Connect With A Local Medicare Insurance Agent Today

Medicare Part D prescription drug coverage is often highly advantageous for Medicare beneficiaries. Its important to understand the standard and variable costs you can expect with a Medicare Part D plan, separate from your Original Medicare plan costs. For assistance evaluating Part D plans and gaining more information on anticipated plan costs, consult with our licensed Medicare insurance agents today! Medicare Portal offers free one-on-one advisory services over the phone, online and in-person at your convenience.

Should I Get A Medicare Part D Plan

If you have Original Medicare but you donât have prescription drug coverage, you should purchase a Medicare Part D plan. Make sure to enroll as soon as youâre eligible so you can avoid the late penalty.

If you have prescription drug coverage through an employer, union, or trade group, check to see if their plan covers more than the Medicare Part D plans you can buy in your area. For most people, workplace coverage terminates for good once they buy a Part D plan.

When you should consider Medicare Part D:

-

You have no other prescription drug coverage

-

Original Medicare and Medicare Part D are cheaper than your other coverage

-

You qualify for Extra Help, a program that helps low-income Americans pay Part D prescription drug costs

-

You have Medicare Supplement Insurance Medigap policies can no longer be sold with prescription drug coverage

When you can possibly skip Medicare Part D:

-

You have prescription drug coverage through Medicare Advantage

-

You have better prescription drug coverage through a past or current employer

-

You get better coverage through other federal programs or agencies, including the VA, TRICARE or the Federal Employee Health Benefits Program

True Out Of Pocket Cost Changes In 2022

After your TrOOP costs reach $7,050 in 2022, youll enter the catastrophic phase. TrOOP costs that count toward you moving out of the donut hole include:

- All payments you have made, including your deductible copayments and coinsurance

- The discount you get on brand-name drugs

- What you pay for drugs that are covered by your plan.

Out-of-pocket costs that do not count include:

- Your plan premium

- The percentage your plan pays for drugs in the coverage gap

- What you pay for drugs that are not covered by your plan

Recommended Reading: Does Medicare Cover Out Of Country Medical Expenses

How Are Part D Copays Determined

Since Medicare Part D plans are sold by private insurance companies, they can choose how much to charge for a copayment. Medicare Part D copays can vary between plans, which is why it is important to compare plans before enrolling in prescription drug coverage.

Generally, Part D plans organize their covered prescription drugs into different tiers. The tiers determine how much a copay will cost for a specific drug. Each plan can determine how to organize its tiers, which means different plans can have a different tier structure. Here is an example of a Medicare Part D drug plan tier according to Medicare.gov:

- Tier 1lowest copayment: most generic drugs

- Tier 2medium copayment: preferred, brand-name drugs

- Tier 3higher copayment: non-preferred, brand-name drugs

- Specialty tierhighest copayment: very high-cost prescription drugs

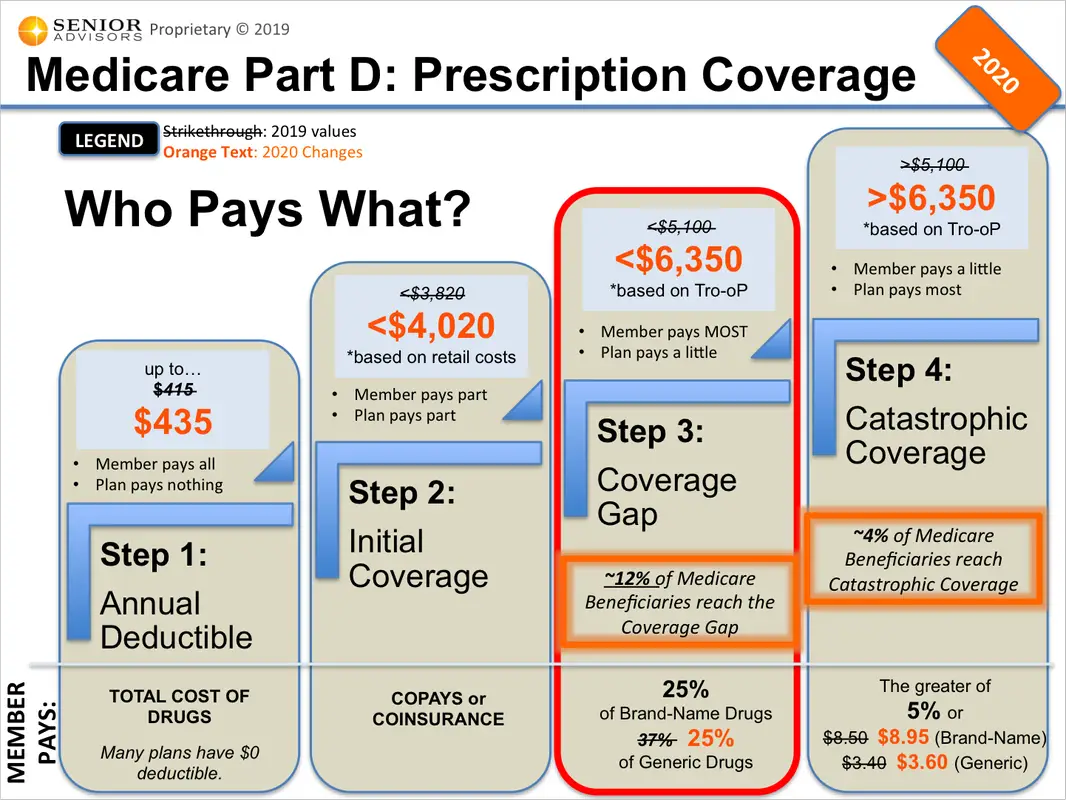

It is important to note, once you enter the last two parts of the four coverage stages of Medicare Part D you will no longer pay your plans set copay amount. Instead, in the coverage gap or donut hole phase, you will be responsible for 25% of the cost of your medications. After you exit the donut hole phase and enter the catastrophic coverage phase, your prescription drug costs will dramatically decrease and youll only be responsible for around 5% of the cost of your medications.

Generic Vs Brand Name Drugs

During the coverage gap, the amount you pay for generic drugs will count towards the coverage gap. With brand name drugs, both the amount you pay and any discount on the brand name drugs will count towards the coverage gap. Some Part D plans offer discounts on brand name drugs during the coverage gap.

Read Also: Where Can I Get Medicare Information

Understanding Medicare Part D Stages Of Coverage

Medicare Part D has four stages of coverage that dictate a beneficiarys out-of-pocket costs each year. The first stage of Part D coverage is the annual deductible. For the year 2021, the Medicare Part D allowable deductible is $445. Participating plans can offer plans with a lower deductible, but they cannot offer a plan with a deductible higher than $445.

The second stage of Medicare Part D coverage is the initial coverage phase. During this phase, the beneficiary will typically pay copays for prescriptions. Your medications will be categorized by a tier, 1-5, that will dictate your copay or coinsurance. Based upon the medications you need, you will pay a specific amount according to the tier that the medication you need is designated.

The third component to Medicare Part D coverage is the coverage gap, also known as the donut hole. After a beneficiary reaches the initial coverage limit for a year, that recipient enters a coverage gap. Within the gap, you should expect to pay 25% of the retail cost of your prescription medications.

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

Recommended Reading: Does Medicare Cover The Cost Of An Ambulance

How To Get Supplemental Medicare Coverage For Rheumatoid Arthritis

Chronic conditions can impact your bones, if you need a bone density test, Medicare has some coverage if your doctor deems it necessary. If you have Rheumatoid Arthritis, youll benefit from coverage beyond Medicare. Our agents can explain your options and find the best supplemental plan. Give us a call or fill out our form, and well prepare a free quote for you. We can identify the top carriers with the lowest premiums, and you can make the final choice.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Dont Miss: How To File A Medicare Claim Electronically

How Much Does Medicare Cost

Health care is a major cost for most people, especially retirees. Insurance like Medicare can make these costs more affordable. Medicare is aimed at assisting those over 65 to cover healthcare costs, and there are different types of Medicare available to those who qualify. Whether you are close to retirement or planning for your future, you may be wondering, how much does Medicare cost? Consider this article a guide to your Medicare-related questions.

Recommended Reading: Does Medicare Coordinate With Auto Insurance

Eliquis Coverage Through Medicare Part D

Medicare Part D is a part of Medicare that covers prescription drugs, and is offered by private insurance companies. Unlike original Medicare, the pricing is only partially set by the government. Medicare Part D will cover your Eliquis prescription, but you may have to pay a deductible, copayment, or coinsurance.

How To Shop For Coverage

Sometimes cheaper is better, but that’s typically not the case with Medicare Part D. The most important thing to check is the plans coverage for the drugs you currently take. Your out-of-pocket expenses will more than negate the money you saved on the premiums if a low-cost plan doesnt cover your drugs.

Look at the benefits, and compare them to what you would pay out of pocket. Also look at the costs before, during, and after the donut hole. Look at the premium once you calculate how much you would pay compared to what the plan would pay. Sometimes a higher premium will cost you less because your out-of-pocket expenses are lower.

You May Like: Does Medicare Pay For Tummy Tuck

How Much Does Eliquis Cost

As we mentioned, the cost of Eliquis is extremely high for most, coming in at over $500 for a 30 day supply. However, most people do not end up paying this amount. If you see this as the listed price, it is no error, but you can expect to pay significantly less for a few reasons.

If you have prescription drug coverage, then your plan will likely cover the majority of the cost of Eliquis once youve met your deductible. If you dont have a prescription drug plan, there are a variety of savings options available that can drastically reduce the cost of Eliquis.

Its important to note, however, that this list price of Eliquis may still be paid in full by some who dont have these options available. Because Eliquis is such an expensive medication, you should make sure that you have a coverage plan available that can take care of as much of the costs as possible.

Can I Buy A Generic Version Of Eliquis

A generic version of Eliquis is not currently available to buy. However, the FDA approved a generic version of Eliquis in early 2020. This generic version will simply be called Apixaban. For now, we cant tell how much Apixaban will cost. However, it will likely be significantly cheaper than name-brand Eliquis.

Recommended Reading: When Can You Change Your Medicare Part D Plan

Medicare Part D Plans And Eliquis Coverage

Medicare Part D prescription drug plans are a popular way to get additional prescription drug coverage that isnt available from Original Medicare. Prescription drug plans are offered by private insurance companies but are only available to Medicare beneficiaries. They are regulated by the government to some degree, but the prices and coverage will still vary as they do under most private plans.

Part D has a maximum deductible amount of $480, so no plan will be able to include a higher deductible in 2022. This means that even if you have Part D coverage for Eliquis, you will still need to pay these costs before your coverage begins.

Premiums for Part D average around $40-45 per month, although there is a large amount of variety here, and some people will pay significantly more than this. There is also a Part D income-related monthly adjustment which will require you to pay additional fees to the United States government, depending on your income.The actual cost of Eliquis under Part D will also vary widely. However, some people pay under $50 per month for their Eliquis coverage, which is obviously much lower than the list price. If your plan covers Eliquis , then you will pay much lower than the list price, but check your plan’s details and compare plans to see how these costs apply to you. Your Part D plan may also require you to obtain prior authorization before it approves a name-brand prescription when generic alternatives are available.

Medicare Part D Overview

Medicare Part D provides prescription drug coverage to Medicare recipients. You pay a monthly premium so that when you need to get prescription medication, your insurance will cover some of the cost. Part D plans are called Medicare prescription drug plans, or PDPs, and theyâre administered through private health insurance companies. All of the insurance companies offering Part D plans are approved by Medicare to do so.

Getting a Medicare prescription drug plan is optional, but prescription drugs are expensive and most people would benefit from getting a PDP. Even if you donât use any prescriptions right now, itâs best to get a plan soon after you enroll in the regular Medicare program because you will need to pay a late enrollment penalty if youâre eligible to enroll, donât enroll, and then try to enroll later on.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

You May Like: What Is A Good Secondary Insurance To Medicare

What Are The Costs Of Medicare Part D Prescription Drug Coverage

Q: What are the costs of Medicare Part D prescription drug coverage?

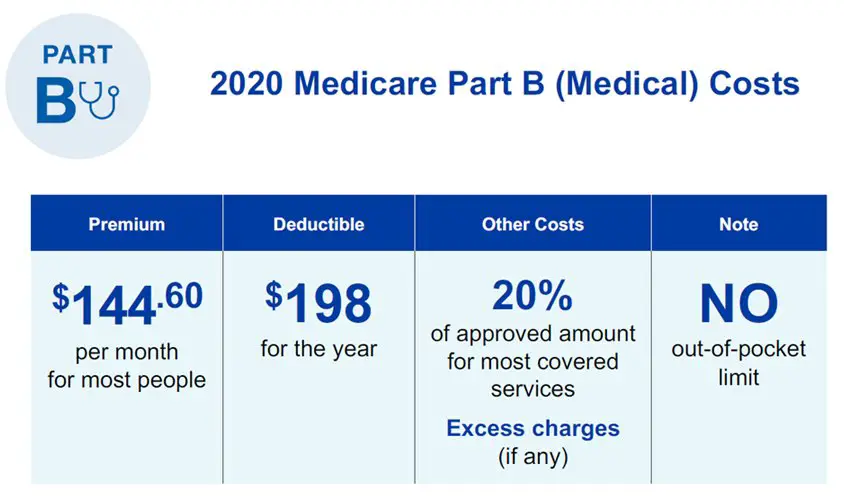

A: When you enroll in Medicare Part D coverage, you will depending on your plan likely pay a monthly premium, an annual deductible, and coinsurance or copays.

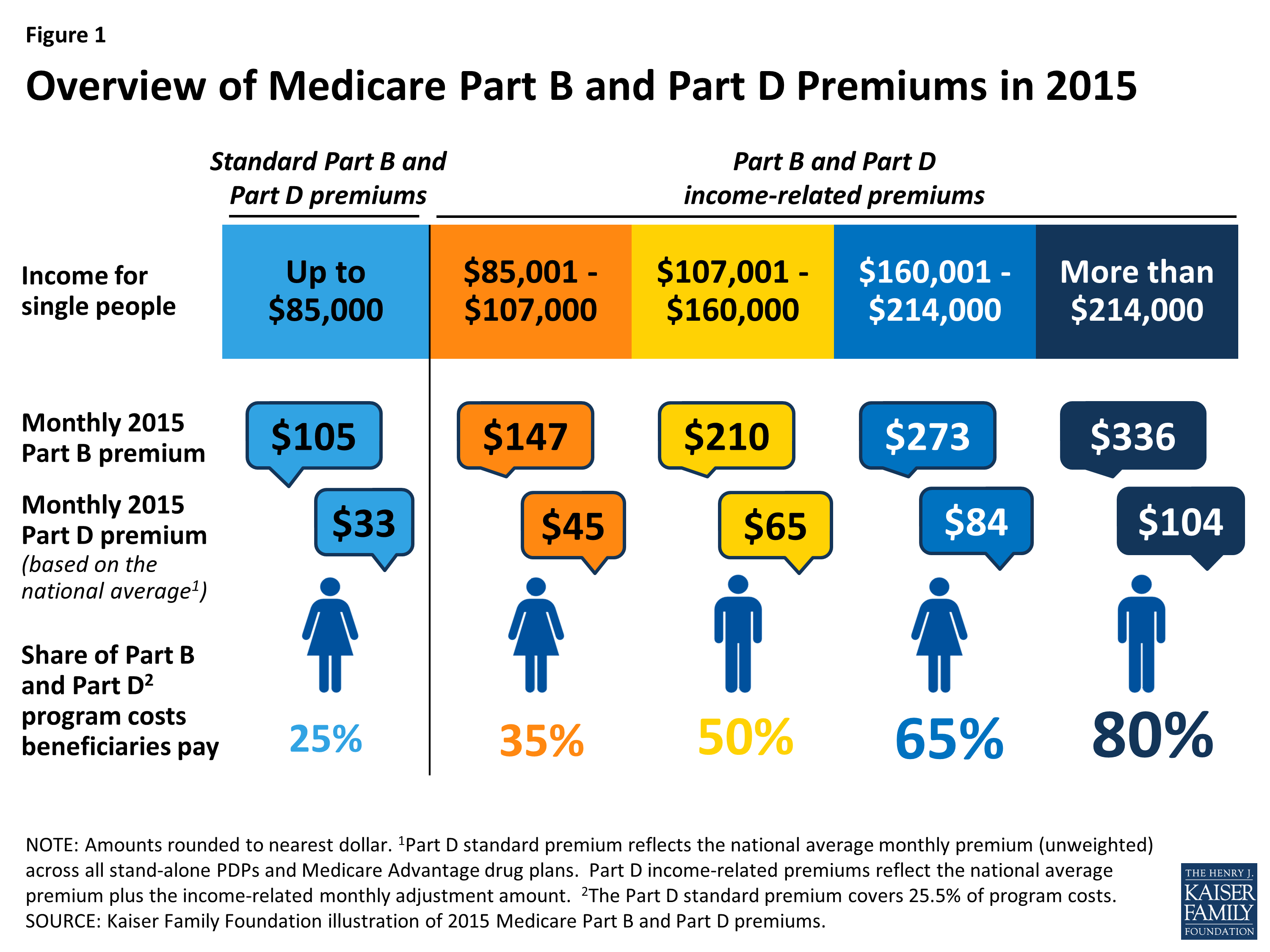

Premiums vary by plan and by geographic region but the average monthly cost of a stand-alone prescription drug plan with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Premiums vary tremendously however, depending on location and the plan selected. In 2021, actual monthly premiums for stand-alone PDPs vary from under $6/month to over $200/month.

Want to make changes to your Part D coverage? Discuss your options with a licensed Medicare advisor at .

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020. But not all plans have deductibles, and some have deductibles that are lower than the maximum allowed .

After the deductible is met, PDP policyholders pay copays or coinsurance during their initial coverage period until the total of their prescription drug costs reaches $4,130 in 2021 . The deductible is included in the portion that the beneficiary pays, so if your deductible is $445, that counts towards the $4,130 initial coverage threshold.

Car Insurance Albuquerque Nm

Category: Insurance 1. The Cheapest Car Insurance: Albuquerque, NM ValuePenguin Aug 16, 2021 State Farm has the cheapest rates for both full and minimum coverage in Albuquerque, New Mexico. Drivers could pay $45 per month for minimum Compare 2021 car insurance quotes from Liberty Mutual, Farmers, Nationwide, and

Also Check: Is Xolair Covered By Medicare Part B

Medicare Part D Enrollment

Medicare Part D is a voluntary program but without it you may pay a lot for medications that you need down the road. If Medicare will be your primary coverage, you should enroll in Part D when you first become eligible at age 65.

Many people who are still working at age 65 delay their enrollment into Part D until they retire. As long as your employer insurance has drug coverage that is as good as or better than Medicare Part D, you can delay enrollment without penalty.

Extra Help For Medicare Part D

Extra Help is an assistance program that helps lower income individuals more easily afford Medicare Part D. Extra Help helps pay for Part D premiums, deductibles and copayments/coinsurance.

Learn more about Medicare Part D Extra Help, including how to qualify, where Extra Help is offered and how to find other assistance programs designed to help cover Part D prescription drug costs.

Don’t Miss: What Does Aarp Medicare Supplement Cost

I Dont Have Insurance Or Cimzia Is Not Covered By My Insurance Plan

If you do not have insurance or CIMZIA is not covered by your insurance plan, please contact our team of compassionate and informed professionals for more information to see what options might be available to you. Contact ucbCARES at 1-844-599-CARE or visit us online.

9 IQVIA LAAD data and Centers for Medicare & Medicaid Services . Medicaid and CHIP Overview. Maximum Allowable Copayments Determined by Eligible Populations Household Income. Updated May 2020. **All out-of-pocket charges are based on the specific states defined payment amount for that service. Certain groups, including children, terminally ill individuals, and individuals residing in an institution are exempt from cost sharing. Refer to your state agency for details about Medicaid out-of-pocket costs. https://marketplace.cms.gov/technical-assistance-resources/medicaid-chip-overview.pdf. Accessed December 2020.

10 Most consumers have some type of health insurance coverage that includes a prescription drug benefit. According to recent data, just under 9% of the total U.S. population is uninsured. .

When Can I Sign Up For A Medicare Part D Plan

You are eligible to sign up for a Prescription Drug Plan during the seven-month window surrounding your 65th birthdaythe three months before you turn 65, the month you turn 65, and the three months after your 65th birthday.

After that, if you want to change plans in any way, you need to wait until the Medicare Open Enrollment period , which is from October 15 to December 7 each year.

Important note: If you dont sign up for a Prescription Drug Plan when you sign up to get Medicare, you could pay a penalty those who go more than 63 days without a Prescription Drug Plan are charged a late enrollment fee, which goes up for every month you are uninsured.

Read Also: Does Medicare Provide Life Insurance

What Is The Medicare Part D Late Enrollment Penalty

You may owe a Medicare Part D late enrollment penalty if you do not have any form of prescription drug coverage for 63 days in a row after your IEP. You will be required to pay this penalty for as long as you have Medicare coverage. The Medicare Part D late enrollment penalty you must pay depends on how long you did not have any form of prescription drug coverage. The longer you went without coverage, the higher the penalty.

Here is how the late enrollment penalty is calculated:

- Count the number of months you didnt have prescription drug coverage.

- Multiply this number of months by 1 percent.

- Multiply the previous total by the national base beneficiary premium .

- Round the result to the nearest $0.10. This is the number you will pay each month in addition to your monthly drug coverage premium.

If you receive a notification youre being charged for prescription drug coverage, and you think its in error, you can appeal this decision. You must file an appeal within 60 days from when you received a letter notifying you of the late enrollment penalty.