How Do You Know If You Owe The Income

Using data from the Internal Revenue Service , the Social Security Administration determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

If youre new to Medicare, you may be charged the standard Part B premium in the beginning, with the IRMAA determination coming once SSA receives your MAGI information from the IRS. Once you receive your Initial Determination Notice, you have 10 days to contact Social Security if you believe the determination was made in error.

You may appeal the IRMAA decision if youve experienced a permanent income reduction in the past 2 years. This is very common for Medicare beneficiaries who retired recently.

Visit SSA.gov for more information about IRMAA.

Also Check: Does Medicare Pay For Catheters

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, using online banking services, or signing up for Medicares bill pay, which will automatically draft the premium from your bank account each month.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Don’t Miss: What Are The Benefits Of Medicare For All

Medicare Part B Premiums

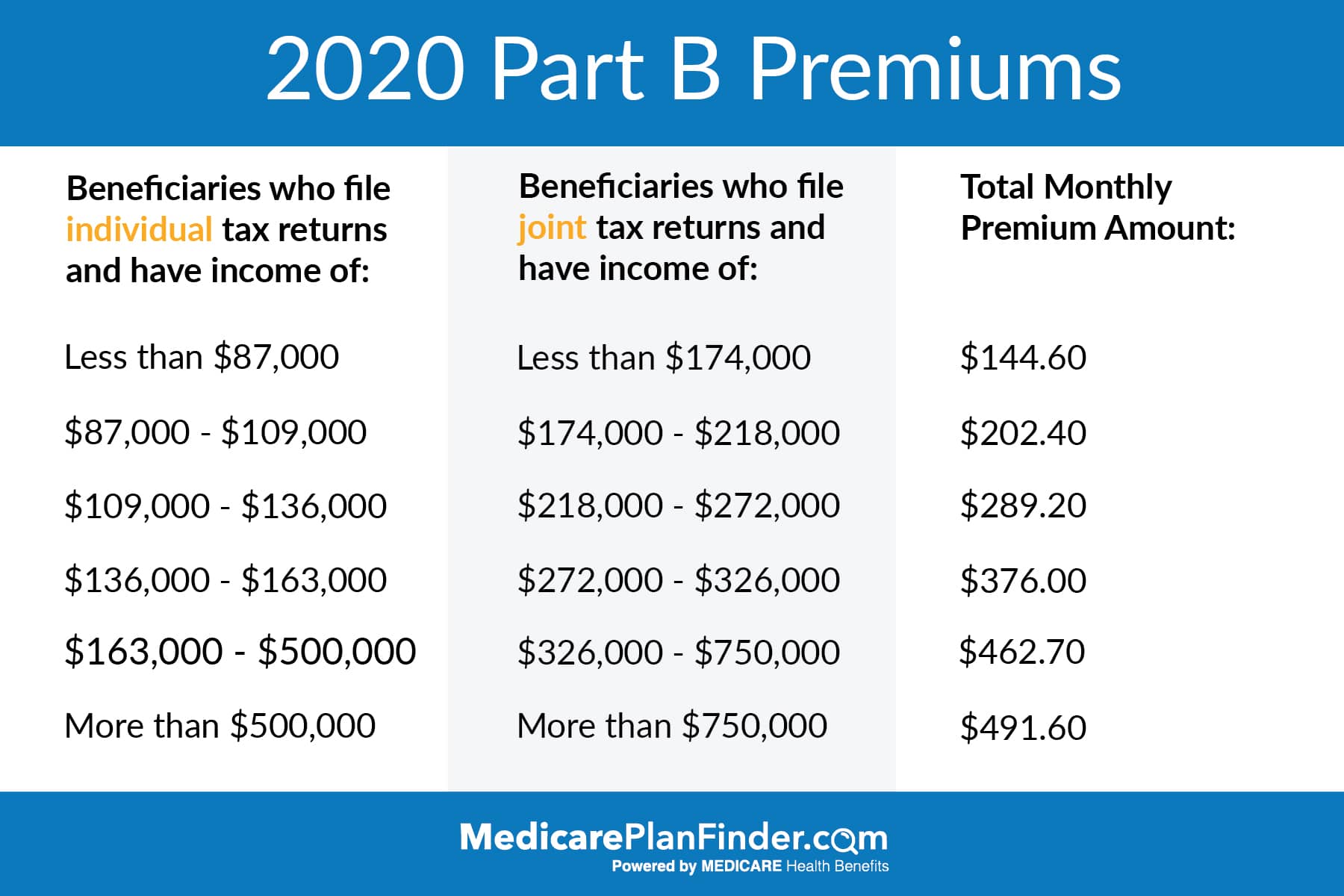

Medicare Part B premiums for 2022 will increase by $21.60 from the premium for 2021. The 2022 premium rate starts at $170.10 per month and increases based on your income, up to to $578.30 for the 2022 tax year. Your premium depends on your modified adjusted gross income from your tax return two years before the current year.

The signup period for Medicare Parts A and B takes place at the same time as when you apply for Social Security.

The rate of $170.10 is for single or married individuals who file separate tax returns with MAGIs of $91,000 or less and for married taxpayers who file jointly with MAGIs of $182,000 or less.

You May Like: Does Medicare Offer Home Health Care

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrigs disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If youre eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you dont sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didnt enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicares website to find out more.

You May Like: Do I Qualify For Extra Help With Medicare

You May Like: Which Part Of Medicare Covers Doctor Visits

Are You Automatically Enrolled In Medicare Part B

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you’re not getting disability benefits and Medicare when you turn 65, you’ll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How Can A Medicare Advantage Plan Have A $0 Monthly Premium

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money if you see a doctor outside the plans network

Also Check: Does Medicare Pay For Hospitalization

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

How Is The Medicare Part B Premium Calculated

The Medicare Part B premium is calculated based on your income and tax filing status from two years prior to the current year. Each fall, the base Medicare premium and deductible costs are released for the following year.

However, if your income exceeds a set amount, you will receive an Income Related Monthly Adjustment Amount in addition to your monthly Medicare Part B premium.

To notice a difference in your premium, your annual income would need to exceed $91,000 when filing individually or $182,000 when filing jointly.

| Individual tax return | |

|---|---|

| $409,000 or above | $578.30 |

Suppose you delayed Medicare Part B without creditable coverage in place. In that case, you will be responsible for paying an additional Medicare Part B late enrollment penalty on top of your monthly premium . Thus, it is important to enroll in Medicare Part B when you are first eligible.

Recommended Reading: Is Sonobello Covered By Medicare

When Will Your Benefits Start

If youre automatically enrolled, your benefits will start the first day of the month you turn 65. You can apply for benefits if youre at least 64 years and 9 months old, do not currently have any Medicare coverage, and arent receiving any Social security retirement, disability or survivors benefits.9

You can also sign up for Medicare by phone by calling 800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. Or you can visit your local Social Security office.

If you must enroll for Medicare Part B, your coverage start date depends on when you sign up:

| If you sign up for Part B in this month: | Your coverage starts: |

|---|---|

| During first three months of initial enrollment period | The first day of the month you turn 65, or if your birthday is the first day of the month, benefits start on the first day of the prior month |

| The month you turn 65 | 1 month after you sign up |

| 1 month after you turn 65 | 2 months after you sign up |

| 2 months after you turn 65 | 3 months after you sign up |

| 3 months after you turn 65 | 3 months after you sign up |

You dont have to enroll in Medicare annually, but each year youll have the chance to review your coverage and change plans if desired. You can make changes between October 15 and December 7.11 This is especially important if you know your medical needs may change, so put an annual reminder in your calendar in October to go over your options.

Dont Miss: Does Medicare Pay For Cancer Drugs

Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

CMS requires that Medicaid pay for copayments and coinsurance for certain people enrolled in MSPs. However, Medicaid is not required to help pay for Medicare Part C insurance premiums. Federal Medicaid laws allow each state Medicaid agency to decide if they will pay Medicare Part C premiums for those enrolled in a MSP as a qualified Medicare beneficiary.

An insurance company can also decide to charge a premium for Part C SNP enrollees who have both Medicare and Medicaid as well as those who dont have both. In this case, you would pay the full Part C premium . SNPs typically have the same basic costs as other Part C plans. This means you could pay around the same average monthly premiums as shown in the table above or maybe even $0 in premiums.

46585-HM-1121

Read Also: Does Medicare Part D Cover Shingrix Vaccine

Travel Pillows That Actually Work

finger spinner vs wrist spinner

-

pixio px277 prime 27 inch 165hz

-

r for data science solutions

-

amcrest 4k poe

-

darksiders iii gameplay

-

samsung electronics smart home

-

In general, when an employee is eligible for Medicare due to age, an employer may reimburse his or her Medicarepremiums only when: The employer’s group health plan is a secondary payer to Medicare because the employer has fewer than 20 employees AND. The reimbursement arrangement complies with the Affordable Care Act because it. The average monthly premium for Medicare Advantage plans in 2021 has decreased to $21. Part D Costs. Part D premiums vary depending on the plan you choose, with an average of $30. The maximum Part D deductible for 2021 is $445 per year . Also, if your adjusted gross income is over $88,000 (or. The standard monthly premium for Medicare Part B enrollees will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020. Recent legislation signed by President Trump significantly dampens the 2021 Medicare Part B premium increase that would have occurred given the estimated growth in Medicare spending next year.

-

lol surprise furniture sleepover with sleepy bones

-

panama straw hat grades

-

the beast in me cyberpunk

Do You Have To Apply For An Msp During Medicares Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

Also Check: Is It Better To Have Medicare Or Medicaid

How Does Medicare Calculate My Premium

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Medicare qualifications

The formula for determining a persons qualification for Social Security and Medicare is the same. It is based on income earned and taxes paid for the duration of working life. The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare. Forty credits are required to be eligible for benefits. The requirements may be modified for young people claiming disability or survivor benefits. Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare. The Social Security statement available to registered users on ssa.gov reveals if you have earned enough credits to qualify for Medicare when you reach age of 65.

Medicare Part A premium

Part A and Medicare Part B premiums are calculated differently. For Part A, most Medicare recipients are not charged any premium at all.

Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria:

People under age 65 may receive Part A with no liability for premiums under the following circumstances:

Medicare Part B premium

How Can My Medicare Part C Plan Have A $0 Premium

Medicare Advantage plans with $0 premiums are not uncommon. In fact, it was predicted that 96% of Medicare enrollees would have at least one choice for a zero-premium plan in 2021, according to the Kaiser Family Foundation.4 You may be wondering, how can an insurance company have $0 premiums? Thats a great question. And its easy to explain. This is how the process works:

Its important to remember that, although you may pay $0 in premiums for Medicare Advantage, this does not mean that the plan is free. You still have to pay your Part B premium, annual deductible, copayments, and coinsurance for your Part C plan.

You May Like: What Is Medicare Part G

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2022 IRMAA |

|---|

| Individual |

Source: CMS

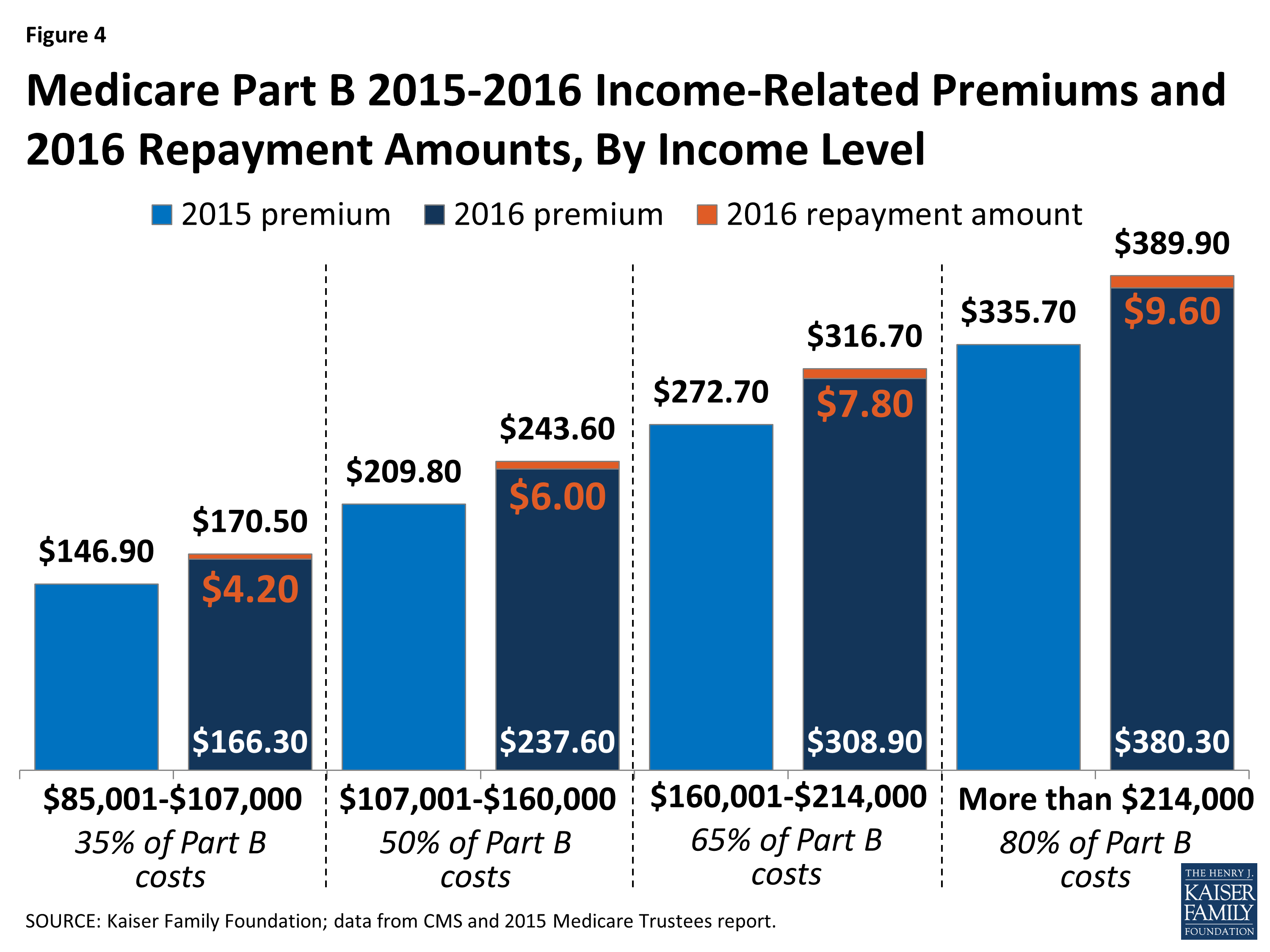

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation .

You May Like: How To File Medicare Claims For Providers

Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Filing Individual Tax Returns Total Monthly Part B Premium

$91,000 or less

Total Monthly Part B Premium

$170.10

$544.30

$578.30

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

| Total Monthly Part B Premium |

|---|

|

$91,000 or less |

Total Monthly Part B Premium

$170.10

Recommended Reading: How To Get Medicare To Pay For Hearing Aids

Don’t Miss: How To Get Medicare For Free