Avoid Medical Underwriting When Enrolling In Medigap

If you want a Medigap plan, the best time to enroll is usually during your initial enrollment period when you turn 65. This will give you the best rates, and you’ll have “Medigap guaranteed issue,” which means you cant be denied coverage because of a medical condition.

However, you can be eligible for guaranteed issue in other situations such as if you move outside of your current Medicare plan’s service area or if you lose another type of coverage such as a retiree plan. Some states provide even more opportunities to qualify for Medigap with a preexisting condition.

In particular, Medigap Plan G will cover most medical costs except for the $233 Medicare Part B deductible. Plus, the plan is available to all new enrollees, and it’s widely offered by most Medigap providers.

You’ll also need prescription coverage, which requires a separate Medicare Part D plan. Because medications are often an important part of cancer treatment, it’s helpful to keep in mind that medications administered at a doctor’s office, hospital or medical facility would be a part of your Medigap coverage. However, the medications you take at home are typically part of your prescription plan.

If you go through medical underwriting after a cancer diagnosis without the protections of Medigap guaranteed issue, your Medigap application will usually be denied.

In this situation, enroll in a Medicare Advantage plan with good coverage for cancer during the fall open enrollment period.

What Are The Top Medicare Supplement Plans

Medicare Supplement plans pay secondary, meaning after Original Medicare pays its portion. Each Medigap plan is identified by a different letter, A through N.

There are 12 Medicare Supplement plans available to those enrolled in Original Medicare ten lettered plans and two high deductible plans. Across all carriers, benefits from the same letter plan are identical.

However, the top three Medicare Supplement plans are those with the highest levels of benefits. These plans are popular because of their coverage, low out-of-pocket costs, availability, and overall client satisfaction.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Below we review the top three Medicare Supplement plans and how you can benefit from their coverage.

If You Have A Low Income: Medicare And Medicaid Dual Enrollment

When facing the high cost of cancer treatment, those who have a low income can enroll in both Medicare and Medicaid to reduce costs.

In states with expanded Medicaid eligibility, you can qualify for Medicaid if you are an individual earning less than $18,754. Medicaid eligibility varies by state, and talking to your Medicaid state agency can help you to determine if you qualify.

Plus, the high cost of cancer treatment can also make it easier to qualify for Medicaid because of the spenddown program.

If the amount you pay for Medicare coverage, deductibles and copayments is more than your available resources, this can be a useful way to lower your costs. Program details vary by state, but generally, the program allows you to subtract your medical expenses from your countable income, and this new income figure can be used to qualify for Medicaid.

Recommended Reading: How Does Medicare Work In Texas

What’s The Least Expensive Medicare Supplement Plan

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage. Only a few providers offer these plans, and a high-deductible Plan G from Mutual of Omaha costs about $54 per month.

Are You Considering A Medicare Supplement Plan

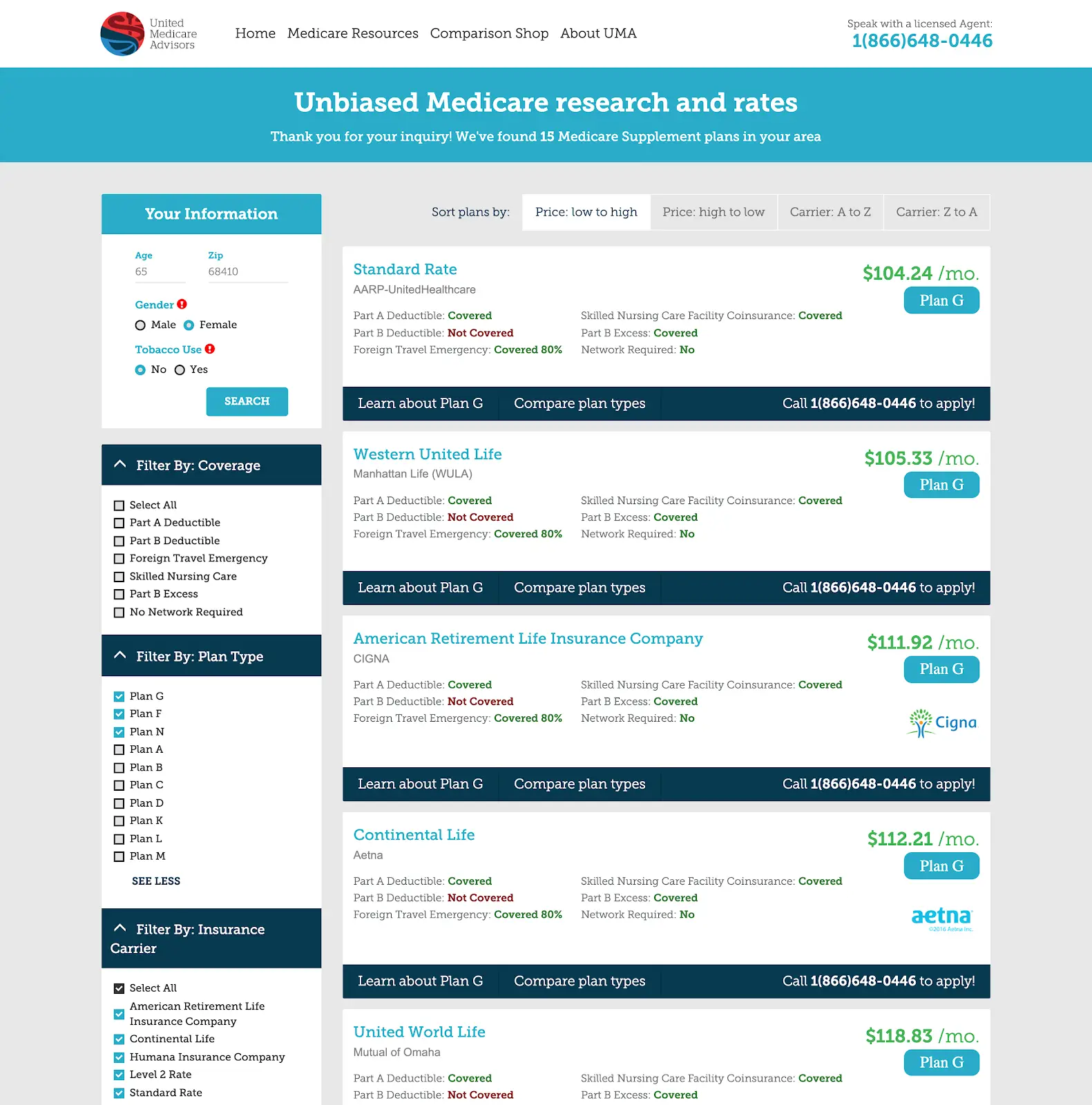

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

Also Check: Is Oral Surgery Covered Under Medicare

So Which Of These Medicare Supplement Plans Are The Best

To determine which Medicare Supplement plan is right for you, you should determine which policy provides the best benefits for your medical needs.

Consider, for instance, how well each plan covers skilled nursing or foreign travel emergencies if you desire coverage in those areas. Further, if you think you will require hospitalization in the future, a plan that pays for the Medicare Part A deductible may prevent you from incurring a large hospital bill.

Here are other plans and how they will best suit you:

Plan G: Best Medicare Supplement Plan For New Enrollees

Because of the enrollment rules tied to Plan F, new enrollees are barred from enrolling in that popular plan. So whats the best Medigap plan for someone who became eligible for Medicare after Jan. 1, 2020?

Plan G offers all of the same benefits as Plan F except that it doesnt pay for the Medicare Part B deductible. The Part B deductible is $233 per year in 2022, so its a relatively small cost requirement when compared to some other types of Medicare out-of-pocket copays and deductibles. And the monthly premiums for Plan G are typically lower than those of Plan F, which can more or less cancel out the Part B deductible cost.

Plan D is another candidate for the best Medigap plan for new enrollees. Plan D offers the same coverage as Plan G with the exception of Medicare Part B excess charges. However, excess charges can usually be avoided simply by making sure to only visit health care providers who accept Medicare assignment.

Recommended Reading: How Do I Get Part A Medicare

Don’t Miss: When Can I Enroll In A Medicare Supplement Plan

Plan B: Best Medicare Supplement Plan For Basic Benefits

Some beneficiaries just want a basic Medigap plan with no thrills. Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly:

- Medicare Part A deductible

- Medicare Part A coinsurance

- Medicare Part B coinsurance

Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face. This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they dont.

Medicare Supplement Plans F G And N: Which Is Best

Medicare Supplement plans F, G and N are the most popular Medigap plans with the highest rates of enrollment nationwide. Which one is best depends on the beneficiary and their specific health care needs.

By and large, Plan F is the most popular Medicare Supplement plan due to its coverage of more out-of-pocket Medicare costs than any other Medigap plan type. Plan F pays for Medicare deductibles, copays and other costs associated with Medicare-covered services, so beneficiaries dont have to worry about out-of-pocket expenses. However, Plan F is no longer available to any Medicare beneficiary who became eligible for Medicare on or after January 1, 2020.

Due to these enrollment restrictions, Plan G is becoming the most popular Medicare Supplement plan type for new Medicare enrollees, as it covers the most Medicare costs of any Medigap plan type thats available to all beneficiaries. Plan G beneficiaries only have to pay their annual Medicare Part B deductible, after which the plan provides 100% coverage on all Medicare-covered medical expenses.

Read Also: What Is The Deadline For Medicare Supplemental Insurance

Plan K: Best For Those Looking For Cheap Medicare Supplement Plans

Consider Plan K if youre looking for a Medigap policy thats as cheap as possible and still offers some extra coverage.

In contrast to many other Medigap policies, Plan K only covers 50% of Medicare Part B coinsurance, blood, hospice care, skilled nursing, and the Part A deductible. Several Medigap plans, including Plan G, provide full reimbursement for these services. However, these plans are far more expensive.

If you dont think you will need skilled nursing in the future, its okay to settle with Plan K. But, if you do, remember that Plan L will only cover 50% of the cost.

Given the less coverage, the monthly premiums for Plan K are much lower. The policy costs about $77 per month, so its an affordable Medicare Supplement plan, especially for low-income seniors.

Mutual Of Omaha: Best Overall Medicare Insurance Company

It is clear why Mutual of Omaha is at the top of our list. This company has an A+ rating with AM Best and an AA- rating with S& P. Established in 1909, Mutual of Omaha has been a household name for over a century. They pay 98% of Medicare claims within 12 hours, saving clients the hassle of worrying about claim status.

Plus, you receive various policy options when using Mutual of Omaha as a Medicare insurance company. Aside from Medicare Supplement plans, Mutual of Omaha offers Medicare Part D prescription drug plans, dental coverage, and long-term care insurance to name a few of their products.

Also, household discounts make it beneficial to choose Mutual of Omaha if your spouse already has an active Medigap policy with this company.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

| Mutual of Omaha Pros: | Mutual of Omaha Cons: |

| Mutual of Omaha Medicare Supplement Plans are available in almost every state, making it one of the most widely available Medicare Supplement carriers. | For most new to Medicare, only three Medicare Supplement plans are available in most areas. . |

| Carrier offers a significant household discount of up to 12% for policyholders living in the same home. | Internet and mobile access to your plan are more difficult through Mutual of Omaha than other carriers. The website can be difficult for seniors to track claims, review benefits, or make payments. |

Recommended Reading: What Is A Medicare Advantage Plan Ppo

What Is The Average Cost For Supplemental Insurance For Medicare

Because every Medigap plan must include a set list of benefits, comparing Medicare supplemental insurance and finding out the cost is significantly easier than shopping for most other types of insurance. Here are a few factors you might want to consider when you select a plan provider.

- Premiums: Insurance companies each charge their own premiums, which they can set themselves. Comparing a select plan with multiple providers can help you quickly narrow down your most affordable option.

- Customer service: If youre new to Medicare, it may give you peace of mind to know that a helpful customer service team is standing by. Look for insurance providers that offer live assistance that works for you.

- Ease of use: Your Medigap plan provider shouldnt make you jump through hoops to learn about your coverage. Look for a plan provider with an online portal or website thats easy for you to use and understand.

Medicare Supplement Plan G: The Budgeters Plan

Medicare Supplement Plan G allows you to budget your medical spending by only being responsible for the annual Medicare Part B deductible. After this, you receive 100% coverage on all Medicare-covered medical expenses.

In 2022, the Medicare Part B deductible is $233. Thus, outside your monthly premium, your only out-of-pocket medical cost for the entire year is $233. Because of these low out-of-pocket costs, Medigap Plan G is one of the best Medicare Supplement plans in 2022.

Due to Medicare Supplement Plan Fs enrollment regulations, Plan G is becoming the most popular Medigap option.

Medicare Supplement Plan G may be the best plan for those who:

- Want to avoid surprise out-of-pocket hospital costs

- Seek low annual rate increases

- Like to travel outside of the United States

- Live in a state that allows excess charges

Medicare Supplement High Deductible Plan G is just as it sounds. This plan covers the same benefits as the standard Medicare Supplement Plan G but offers a lower monthly premium due to its higher deductible.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Remember that Medicare Supplement High Deductible Plan G comes with the same higher deductible as High Deductible Medicare Supplement Plan F, which is $2,490 in 2022.

Medicare Supplement High Deductible Plan G is a more affordable plan option for those who:

- Cannot afford Medicare Supplement Plan Gs premium

- Are looking for catastrophic coverage

Read Also: How To Apply For Medicare In San Diego

Is A Medicare Supplement Plan Worth It

Yes. A Medicare Supplement plan can help cover what Medicare cantfrom prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits. Even getting one ER visit covered can be a huge benefit financially.

Find The Best Medicare Supplement Plan For Your Budget

Once youâve listed Medicare Supplement Insurance plans that cover your health care needs, a great way to narrow down your options is to choose the best Medicare Supplement Insurance plan for your budget.

Medicare Supplement Insurance plans typically come with a monthly premium. However, insurance companies that sell Medicare Supplement Insurance coverage may price their plans differently.

As youâre deciding on the best Medicare Supplement Insurance plan for your financial situation, keep in mind that insurance companies may use three types of premium-pricing methods:

- Issue-age rated: premiums are based on your age when you enroll and donât go up as you get older.

- Community-rated: all plan members pay the same premium, regardless of their age.

- Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

Please note that premiums may go up because of inflation, regardless of the pricing method.

Also Check: Is Bevespi Covered By Medicare

Blue Cross Blue Shield: Best Medicare Insurance Company Mobile App

Blue Cross Blue Shield has been a prominent insurance company since 1929. Receiving an A rating from AM Best and a B rating from S& P, BCBS is one of the most highly recognized Medicare insurance companies.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Blue Cross Blue Shield focuses on customer satisfaction. The company offers typical Medigap plans and policies bundling dental, vision, and hearing coverage. One of their best assets is an easy-to-use mobile app for customers to track their claims history and payments.

| Blue Cross Blue Shield Pros: | Blue Cross Blue Shield Cons: |

| Customizable Medicare Supplement options can bundle additional benefits into your policy for an extra monthly fee. | Uses several affiliate partners nationwide, so your plan carrier may change if you move to another state. |

| Discounts are available to almost every member . | Monthly premiums tend to be higher than other Medicare Supplement plan carriers. |

What Medigap Plan Do Most People Get

Although plan A or plan E are most popular, Medigap Plan A and Plan N are the next most common Medicare Supplement insurance programs. The most commonly accepted Medigaps are: 49% – all Medigaps beneficiaries enroll under Plan F.

Medigap Plans A, C, F, G and N What’s notable: At more than 170 years old, Manhattan Life is one of the longest continuously operating companies in the U.S. 17 Manhattan Life sells 5 Medicare Supplement Insurance plans, including the popular Plan F, Plan C and Plan G.

Also Check: Does Medicare Pay For Soclean

What Is Medicare Supplement Plan K

Plan K includes the following benefits:

- Coverage for Original Medicare Part A coinsurance and hospital expenses

- 50% coverage for Original Medicare Part B copays and coinsurance

- 50% coverage for blood

- 50% coverage for Part A hospice care

- 50% coverage for skilled nursing facility care

- 50% coverage for Part A deductible

Plan K includes an out-of-pocket maximum of $5,880.

Medicare Part B Excess Charges

A doctor may charge an amount for services that exceeds what Medicare covers. The charged amount that exceeds Medicare coverage is called an excess charge. Medicare limits the extra amount a doctor can charge to 15%. You are responsible for excess charges unless you have a Medicare supplement plan that covers them.

Don’t Miss: What Is The Best Medicare Part D Plan For 2020

Verify The Providers Reputation

A companyâs reputation may help you choose between insurers with similarly priced plans.

- Financial strength: Working with a financially stable company ensures that it will be able to pay for services long into the future, even if costs rise substantially or a disaster requires the company to pay for care for hundreds or thousands of policyholders. AM Best, Moodyâs, Fitch, and Standard & Poorâs are independent agencies that rate insurance companiesâ financial stability. You can visit these agenciesâ websites to see how they rate the financial stability of a specific company. Although many insurance companies list ratings on their websites, you can see the most reliable and recent rating on the independent agenciesâ websites.

- Years in business: The amount of time a company has been in business can indicate that they have reliable business practices and good customer service. You may also wish to compare how long a company has offered Medicare supplement insurance.

- Recommendations: Ask friends and family members to tell you about their experiences with different insurance companies. Read online reviews to determine how the company deals with customers.