The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

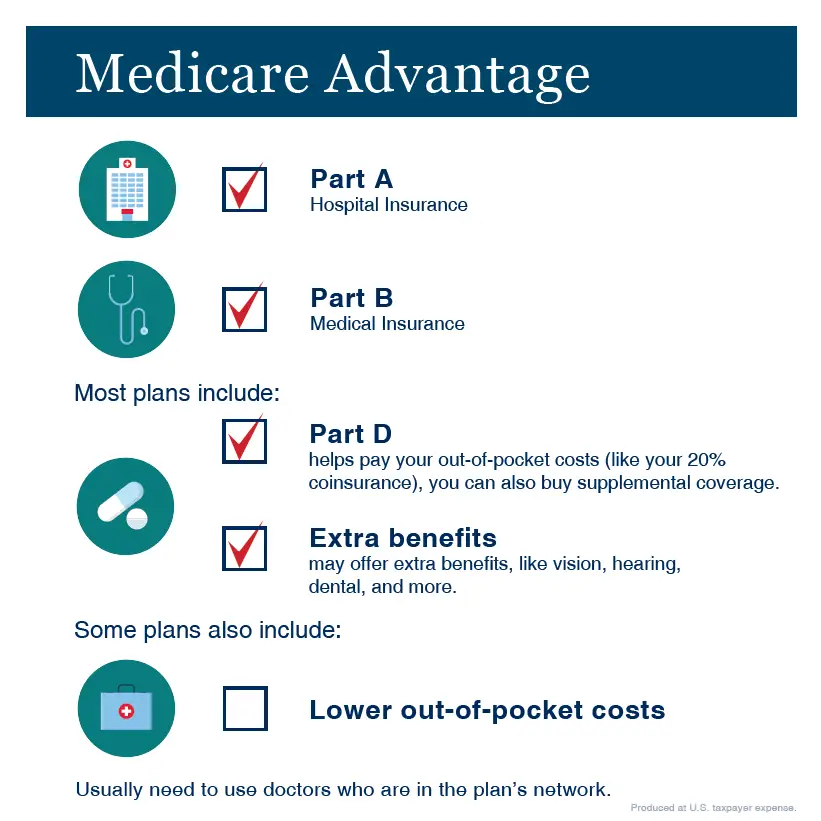

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

If You Get Medicare For Disability And Then Return To Work

If you get Medicare due to disability and then decide to go back to work, you can keep your Medicare coverage for as long as youre medically disabled.3 And, if you do go back to work, you wont have to pay the Part A premium for the first 8.5 years.

Part A is premium-free for those with a disability and under 65 only if you get Social Security or Railroad Retirement Board benefits for 24 months or have ESRD and meet certain requirements.4

If youre 65 or older, Part A is premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years, you already get retirement benefits from Social Security or the Railroad Retirement Board, or youre eligible for these benefits but havent filed for them yet.5

You May Like: Is Medical Part Of Medicare

Recommended Reading: How To File A Complaint With Medicare

Remember The Initial Enrollment Period

It is important to remember that you will still have an Initial Enrollment Period in this situation. It is the same 7-month period that surrounds your 65th birthday.

Unless you have creditable health insurance elsewhere, your IEP is the best time to sign up for Medicare Part A and/or Part B . This is also when you may join a Medicare Advantage or Part D prescription drug plan. If you choose to stay with Original Medicare plus Part D, you may also apply for a Medigap policy during your IEP.

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the planâs denial for a service to be provided.

The Right to Information About All Treatment Options

Recommended Reading: How To Get An Electric Scooter Through Medicare

Can I Get A Medicare Supplement Plan Too

Medicare Supplement Insurance, also known as Medigap, helps pay your out-of-pocket costs under Original Medicare. Rather than covering healthcare directly, these plans help pay your share of costs for services covered by Medicare Part A and Part B.

These plans are also offered by private insurance companies. As with the other private Medicare offerings, you can buy these plans if you are eligible for Medicare, even if you dont receive Social Security benefits of any kind.

It is relevant to note that if you want one of these plans, buying it during your Medigap Open Enrollment Period is your best option. It’s one of the rare times you have guaranteed issue rights. Your Medigap OEP begins the day you’re both age 65 or older AND enrolled in Original Medicare.

When you have guaranteed issue rights, you dont have to deal with medical underwriting. This means that the insurance company cannot deny you coverage or charge you more, even if you have pre-existing medical conditions. Unless you qualify for guaranteed issue rights, Medigap insurers do not have to sell a plan to you.

Medicare Supplement plans are only available to people with Original Medicare. If you have Medicare Advantage, you cannot purchase a Medigap plan.

At What Age Do I Qualify For Social Security

You can begin collecting Social Security retirement benefits as early as age 62. Doing so, however, is often not advisable, since it means lowering your monthly benefits potentially for life.

To collect the full monthly benefit your earnings record entitles you to, you must wait until full retirement age to sign up for Social Security. Depending on your year of birth, that age will fall out somewhere between 66 and 67. For each month you file for Social Security ahead of full retirement age, youll face a reduction in your monthly benefits that will likely remain in effect indefinitely, unless you manage to go through the motions of withdrawing your application soon after filing it.

Read Also: Is Pae Covered By Medicare

If You Are Approaching Or At Age 65

If you are approaching age 65 and you already receive Social Security or Railroad Retirement benefits through early retirement, you will be automatically enrolled in Medicare Parts A and B when you turn 65. Approximately 3 months prior to your 65th birthday, Medicare will send you an initial enrollment package containing general information about Medicare, a questionnaire and your red-white-and-blue Medicare card.

If you receive the initial enrollment package and you want both Medicare Part A and Part B , simply sign your Medicare card and keep it in your wallet.

If you are approaching age 65 and youre not receiving early retirement Social Security or Railroad Retirement benefits, you can apply for Medicare during your 7-month initial enrollment period . Your IEP begins 3 months before you turn 65, includes the month of your birthday and ends 3 months later. Note: To apply for Medicare Parts A and B, you must contact the Social Security Administration at ssa.gov or 1-800-772-1213. You will also need to sign up separately for a Part D plan to cover your prescription drug benefits. Learn more about Medicare Part D.

What Is A Calendar Quarter

The Social Security Administration divides a calendar year into 4 quarters. A calendar quarter refers to a 3-month period, which ends at one of the following calendar dates:

The SSA keeps track of each 3-month quarter a person works and pays their social security and Medicare taxes. Each quarter contributes to a persons eligibility for Medicare Part A.

Also Check: Do Most Doctors Accept Medicare

Recommended Reading: Does Medicare Offer Dental Plans

Medical Conditions And Disabilities

If you have certain disabilities, you may be eligible for premium-free Medicare Part A benefits even if youre under 65 years old.

Social Security Disability Insurance recipients

If you have a disability and have been receiving SSDI benefits for at least 24 months , you will automatically be enrolled in premium-free Medicare at the beginning of the 25th month.

ESRD

If your doctor has diagnosed you with ESRD and youve received a kidney transplant or youre on dialysis, you qualify for Medicare benefits if one of the following criteria applies:

- you qualify for Social Security retirement benefits

- you qualify for Railroad Retirement Board benefits

- your spouse or parent worked long enough to be eligible for Social Security retirement benefits

When you become eligible for Medicare benefits depends on whether you receive dialysis at home or in a treatment facility:

- If youre receiving dialysis in your home, you can apply for Medicare the first day you begin your dialysis program. You need to be sure to apply before the third month of treatment.

- If you receive dialysis in a treatment facility, you can apply for Medicare on the first day of the fourth month of your treatment.

If youre scheduled to receive a kidney transplant, you can apply for Medicare on the first day of the month youre admitted to the hospital to start preparing for the transplant. But if your transplant is delayed, your Medicare benefits wont start until 2 months before the month your transplant takes place.

Why Would I Opt Out Of Medicare

Part B comes with a premium in most cases. Some people delay enrollment in Medicare Part B to avoid paying the premium especially if they have other coverage. The same can be true of Part A, for people that must pay a premium for it.

If you delay enrollment in Part B or Part A, make sure you plan it well to avoid problems. For example:

- Group health plans may have different coverage rules if youre eligible for Medicare coverage. Check with your plan and ask how it would work with and without Medicare.

- You might face a late enrollment penalty if you delay Part B and/or Part A coverage. To avoid a penalty, make sure you enroll in Medicare promptly when your employment ends, or when the group health coverage ends. After the month coverage or employment ends , you might have an 8-month Special Enrollment Period to enroll in Medicare without a penalty. Ask your benefits administrator, or contact Medicare.

Also Check: Does Medicare Help Pay For Incontinence Supplies

How Do I Enroll In Medicare If I Dont Receive Social Security Benefits

If you arent yet receiving Social Security benefits, you can still enroll in Medicare health insurance. To do this, you have to enroll manually, as there is no automatic enrollment for those who arent already receiving Social Security or Railroad Retirement Board benefits before they turn 65. Let’s take a look at what your options are.

Working Past 65 Here’s When And Why You Should Enroll In Medicare

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

If youre not planning to retire anytime soon but youre about to turn 65, you might be wondering if you should sign up for Medicare. Everyones circumstances are different, but in general, the decision to enroll will depend on the size of your employer and the value youre getting from your workplace health insurance.

You May Like: Does Medicare Cover The Cost Of An Ambulance

What To Do: Do The Math Before Retiring

As youre approaching retirement, check your earnings statement first to make sure you have enough credits to qualify for Social Security. If you dont already have 35 years of earnings, consider whether working an additional year or two could help boost your Social Security benefits.

For example, if you worked a first career where you werent covered by Social Security, working for an extra year or two might ensure you qualify for Social Security benefits or boost your monthly benefit amount.

Make Your Decisions Independently

Collecting Social Security is by no means a prerequisite to getting Medicare. In fact, its often advisable to sign up for Medicare as soon as youre eligible but wait on Social Security to avoid a reduction in benefits, or boost them as much as possible.

The only downside to signing up for Medicare alone is having to make your premium payments directly, as opposed to having them deducted from your Social Security benefits, but its a small price to pay for the upside of a higher lifetime income stream.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

Don’t Miss: What Are The Four Different Parts Of Medicare

Using Your Medicare Card

Youll need to have your Medicare card with you any time you have any medical-related visits or services. This is true even if you have Medicare Advantage, Medicare Part D prescription drug coverage or Medigap supplemental insurance.

Your regular doctor may make a copy of your card on your first visit so they will have it readily available on file. But pharmacies, testing labs, some doctors and other health care providers will require you to show it on each visit.

Be sure to let your doctor or other health care provider know if youve received a replacement or updated Medicare card. They will need the new information.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: Does Medicare Pay For Independent Living

Can I Get Medicare Coverage If I Dont Sign Up For Social Security At 65

Who is this for?

If youre not planning on signing up for Social Security right away, you can still enroll in Medicare. Learn how here.

These days, people are retiring later in life than their parents did. If youre still working, you might not want to start collecting Social Security benefits right when you turn 65.

But you can enroll in Medicare at 65 even if youre not getting Social Security. In some cases, signing up for Medicare as soon as youre eligible is better than waiting.

Heres why:

- Medicare might have better coverage than your health insurance plan through work.

- If you dont have a comparable health insurance plan and you wait to sign up for Medicare, your Medicare premiums will be higher when you do sign up.

Getting Medicare Enrollment Assistance

If you have questions about or need help with Medicare eligibility or enrollment due to disability, you will want to talk with Social Security office. You can also go to your local State Health Insurance Assistance Program office for Medicare counseling.

If you get approved for disability benefits but arent yet eligible for Medicare yet , you can reach out your local state human services agency to see if Medicaid may be an option for you.11

Footnotes

You May Like: Does Medicare Cover Dexa Scan

At What Age Can You Earn Unlimited Income On Social Security

Upon reaching full retirement age, you can earn an unlimited income while still receiving Social Security. Full retirement age varies based on the year in which you were born. That age can range anywhere from 65 to 67 based on your birth year. For those born after 1960, you will have to wait until you are 67 to be considered full retirement age. However, for those born before that, you might be able to retire as early as 65.

December 21, 2018 By Danielle Kunkle Roberts

Social Security and Medicare are tied together in some ways, but in others they are separate. In this post, well go over what you need to know about how the two are tied. Many people think you must enroll in Social Security before you can take Medicare, and fortunately, thats not the case.