Best Medicare Supplement Plan For New Enrollees: Plan G

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Medicare Part B deductible, which is only $226 for 2023. After you pay this, Plan G will begin to pay for services such as doctor visits, blood tests or outpatient medical treatment.

Plan G is the most popular Medicare Supplement plan for new enrollees. However, rates can be expensive, averaging $145 per month. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

Find An Available Medicare Supplement Plan F In Your State

Medicare makes this easy by its Medigap Find a Plan database. Enter your ZIP code for a list of available plans in your area and select View Policies on the right of the screen for a list of companies offering Plan F or High-Deductible Plan F. To narrow the pricing window, there is an option to enter age, gender, and tobacco use on the Main Search page.

How Much Does Medicare Supplement Plan G Cost

We looked at the monthly cost for Medicare Supplement Plan G for male and female 65-year-old non-smokers in El Paso County, Texas and Miami-Dade County, Florida. In Texas, monthly premiums for standard Plan G started at $107 and $96, respectively, while in Florida, monthly premiums started at $237 and $222.

Read Also: Does Medicare Start The Month Of Your Birthday

Medicare Supplement Plan N

Medicare Supplement Plan N is becoming very popular now due to its great coverage and lower premiums than Plan G. In fact, Medicare Plan N can be up to $30 less per month than Plan G.

In exchange for lower premiums, you may have some additional out-of-pocket expenses with Plan N as you visit the doctor throughout the year

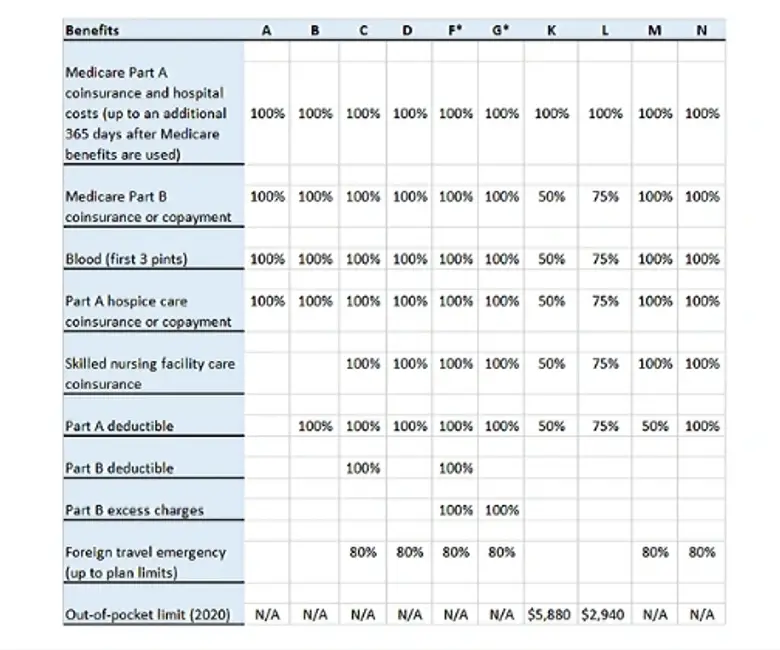

Plan K And Plan L: Best Medicare Supplement Plans For Budgeters

Surprise or unexpected medical bills can ruin anyones budget. But Medigap Plan K and Plan L have annual out-of-pocket limits built into them to give beneficiaries an extra layer of protection.

For 2023, the Plan L out-of-pocket spending limit is $3,470, and the Plan K limit is $6,940. Once a plan member spends that amount on covered care, the plan then pays for 100% of all covered services and items for the remainder of the year.

Original Medicare does not include an out-of-pocket limit, which leaves beneficiaries exposed to potentially high medical bills for more serious injuries or illnesses.

You May Like: Does Medicare Cover Assisted Living In Michigan

Aarp / Unitedhealthcare Is The Best Medigap Plan Provider

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Medicare supplement plans, also called Medigap plans, cover some of the expenses that Original Medicare excludes, like copays and deductibles. You can only get a Medigap plan if you have Original Medicare Part A and Part B.

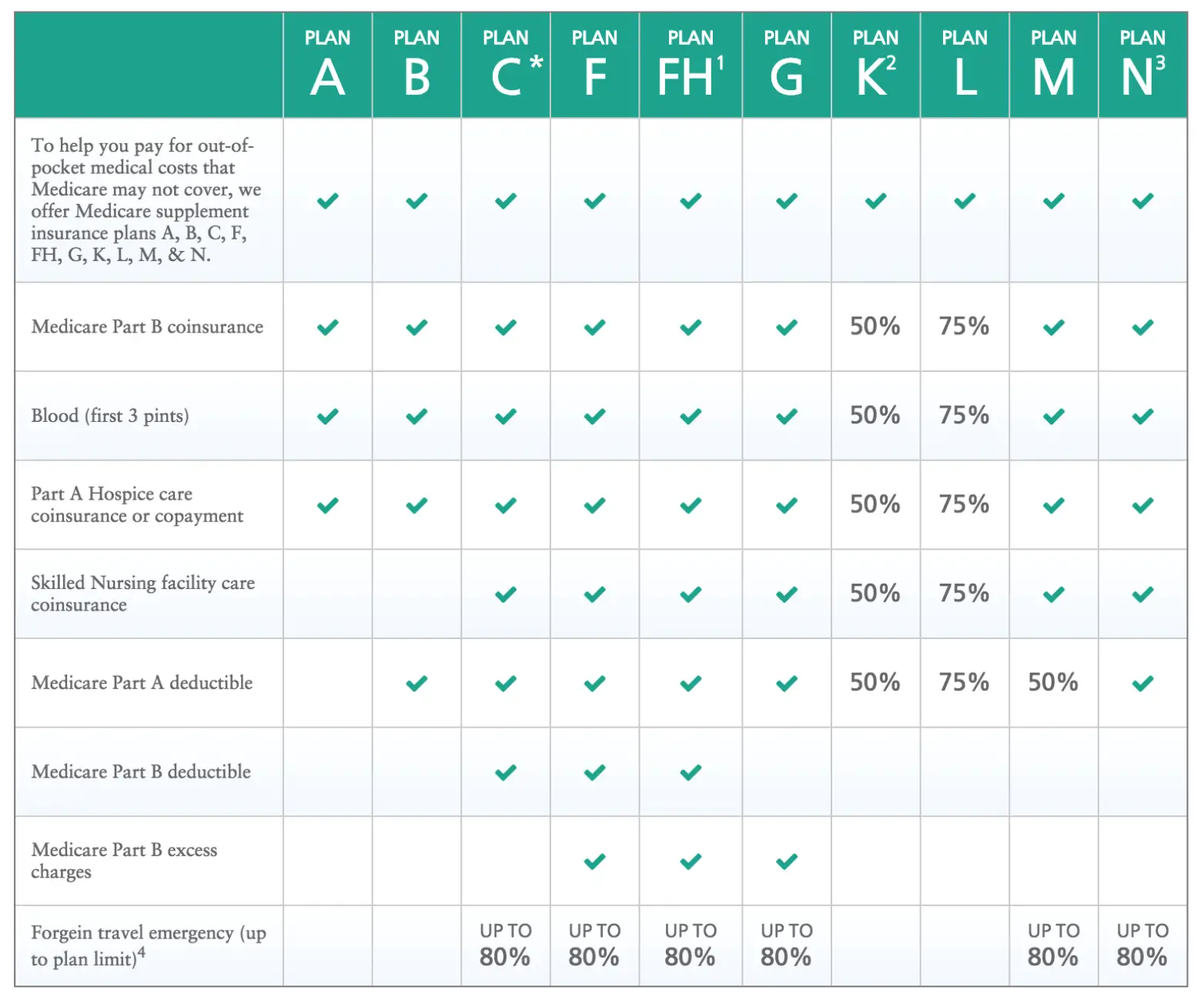

There are 10 types of Medigap policies, with each type offering a standardized set of coverages. The plans are named by letters: A, B, C, D, F, G, K, L, M, and N. Plans F and G also come in high-deductible versions.

The best time to enroll in a Medigap plan is during your six-month Medigap Open Enrollment Period, which starts the first month you have Medicare Part B and youre 65 or older. Its possible to buy a plan outside this window, but it may be more expensive and approval isnt guaranteed.

Medicare supplement insurance is sold through private insurance companies, so its a good idea to compare a few providers when youre shopping for a plan. To help you get started, we reviewed some of the top Medicare supplement insurance companies and selected the best providers based on factors like National Committee for Quality Assurance ratings, financial strength scores, and plan costs.

Medicare Advantage Is Growing In Popularity

The trend is undeniable. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42% of the total Medicare population.1

By 2030, more than 51% of Medicare members are expected to choose Medicare Advantage plans.2

*Costs for Medicare Supplement plans vary by the state you live in and the plan you choose. Medicare Supplement plans can only be paired with Original Medicare.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Y0040_GNHKHNSEN

Recommended Reading: What Is The Monthly Charge For Medicare

What Is The Open Enrollment Period

The open enrollment period is six months from the date a beneficiary is enrolled in Medicare Part B. During the open enrollment period, a person under 65 and on Medicare disability is only able to purchase Medicare supplement insurance Plans A, D or G. This is a special North Carolina law.

During the open enrollment period, the applicant is guaranteed to be issued a policy. Premiums may be higher for Medicare disability beneficiaries than for Medicare beneficiaries 65 or older. The insurance company may impose a pre-existing condition waiting period, but it cannot be longer than six months. This would include any health condition diagnosed or treated six months prior to the Medicare supplement application. If a person has prior creditable coverage, the waiting period must be waived. Creditable coverage is when the beneficiary has been covered by insurance or Medicaid for six months prior to the effective date of the Medicare supplement insurance policy. When a Medicare disabled beneficiary turns 65 years old, he or she will have a new six-month open enrollment period and be able to purchase any of the standardized Medicare supplement insurance.

For those persons that are retroactively enrolled in Medicare Part B due to a retroactive eligibility decision made by the Social Security Administration, the application must be submitted within a six-month period beginning with the month in which the person receives notification of the retroactive eligibility decision.

What Is Medigap Insurance

Medicare Supplement plans are insurance plans that work alongside your Medicare Part A and Part B benefits and help cover some of your Medicare deductibles, coinsurance, copays and other costs.

Here are some key facts about Medicare Supplement Insurance:

- Medigap insurance doesn’t typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare.

- Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare.

- If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don’t pay anything for your services .

Recommended Reading: Does Medicare Part C Cover Dental And Vision

How Much Does Medicare Plan F Cost

This figure depends on a multitude of factors. Plan F premiums hinge heavily on where you reside, but gender, age and tobacco use all come into play as well as insurance providers determine their rates. Sometimes discounts are available for non-smokers, women or married people who have multiple policies. Meanwhile, companies that use medical underwriting might set higher premium rates depending on your health status.

People who are eligible for Plan F enrollment can expect to pay a monthly premium between $150 and $400 , with the average hovering around $230. Again, that number could vary significantly depending on the provider you pick and the personal factors mentioned above.

If you choose a high-deductible Plan F option, the annual deductible is $2,490.

Is Medicare Plan G Worth It

In 2018, the average Medicare Supplement Plan G premium was $122 per month. This was one of the lowest average monthly premiums of any standardized Medigap plan.1

As previously mentioned, the only benefit area that is not covered by Plan G is the Medicare Part B deductible. However, the Part B deductible is only $226 per year in 2023.

When you consider all of the out-of-pocket Medicare costs that are covered by Plan G, you may begin to appreciate the plans value.

- The Medicare Part A deductible for 2023 is $1,600 per benefit period, and you could potentially face multiple benefit periods within the same calendar year.

- You are typically required to pay 20 percent of the Medicare-approved amount for outpatient services and items you receive .

Out-of-pocket Medicare costs like these can add up quickly. Medicare Plan G can help give you greater cost certainty and protection from high out-of-pocket costs.

Medicare Plan G value review: Medicare Plan G provides tremendous value as one of the more affordable Medigap plans offering among the most comprehensive coverage. We rate the value of Medicare Plan G as an A+.

You May Like: Does Medicare Pay For Eye Exams

If Your Income Is High Or Very Low Or Youre Feeling Lucky You Might Be Able To Rely On Traditional Medicare Heres Why Most People Dont

Only 19% of Original Medicare beneficiaries have no supplemental coverage .

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.

Mutual Of Omaha Offers The Lowest Overall Cost And Strong Third

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Original Medicare doesnt cover everything. It can leave you vulnerable to high out-of-pocket costs, especially if youre not in the best health. Fortunately, a Medicare supplement plan can provide coverage for the copayments, coinsurance, and deductibles that you would otherwise pay yourself. Of the plans available to new retirees, Plan G is the most comprehensive, filling all the gaps except the Part B deductible. To help you find the best Medicare Supplement Plan G provider for you, we compared premiums, third-party ratings, and other benefits across insurers.

Also Check: How Are Medicare Premiums Determined

Plan B: Best Medicare Supplement Plan For Basic Benefits

Some beneficiaries just want a basic Medigap plan with no thrills. Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly:

- Medicare Part A deductible

- Medicare Part A coinsurance

- Medicare Part B coinsurance

Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face. This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they dont.

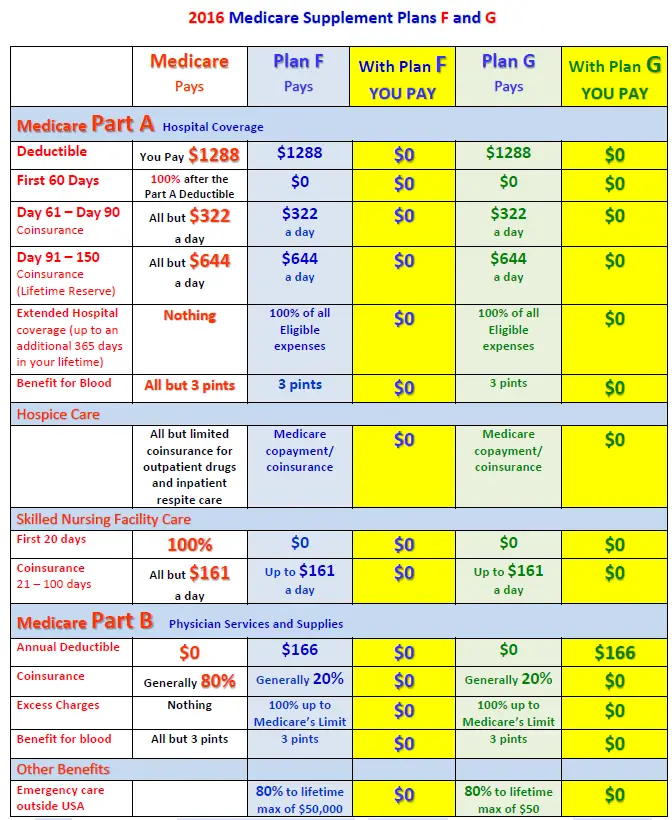

What Is The Difference Between Medicare Supplement Plans F And G

Medicare Supplement Plans F and G are very similar. The one difference is that Plan G does not cover the Part B deductible. Otherwise, they each pay toward the following:

- 80% of foreign travel expenses

- 100% of blood products

- 100% of Part A coinsurance and hospital costs up to 365 days

- 100% of Part A deductible

- 100% of Part A hospice care coinsurance/copayments

- 100% of Part B coinsurance/copayments

- 100% of Part B excess charge

- 100% of skilled nursing facility coinsurance

Recommended Reading: Does Medicare Cover Air Evac

Why Should Seniors Consider Medigap Plans

The reality is that original Medicare pays only about 80 percent of your hospitalization and medical office costs. Medigap plans help keep your costs predictable.

Seniors should consider Medigap plans for these reasons:

- Theyre guaranteed renewable as long as you pay your premiums on time and dont misrepresent information on your application.

- They lower the cost of copays, coinsurance, deductibles, and other charges.

- You have more flexibility to travel out of the country and have medical costs covered under certain plans.

- You can choose any doctor or hospital that accepts Medicare.

Cigna Medicare Supplement In 2023

Cigna has been innovating since 1982. Always offering competitive monthly premiums, Cigna is a top choice for Medicare Supplement plans. Cignas main priorities consist of creating an easy experience, bettering the well-being of their clients, and providing top-notch service. Because of their values, Cigna has created an A rating with A.M. Best.

The MyCigna website offers similar online benefits to members as Aetnas member portal.

You May Like: What Is Medicare Advantage Part C

Rating System For Different Plans Based On Cost And Coverage

To help you decide which plan is right for you, weve created a rating system based on cost and coverage. Each plan is rated on a scale of 1 to 5, with 5 being the highest rating. We looked at factors such as the cost of the plan, the coverage offered, and the customer service provided by the company. We also took into account any additional benefits the plan may offer, such as discounts on prescriptions or dental care.

Best For User Experience: Cigna

Cigna

-

Rates increase based on age

-

Rates not available without a quote

Founded in 1792 as an insurance company, Cigna ventured into health care in 1912 and remains a leader in the industry. It offers Plan F in 46 states, excluding Massachusetts, Minnesota, New York, and Wisconsin, and offers High-Deductible Plan F in 30 states, excluding the aforementioned states as well as Alaska, Arkansas, Delaware, Hawaii, Indiana, Maine, Montana, Nebraska, North Dakota, Oregon, Pennsylvania, Rhode Island, South Carolina, Washington, West Virginia, and Wyoming.

To request a quote or enroll in Cigna Plan F, call the company or fill out the form on its website that requires basic personal information, including your start dates of Medicare Parts A and B. Plans vary based on your age, gender, medical conditions, and address.

The plans are based on an attained-age model in most states it services. Under this format, prices increase regularly based on your age. Cigna has several plans to meet your needs if you are also looking for a Medicare Part D plan to round out your Medicare coverage.

Cost-wise, Cigna is competitive. In all states except for Hawaii, Idaho, Minnesota, and Vermont, it offers further savings with a 7% household discount on monthly premiums when two or more enrollees live together. In Washington, the discount only applies to spouses.

Don’t Miss: How To Get Medicare Number Without Card

The Benefits Of Medicare Supplement Plans

One of the primary benefits of Medicare Supplement plans is that they help mitigate the costs of health care not covered by Original Medicare, such as copayments, coinsurance and deductibles. Any Medicare beneficiary whos concerned about incurring potentially high out-of-pocket costs should consider Medigap plans and how they can help cover these expenses.

Some Medicare Supplement plans also provide coverage for services that Original Medicare doesnt cover, such as medical care needed during travel outside the U.S. Medicare enrollees who enjoy frequent travel often enjoy the additional layer of protection.

Comparing And Contrasting Different Medicare Supplement Plans

When comparing Medicare supplement plans, its important to look at the benefits offered by each plan. Each plan offers different coverage, so its important to review the details of each plan to determine what services are covered. Its also important to consider your individual needs when choosing a plan. For example, if you have a chronic condition, you may want to choose a plan that offers more comprehensive coverage for that condition. Additionally, its important to compare the cost of each plan to make sure youre getting the most bang for your buck.

Read Also: Can Medicare Take Your House

How Much Do Medicare Supplement Plans Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

What You Need To Know To Choose

- Consider the monthly premium price. Medicare supplement insurance is highly regulated insurers must offer essentially the same coverage for each of the 10 types of Medicare supplement policies. Make sure you can handle the monthly expenses and you are comfortable with the value.

- Calculate the total out-of-pocket costs. Include your monthly premium and an estimate of Part D drug coverage, which Medicare supplement plans dont include.

- Check out incentive benefits. Some insurers offer Medicare supplement customers incentives such as a discount on dental, hearing or vision insurance purchases. They may also have free or discounted gym plans.

- Consider these issues. The most popular is Plan F, but it is no longer available to new enrollees. Plan G and Plan G high deductibles are similar, but they dont cover the Medicare Part B deductible, which Plan F does. They do cover Part B excess charges, which can be an advantage if the healthcare provider you pick charges more than Medicare allows. Another popular feature available in Plan G and some of the other plans is coverage of foreign travel emergencies.

- Evaluate customer service. Good customer service is what sets Medicare supplement plans apart. Asking friends and neighbors who subscribe is a way to rate customer service in your area.

Numerous supplemental plans from which to choose

Ten basic Medigap policies exist, each with different benefits.

Don’t Miss: Will Medicare Pay For Ymca Membership