Top 10 Best Medicare Supplement Insurance Companies For 2023

There are many Medicare coverage options to choose from when looking for the right Medicare Supplement. Since all the plans are standardized, it truly comes down to price and the quality of the insurance company. Today well discuss the top Medicare Supplement companies for 2023.

Medicare Supplement Medigap Insurance

Medicare Supplement insurance is health insurance sold by private insurance companies to cover some of the gaps in expenses not covered by Medicare.

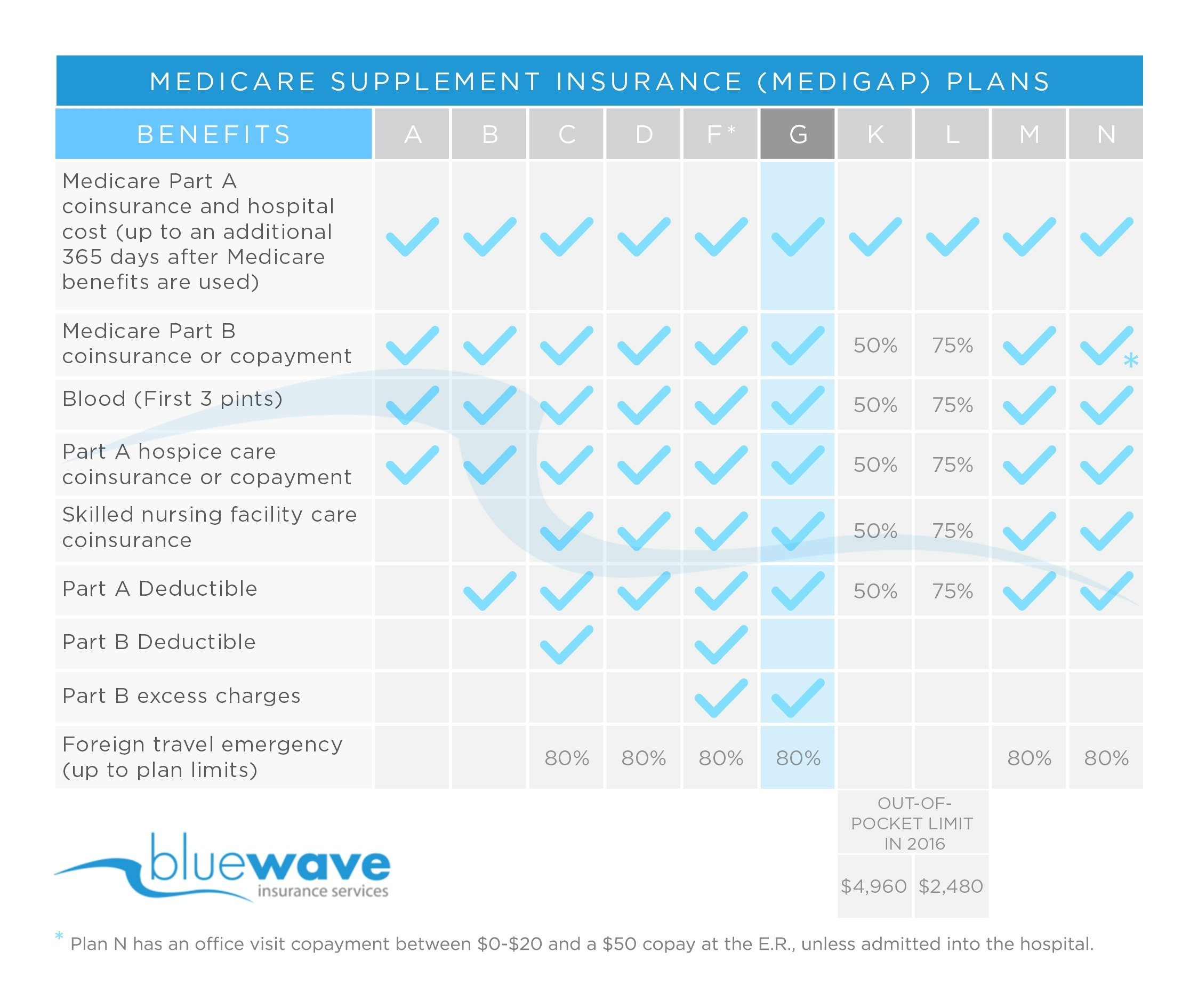

For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N. Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare.

As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers. Medigap plans H, I, and J, which contained prescription drug benefits prior to the Medicare Modernization Act, were eliminated. Plan E was also eliminated as it is identical to an already available plan. Two new plan options were added and are now available to beneficiaries, which have higher cost-sharing responsibility and lower estimated premiums:

- Plan M includes 50 percent coverage of the Medicare Part A deductible and does not cover the Part B deductible

- Plan N does not cover the Part B deductible and adds a new co-payment structure of $20 for each physician visit and $50 for each emergency room visit

Best Medicare Supplement Insurance Companies In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Supplement Insurance, or Medigap, covers gaps in Original Medicare coverage, such as certain out-of-pocket expenses like copays, coinsurance and deductibles.

Medigap plans are sold by private insurance companies, but the plans Medicare coverage is regulated by the government. So, for example, Medigap Plan G has the same Medicare benefits regardless of which insurance company you choose.

In most states, there are 10 standardized Medigap plan types. The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service. Each company has different strengths and weaknesses.

Also Check: Does Plan F Cover Medicare Deductible

How Much Does Medicare Supplement Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

Most Popular Medicare Advantage Company: Aarp/unitedhealthcare

- Customer satisfaction is below average

- 22% more complaints than a typical company

- Those who need expensive or ongoing medical care should be careful to avoid plans with a high out-of-pocket maximum

Full details about AARP/UHC Medicare Advantage

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with 27% of all enrollment. Plans are well rated and have affordable premiums and add-on benefits, a valuable combination that could account for the company’s popularity.

The plans may not be as highly rated as those from Kaiser Permanente, but they are still rated above average while also being priced affordably at about $21 per month.

AARP Medicare Advantage plans are administered by UnitedHealthcare , which offers good benefits and a wide network of providers. There’s also the option to get a PPO plan for better access to out-of-network care.

The company stands out for its broad range of add-on programs and discounts including vision, dental, free gym memberships, mental fitness and a credit toward over-the-counter products. These programs can be especially useful for those who want to stay healthy on a budget.

You May Like: Does Medicare Help Pay For Incontinence Supplies

How To Choose The Best Medicare Advantage Plan

Choosing your best Medicare Advantage plan will depend on the cost, amount of coverage and provider network of the policy. These will vary greatly when comparing insurers but will also differ between the plans that each provider offers. That’s why it’s important to understand these categories and how they will change your Medicare health insurance.

1. Compare monthly costs

Medicare Advantage costs include your monthly premium, deductible, out-of-pocket maximum, copays and coinsurance. The monthly premium for a policy usually impacts the level of the deductible and out-of-pocket maximum. For example, if you select a plan with a higher monthly premium, then the deductible and the amount you need to pay out of pocket are usually lower.

2. Assess how much health care you expect to need

Your medical usage will determine which plan has the best coverage for you. To minimize your costs, you should match your medical needs to the plan’s benefits. For example, those who need expensive health services such as surgery should focus on a plan with a low out-of-pocket maximum, which will provide a good cap on your annual medical expenses. However, those who have typical or moderate medical needs should look more closely at the plan’s deductible and the coinsurance or copayment, which is the cost-sharing rate you’ll pay for health services.

3. Consider any additional benefits that are included

4. Look at provider networks

List Of Medicare Advantage Plans From Top Regional Insurers

In addition to the major insurance companies, there are also regional insurance providers with very highly rated Medicare Advantage plans.

On Medicare.gov, the average star rating for these regional providers is above 4.5, an achievement that Kaiser Permanente is the only national insurer to achieve. For those who want a highly rated plan but who don’t have access to Kaiser Permanente, these smaller insurers are a great option. For example, those living in some areas of New York can choose a Medicare Advantage plan from CDPHP, a 5-star insurer with an average rate of just $44 per month.

| Insurer |

|---|

| 4.8 |

Average monthly cost and star rating for 2022 plans sourced from Medicare.gov

Keep in mind that there are a few additional factors to weigh when considering a smaller insurance company. One of the advantages is that a smaller company could be better tied into the local community and have more investment in the health needs of the Medicare enrollees who live in the region.

On the other hand, a smaller company may not have the same financial strength as the major insurers. Among the list of Medicare Advantage plans above, only two have ratings with AM Best: Capital Health Plan has an A+ , and Highmark has an A . These high financial ratings mean that the companies are well-positioned to pay out large claims. The rest of the companies are unrated, which means we don’t have any information about their financial strength.

Don’t Miss: Does Medicare Part D Cover Shingrix Vaccine

What Is A Medicare Supplement Plan

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

You May Like: Do Churches Get Government Funding

How To Sign Up For Medigap Plans

Signing up for a Medigap plan is easy. Medicare supplements may be bought through an agent or from the carrier directly, says Corujo. Since theres no annual open enrollment period, you may join at any time.

To buy a Medigap policy, its best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

Follow the steps below to purchase your Medigap plan:

- Enroll in Medicare Part A and Part B. This step is required to purchase a Medigap plan. Remember: Medicare and Medigap plans dont cover prescription drugs, so you may also want to consider enrolling in a Medicare Advantage plan or a plan that offers drug coverage. If you choose a Medicare Advantage plan, you cannot then enroll in a Medigap plan. If youre already enrolled in a Medicare Advantage plan, consider whether a Medigap plan would benefit you if so, drop your Medicare Advantage plan before buying a Medigap plan.

- Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.

- Compare costs between companies. Costs will vary depending on the company, state and other factors, but the coverage they offer will be the same.

- Select a Medigap plan that works best for you and purchase your policy.

Don’t Miss: What Is Traditional Medicare Coverage

Selecting The Right Medicare Supplement Company

Choosing the right Medicare supplemental insurance company means finding the Medigap plan that best meets your situation and needs. Youll need to carefully weigh your health and financial situation and what each plan offers.

How to Select the Best Medigap Company

- Determine Your Eligibility

- To be eligible for Medigap coverage, you first have to be enrolled in Original Medicare . You cant buy Medicare supplemental insurance if you have Medicare Advantage.

- Price and Budget

- If you want additional coverage against unexpected medical bills and are willing to pay an additional premium on top of Medicare Part B, Medigap may be right for you.

- Health and Financial Needs

- If you are in good health and dont expect expensive medical care, certain Medigap plans may be the right choice for you. Plans A, K and L provide only basic coverage and may be a better option. You may also prefer a Medicare SELECT plan if you want to keep your premiums low.

- Services and Benefits

- Consider if the company also sells Medicare Part D prescription drug coverage. You may also find discounts if you bundle your Medigap policy with home, auto or other coverage from the company.

- Research and Compare Prices

- Be sure to research the background of the company and compare its Medigap plan prices to the same plans offered by several other companies. Remember that the same plan may cost much less at another company.

Don’t Leave Your Health to Chance

How Much Does A Medicare Supplement Plan Usually Cost

The average costs for a Medicare Supplement Plan vary by state and plan type. For example, some companies offer high-deductible Supplement Plans. These are usually much less expensive monthly because you must first meet a spending deductible. Plans that cover more will usually have a higher monthly premium.

Plan pricing also varies based on a persons geographic location, health, and age. Medicares Plan Finder will provide a range of costs for each plan. These may be as low as $50 a month for high-deductible plans to as high as $400 or more a month for an older person who smokes and wants comprehensive Medigap coverage.

You May Like: Can You Apply For Medicare After 65

What Is The Most Popular Medicare Supplement Plan

It can be challenging for seniors to choose the best Medicare Supplement plan to meet their specific healthcare needs. In order to help you narrow your options down, this article features three popular Medicare Supplement plans, along with a comprehensive breakdown of each.

Key Takeaways

- A Medicare Supplement plan provides additional insurance coverage that regular Medicare doesnt.

- The federal government has 10 standardized Medicare Supplement plans that insurance companies must offer.

- Its essential to do your research to determine which plan is best for your healthcare requirements.

- Weve listed three popular Medicare Supplement insurance plans you may want to consider.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Also Check: How Does An Indemnity Plan Work With Medicare

What Is Medigap Plan K What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medigap Plan K is a Medicare Supplement Insurance plan that covers certain out-of-pocket expenses associated with Medicare Part A and Part B coverage. Plan K differs from most other Medigap plan options because it pays only part of the cost of the services it covers, but that reduced coverage also helps keep premium costs down.

More Faqs About The Optus Data Breach

The consequences of a data leak for a company and its customers can be quite severe. Financially, data leaks can cost institutions millions, which goes towards press, tech upgrades, staff, customers support, and more.

For customers, the loss of privacy can be at best an inconvenience, at worst an invasion. They may have to pay for support services or to redo official documents, and must employ extra vigilance against scammers in the wake of the attack.

The effects for everyone involved can be long-lasting, too, so it’s vital to seek resources and take proactive steps to protect your accounts and personal information in the wake of a data breach.

Optus claims no payment details such as credit card or direct debit numbers were lost in the September 2022 data breach, so there is no need to change your payment details to your Optus account. Instead, banks will be on the lookout for fraudulent activity on customer accounts, and it may be wise to change relevant internet banking passwords and enable multi-factor authentication to keep your bank accounts safe.

Optus claims it will continue to offer advice and support to customers affected by the data leak, which includes customers dating back to 2017. If you are concerned you may have been impacted, contact Optus through the My Optus app or by calling 133 937.

Looking for options beside Optus? Browse and compare mobile plans below ranked by WhistleOut for most included value.

Advertiser disclosure

Advertiser disclosure

Recommended Reading: Does Medicare Offer Home Health Care

Best In Broad Information: Blue Cross Blue Shield

Blue Cross Blue Shield

Unlike many other companies, Blue Cross Blue Shield doesnt offer specific estimates on its main website based on your ZIP code, date of birth, and other information most of the more in-depth information is found on the state affiliates’ webpages. Its coverage page does on the main site, however, lay out the basics for Medicare and Medicare Part D.

-

Detailed plan descriptions broken down by state

-

Very straightforward educational materials on the main website

-

Different levels of coverage

-

No easily accessible price comparisons

-

Limited explanation on the difference between different levels of coverage

Blue Cross Blue Shield clearly takes patient education seriously. It wants to provide accurate information from the start, and its approach and website are different from most other companies. Instead of offering estimates based on your personal information, Blue Cross Blue Shield provides lots of general, up-front information about Medicare and all its different Parts, including Part D. It also offers a state-by-state breakdown of offerings and who to contact for more information. Its quote process is not the most straightforward if you visit your states Blue Cross Blue Shield website, you will be redirected to Anthem to begin a more detailed quote process.