B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays.

Don’t Miss: Does Medicare Offer Dental And Vision

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

She Was A Victim Of The Medicare 3

The 3-day rule is Medicares requirement that a patient has to be admitted to the hospital for at least 3 days in order for Medicare to cover the cost of a SNF after the hospitalization. If the patient is admitted for less than 3 days, then the patient pays the cost of the SNF and Medicare pays nothing. So, if this patient was in the hospital for 4 days, why didnt Medicare cover the cost of the SNF?

It all has to do with when the inpatient stay clock starts and that has nothing to do with when the patient first comes into the hospital for a surgery or a medical condition. It solely depends on when the attending physician entered an order for that patient to be in inpatient status as opposed to observation status. Medicare considers a patient to be in inpatient status if that patient is anticipated to need to be in the hospital for 2 midnights and in observation status if the patient is anticipated to be in the hospital for less than 2 midnights. Observation status was originally intended to be used to observe the patient to determine whether the patient is sick enough to warrant being admitted to the hospital.

You May Like: Is Wellcare The Same As Medicare

Will Medicare Pay For A Total Knee Replacement

- Asked July 24, 2013 in

Contact Bruce McLean Contact Bruce McLean by filling out the form below

Bruce McLeanOwner, Better Benefits, Medicare is very comprehensive health coverage for those that qualify. Medicare will cover a Total Knee Replacement as long as the Physician, Hospital, and any other healthcare providers are deemed as providers. You can check each provider out on the Medicare.gov website. Medicare Part A would cover the hospital expenses and if a Skilled Nursing Facility is needed for rehabilitation. You will have a deductible if you only have Medicare A and B. A Medicare Supplement can cover all or part of the out of pocket costs. Medicare Part B would cover the Physician charges and any outpatient services required. You have an annual deductible and 20% coinsurance. A Medicare Supplement can cover all or part of these our to pocket cost.Medicare Advantage plans have daily charges and copays that vary for every plan. You should check with the plan to confirm that the providers are in their network and determine what your costs might be.Answered on July 24, 2013+24

Read Also: Is Dexcom G6 Cgm Covered By Medicare

How Medicaid Is Funded

Medicaid is funded by the federal government and each state. The federal government pays states for a share of program expenditures, called the Federal Medical Assistance Percentage . Each state has its own FMAP based on per capita income and other criteria. The average state FMAP is 57%, but FMAPs can range from 50% in wealthier states up to 75% for states with lower per capita incomes. FMAPs are adjusted for each state on a three-year cycle to account for fluctuations in the economy. The FMAP is published annually in the Federal Register.

As mentioned above, the CARES Act will provide additional funds to states for costs related to COVID-19.

Also Check: Is Pennsaid Covered By Medicare

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Youll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

- DeductibleA set amount you pay out of pocket for covered services before Medicare or your plan begins to pay.

- CopayA fixed amount you pay at the time you receive a covered service or benefit. For example, you might pay $20 when you visit the doctor or $12 when you fill a prescription.

- CoinsuranceThe amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

Other Medically Necessary Services

Many other items are covered by Part B in addition to preventive services. A deductible may apply to several of them, and you may have to pay 20% of the Medicare-approved cost. There’s no yearly limit on how much you may have to pay in out-of-pocket costs for health care services.

Many people also have a Medicare Supplement policy for this reason, sometimes called a Medigap policy because it helps cover the gaps in coverage. These supplemental policies may provide more complete coverage with the assurance of annual out-of-pocket cost limits.

Some items covered by Part B which may be subject to the deductible and copay include:

- Ambulance services

- Physical therapy

- Second surgical opinions

- Tests such as MRIs, CT scans, EKG/ECGs, and a CPAP trial for up to three months if you’ve been diagnosed with obstructive sleep apnea

Medicare Part B also covers most lab services, such as blood tests, urinalysis, and tests on tissue samples. You usually won’t have to pay extra for these lab services. Additional services not listed here may also be covered.

Read Also: Does Kaiser Permanente Take Medicare

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

How Much Does Medicare Cost A Cost Breakdown

Several factors determine how much you pay for your Medicare, including your age, your annual income, the type and amount of Medicare services you enroll for, how much you use the services, and whether or not youre covered under any other health insurance plan.

Additionally, Medicare expenses consist of several types of costs: monthly premiums, deductibles, , copays, , and coinsurance . There is also a late enrollment fee that you may have to pay if you enroll after the age of 65.

Also Check: How Soon Can You Enroll In Medicare

Most Medicare Advantage Plans Offer Prescription Drug Coverage

Medicare Advantage plans are an alternative to Original Medicare .

Medicare Advantage plans provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesnt cover.

Some of these additional benefits can include things like:

- Routine dental, vision and hearing care

- Membership to health and wellness programs like SilverSneakers

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How Do You Proceed Once Your Parent Has A Doctors Signed Prescription For A Dme

As long as Medicare Part B is satisfied that your parents DME is medically necessary, they will cover 80% of theMedicare-approved price for the DME.

Your parent will then be responsible for paying their Medicare 20% co-payment of the Medicare-approved price of the DME, as long as they have used a Medicare-enrolled participating supplier who accepts assignment.

If not, your parent may owe much more !

Your parent will also have to pay their deductible, if it hasnt already been met.

Recommended Reading: Who Must Apply For Medicare

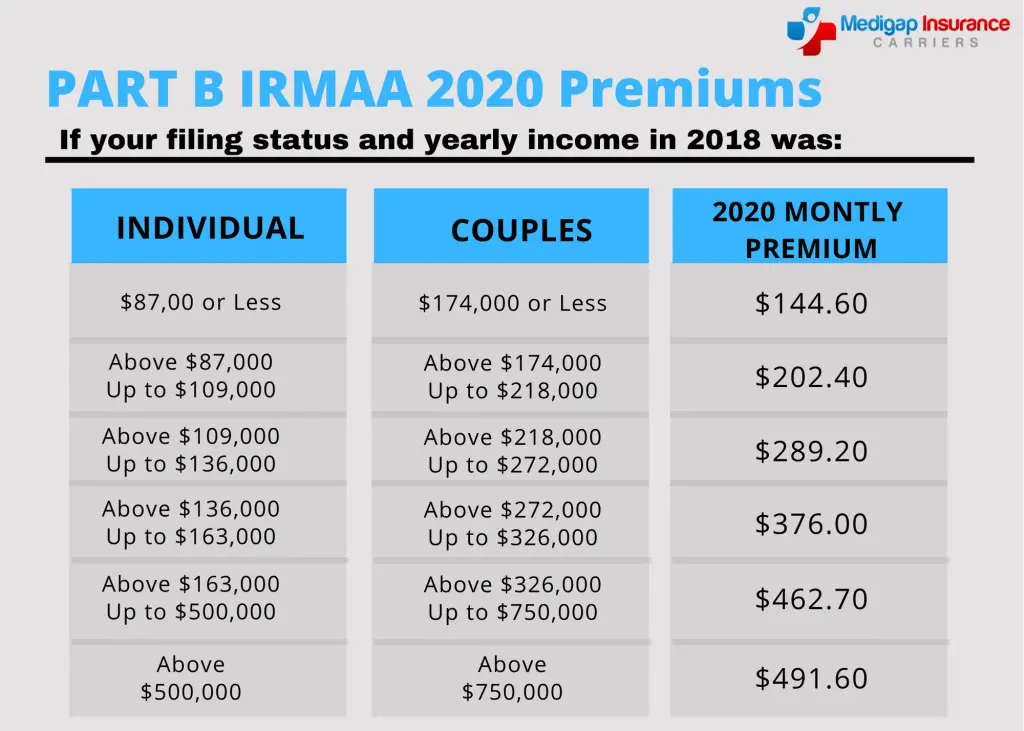

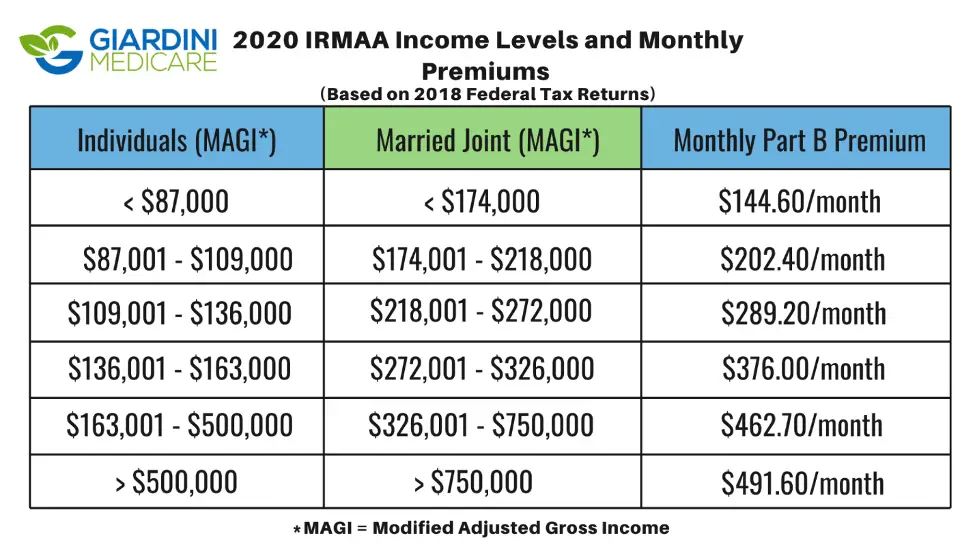

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

You May Like: Does Quest Labs Accept Medicare

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

What Is The Best Injection For Knees

The best injection for knee osteoarthritis depends on the nature and severity of your symptoms and your overall health profile. Your doctor can recommend the right knee injection for your specific needs. Three types of injections are commonly used to treat osteoarthritis.

- Corticosteroid injections work by easing inflammation. Their benefits typically last for two to three months. Often, this is the first type of injectable treatment that doctors recommend. If you have diabetes, your doctor may opt for another type of injection, as corticosteroids have the potential to increase blood sugar levels.

- Platelet-rich plasma or PRP injections use your own plasma to support the healing of knee cartilage and lessen inflammation.

- Hyaluronic acid injections increase your supply of a natural fluid present in your joints to provide lubrication and diminish inflammation.

All three types of knee injections must be administered by a doctor or other medical professional.

Recommended Reading: What Age Can I Qualify For Medicare

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2022, most people earning no more than $91,000 will pay $170.10/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The standard Part B premium increase for 2022 amounts to nearly $22/month, and is higher than the premium that had been projected in the Medicare Trustees Report.

CMS noted that the higher Part B premiums are due to a variety of factors, including costs associated with the COVID pandemic, the 2020 legislation that kept 2021 Part B premiums lower than they would otherwise have been , and potential costs related to new drugs that might be covered under Part B in the near future .

As described below, the Social Security cost-of-living adjustment can sometimes limit the increase in Part B premiums, but thats not the case for 2022. Although the premium increase is significant, the Social Security COLA was historically large for 2022, and adequate to cover the additional Part B premiums.

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Read Also: How Much Does Medicare Supplemental Insurance Cost Per Month