Are Medicare Premiums Lowering In 2023

The New York Times noted that after the sizable Medicare Part B premium increase was announced in 2021, followed by public protest rallies, some hospitals and doctors refrained from prescribing the drug. After the premium increase went into effect, the manufacturer announced it was cutting the price of Aduhelm to $28,200, based on a lower demand than predicted.

An article in U.S. News cited a CMS report that said the premium recommendation for 2022 would have been $160.40 a month had the price cut and the coverage determination both been in place when officials calculated the figure. But a midstream change in the 2022 Medicare Part B premium would be unprecedented. However, there is the potential that the cost savings will be passed along to Medicare recipients through lower 2023 Medicare Part B premiums.

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Full Transcript Of Video

Hey friends, the Fearless Advisor here. Today I am going to discuss adjusting your Medicare premiums after a decline in your income.

Medicare is a program that helps with medical expenses for Americans over the age of sixty-five. The program is very specific on when you must enroll or be subject to a delayed enrollment penalty, which lasts a lifetime! These requirements can really get our emotions stirred and cause us to make decisions quickly and possibly pay some higher premiums at the beginning of our Medicare journey.

Recommended Reading: Can You Have More Than One Medicare Supplement Plan

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $170.10/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $322.10/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Original Medicare Part B Medical Coverage

What it helps cover:

Other Part B costs:

- There is a $233 . After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for and .

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Recommended Reading: Does Medicare Cover Stair Chairs

What If Your Medicare Premium Payment Is Late

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says Delinquent Bill at the top, pay the total amount due, or youll lose your Medicare coverage. Get a sample of the delinquent bill in English.

Dont risk losing your Medicare coverage

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Recommended Reading: Does Medicare A Or B Cover Prescriptions

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Related Training & Materials

Frequently Asked Questions about Medicare Part A and B “Buy-in” : The main policy questions, & responses, submitted to CMS to date on the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Five Key Policy Topics From the Updated Manual on State Payment of Medicare Premiums: CMS designed this webinar for state policy staff to introduce five key policy topics addressed in the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Overview of the CMS State Buy-In File Exchange: A webinar, with associated slides, available as a resource to support states moving to daily exchange submission.

Recommended Reading: Does Medicare Cover Walking Canes

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

How Medicare Premiums Are Calculated

If you’re currently on Medicare, you probably know that your monthly premium is subject to change each year. But exactly how your premium changes isnt based on the factors you might think, like your health, annual income, or chosen Medicare plan.

Instead, your Medicare Part B premiums will likely increase due to rising healthcare costs.

Understanding how your Medicare premiums are determined can help you better plan your healthcare finances, which is especially important for seniors on a fixed income.

Lets take a closer look at what Medicare is, how monthly payments are calculated, and the current rates you can expect.

You May Like: Will Medicare Pay For A Roho Cushion

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

89 percent of Medicare Advantage plans include prescription drug coverage in 2021 . More than half of all 2021 MA-PD plans charge no premium, other than the Medicare Part B premium.1

The average 2022 Medicare Advantage plan premium is $62.66 per month.2

Medicare Advantage plans are required to offer the same benefits as Original Medicare , and some Medicare Advantage plans may also offer additional benefits for things like routine dental and vision coverage, non-emergency transportation, caregiver support, allowances for over-the-counter items and more.

And according to Medicare expert John Barkett, Medicare Advantage monthly premiums dropped in 2020 by as much as 14 percent. Hear more about this in the video below.

What Medicaid Helps Pay For

If you have Medicare and qualify for full Medicaid coverage:

- Your state will pay your Medicare Part B monthly premiums.

- Depending on the level of Medicaid you qualify for, your state might pay for:

- Your share of Medicare costs, like deductibles, coinsurance, and copayments.

- Part A premiums, if you have to pay a premium for that coverage.

Recommended Reading: How To Apply For Medicare Supplemental Insurance

Medicare Part A Premium

Medicare Part A is hospital insurance, and it helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Most people do not pay a premium for Medicare Part A in 2022.

You must have worked and payed Medicare taxes for 40 quarters to qualify for premium-free Part A.

If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 permonth. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

How it changed from 2021The 2021 Part A premiums increased by $15 and $28, respectively, in 2022.

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Read Also: Do You Have To File For Medicare

Planning For Medicare Taxes Premiums And Surcharges

A little foresight can reduce costs.

Image by mordolff/iStock

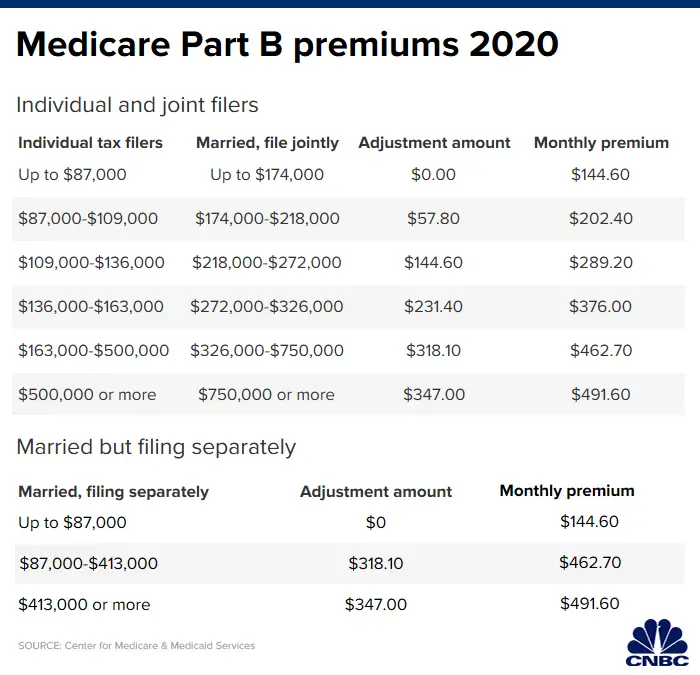

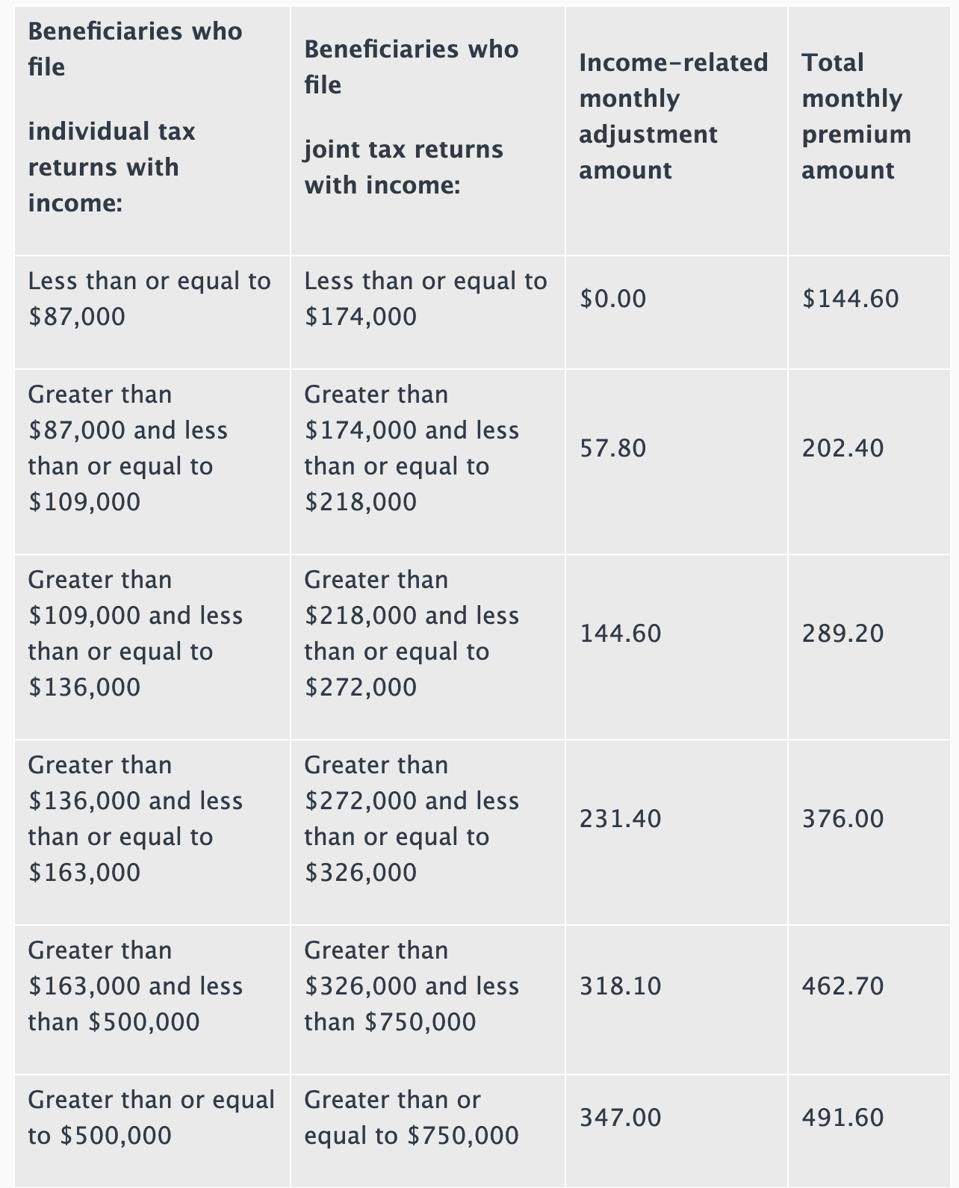

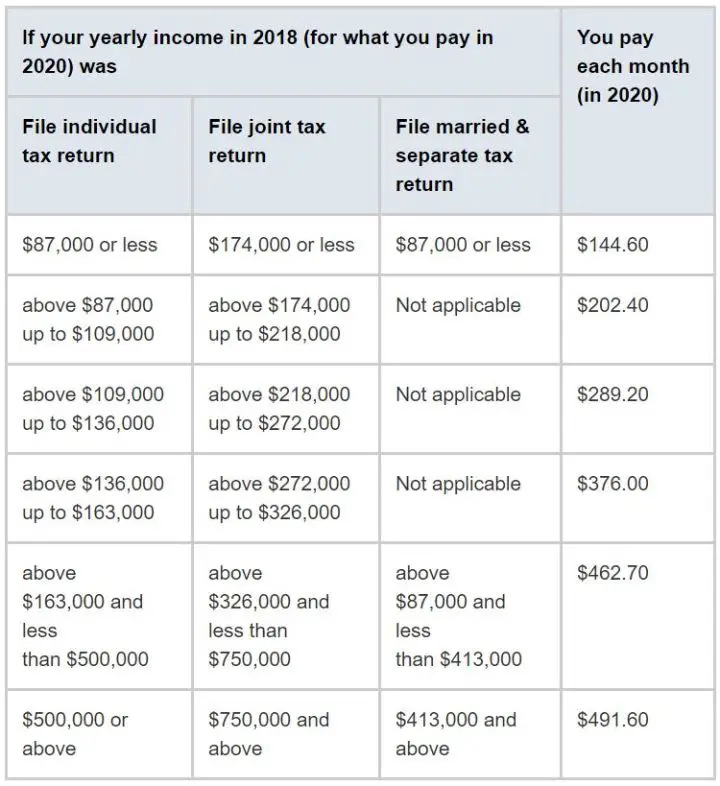

Medicare and budgeting for future medical expenses are important elements of personal financial planning. Sometimes, controlling Medicare premium costs is overlooked and estimating future medical out-of-pocket expenses is understated. Accordingly, this article focuses on Medicare planning issues that CPA financial planners should consider when advising clients. These issues include an overview of Medicare taxes, the determination of premium surcharges, projected future health care costs, and strategies to mitigate the impact of the escalating Medicare charges paid by many higher-income clients.

Paying Medicare Premiums In 2022

As youre learned in this article, not all Medicare premiums are alike. And neither are the ways in which they can be paid.

If a premium is owed for Medicare Part A, a monthly bill is typically sent to the beneficiary.

If you receive Social Security benefits, you can generally have your Part B, Medicare Advantage, Part D or Medicare Supplement Insurance premiums deducted directly from your Social Security check. Those who do not receive Social Security benefits are directly billed for their premiums.

Payment arrangements may include mailing a check, an electronic transfer from a bank account or charging a credit or debit card.

Read Also: Does Medicare Part B Cover Blood Tests

Medicare Part B Premium

The Medicare Part A premium is free for most beneficiaries, but the Medicare Part B premium is always required. If you are collecting Social Security or Railroad Retirement Board benefits when you become Medicare-eligible, your monthly benefit payments will automatically be reduced by the Part B premium amount.

The standard Part B monthly premium in 2021 was $148.50, and in 2022, the amount increased to $170.10. Pundits are suggesting premiums will decrease for 2023. Understanding what propelled the 2022 premium increase can give you a sense of what to expect in 2023.

Get easy-to-read, informative Medicare articles like this in your inbox every month.

Discounts And Financial Assistance

Just like there are various methods of paying Medicare premiums, there are also some different ways to get help paying them.

- Medicare Savings Programs can help pay for Part A and Part B premiums, and potentially other out-of-pocket costs.

- Extra Help is a federal program that helps pay for Part D premiums.

- PACE can help alleviate the cost of a Part D plan.

In addition, because Medicare Advantage, Part D and Medigap plans are sold by private insurers, companies may offer various discounts and cost-saving incentives to customers.

Some of the offers that can be found may include discounts for households or married partners, non-smokers and more, but these will vary based on the plan provider.

Also Check: Can I Sign Up For Medicare Part B Online

Medicare Part B Premiums For Tricare For Life

When you use TRICARE For Life, you don’t pay any enrollment fees, but you must have Medicare Part A and Medicare Part B.

- Medicare Part A is paid from payroll taxes while you are working.

- Medicare Part B has a monthly premium, which is based on your income.

If you get Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will get deducted from your benefit payment.

Does The Medicare Part B Premium Go Up Every Year

The Part B premium is hardly the only Medicare cost that will go up every year.

The Medicare Part A premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.

Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year.

There are a number of contributing factors to why Medicare costs go up each year, such as:

- As of 2019, close to 10,000 Americans become eligible for Medicare every single day.1

- Americans are living longer, and therefore requiring more years of health care.

- As the population ages, the ratio of employed workers to retirees continues to shrink.

- The cost of health care continues to rise.

When you add it all up, you have fewer people paying Medicare taxes that support an increasing number of Medicare beneficiaries who are themselves living longer and being charged more for their care.

Increasing the Part B premium is one way that these rising costs are partially addressed.

Recommended Reading: What Is Medicare Part A And B

Set Up Online Bill Payment With Your Bank

Set up your one-time or recurring payment correctly with your bank. Enter your information carefully, to make sure your payment goes through on time.

Give the bank this information:

- Your 11-character Medicare Number: Enter the numbers and letters with NO DASHES, spaces, or extra characters. Where to find your Medicare NumberThe letters B, I, L, O, S, and Z arent used in Medicare Numbers. If you see a 0 in your Medicare Number, enter it as a zero, not the letter O.

- Payee name: CMS Medicare Insurance

- Payee address:St. Louis, MO 63179-0355

- The amount of your payment

The bank might mail a paper check even if youve set up an online payment. Why would the bank mail my payment?

Generally, online payments process in 5 business days. If your bank mails a check, it may take longer. Your bank statement will show a payment made to CMS Medicare.

Pay the correct amount

If you want to have automatic payments set up that will update if your premium changes, sign up for Medicare Easy Pay. Get details about Easy Pay.

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Don’t Miss: Does Medicare Cover The Cost Of A Shingles Shot