Is The Medicare Part A Deductible Increasing For 2022

Part A has a deductible that applies to each benefit period . The deductible generally increases each year, and is $1,556 in 2022, up from $1,484 in 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Compare 2021 Medicare Supplement Insurance Plan Costs

A licensed insurance agent can help you find Medigap plans that are available where you live. You can find out the types of benefits each available plan may offer, the insurance companies that sell them and the premium costs you can expect to pay.

You can request an online plan comparison for free, with no obligation to enroll.

Find Medigap plans in your area.

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

Recommended Reading: How Much Is Medicare Plan B

The Medicare Seniors Know And Love

Original Medicare, which roughly 70% of eligible members are still enrolled in, is comprised of three key components: Part A, Part B, and Part D.

Part A, also known as hospital insurance, covers in-patient hospital stays, surgeries, and long-term skilled nursing care, as an example. The great thing about Part A is that there’s no premium required for a vast majority of Americans. Just as 40 lifetime work credits qualifies someone to receive Social Security benefits during retirement, 40 lifetime work credits also allows an individual to receive Medicare Part A without a premium once they reach age 65, or have other extenuating circumstances arise, such as becoming disabled.

Part B, also known as outpatient services, covers eligible medical costs in the outpatient setting, such as doctor and clinic visits. Part B has also come to cover select pharmaceutical products that are administered on an outpatient basis, such as IV-based cancer treatments. Unlike Part A, Part B does require a monthly premium from members, and certain well-to-do persons could face a surcharge to their monthly premium if their individual income or combined income as a couple tops $85,000 or $170,000, respectively, in 2017.

Are There Ways To Save On My Medicare Out

If youre concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs:

- Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs.

- Medicare Supplement Insurance plans can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans dont cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses.

- Medicare Advantage plans provide all the same benefits as Medicare Part A and Part B . Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

Also Check: What Are Medicare Part Abcd

Medicare Part A Cost Increases

Most people receive premium-free Part A.

In 2021, people who are required to pay a Part A premium must pay either $259 per month or $471 per month, depending on how long they or their spouse worked and paid Medicare taxes.

Those are increases of $7 and $13 per month respectively from 2020 Part A premiums. The costs may increase again in 2022.

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible.

The Part A deductible amount may increase each year, and it will likely be higher in 2022.

Have Social Security Recipients Been ‘held Harmless’ For Part B Premium Increases Recently

In most years, Social Securitys COLA results in a large enough increase that higher Part B premiums can be deducted from the new payments without ending up with Social Security checks that are lower than the previous year.

For beneficiaries who areheld harmless, and for whom the Part B increase would otherwise exceed their Social Security COLA, the Part B increase ends up being limited to the amount of the COLA. That means their full COLA is used to cover the Part B premium increase and theyll end up with Social Security checks that are exactly the same as they were the year before.

- People who are new to Medicare

- People who arent receiving Social Security benefits

- People who pay higher premiums for Medicare as a result of having high incomes.

You May Like: How To Decide Between Medigap And Medicare Advantage

How Much Is The Medicare Part A Coinsurance For 2022

The Part A deductible covers the enrollees first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage during that same benefit period, theres a daily coinsurance charge. For 2022, its $389 per day for the 61st through 90th day of inpatient care . The coinsurance for lifetime reserve days is $778 per day in 2022, up from $742 per day in 2021.

What Does Medicare Part C Cost In 2021

Medicare Part C plans are sold by private insurance companies, so plan premiums, deductibles and other costs can vary.

Despite regular increases in Original Medicare costs, Medicare Advantage premiums have decreased in recent years.

The average 2022 Medicare Advantage plan premium is $62.66 per month for Medicare Advantage plans that include prescription drug coverage.2

Increasing competition may be contributing to falling premiums. The number of Medicare Advantage plans available in 2021 represents a 13 percent increase from 2020 and the highest number of plans ever available.3

Its possible that the competition within the Medicare Advantage market will keep Medicare Advantage plan premiums lower.

As mentioned above, many Medicare Advantage plans feature $0 premiums.

Also Check: Does Medicaid Cover More Than Medicare

How Much Is Medicare Advantage Going Up In 2022

As more and more baby boomers reach retirement age, Medicare Advantage numbers are expected to grow. The Medicare changes to enrollment in 2022 are predicted to jump from 26.9 million to 29.5 million seniors. The more enrollees there are in the system, the more costs are shared by all which means your monthly costs for a Medicare Advantage plan will be less expensive. According to KFF, the average Medicare beneficiary has access to double the amount of Medicare Advantage plans compared to previous years. Most beneficiaries have access to 39 Medicare Advantage plans.

How Much Is Medicare Part D Going Up In 2022

Lastly, theres Medicare Part D. There are some minor yet noteworthy Medicare changes happening for the government-sponsored prescription drug program in 2022. Sadly, there will be an increase in the monthly premium for all seniors across the board. But others will get better, more affordable access to one of the most common and necessary life-saving drugs in demand today.

Also Check: How To Check Medicare Status Online

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Don’t Miss: What Age Can You Get Medicare Part B

Medicare Premiums To Increase Dramatically In 2022

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

The Centers for Medicare and Medicaid Services announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicares outlay for an expensive new drug that was recently approved to treat Alzheimers disease. Because most recipients have their Medicare premium deducted from their Social Security check, the upswing in Medicare premiums means that the Social Security cost-of-living increase of 5.9 percent, which was the largest in 39 years, will be smaller for most people.

Local Elder Law Attorneys in Your City

City, State

While the majority of beneficiaries will pay the added amount, a “hold harmless” rule prevents Medicare recipients’ premiums from increasing more than Social Security benefits. This hold harmless provision does not apply to Medicare beneficiaries who are enrolled in Medicare but not yet receiving Social Security, new Medicare beneficiaries, seniors earning more than $91,000 a year, and “dual eligibles” who get both Medicare and Medicaid benefits.

Here are all the new Medicare payment figures:

Your “Medigap” policy may cover some of these costs.

Premiums for higher-income beneficiaries are as follows:

Financial Planning And Health Insurance Go Hand In Hand

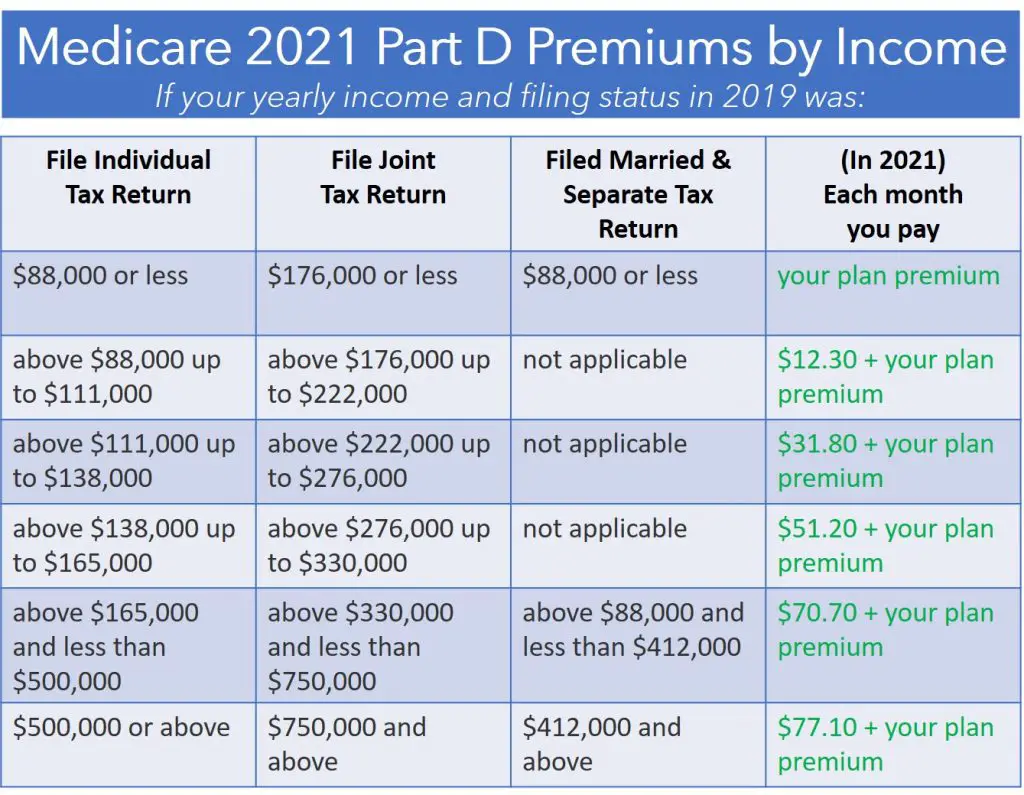

If your income exceeded $91,000 in 2020, your 2022 Medicare Part D and Part B premiums depend on your income. And as you can see in the tables above, the additional premiums can be substantial.

Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. And since the government will base your premiums on your income from two years ago, youll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income.

Jae W. Oh is a nationally recognized Medicare expert, frequently quoted in the national press, including on USA Today, Dow Jones, CNBC, and Nasdaq.com, as well as on radio talk shows nationwide. His book, Maximize Your Medicare, is available in print and ebook formats. Jae has appeared as a speaker in front of libraries, companies, as part of college-sponsored programs. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states.

Read Also: What Is The Difference Between Medigap Insurance And Medicare Advantage

Why Did My Medicare Part B Premiums Change

There are several things that affect how much you pay each month for Medicare Part B. What are these factors?

If you have a Medicare Part B plan, you should be familiar with your planâs annual rate changes. Your coverage hasnât changed, so why are you paying differently? Besides the standard premium for Medicare Part B, there are several factors that influence your bill.

Will My Medicare Supplement Insurance Premiums Go Up

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments.

The average a Medigap plan premium in 2018 was $125.93 per month.2

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher.

Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Don’t Miss: Is It Better To Have Medicare Or Medicaid

Beneficiaries Could See A Reduced Part B Premium After Biogen Announced It Would Slash The Price Of Its Expensive And Controversial New Alzheimer’s Treatment Aduhelm

Seniors could see a cut in their monthly Medicare Part B premiums for 2022 after a controversial new drugs price was slashed.

In November, Medicare set the monthly Part B premium at $170.10 for this year, a more than 14% increase from 2021. The agency said the increase was due in part to Medicare beneficiaries potentially being prescribed Aduhelm, an Alzheimers treatment manufactured by Biogen that was approved by the Food and Drug Administration last year. Since the drug must be administered by a physician, it is covered under Part B. Initially, the drug would cost $56,000 each year per patient, though Biogen later announced the price would be reduced to $28,200.

Health & Human Services Secretary Xavier Becerra said on Monday in a press release that he had asked Medicare to reassess the recommendation for the 2022 Medicare Part B premium, given the dramatic price change of the Alzheimers Drug, Aduhelm.

With the 50% price drop of Aduhelm on January 1, there is a compelling basis for CMS to reexamine the previous recommendation, he added.

The Kaiser Family Foundation estimated in June before the drugs price was cut that if just a quarter of the 2 million Medicare beneficiaries who were prescribed an Alzheimers treatment under Part D in 2017 took Aduhelm, it would cost Medicare $29 billion in one year. Overall, Medicare spent $37 billion on all Part B drugs in 2019, according to KFF.

How Much Did The Medicare Part A Deductible Go Up In 2021

The Part A deductible does not operate on an annual basis, but rather it is based on benefit periods.

A benefit period begins the day you are admitted to a hospital or skilled nursing facility as an inpatient, and it ends when you have not been an inpatient for 60 consecutive days.

For 2022, the Medicare Part A deductible is $1,556 per benefit period.

This list shows how the Part A deductible has changed in recent years.

- 2021 = $1,484 per benefit period

- 2020 = $1,408 per benefit period

- 2019 = $1,364 per benefit period

- 2018 = $1,340 per benefit period

- 2017 = $1,316 per benefit period

- 2016 = $1,288 per benefit period

- 2015 = $1,260 per benefit period

- 2014 = $1,216 per benefit period

Also Check: Does Kaiser Permanente Take Medicare

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.