How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

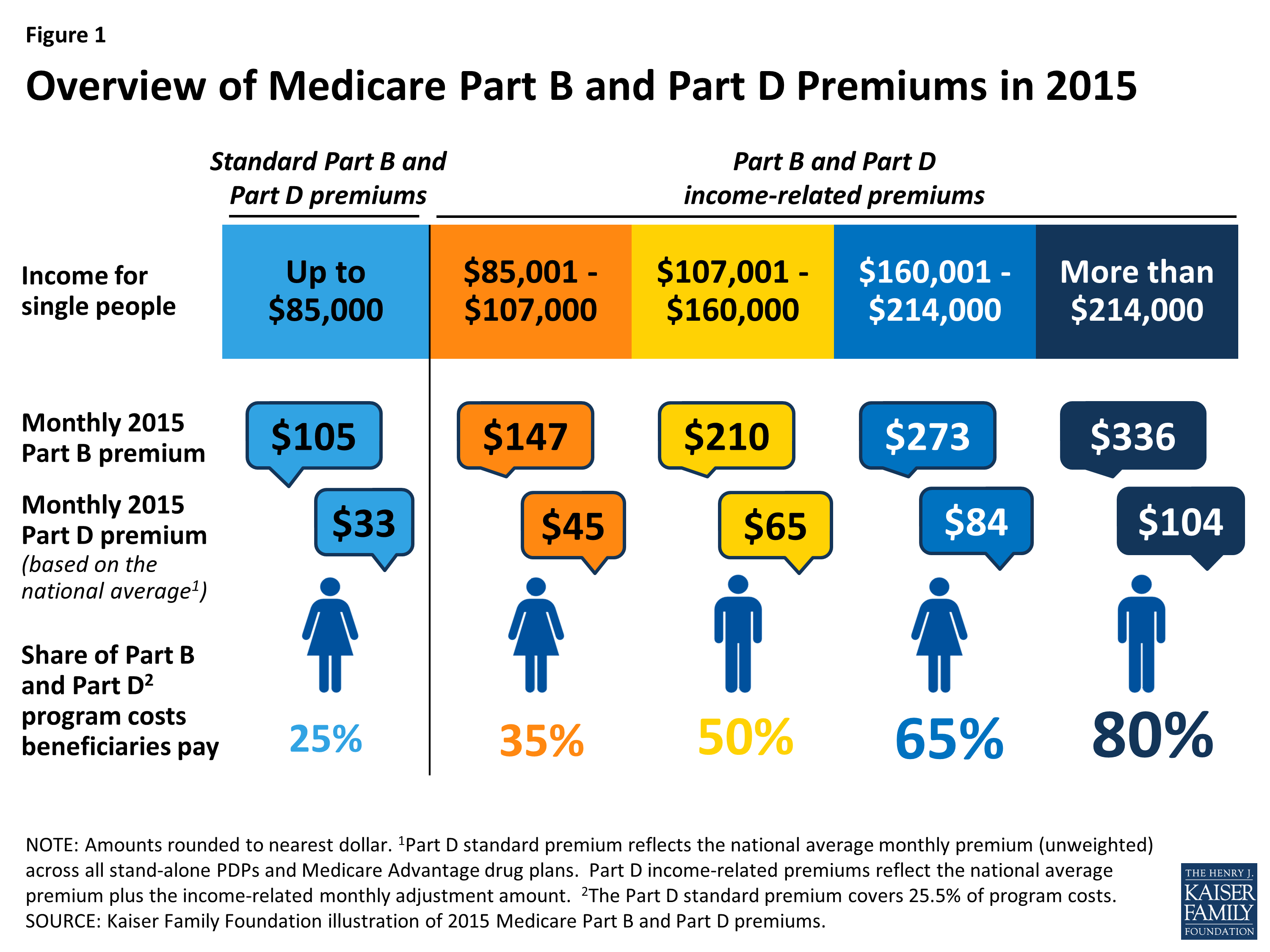

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Medicare Supplement Rate Increases

How much do Medicare Supplement Rates go Up? For most health insurers, once a policy has been issued, any rate changes are generally event-driven.

Medicare Supplement policyholders should not be surprised when their rates go up, in fact, they should expect a rate increase every year. If you just got another Medicare supplement rate increase, enter your information in the quote tool on this page or call to discuss your options. Keep reading to understand how Medicare supplement prices increase.

Easy article Navigation

Recommended Reading: Does Medicare Cover Ambulance Fees

How Does Age Affect Medicare Supplement Insurance Premiums

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2020.

Each type of cost model can affect the average price of a given Medigap plan.

-

Community-rated Medigap plansWith community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.

For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

-

Issue-age-rated Medigap plansWith issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.

You will typically pay less for an issue-age-rated plan if you enroll in the plan when youre younger. Your premiums also wont increase based on your age.

-

Attained-age-rate Medigap plansAttained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Also Check: Does Medicare Cover Bladder Control Pads

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Read Also: What Is The Difference Between Medicare

Medicare Part A Cost Increases

Most people receive premium-free Part A.

In 2021, people who are required to pay a Part A premium must pay either $259 per month or $471 per month, depending on how long they or their spouse worked and paid Medicare taxes.

Those are increases of $7 and $13 per month respectively from 2020 Part A premiums. The costs may increase again in 2022.

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible.

The Part A deductible amount may increase each year, and it will likely be higher in 2022.

Medicare Supplement Claim And Rate Trends And Their Impact On Profitability

Issue: March 2019 | Medicare Supplement || EnglishBy Andy Baillargeon, Life/Health Chief Specialty Pricing Officer, Portland

Medicare Supplement claim costs are on the rise.

Gen Re observed 2018 year-over-year claim cost trends of approximately 8% for recently issued Medicare Supplement business . For older business, that trend is around 5%. Both numbers are up approximately 3 points over what was observed in 2017.

Gen Re measures Medicare Supplement claim cost trend as the year-over-year change in claim costs on the same lives, after removing the impacts of aging and underwriting wear off. Implicitly, this number includes the impact of the increase in medical costs, as well as the impact of changes in utilization, cost shifting between Medicare and Medicare Supplement, etc. It is an all-inclusive definition that is intended to reflect the true underlying change in costs for the Medicare Supplement product, year over year.

The 2018 Medicare Trustees Report showed a significant increase in Part B claim costs per capita in 2018 over 2017. The period 20152019 is shown below for both the 2017 and 2018 reports.

Note that the 5.9% number in the 2018 report is a reasonable average of our 8% on new business and 5% on older business that we have observed in the 2018 experience.

You May Like: How Much Does Medicare Part B Cost At Age 65

You May Like: Can You Sign Up For Medicare Online

Medicare Part A And Part B Premium Increases For 2022

The Centers for Medicare & Medicaid Services released the Medicare Part A and Part B premiums and deductibles and coinsurance, as well as the Medicare Part B and D income-related monthly adjustment amounts, that will take effect on January 1, 2022. Both the standard Part B premium and the Part B deductible for all Medicare beneficiaries will increase by more than 14 percent. The Medicare Part A inpatient deductible will increase by less than 5 percent.

Sponsors of group health plans that cover retirees need to know this information when reviewing their coverage for Medicare-eligible retirees, including Medicare Prescription Drug Plans or Medicare Advantage Plans.

Does The Medicare Part B Premium Go Up Every Year

The Part B premium is hardly the only Medicare cost that will go up every year.

The Medicare Part A premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.

Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year.

There are a number of contributing factors to why Medicare costs go up each year, such as:

- As of 2019, close to 10,000 Americans become eligible for Medicare every single day.1

- Americans are living longer, and therefore requiring more years of health care.

- As the population ages, the ratio of employed workers to retirees continues to shrink.

- The cost of health care continues to rise.

When you add it all up, you have fewer people paying Medicare taxes that support an increasing number of Medicare beneficiaries who are themselves living longer and being charged more for their care.

Increasing the Part B premium is one way that these rising costs are partially addressed.

Also Check: Does Social Security Disability Qualify You For Medicare

Government May Scale Back Medicare Part B Premium Increase

- This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

- The manufacturer has since cut the estimated per-patient annual treatment cost to $28,000, from $56,000.

- Medicare officials are expected this week to issue a preliminary determination of whether or to what extent the program will cover the drug.

There’s a chance that your Medicare Part B premiums for 2022 could be reduced.

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year’s standard premium, which jumped to $170.10 from $148.50 in 2021.

About half of the larger-than-expected increase was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite not knowing yet to what extent the program would cover it. Either way, the manufacturer has since cut in half its estimated per-patient price tag to $28,000 annually from $56,000 meaning Medicare’s cost estimate was based on now-dated information.

More from Personal Finance:

“With the 50% price drop of Aduhelm on Jan. 1, there is a compelling basis for CMS to reexamine the previous recommendation,” Becerra said.

A CMS spokesperson said the agency is “reviewing the secretary’s statement to determine next steps.”

How Much Is The Medicare Part A Coinsurance For 2022

The Part A deductible covers the enrollees first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage during that same benefit period, theres a daily coinsurance charge. For 2022, its $389 per day for the 61st through 90th day of inpatient care . The coinsurance for lifetime reserve days is $778 per day in 2022, up from $742 per day in 2021.

Read Also: How To Apply For Medicare Advantage

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Is Irmaa Based On Agi Or Taxable Income

An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you’re required to pay an IRMAA based on the modified adjusted gross income reported on your IRS tax return from two years prior.

Also Check: What Is Medicare Advantage Coverage

How Did Medicare Part D Plan Costs Change In 2022

Although Part D plans are sold by private insurance companies, they must abide by certain cost rules determined by the CMS.

The CMS applied these rules for certain 2021 Part D costs:

- The maximum annual Part D plan deductible will be $480 in 2022.

- The Part D plan initial coverage limit will be $4,130 in 2022.

- Once you and your Part D plan have spent $4,130 on prescription drug costs in 2022, you will enter the Part D donut hole coverage gap. During the coverage gap, your plan limits how much it will pay for your prescription drug costs.While you are in the donut hole in 2022, you will pay 25 percent of the cost of brand name drugs and generic drugs until you reach the catastrophic coverage stage.

- Once you reach the maximum annual out-of-pocket spending limit of $7,050 in 2022, you enter the catastrophic coverage stage. In this coverage stage, youll only pay a small coinsurance or copayment amount for your covered drugs.

Are you looking for Medicare prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Compare Medicare Advantage Plans In Your Area

If you have questions about you Part B premium or would like to learn more about how a Medicare Advantage plan can help you save on your health care costs, call to speak with a licensed insurance agent today.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 Bergman, Adam. Social Security Feels Pinch as Baby Boomers Clock Out for Good. . Forbes. Retrieved from www.forbes.com/sites/greatspeculations/2018/06/21/social-security-feels-pinch-as-baby-boomers-clock-out-for-good/#f5bc5b449951.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

You May Like: How To Make Medicare My Primary Insurance

Do Medicare Supplement Plan Premiums Increase With Age

Medicare Supplement, or Medigap, plans are sold by private companies and can help pay for some of the deductibles, copayments, and coinsurance that Original Medicare doesnt. Medigap insurance is not health insurance, but it is instead insurance to cover the costs associated with utilizing Original Medicare insurance. This is beneficial for seniors who are concerned about unexpected medical costs that may suddenly put a large financial burden on an already stretched budget.

Although they are standardized by the federal government and identified by letters A-N, Medigap costs can vary. Each insurance company can choose the way it sets pricing for its Medicare Supplement plans. Medicare Supplement plans can be priced in three ways:

- Community rated

- Attained-age rated

Community rated

With this type of policy, everyone who carries coverage within a certain category pays the same amount without regard for age. Essentially, all people who are part of a specific plan are considered a community, and the community pays one price regardless of additional factors.. Premiums may go up for other reasons, but age is not a factor.

If youll be signing up for Original Medicare soon, you may want to consider the potential out-of-pocket costs you may incur. While Original Medicare offsets many costs of medically necessary services and supplies, your cost-sharing responsibilities may still be higher than youre comfortable with.

Medigap May Help

Related articles:

The Hold Harmless Provisions Impact

For 2020, the Social Security COLA was 1.6 percent, which increased the average retirees benefit by about $32/month. Part B premiums for most people increased slightly to $144.60/month. As was the case in prior years, some beneficiaries are again paying less because of the hold harmless provision.

For 2019, the Social Security COLA was 2.8 percent. The standard Part B premium increased only slightly, to $135.50/month, the COLA was more than adequate to cover the full increase for most enrollees. The federal government estimated that only about 3.5 percent of Medicare Part B enrollees would receive COLAs that still werent sufficient to cover the full increase in their Part B premiums, and would thus still be paying less than the standard premium in 2019.

For 2018, the Social Security COLA was 2 percent. The standard Part B premiums remained at $134/month, and the 2 percent COLA was enough to cover most of the increase . Once again, the full COLA for most beneficiaries went towards the higher Part B premiums, and didnt quite cover the full amount. So the average Medicare Part B enrollee was paying about $130/month in 2018.

For 2017, the provision meant that the 10 percent rate increase for that year only applied to about 30 percent of Medicare enrollees. The other 70 percent paid about $109/month .

For beneficiaries who were not held harmless for 2016, premiums for Part B increased by about 16 percent over 2015 rates .

Don’t Miss: How To Appeal Medicare Part B Late Enrollment Penalty