Uncertainty About The Budgetary Effects

CBO’s estimates rely in part on its projection of the income distribution of Medicare enrollees. That projection is uncertain, in part, because a relatively large share of income for that group comes from sources that are less predictable, such as dividends and capital gains. That uncertainty in the projection of the income distribution leads, in turn, to uncertainty in CBO’s estimate of the number of Medicare enrollees who would pay higher premiums under the option.

Another source of uncertainty is the projection of the basic premium for Part B. The premium could be lower than CBO projects, for example, if per-enrollee spending grew more slowly than anticipated. If the premium was lower than projected, the option would result in less savings because each affected enrollee’s premium would increase by a smaller dollar amount. Conversely, if the premium was higher than projected, the savings from the option would be greater.

What Is A Medicare Premium

To enroll in a Medicare health plan, you must contribute a monthly amount known as the Medicare monthly premium. Most people dont have to pay a premium for Part A as they or their spouses have been paying their Medicare taxes while they were working. If you havent paid enough Medicare taxes, you may be able to buy Part A when you are eligible for Medicare.

The majority of people, however, must pay a premium for parts B and D. Coinsurance or the cost-sharing between you and your health care plan is applicable in Part B of Medicare.

D Costs With Higher Incomes

Medicare beneficiaries who have higher incomes may have to pay an additional amount for Medicare Part D premiums . This additional amount is called the Income-Related Monthly Adjustment Amount and applies to all prescription drug coverage through Medicare including Medicare Advantage plans. The additional amount you pay is determined by the Social Security Administration and is based on income reported on your IRS tax return two years prior. For example, if you enroll in a Part D plan for 2021 and have a higher income, the additional amount you will pay is determined by your reported earnings from the 2019 tax year.

Read Also: Is Imvexxy Covered By Medicare

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

How Medicare Premiums Are Calculated

If you’re currently on Medicare, you probably know that your monthly premium is subject to change each year. But exactly how your premium changes isnt based on the factors you might think, like your health, annual income, or chosen Medicare plan.

Instead, your Medicare Part B premiums will likely increase due to rising healthcare costs.

Understanding how your Medicare premiums are determined can help you better plan your healthcare finances, which is especially important for seniors on a fixed income.

Lets take a closer look at what Medicare is, how monthly payments are calculated, and the current rates you can expect.

Read Also: What Is Better Medicaid Or Medicare

What Is The Medicare Hold Harmless Rule

Your Medicare premiums arent the only thing that will go up each year: your Social Security benefit payment will typically also increase each year.

The Social Security Administration uses the consumer price index for workers to make annual adjustments to benefit payment amounts. This is called the cost of living adjustment, or COLA, and is a way to help benefit payments keep up with the cost of living.

The cost of health care often rises faster than inflation, however. Fortunately, the hold harmless rule prevents Medicare premiums from increasing by a higher amount than the Social Security COLA.

The hold harmless rule does not apply to you, however, if:

- This is your first year receiving Medicare Part B benefits

- You are enrolled in a Medicare Savings Program

- You pay an IRMAA

- You were enrolled in an MSP in 2021 but lost program coverage because your income increased

If you pay a Part B late enrollment penalty, your penalty cannot be waived as part of the hold harmless rule. In fact, your late enrollment penalty will increase according to how much the Part B premium will go up each year.

You May Like: How To Find A Medicare Number For A Patient

Where Can I Get More Information

Does income affect Medicare may not be your only question. If not, the good news is that you can usually track down the information you need online. The best resource is your my Social Security account. This is where youll get some answers specific to your own Medicare payments.

To ask about Medicare premiums or any other Social Security- or Medicare-related topic, your local Social Security office can be a great resource. But you can also pick up the phone and call 1-800-772-1213, or 1-800-325-0778 if you have difficulty hearing. The SSA answers calls on weekdays from 8 a.m. to 7 p.m., but you can also get information via the automated service after hours.

Also Check: Does Medicare Cover Portable Oxygen

Help With Medicare Part A And Part B Costs

Please note that the income and resource limits listed here are for 2016.

If youre disabled or have a low income, you might qualify for a Medicare Savings Program through Medicaid. Besides helping with your Medicare Part A and/or Part B premiums, some MSPs might help with other Medicare Part A and Part B costs, such as coinsurance. There are four types of MSPs, each with different eligibility criteria:

Resources include, but arent limited to, money you have in the bank, stocks, and bonds they dont include certain possessions, such as your home. To find out if you qualify for a Medicare Savings Program, contact your state Medicaid office.

Medicare Part A Premium

Most beneficiaries qualify for premium-free Medicare Part A. This insurance isnt income-based rather, the premium depends on how many years you worked and paid Medicare taxes. Heres a breakdown of the Part A monthly premium in 2016. If youve worked while paying Medicare taxes:

- For at least 10 years while paying Medicare taxes, you dont pay a premium

- For 30 to 39 quarters, you pay $226

- For less than 30 quarters, you pay $411

Don’t Miss: Is Medicare A Federal Program

When And How To Apply For Medicare

If you already receive benefits from Social Security , you will automatically be enrolled in Part B, and Part A, starting the first day of the month in which you turn 65. If you’re not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare.

Although Medicare Eligibility Has Nothing To Do With Income Your Premiums May Be Higher Or Lower Depending On What You Claim On Your Taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits. Known as the Income-Related Monthly Adjustment Amount, or IRMAA, Social Security will notify you if your income places you in this higher bracket.

Less than 5 percent of Medicare beneficiaries have to pay the IRMAA surcharge.

Don’t Miss: When Is One Eligible For Medicare

The Secure Act And Irmaa

Further complications have been introduced as a result of the SECURE Act , which was enacted in late 2019. The SECURE Act has a number of different features such as allowing IRA contributions after age 70½ if youre still earning an income and it extends the minimum age that one must receive RMDs from 70½ to 72.

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in the tables above.

When people withdraw from qualified funds such as a 401, IRA, or 403, these funds are taxable once they are transferred to your individual checking, savings or brokerage account . The amount distributed is added to your taxable income, so exercise caution when youre receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Further, non-qualified funds must also be tracked because of the way that mutual funds capital gains and dividend distributions are made. At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums.

What Is An Irmaa

The Social Security Administration determines your IRMAA. This is based on information provided by the Internal Revenue Service . You could receive a notice from the SSA regarding an IRMAA at any time of the year.

If the SSA decides that an IRMAA applies to your Medicare premiums, youll receive a predetermination notice in the mail. This will inform you about your specific IRMAA and will also include information such as:

- how the IRMAA was calculated

- what to do if the information used to calculate the IRMAA is incorrect

- what to do if you had a reduction in income or a life changing event

Youll then receive an initial determination notice in the mail 20 days or more after getting the predetermination notice. This will include information about the IRMAA, when it goes into effect, and steps that you can take to appeal it.

You wont have to take any additional action to pay the surcharges associated with the IRMAA. They will be automatically added to your premium bills.

Each year, the SSA reevaluates whether an IRMAA should apply to your Medicare premiums. So, depending on your income, an IRMAA could be added, updated, or removed.

Medicare has several parts. Each part covers a different type of health-related service. Below, well break down the parts of Medicare and review whether its affected by IRMAA.

Recommended Reading: How Do I Enroll In Medicare Plan B

What Is A Medicare Cliff

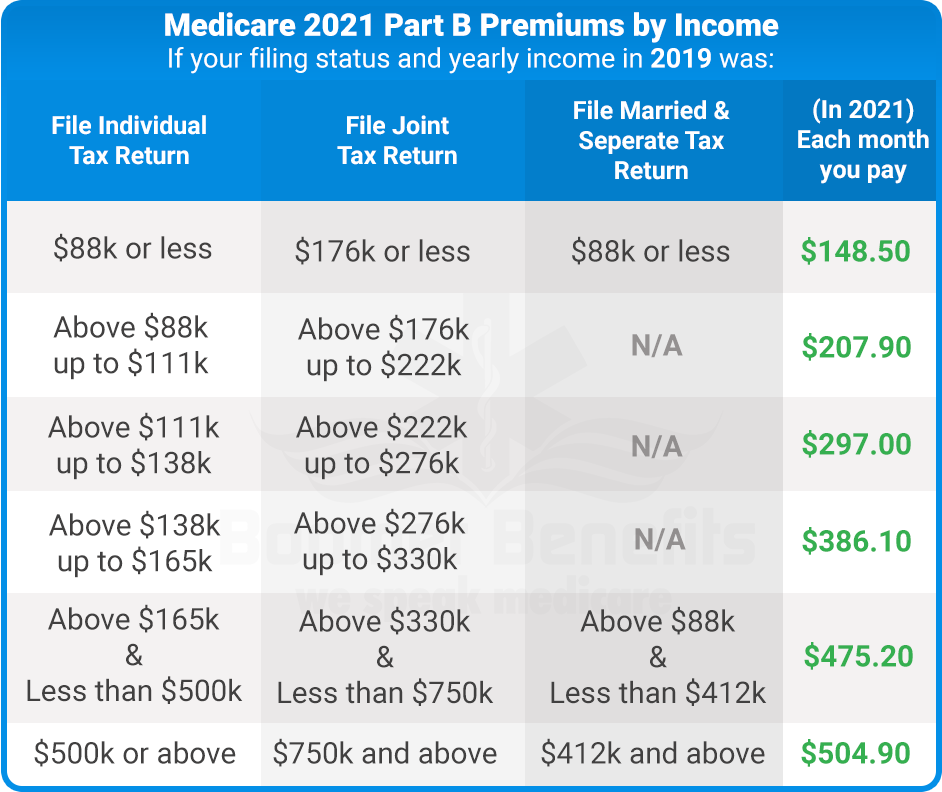

Medicare Part B monthly premiums are what you pay each month to have coverage. Premiums are based on your income level from 2 years ago. If you earn more than $88,000 as an individual, or $176,000 with your spouse, you will have to pay an income-related monthly adjusted amount on top of your Medicare Part B premium. This means that an increase in income, even as little as $1, could push you over your current income bracket for Medicare premiums. This results in a significantly higher premium. In other words, pushing you off an income-based cliff.

What Affects Medicare Advantage Premiums

Medicare Advantage premiums are primarily based on the services offered within a plan, not a policyholders income. Not all Medicare Advantage plans have premiums these plans are usually the same price as Original Medicare. Pricing can be even less than Original Medicare if a Medicare Advantage plan pays part of the standard Plan B premium amount but does not require its own premium.

However, many Medicare Advantage plans will come with an individual premium, in addition to standard Part B premiums. This amount must be paid to the insurance provider on top of any Plan B premiums owed. Medicare Advantage premiums will vary from one plan to another, as well as from one insurance provider to another. There is no standard pricing for Part C premiums.

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium. However, plans with more expansive coverage, such as those that cover hearing, vision, dental or prescription drugs, will likely have a higher premium.

Overall, how much seniors pay in Medicare premiums has two components: the income-based Plan B premium and any additional premium a Medicare Advantage provider charges. Medicare Plan B premiums are based on income, and thus the total amount owed is income-driven, but Medicare Advantage premiums are based on services.

You May Like: When Am I Required To Sign Up For Medicare

Who Has To Pay The Medicare Surcharge

Higher-income beneficiaries face the IRMAA surcharge. In this case, “high earner” refers to anyone who claimed an income greater than $97,000 per year or $194,000 per year .

There is no premium surcharge for Medicare Part A even if you do not qualify for premium-free Part A. If the Social Security Administration determines you owe the adjusted amount, the surcharge is added to your Part B and Part D premiums.

Financial Planning And Health Insurance Go Hand In Hand

If your income exceeded $97,000 in 2021, your 2023 Medicare Part D and Part B premiums depend on your income. And as you can see in the tables above, the additional premiums can be substantial.

Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. And since the government will base your premiums on your income from two years ago, youll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income.

Jae W. Oh is a nationally recognized Medicare expert, frequently quoted in the national press, including on USA Today, Dow Jones, CNBC, and Nasdaq.com, as well as on radio talk shows nationwide. His book, Maximize Your Medicare, is available in print and ebook formats. Jae has appeared as a speaker in front of libraries, companies, as part of college-sponsored programs. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states.

Don’t Miss: Are You Required To Get Medicare At 65

How Can You Protect Yourself From Increased Premiums This Year

If youre worried about increased premiums and your 2019 income tax return does not reflect your current income, you can ask the Social Security Administration to reduce or eliminate your IRMAA. Reasons the SSA will reconsider your IRMAAs include:

- Change in marital status

- Loss of pension

- Stopping work or reducing hours

Make sure to gather and submit documents to support your appeal . To appeal your IRMAAs, fill out this form or visit HHS.gov.

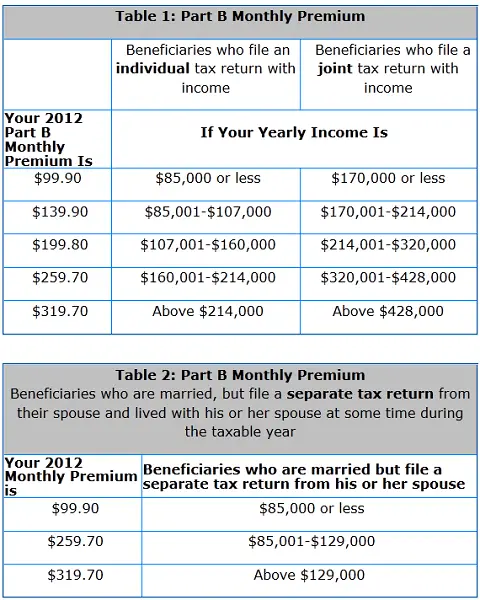

Medicare Part D Premiums. Source: Centers for Medicare and Medicaid Services.

Who Will Have To Pay The Extra Amount

When you sign up for Social Security, youll also want to sign up for Medicare. As long as you meet the age and work history qualifications, youll get Medicare Part A for free. But youll also want Part B, which covers your doctors visits and other specific medically necessary services.For Part B, youll pay monthly premiums.These Medicare payments, based on income, can change from one year to the next. In 2022, as long as your 2020 adjusted gross income was $91,000 or less, or $182,000 or less if youre married filing jointly, youll pay only $170.10 per month.

Once youve exceeded that Medicare threshold, the amount you pay depends on your income. If you earn between $91,001 and $114,000, your premium will be $238.10. It goes all the way up to $578.30, which applies to single filers earning $500,000 or more in 2020.

Be confident in your health and wealth through retirement.

Don’t Miss: How To Retrieve My Medicare Number

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.