Do I Have Choices In How I Receive Medicare Benefits

Yes there are two choices. You can either use the traditional fee-for-service delivery system, in which you visit a hospital or doctor of your choice and pay a fee for services rendered, or you can join a Health Maintenance Organization with a Medicare contract. An HMO is a network of health care providers that offers comprehensive health care coverage.

Skilled Nursing Facility Care

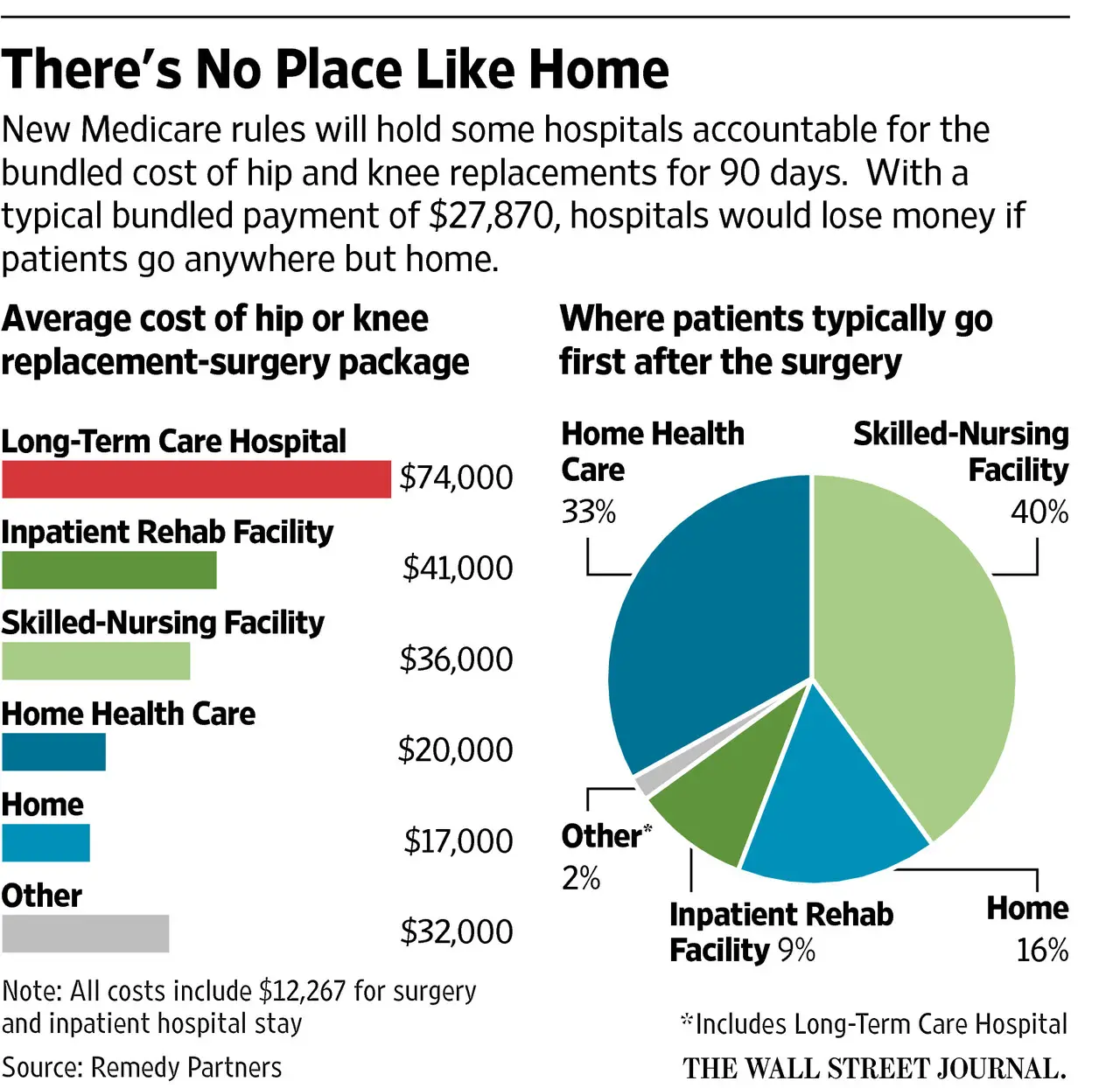

Part A will help cover many services in a Skilled Nursing Facility . This includes room and board, as well as administering medicine or changing sterile dressings. Medicare will cover you for up to 100 days in each benefit period. To qualify for this coverage, you must spend at least 3 days as an inpatient in a hospital within 30 days of being admitted to an SNF.

How Long Will It Take To Pay

Medicare and Medicaid will take some time to process your hospital bill.

You must wait to pay your hospital bill until your insurance company or Medicare has paid.

You cannot pay your hospital bill more than three months after you receive your bill.

Medicaid will also have a three-month limitation. If your hospital bill is more than $1,500, you may have a late payment penalty.

If you do not have health insurance, you may still be responsible for the entire cost.

In some cases, you may still be required to pay a deductible, copayment, or coinsurance for certain medical services.

You may have a late payment penalty if you do not pay your hospital bill within three months of receiving it.

You can ask your hospital or insurance company about payment plans.

You can also apply for a payment plan through Medicare or Medicaid.

Don’t Miss: What Are My Medicare Premiums

What Does Medicare Part B Cover

Medicare Part B covers doctor visits and most routine and emergency medical services. It also covers some preventive care, like flu shots.

What is covered by Medicare Part B

- Doctor visits, including when you are in the hospital

- An annual wellness visit and preventive services, like flu shots and mammograms

- Clinical laboratory services, like blood and urine tests

- X-rays, MRIs, CT scans, EKGs and some other diagnostic tests

- Some health programs, like smoking cessation, obesity counseling and cardiac rehab

- Physical therapy, occupational therapy and speech-language pathology services

- Diabetes screenings, diabetes education and certain diabetes supplies

- Mental health care

- You enroll for the first time in 2021.

- You arent receiving Social Security benefits.

- Your premiums are billed directly to you.

- You have Medicare and Medicaid, and Medicaid pays your premiums.

Your Part B premium may be less than the standard amount if you enrolled in Part B in 2020 or earlier and your premium payments are deducted from your Social Security check.

Your premium may be more than the standard amount based on your income. You will pay an incomerelated monthly adjustment amount if your reported income from 2019 was above $88,000 for individuals or $176,000 for couples. Visit Medicare.gov to learn more about IRMAA.

And while Medicare will share your Part B health care costs with you, there is something called Medicare assignment thats important to understand.

Medicare Part A Premiums

Most people don’t pay premiums for Part A, but if you didn’t work for 10 years in a job paying Medicare taxes, you may have to pay a monthly premium between $274 and $499 .

If you are low-income and eligible for the Qualified Medicare Beneficiary cost-reduction program, administered by your state’s Medicaid program, it will pay for your Part A premium.

Recommended Reading: Is Humana Medicare Advantage A Good Plan

What Is A Qualifying Hospital Stay For Medicare

qualifying hospital stayhospital stayhospitalhospital

What is a medicare qualifying hospital stay?

Keeping this in view, what is a Medicare qualifying hospital stay? Patient Criteria for Medicare Coverage of SNF Stays This means an inpatient hospital stay of three consecutive days or more, starting with the day the hospital admits them as an inpatient, but not including any outpatient or observation days or the day they leave the hospital.

how Long Does Medicare pay for hospital stay?

Contents

What Other Coverage Works With Medicare Part A

Medicare may not cover everything you need. But there are other ways you can help pay for some medical costs. One option is Medicare Supplement Insurance, also called Medigap. Although Medigap cant cover long-term care, it can help cover costs such as copayments, deductibles or coinsurance. Medigap is not the same as Medicare Advantage and can only be combined with Original Medicare.

Medicare Advantage is another option. Medicare Advantage plans are offered through private companies, and offer coverage for everything included in Original Medicare Part A and Part B. Many Medicare Advantage plans may also include coverage for services outside of Original Medicare, including vision, dental or Part D prescription drug coverage.

Explore Medicare

Recommended Reading: Can You Get Medicare If You Work Full Time

Does Original Medicare Cover Hospital Stays

With the cost of a three-day hospital stay averaging around $30,000, making sure youre covered for hospital visits is essential

This coverage includes inpatient care at the following types of facilities, according to Medicare.gov

-

Inpatient psychiatric facilities .

-

Inpatient rehabilitation facilities.

The following services are included in your Medicare Part A hospital coverage:

-

A semi-private room.

-

Other hospital supplies and services needed for your treatment.

Hospital inpatient care is also covered if you participate in a qualifying clinical research study.

Be aware that Medicare Part A covers only Medicare-approved hospital services and items, not the doctors’ services you receive while hospitalized, which fall under the umbrella of Medicare Part B. Your Part B coverage pays 80% of any Medicare-approved doctors’ services you receive while hospitalized.

What Does Medicare Not Cover

- Custodial care This is given by a medically unskilled person to help a patient with the tasks of daily living, such as walking, bathing, or dressing. Even if you are in a hospital that participates in Medicare or are in a skilled nursing facility, Medicare will not cover the cost of the service if it is mainly custodial.

- Dental care and dentures .

- Routine checkups and tests directly related to those checkups .

- Most immunization shots .

- Most prescription drugs

- Routine foot care .

- Services outside the United States .

- Tests for, and the cost of, eyeglasses or hearing aids .

- Personal comfort items, like a phone or TV in your hospital room.

- Cosmetic Surgery

- Experimental Procedures

Read Also: How Much Will Medicare Pay For Mental Health Services

Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Paying For The Doctor When You Have Original Medicare

For Medicare-covered services, you must first pay the Medicare Part B annual deductible, which is $166 in 2016. After you have met your deductible, you pay a Part B coinsurance for Medicare-covered services. For doctors visits you generally pay 20 percent of the Medicare-approved amount for care you receive. This is also called a 20 percent coinsurance.

However, you may have to pay more depending on what type of doctor you see and whether your doctor takes Medicare assignment. A doctor who takes Medicare assignment agrees to accept the Medicare-approved amount as full payment. In general, there are three categories of Original Medicare doctors:

- If you see a participating doctor, you are only responsible for paying a 20 percent coinsurance for Medicare-covered services. Most doctors who treat patients with Medicare are participating doctors.

Be sure to always ask your doctor if he/she accepts Medicare before you get care.

Read Also: How Do I Apply For Medicare Part B

Who Is Eligible For Health Care In Canada

Our national health insurance program is designed to ensure that all insured persons have access to medically necessary hospital and physician services on a prepaid basis. The Canada Health Act defines insured persons as residents of a province. The Act further defines a resident as:

a person lawfully entitled to be or to remain in Canada who makes his home and is ordinarily present in the province, but does not include a tourist, a transient or a visitor to the province.

Therefore, residence in a province or territory is the basic requirement for provincial/territorial health insurance coverage. Each province and territory is responsible for determining its own minimum residence requirements with regard to an individuals eligibility for benefits under its health insurance plan. The Canada Health Act gives no guidance on such residence requirements beyond limiting waiting periods to establish eligibility for and entitlement to insured health services to three months. Most provinces and territories also require residents to be physically present 183 days annually, and provide evidence of their intent to return to the province.

Other Items And Procedures Not Covered By Medicare

It is virtually impossible to keep track of everything Medicare may or may not cover. However, there are certain criteria that must be met.

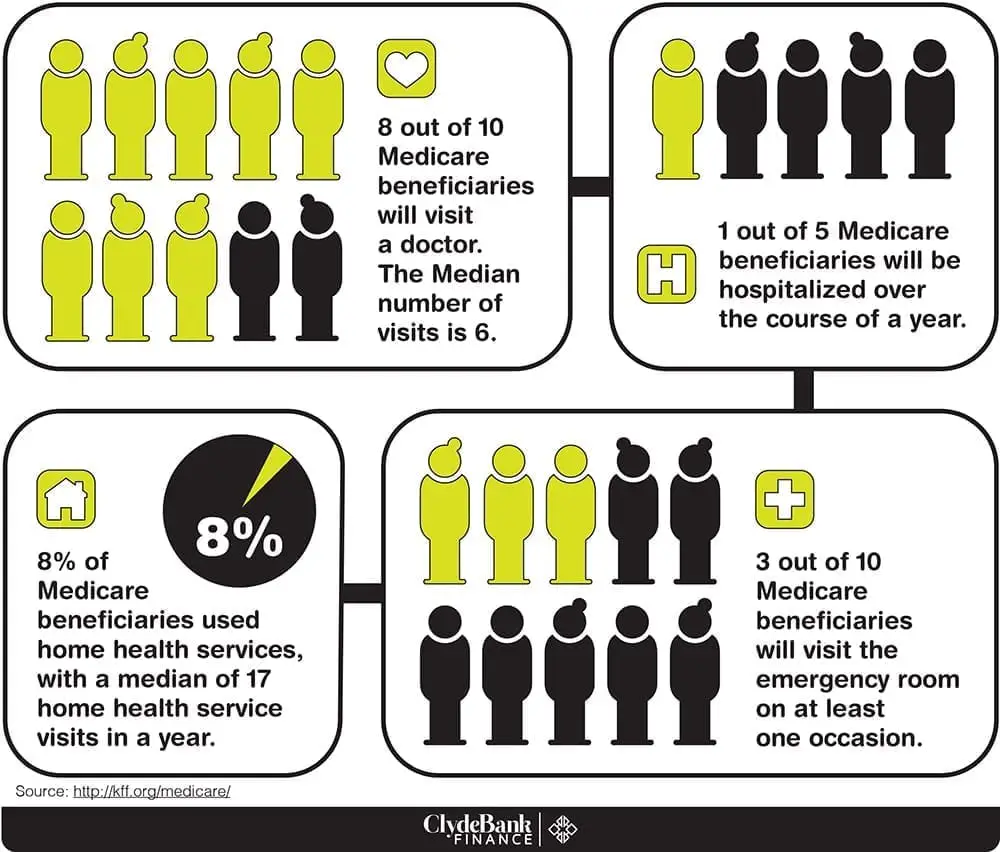

For example, the physician has to agree to accept Medicare payments. Doctors are not required to accept the government programs.

According to the Kaiser Family Foundation, close to 90 percent of the U.S. Doctors accept Medicare patients. However, approximately 80 percent are accepting new patients and the remainder does not accept new Medicare patients.

Virtually all family doctors accept Medicare. However, only 55 percent of psychiatrists in the nation accept Medicare patients, according to a story in the New York Times referencing a study published in the Journal for the American Medical Association .

Also Check: Is It Too Late To Sign Up For Medicare Advantage

Does Medicare Cover Hospital Stays

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Part A covers hospitalizations, but youre responsible for the Part A deductible. After 60 days youll have to pay coinsurance, and the amount increases based on the length of your stay.

A Premiums Deductibles & Coinsurance

The chart below lists the Part A premiums, deductibles and coinsurance for inpatient hospital and skilled nursing facility care for Original fee-for-service Medicare. For a comprehensive list of Part A and B costs, see our summary chart, Medicare Benefits & Cost-Sharing for 2023

Part A Hospital Insurance Premiums, Deductibles & Coinsurance

| If You Have |

|---|

Also Check: Who Provides Medicare Advantage Plans

Enrolling In Medicare Part B If You Are 65 Or Older Still Working And Have Insurance From That Job

You are not required to take Part B during your Initial Enrollment Period if you are still working or your spouse is still working and one of you has coverage as a result of that current work. You should only delay Part B if this current employer insurance is the primary payer on your health care expenses . You should talk to your employer when you become eligible for Medicare to see how employer insurance will work with Medicare. Generally, if you are eligible for Medicare because you are over 65, the employer must have more than 20 employees to be the primary payer. If you are eligible for Medicare because you get SSDI, the employer must have more than 100 employees to be the primary payer.

If there are fewer than 20 employees at the company where you currently work or your spouse currently works, Medicare is your primary coverage. In this case, you should not delay enrollment into Part B. If you decline Part B, you will have noprimary insurance, which is usually like having no insurance at all.

In either case, if you have insurance from a current employer, you qualify for aSpecial Enrollment Period . During this period, you can enroll in Part B without penalty at any time while you or your spouse is still working and for up to eight months after you lose employer coverage, switch to retiree coverage, or stop working.

The Majority Of The Public Holds Favorable Views Of Medicaid

Public opinion polling suggests that Medicaid has broad support. Seven in ten Americans say they have ever had a connection with Medicaid including three in ten who were ever covered themselves. Even across political parties, majorities have a favorable opinion of Medicaid and say that the program is working well . In addition, polling shows that few Americans want decreases in federal Medicaid funding. In addition to broad-based support, Medicaid has very strong support among those who are disproportionately served by Medicaid including children with special health care needs, seniors, and people with disabilities.

Figure 10: Large Shares Across Parties Say They Have a Favorable Opinion of Medicaid

You May Like: What Does Medicaid For Adults Cover

You May Like: Does Medicare Cover Air Evac

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

How To Read Your Bill

Once you receive a medical bill from your healthcare provider, you will notice that it consists of multiple components that might not be clear to you. For most patients, the codes, descriptions, and prices listed in their bills can seem confusing.

The following example explains each element of your bill with an in-depth description. It is important not to get your medical bill confused with the Explanation of Benefits , an insurance report we cover following the bill.

Recommended Reading: What Does Medicare Supplemental Insurance Cost

Private Health Insurance Cover For A Hospital Visit

Private hospital cover is available through all major private insurance health funds. Private health insurance can give you more choice about when you want to go into hospital , whether you would like a private room and who you want as your doctor.

Most private health insurance funds offer plans that provide a combination of hospital, general medical and extras cover, depending on what you prefer.

% Of Approved Charges For Some Services

There are several types of treatments and medical providers for which Medicare Part B pays 100% of the approved charges rather than the usual 80%, and to which the yearly Part B deductible does not apply. In these categories, you are not required to pay the regular 20% coinsurance amount. In most of the categories, the provider accepts assignment of the Medicare-approved charges as the full amount, so you actually pay nothing at all.

Also Check: How To Request A Replacement Medicare Card

Costs And Coverage For Inpatient Hospital Care

When admitted as an inpatient to a hospital, you are required to pay a deductible for each benefit period. There is no coinsurance for the first 60 days, but after 60 days, there will be an everyday coinsurance you must pay. Medicare Part A hospital insurance benefits include nurses services, X-rays, medically necessary drugs, appliances, equipment, and supplies the hospital provides for your use during the inpatient hospital stay.

However, Medicare doesnt cover procedures or treatments that are considered experimental. Also, if your hospital stay extends beyond 60 days, you will be responsible for more of the cost of your care. Beyond the 90th day of your hospital stay, you will start tapping into your 60-day lifetime reserve. In addition, Part B helps Medicare beneficiaries cover the doctors services they receive while in the hospital. However, you are responsible for 20% coinsurance for these doctors services.

How And When Do I Apply For Medicare

Medicare applications are handled through your local Social Security office and are usually submitted when you apply for Social Security. To ensure that your entrance into Medicare is problem-free, you should contact your local Social Security office within three months before you turn 65. If you fail to enroll within this three-month period, youll have to pay a penalty for late enrollment. This time frame is important particularly for those who have retired or plan to retire before age 65.

Medicare becomes effective for people following the regular application process on the first day of the month in which they turn 65. What does Part A of Medicare cover? Part A helps pay for Hospital Inpatient care. For each benefit period, Medicare pays all covered costs except the Part A deductible during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days. A benefit period begins when you are admitted to a hospital and ends when you have been out of the hospital or have not received skilled care in a nursing facility for 60 consecutive days. In addition to this benefit period, you are given 60 lifetime reserve days that can be used only once.

IMPORTANT: Medicare does not pay for custodial care if it makes up the bulk of services received in a nursing facility. . Because many people in nursing facilities receive this type of care, it may be useful for you to keep in mind that Medicare does not pay for it.

Recommended Reading: Which Medicare Plans Offer Silver Sneakers