What Original Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. With a few exceptions, Original Medicare doesn’t include coverage for prescription drugs. It also does not cover health care benefits you may have been used to getting with an employer plan such as dental, vision, hearing health care or wellness items like fitness memberships.

Late Enrollment Penalties For Medicare Part A And Part B

Both Medicare Part A and Part B can have late enrollment premium penalties.

The Part A Late Enrollment Penalty

If you must pay a Part A premium and enroll late, you could pay a penalty. The Part A late enrollment penalty is 10% of the Part A premium. You pay the penalty in addition to your Part A premium for twice the number of years you delay enrollment.

Example: If you delay 2 years, you will pay an additional 10% of the Part A premium for 4 years .

The Part B Late Enrollment Penalty

The Part B penalty is 10% of the monthly premium amount for each full 12-month period enrollment is delayed. You pay the Part B premium penalty in addition to your Part B premium for as long as you have Medicare Part B.

Example: You delayed Part B 3 years. To calculate how much your penalty will cost, you’ll multiply x . In this case, x . Thus, your Part B premium penalty will be 30% of the Part B premium.

What Does Medicare Part B Cost

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 and increases with income.3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier.

The annual deductible for Part B is $198 in 2020 .4 Once this is paid, youll only pay your coinsurance payments, which are 20% of covered expenses.

Some low-income and disabled people may be eligible for help paying Part B premiums through their state’s Medicare Savings Program . Those eligible for free Medicare Part B may qualify for free or lowered deductibles and coinsurance as well.

If you con’t qualify for an MSP, consider purchasing a Medicare Supplement plan to help cover the costs of both Parts A and B.

Learn more about Medicare costs.

You May Like: Does Medicare Part B Cover Freestyle Libre Sensors

What Original Medicare Does Not Cover

Medicare Part A and Part B deal with hospitalization and treatment of illnesses by a physician. The limited scope of Original Medicare excludes many often common types of health services. You dont get coverage with Original Medicare for: *Routine eye examinations *Routine teeth cleanings or check-ups *Cosmetic surgery unless performed because of an accident or traumatic injury *Removal of calluses from feet *X-rays and other tests from chiropractors *Manipulations by a chiropractor, except for a single one to correct a partial dislocation of a spinal vertebra *Costs of long-term care in a nursing home

Is Custodial Care Covered If I Receive It As Part Of Another Covered Treatment

Yes. While Medicare doesnt cover custodial and long-term care, these services are typically included if you receive them as part of another medically necessary treatment. For example, Medicare will cover the short-term custodial care you receive while recovering from surgery at a skilled nursing facility. The care can include assistance with feeding, dressing and other normal daily activities. Medicare will not cover these services after youve recovered enough to be discharged following your surgery.

Also Check: Can I Sign Up For Medicare Part B Online

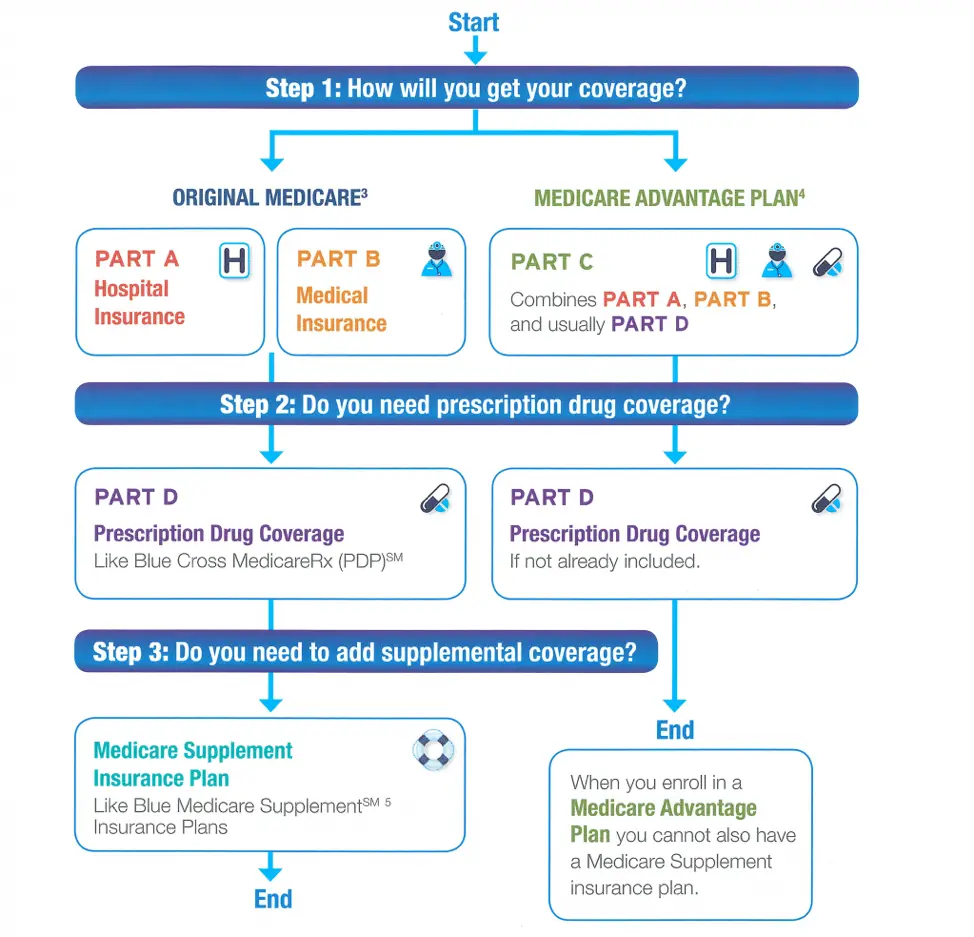

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur. If you decide that the Medicare Advantage Plan isn’t for you, you have the right under federal law to purchase any Medigap plan if you switch to Original Medicare within 12 months of the date that you joined a Medicare Advantage Plan for the first time.

You may also switch from your Medicare Advantage Plan to Original Medicare during the annual Open Enrollment Period or if you qualify for a Special Enrollment Period. However, you may not be able to purchase a Medigap policy . If you are able to do so, it may cost more than it would have when you first enrolled in Medicare.

Keep in mind that an employer only needs to provide Medigap insurance if you meet specific requirements regarding underwriting . The wait time for Medigap coverage can be avoided if you have what is called a “guaranteed issue right.”

A thorough breakdown of what is considered a “guaranteed issue right,” where an insurance company can’t refuse to sell you a Medigap policy, can be found on the Medicare website.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

Medicare Part A Hospital Care Coverage

As a Medicare Part A beneficiary, you will receive coverage for hospital expenses that are critical to your inpatient care, such as a semi-private room, meals, nursing services, medications that are part of your inpatient treatment, and any other services and supplies from the hospital. This includes inpatient care that received through:

- Acute care hospitals

- Part-time or intermittent home health aide services

- Durable medical equipment, when ordered by your doctor*

*If your doctor orders durable medical equipment as part of your care and the equipment meets eligibility requirements, this cost is covered separately under Medicare Part B. If youâre eligible for coverage, Medicare typically covers 80% of the Medicare-approved amount for the durable medical equipment.

You May Like: How To Get Dental And Vision Coverage With Medicare

What Does Medicare Part A Cost

Many are eligible for premium-free Part A, which is exactly what it sounds likequalified Medicare beneficiaries arent required to pay a premium for Medicare Part A coverage. To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements:

- You or your spouse paid Medicare taxes while employed with the government.

- You are eligible for Social Security or Railroad Retirement Board benefits but havent started collecting them yet.

- You currently receive retirement benefits from Social Security or the Railroad Retirement Board.

If you are under age 65, you might still be eligible for premium-free benefits if you meet one of two requirements:

- You have received Social Security or Railroad Retirement Board benefits for two years.

- You have End-Stage Renal Disease .

If you dont meet any of the five requirements above, youll have to pay a premium for Part A. For 2020, the monthly premium is $458 .1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 to cover hospital inpatient care.2

Most Plans Also Cover Additional Benefits That Arent Available With Medicare Part B Or Part A

28.if you have original medicare, you will not pay anything for home health visits, but if you require medical equipment, you will pay 20% of the medicare approved amount for the rental or purchase of the durable medical equipment . Part b also covers durable medical equipment, home health care, and some preventive services. 7.medicare, the government insurance program for seniors, provides coverage for various health care needs and services.

Knowing you have heart disease means little if there is nothing you can do about it. Hereâs the kind of home health services medicare may cover: 27.original medicare will cover certain home health care services through the home health benefit if you father meets a few requirements.

6.the only extra cost youâll have for home health services is 20 percent of whatever durable medical equipment is needed for your services. Citizens age 65 and older for inpatient stays in hospitals and similar medical facilities. 25.medicare part a, which is hospital insurance, does not pay for assisted living.

Below is a list of specifics regarding what is covered under medicare part b: There is no prior hospital stay requirement for part b coverage of home health care. Medicare covers only a very limited selection of chiropractic services, of which are covered by part b.as part b is the part of medicare that covers outpatient medical services, it makes sense that this coverage would apply to chiropractors.

6 $0 for home health services

Also Check: When Do Medicare Premiums Start

How Do I Apply For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. If you are not collecting Social Security benefits, you will need to enroll yourself. You can apply for Medicare Part B online, over the phone, or in person.

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll in the future.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Choosing Between Medicare Advantage And Medicare Supplements

If you want to go beyond Original Medicare, consider that youll generally pay more for a Medicare Supplement Plan than for Medicare Advantage. Although Medigap plans normally do not cover services beyond what Original Medicare covers, you may use Medicare Supplement Plans at any facility or medical practice that accepts Medicare. Medicare Advantage plans restrict you to providers in the particular network of the Medicare Advantage insurer.

- Information

Don’t Miss: Does Kaiser Medicare Cover Dental

Enrollment Periods: When Can I Sign Up For Medicare Part B

Initial Enrollment Period

If you arent receiving Social Security and dont have health insurance through an employer upon turning 65 you must enroll in Medicare during your Initial Enrollment Period .

- The IEP is a seven-month period the fourth month being the one in which you turn 65.

- You can enroll in Medicare starting up to three months before your 65th birthday and your window to sign up ends three months following your 65th birthday.

- Your Part B coverage will be delayed if you wait until the month you turn 65, or later, to enroll.

Special Enrollment Period

If you delayed Medicare enrollment after turning 65 because you were insured through an employer for whom you or your spouse was still actively working you need to sign up for Medicare during a Special Enrollment Period .

- The SEP allows you to sign up for Medicare starting at any point before your or your spouses employment draws to an end, up until eight months following your retirement.

- If you are younger than 65 and lose your employer-sponsored health coverage when your older spouse retires and signs up for Medicare, you will need to find separate coverage for yourself.

General Enrollment Period

If you declined to enroll in Part B when you were first eligible, and dont qualify for a Special Enrollment Period, you can sign up during a General Enrollment Period.

Are There Prescription Drugs Not Covered By Medicare

Yes, much like medical services, Medicare will only cover medically necessary prescription drugs. Drugs not covered by Medicare can include weight loss or sexual health medications. But Medicares prescription drug coverage exclusion can also extend to brand-name drugs with suitable generic options available at lower prices. The main takeaway is that Medicare generally covers medications you need, but you may need to look past the brand names. Discuss your medications with your doctor if you have any questions.

Read Also: Can You Get Medicare Insurance At 62

Consider Your Other Costs

Out-of-pocket costs can quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

How Do I Enroll In Medicare Part B

To get on Medicare Part B, check to see if you will be automatically enrolled in Original Medicare.

If youre not automatically enrolled, you can go on Medicare Part A and Part B with the help of Social Security.

Special Part B Enrollment Circumstances:

- If you live in Puerto Rico and youre already receiving Social Security or disability benefits when you turn 65 years old, you will only be enrolled in Part A automatically. You will need to apply for Part B coverage on your own.

- If you arent receiving Social Security when you turn 65 years old, your enrollment in Medicare isnt automatic you will need to apply for Part A and B coverage.

Recommended Reading: Is Silver Sneakers Part Of Medicare

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

Recommended Reading: Does Medicare Cover Parkinson’s Disease

Does Medicare Ever Make Exceptions On What It Covers

If you need a service or item that Medicare does not cover or if Medicare denies a claim you think it should not have you may have options. Discuss with your doctor whether Medicare covers the specific services you receive. When you receive your Medicare Summary Notice , review any charges and how much Medicare covers them. If Medicare denies a claim, your MSN will provide instructions on how to file an appeal, and the appeals due date.

Understanding Coverage Gaps In Original Medicare

Many retirees think Medicare covers most health care expenses.

In reality, Medicare Part A and Part B otherwise known as Original Medicare has several coverage gaps.

In general, Original Medicare does not cover:

- Prescription drugs

Original Medicare does not cover most prescription drugs.

However, You Can Get Drug Coverage One of Two Ways

You can use the Medicare Plan Finder to compare Part D or Medicare Advantage plans in your area.

Medicare Part B may cover some outpatient drugs under limited circumstances.

For example, certain injectable osteoporosis drugs and oral drugs for end-stage renal disease are covered.

In general, drugs covered under Medicare Part B are usually received at a doctors office or hospital outpatient setting.

In these situations, youll owe 20 percent of the Medicare-approved amount for covered Part B drugs administered in a doctors office or pharmacy, and the Part B deductible applies.

Also Check: Does Medicare Cover Kidney Transplant

Why Is Medicare Advantage A Bad Choice

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Who Is Eligible For Medicare Part B Coverage

For those 65 Years and Older

The main group for which Medicare was set up. To qualify, youll need to fulfill two requirements:

For those 65 Years and Younger

There are few cases where people under the age of 65 are eligible to get Medicare benefits. To qualify, youll need to belong to one of three groups:

Read Also: Is Chantix Covered By Medicare

What Is Not Covered By Medicare Part B

1. Long-term Care: Services that help you perform basic tasks, whether through a caregiver or a stay in a nursing home, are generally not covered by Medicare.

2. Hearing Aids: Hearing aids and most audiology services are not covered by Original Medicare.

3. Dental Care: The vast majority of dental care including cleanings, fillings, dentures, and tooth removal is not covered by Original Medicare.

4. Glasses: Original Medicare will not pay for your glasses or related eye exam. Cataract surgery and other vision care expenses are generally covered by Part B.

5. Less Common Medical Services: Less common expenses that some health plans cover such as cosmetic surgery, corn removal, and travel between appointments are also not included in Part B coverage.