Can You Get Medicare Supplement Insurance If You Are Under 65

Federal law doesnt require insurance companies to sell Medicare Supplement Insurance for disabled people under age 65, but some state laws do. If youre enrolled in Medicare under 65 due to a disability and/or end-stage renal disease , your eligibility for Medicare Supplement Insurance will depend on the state you live in.

The following states require that insurance companies offer at least one type of Medigap plan to people under 65 who receive Medicare benefits:

- California*, Colorado, Connecticut, Delaware**, Florida, Georgia, Hawaii, Illinois, Kansas, Louisiana, Maine, Maryland, Massachusetts*, Michigan, Minnesota, Mississippi, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oklahoma, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Vermont* and Wisconsin.

*These states require that insurance carriers offer at least one Medigap policy to those under 65 who are disabled. This requirement does not include those under 65 with ESRD.

**Delaware requires that insurance carriers offer at least one Medigap policy to those under 65 who have ESRD. This requirement does not include those under 65 who are disabled.

Even if your state isn’t listed above, you may be able to get coverage.

Some insurance companies voluntarily sell Medicare Supplement Insurance plans for disabled people who are under 65. If they do, they generally use medical underwriting in the application process, which could affect your Medigap policy cost.

Getting Medicare For The First Time

Your Medigap Open Enrollment Period is separate from your Initial Enrollment Period when you first qualify for Medicare.

When you sign up for Medicare with Social Security or get automatically enrolled, you will not have a Medicare Supplement plan. What youll have is Original Medicare, or Medicare Part A and Part B . This is the traditional health insurance program thats run by the federal government.

Once you have Part A and B, you can get a Medicare Supplement plan.1

Tip: Be careful not to confuse your Medigap Open Enrollment Period, sometimes referred to as the Medicare Supplement Open Enrollment Period, with the Annual Enrollment Period that runs from October 15 to December 7 each year. The Annual Enrollment Period allows you to make changes to your Medicare coverage, such as switching between Original Medicare and Medicare Advantage.

Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.

Recommended Reading: Do Teachers Get Medicare When They Retire

What Is A Medicare Supplement Plan Or Medigap Policy

Medicare Supplement, or Medigap, is an optional health insurance plan that works with Original Medicare .2 Only private insurance companies sell Medigap policies. You pay a monthly premium to the company, and in exchange, your policy covers some to all of your Parts A and B out-of-pocket expenses after Medicare pays its portion.* Once you pick the benefits you want, a policy, no matter which company sponsors it, must provide them, but prices can vary among companies.

Medigap policies:

- Help pay for out-of-pocket costs Original Medicare doesnt cover, such as deductibles, coinsurance, and copayments

- May provide coverage for qualifying emergency care you receive in a foreign country

- Provide nationwide coverage at any provider that accepts Medicare

- Only cover one person your spouse cant enroll on the same plan

- Are guaranteed renewable as long as you pay your monthly premiums on time

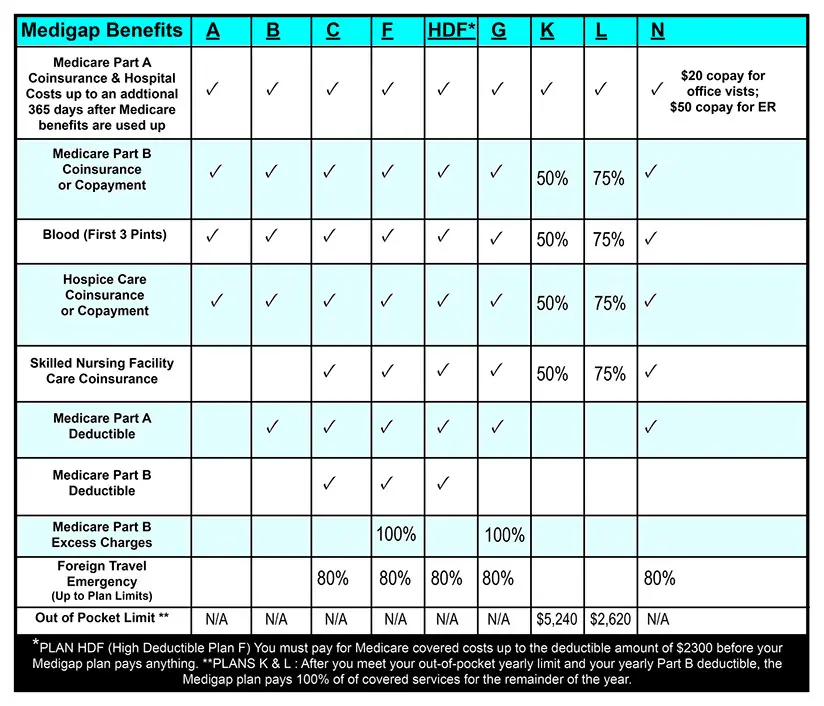

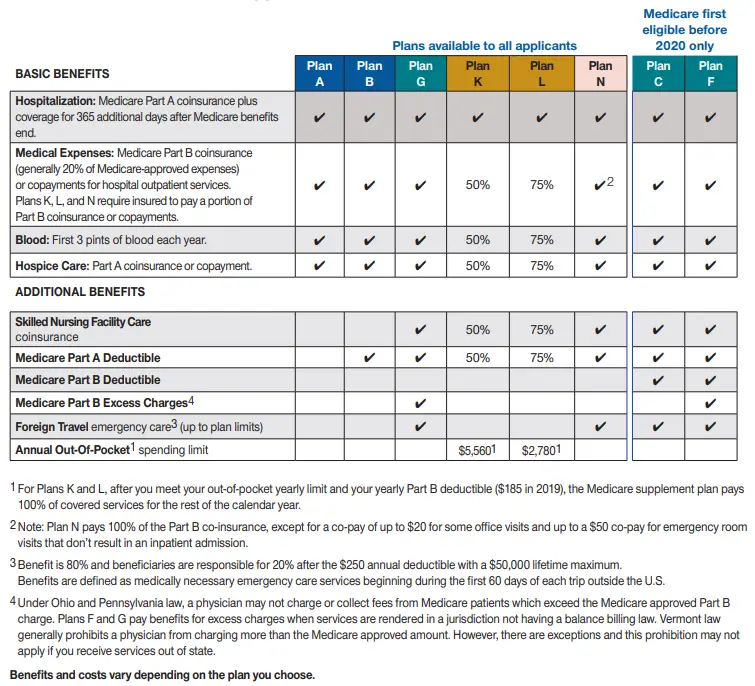

- Come in 10 standard types in most states, which are labeled by letters: A, B, C, D, F, G, K, L, M, N**

- Each plan covers a portion of certain costs. For example, most plans pay 100% of your Part A deductible .3

*You must pay your Medicare Part B premium in addition to your Medigap premium. Plans C and F are not available to newly-eligible beneficiaries on or after January 1, 2020. **Medigap plans are standardized differently in Massachusetts, Minnesota, and Wisconsin.

What Does Medicare Supplement Plan C Cost

The average premium cost for Medicare Supplement Insurance Plan C in 2018 was $189.88 per month.1

Its important to note that Medigap plan costs may vary based on factors such as age, gender, your health, how your insurance carrier rates its plans and where you live.

Medigap Plan C costs may also vary based on when you enroll.

The average cost listed above includes Medigap Plan C options that may offer lower premiums than what is listed, as well as some plans with higher premium costs.

Dont Miss: What Is The Medicare Out Of Pocket Maximum

Read Also: Does Medicare Cover Cpap Cleaner

Humana Medicare Supplement Insurance Plans

In most states*, policies are standardized into plans labeled A through N. All policies cover basic benefits, but each has additional benefits that vary by plan.

Medicare Supplement insurance plans A through G generally provide benefits at higher premiums with limited out-of-pocket costs compared to plans K through N. Plans K through N are cost-sharing plans offering similar benefits at lower premiums with greater out-of-pocket costs. Some companies may offer additional innovative benefits.

Effective Jan. 1, 2020, plan options C, F and High Deductible Plan F are only available for purchase by applicants first eligible for Medicare prior to 2020.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company.

Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

GNHL7EUEN

What Is A Medicare Supplement Plan

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

You May Like: Do You Need A Medicare Supplement

Medicare Supplement Insurance Plans

A Medicare Supplement Insurance Plan works with Original Medicare. While Medicare Parts A and B cover a lot of health care costs, they dont cover all costs. A Medicare Supplement Insurance Plan covers the costs that Original Medicare doesnt, like:

Coinsurance Copayments Deductibles

Medicare can change these amounts each year, but Medicare Supplement Insurance Plans adjust to always cover them.

Plans are identified by the letters A, B, C, D, F, G, K, L, M and N. Each plan covers a different set of costs. Some plans only cover basic benefits. Other plans cover a wider range of health care costs and benefits.

Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs. However, prescription drug plans are available. Some Medicare Supplement Insurance Plans cover foreign travel care.

These plans have the same benefits for everyone. Plan G from one company has the same coverage as Plan G from another company. The only differences are premiums and service. You can use any doctor, specialist or hospital that accepts Medicare.

You can enroll in a Medicare Supplement Insurance Plan year-round, but only during the open enrollment period is acceptance guaranteed. This period starts the first month that you are 65 and enrolled in Medicare Part B. After the open enrollment period, youll need to meet certain requirements to be accepted and may have to pay more once youre a member.

When Can I Be Denied A Switch Of Medigap Policies

You may wish to switch from one Medigap policy to another for reasons such as wanting a less expensive policy, paying for unnecessary benefits, or needing more benefits. However, you wont have a right to change Medigap policies under federal law unless youre within the 6- month Medigap open enrollment period or already eligible under a specific circumstance, or have a guaranteed issue right.

Read Also: Can I Get Glasses With Medicare

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

What Are Medicare Advantage Plans

The Medicare Advantage program gives you an alternative way to receive your Medicare Part A and Part B benefits. The exception is hospice care, which continues to be covered by Part A.

Offered by private insurance companies contracted with Medicare, Medicare Advantage plans often include additional coverage, such as prescription drug coverage and routine dental services. All Medicare Advantage plans must limit your maximum out-of-pocket expenses to a specified amount that Medicare sets manually. The government-sponsored Medicare program does not have this protection.

Some Medicare Advantage plans are designed to help people with special health-care needs, such as diabetes or congestive heart disease.

Deductibles, copayments and coinsurance amounts vary among Medicare Advantage plans. Medicare Advantage plan premiums vary as well, and some insurance companies may offer $0 premium Medicare Advantage plans. However, you will still have to pay your Medicare Part B premium if you sign up for a Medicare Advantage plan.

You might have to use the Medicare Advantage plans network of participating providers to receive the full benefits of the plan. You have to reside in the plans service area.

Also Check: What Date Does Medicare Coverage Start

Do Guaranteed Issue Rights Apply To High

You may have guaranteed issue rights to purchase specific Medigap policies in certain situations without medical underwriting. This means that a company must offer you a particular type of Medigap policy that covers any preexisting conditions and cannot increase your premiums due to your health status.

There are several situations in which you may have guaranteed issue rights. For example, you might have the right to purchase a Medigap policy if you move outside your existing Medicare Advantage plan’s coverage area or your insurer leaves Medicare. You can only assert your guaranteed issue rights to buy High-Deductible Plan G if you have the right to enroll in Medicare Supplement Plan G.

What Is Medicare Supplement Plan C

In general, Medicare Supplement plans can help you significantly reduce or eliminate your bills so that you can focus on getting quality healthcare when you need it. Medicare Supplement Plan C covers most of the out-of-pocket costs left from Original Medicare that youd otherwise be responsible for. However, many carriers dont offer Plan C, and you may not be eligible to purchase it.

If you didnt become eligible for Medicare before January 1st, 2020, you wont be able to apply for Medigap Plan C. You can confirm when you became eligible by looking at the Part A start date on your Medicare card. However, if you cant get Plan C, you have other options. Medigap Plan G offers similar coverage, and is typically available at a lower premium than Plan C. Because of this, it may be a better option for you regardless of whether or not youre eligible for Plan C.

Dont Miss: Is Allergy Testing Covered By Medicare

Read Also: When Can You Join Medicare

Waiting For Your Open Enrollment Period

Generally, your Medigap open enrollment period begins when you turn 65 and are enrolled in Medicare Part B. During your open enrollment period, you have a wider variety of Medigap plan options to choose from, and companies cant charge you a higher premium based on your medical history or current health status.

If you get Medicare Part B before you turn 65, your OEP automatically begins the month you turn 65. Some states have Medigap open enrollment periods for people under 65. If thats the case, youll still get a Medigap OEP when you turn 65, and you’ll be able to buy any policy sold in your state.

Before making a purchase, find out what rights you have under state law as someone who is younger than 65 and enrolled in Medicare due to a disability. Learn more by reviewing the Medicare and You handbook.

If you have questions about Medicare Supplement Insurance and want to speak to someone one-on-one, call a licensed agent today. Agents can help you find plans in your area and walk you through the process of buying a policy.

Preparing For Your Medicare Supplement Open Enrollment Period

Those eligible for automatic enrollment to Original Medicare or who enroll in Medicare up to three months before their 65th birth month will receive their Medicare ID card in the mail about 4 weeks after they apply. Once you have your Medicare card, you can begin the process of applying for Medigap coverage.

Most Medicare Supplement carriers will allow Medicare beneficiaries to submit their Medigap application up to six months before their Medicare Part B effective date. The carrier will process your application as if youre already in your Medigap Open Enrollment Period, with no health questions.

Once you apply for Medicare or know your Medicare Part B effective date, theres no need to wait to enroll in a Supplement plan until you turn 65. With rates constantly changing, we often help our clients lock in their Medigap plan months ahead of their 65th birthday. Keep in mind, you wont be able to receive the policy benefits until youre 65 and have Medicare Part B.

You May Like: What Is The Best Medicare Advantage Plan In Texas

When Can You Sign Up For Medicare Supplement Plans

When it comes to Medicare Supplement plans, you can apply any time throughout the year. So, even if your Open Enrollment window has passed, you can still enroll. However, youll most likely need to go through medical underwriting and answer health questions during the application process.

Outside your one-time Medicare Supplement Open Enrollment Period, a carrier can deny you coverage due to pre-existing conditions or health issues. The only way around this is through guaranteed issue rights due to a circumstance that qualifies you for a Special Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Some states have unique open enrollment rules, such as birthday rules. These rules allow you to enroll in Medigap at certain times, without answering health questions.

What Doesnt Medigap Plan C Cover

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesnt accept assignment meaning they wont accept the Medicare-approved amount as full payment for covered services.

The difference between what Medicare pays for a certain medical service, and what your doctor or provider charges for it, is the Medicare Part B excess charge, which youre responsible for paying out-of-pocket. In some cases, you may be charged up to 15% more than the Medicare-approved amount for a service.

You can avoid Medicare Part B excess charges by choosing doctors who agree to accept assignment, which can be found using Medicares Physician Compare tool.

To see how the basic benefits of Medicare Supplement Insurance Plan C coverage compares to those of other Medigap plans, refer to the chart below.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Recommended Reading: Does Medicare Plan F Cover Acupuncture

You May Like: Is Medicare Accepted In Puerto Rico

What Happened To Medigap Plan C In 2020

Plan C is one of the more comprehensive standardized Medigap plans. Plan C offers coverage for all of the standardized Medigap benefits except for Part B excess charges.

Due to recent legislation, Plan C is not available for sale to Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020.

If you became eligible for Medicare before Jan. 1, 2020, you may still be able to enroll in Plan C after that date .

If you are enrolled Plan C before Jan. 1, 2020, you may be able to keep your Plan C coverage going forward .

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

Recommended Reading: Does Medicare Cover Ear Cleaning