022. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums.

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you wont pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Like Medigap Plan F, Plan G also covers excess charges. Doctors who dont accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures. This is known as the excess charge.3 Most doctors accept the Medicare-approved payment and cannot bill you the extra amount. Since 2016, excess charges are illegal in these states: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

Top Coverage

Plan G offers top coverage for preventive visits, emergency care or chronic conditions.

Don’t Miss: How To Qualify For Medicare In Florida