Why A Medicare Buy

Medicare is by many measures a tremendous success story, providing health care coverage for the elderly and disabled. Before the program started in the 1960s, the elderly had great difficulty purchasing health care coverage and faced challenges accessing health care.

Medicare has largely addressed the fundamental problem of access to coverage for the age 65+ population, while keeping administrative costs down. So, expanding this program to other groups of people facing challenges accessing insurance coverage and health care is a logical idea.

Advantages of a Medicare Buy-In

- Guaranteed access and continuity of coverage. Being allowed to purchase Medicare coverage would provide long-term access to health insurance, continuity of plan and providers, and stability for many older adults.

- Better health and lower future Medicare costs. A buy-in program may actually reduce Medicare spending if it means that people have access to preventive and other services that can improve their health as they become eligible for Medicare under the traditional rules.

- Efficiency and speed of building on existing infrastructure. Medicare buy-in would build on an existing program rather than creating a new one, allowing it to be implemented more quickly than a new mechanism, such as an Exchange.

Concerns about a Medicare Buy-In

Medicare Typically Bills In 3

Medicare helps pay for a variety of healthcare services, but it isn’t free. Beneficiaries are responsible for a variety of Medicare costs, including monthly premiums, deductibles, and coinsurance or copayments.

Most Medicare beneficiaries collect Social Security benefits. For these enrollees, Medicare premiums are deducted from their monthly Social Security check. But if you haven’t retired yet, you have to pay your bill directly to Medicare. Or, if you’re what Medicare terms a high earner, you may pay more for Medicare. This page looks at a number of reasons your first Medicare bill may be higher than you expected.

The Task Force On Prescription Drugs

Soon after Medicare was implemented, unexpected increases in the programs spending on hospital and physician services drew the attention of officials in the U.S. Department of Health, Education and Welfare and the White House. The particular policies that contributed to the early and rapid rise of Medicare expenditures were the cost-based reimbursement of hospitals and the payment of physicians based on customary, prevailing, and reasonable charges . When President Johnson was faced with proposals to expand Medicareprecisely what its original supporters had anticipatedit seems likely that he did not want to add even more to the programs rapidly rising costs. In the fall of 1967, for example, he would not agree to support a proposal, called KiddyCare, from HEW to provide Medicare coverage for pregnant women and children .

The task force found that all out-of-hospital prescription drug use, prices, and expenditures had risen rapidly between 1950 and 1965. The number of prescriptions had climbed from 363 million in 1950 to 833 million in 1965 to 930 million in 1967. The number of prescriptions per capita had almost doubled from 2.40 to 4.75, and expenditures had risen from $736 million in 1950 to $3.25 billion in 1967. Moreover, the burden of prescription drug use fell disproportionately on the elderly, who incurred 47 percent of the total costs .

Also Check: How To Check Medicare Deductible

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

TTY 711, 24/7

A closer look at 2021 data also reveals:

- Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

- All states except for Alaska offer at least one $0 monthly premium Medicare Advantage plan. $0 premium plans may not be available in all locations within each state.

In addition to premiums, many Medicare Advantage plans typically include some out-of-pocket expenses. These can include plan deductibles, copayments or coinsurance and an out-of-pocket spending maximum.

Compare Medicare Advantage Plans In Your Area

If you have questions about you Part B premium or would like to learn more about how a Medicare Advantage plan can help you save on your health care costs, call to speak with a licensed insurance agent today.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

Read Also: Can You Have Humana And Medicare

If Your Income Has Gone Down

If your income has gone down and the change makes a difference in the income level we consider, contact us to explain that you have new information. We may make a new decision about your income-related monthly adjustment amount for the following reasons:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Will Medicare Cover Hearing Devices In The Future

The number of people questioning Does Medicare cover hearing aids? and Why doesnt Medicare cover hearing devices? is rising. And organizations and lawmakers are taking notice. The Medicare Hearing Aid Coverage Act of 2021-2022 and other similar legislation could expand hearing aid coverage if passed.

Don’t Miss: What Is Troop In Medicare

Pain And Complications Of Shingles In Elderly People

Older adults who develop shingles are often surprised at how painful it is. Many say that it is far more painful than the original chickenpox virus that affected them in childhood. Often the skin in the area of the rash continues to hurt even after the rash has healed.

The individual may feel stabbing or throbbing or even weakness. Doctors call this post-herpetic neuralgia, and it can sometimes last for months or even years.

There are also risks for older adults who develop shingles. The blistered area of skin can become infected, requiring antibiotics in addition to antivirals. Such infections can lead to scarring. The rash is also uncomfortable and makes it challenging to rest. When healing takes longer than usual, some individuals can feel despair or even depression. In rare cases, it can lead to encephalitis.

The virus can also be transmitted to other parts of your body, such as your eyes or lips. The herpes virus can cause outbreaks that may affect hearing and vision.

Another thing to be concerned about is contagion. While shingles itself is not contagious, the virus that causes it is. If your spouse has never had chickenpox and has not been vaccinated, he or she could develop chickenpox as an adult. Its important to keep your skin clean and dry and prevent it from rubbing against any other person who could get infected.

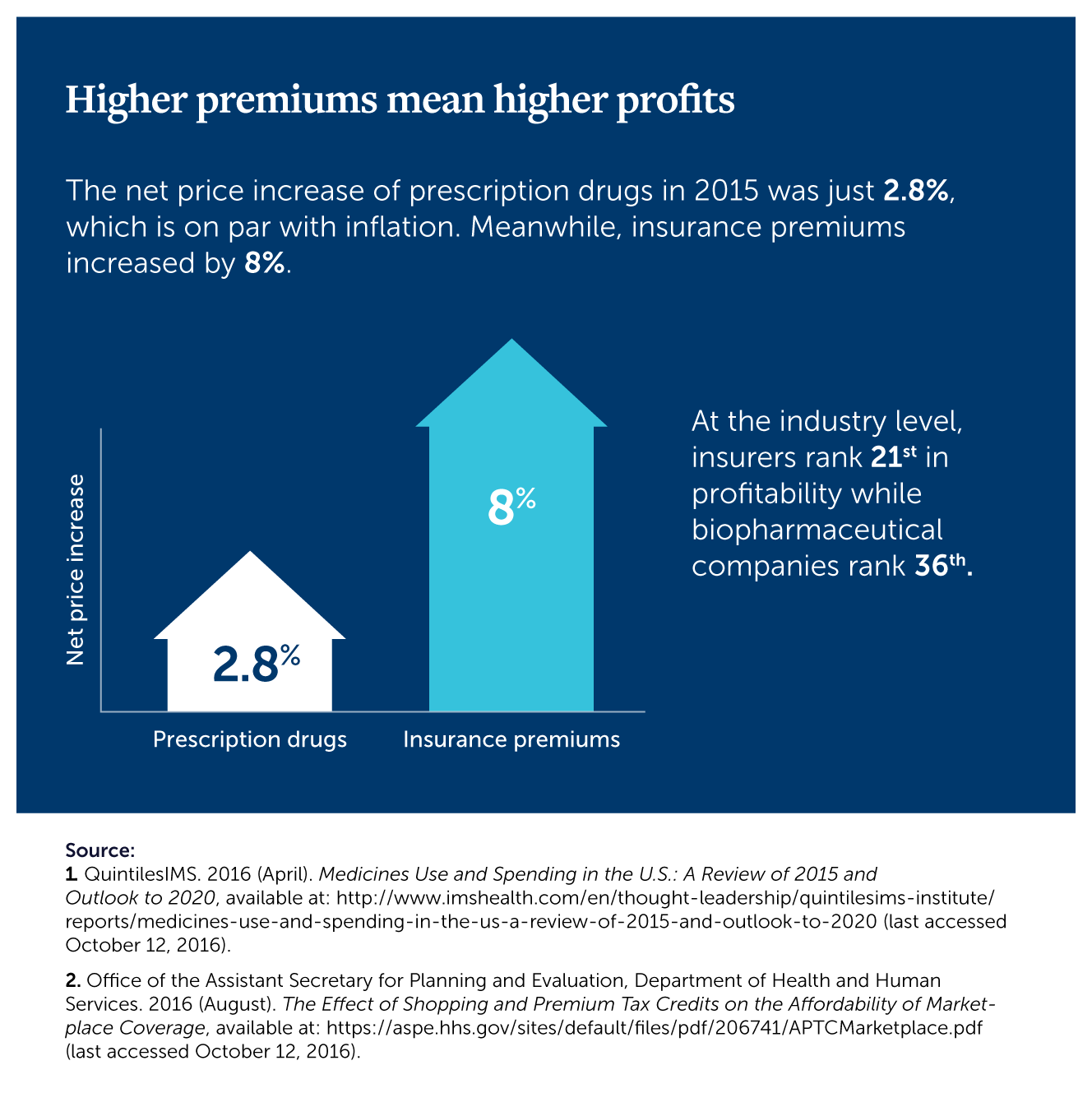

Pharmaceutical Drugs In The Retail Setting

Under the Medicare Modernization Act of 2003, which established the Part D benefit that pays for drug purchased from pharmacists, the federal government is prohibited from negotiating or setting prices on behalf of Part D beneficiaries.51 Because of this, Medicares prices for pharmaceutical drugs arent necessarily lower than those in the commercial market. For the sake of comparison, the Department of Veterans Affairs , which can negotiate prices for prescription drugs, pays 40 percent less than Medicare for prescription drugs. Researchers estimate that the Medicare program would have saved $14.4 billion in 2016 if Part D used VA prices.52

Large employer spending on prescription drugs is more akin to Medicare Part D spending. For example, large employers spent $1,134 on average, per user on etanercept in 2016, while Part D , spent $1,610.53 This makes sense, as a higher percentage of Part D beneficiaries had high prescription drug out-of-pocket costs compared to people covered through a large employer. Another analysis revealed minimal spending differences between private insurers and Part D. The top 10 most expensive drugs constituted 18 percent of private spending and 17 percent of Part D spending in 2017.54 For these reasons, Part D drug prices may not serve as a good benchmark for reining in pharmaceutical prices.

Read Also: How Is Medicare Part B Financed

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

Does Medicare Cover Hearing Aids Final Thoughts

If you are struggling with hearing loss as you age, you should know that a hearing aid device is a worthy investment. It will help you restore your hearing and improve your life overall. However, these devices come with a hefty price tag. Having insurance that could offer some help footing the bill goes a long way.

Unfortunately, Medicares Original plans wont be able to provide any help with the cost of the device or the accompanying exams. Medicare Advantage plans, like Plan C, offer hearing aid coverage. While the amount isnt high , its still better than anything, so be sure to look into your options and enroll on time to be eligible.

You May Like: Does Medicare Advantage Pay For Hearing Aids

What Everyone Should Know About The Shingles Vaccine

Shingles vaccination is the only way to protect against shingles and postherpetic neuralgia , the most common complication from shingles.

CDC recommends that adults 50 years and older get two doses of the shingles vaccine called Shingrix to prevent shingles and the complications from the disease. Adults 19 years and older who have weakened immune systems because of disease or therapy should also get two doses of Shingrix, as they have a higher risk of getting shingles and related complications.

Your doctor or pharmacist can give you Shingrix as a shot in your upper arm.

Shingrix provides strong protection against shingles and PHN. In adults 50 years and older who have healthy immune systems, Shingrix is more than 90% effective at preventing shingles and PHN. Immunity stays strong for at least the first 7 years after vaccination. In adults with weakened immune systems, studies show that Shingrix is 68%-91% effective in preventing shingles, depending on the condition that affects the immune system.

What Are The Complications Of Shingles

The most common and lasting complication of shingles is nerve pain, whats called postherpetic neuralgia , which can last for months or even years, long after the rash has cleared up. According to the CDC, between 10% and 18% of people whove had shingles will develop PHN.

PHN is a stabbing or throbbing pain or weakness where the shingles rash had been. The risk increases with age and the pain lasts longer and is more severe than in younger people.8

In rare cases, shingles can develop into pneumonia, hearing problems, blindness and brain inflammation.9 Only 1% to 4% of people with shingles are hospitalized for complications, though these are typically older adults and people whose immune systems are weak or suppressed, and fewer than 100 people die from shingles each year.10

Also Check: Do You Have To Resign Up For Medicare Every Year

How Much Will Medicare Pay For Hearing Aids

Original Medicare plans dont cover hearing care or hearing aids, and the program is pretty clear about that on its website . However, some other Medicare options, like the Advantage plans, may cover the cost of your hearing aids. In such cases, the Medicare-approved amount usually isnt enough to cover the entire cost of the devices.

When the program does cover hearing devices, it usually covers around 30% of the cost. That means if the hearing aids youre considering cost $2,000, the insurance provider will pay about $600. You would have to pay the remaining $1,400 out-of-pocket.

Does Medicare Cover The Shingles Vaccine Will I Have To Pay For The Shot

The CDC recommends people 50 years and older get the shingles vaccine. The shot is widely available and the cost may be covered if you have Medicare Advantage or Medicare Part D. Depending on your plan, you may have to cover a deductible, co-pay, or pay for the shot out of pocket and get reimbursement.

Shingles can cause serious complications, like painful long-term nerve damage. To stay safe from such complications, you may want to consider the new shingles vaccine . An older vaccine once widely administered in the U.S. was less effective and is no longer on the market.

Recommended Reading: How To Figure Shingles Needed

Don’t Miss: When Can You Start Medicare

Will There Be Any Side Effects From The Shingles Vaccination

There are 2 shingles vaccines: Zostavax and Shingrix .

With both vaccines its quite common to get redness and discomfort at the vaccination site, headaches and fatigue, but these side effects should not last more than a few days. See a GP if you have side effects that last longer than a few days, or if you develop a rash after having the shingles vaccination.

Read more about the shingles vaccine side effects.

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker. A range is given since costs can vary.

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

Don’t Miss: How To Appeal Medicare Part B Late Enrollment Penalty

Ways To Pay Your Medicare Premium Bill

There are four ways to pay your Medicare Premium Bill:

- Sign up for Medicare Easy Pay, which allows Medicare to automatically deduct your premiums from your personal savings or checking account.

- Through your MyMedicare.gov account. If you don’t have one, create one here. This is the easiest way to make sure Medicare always has your most up-to-date information and answer common Medicare questions.

- Use your personal checking or saving account’s online bill pay service.

- Pay your bill via U.S. mail, using the payment coupon included with your Medicare Premium Bill. Payment options include check, money order, credit card, or debit card.

For more information on paying your Medicare premiums, go to Medicare.gov.

Medicare Part D Costs And Tiered Formularies

Tiered formularies are another way insurers keep costs low. Under a tiered formulary system, plans place different medications in different price categories, or tiers. Copayments or coinsurance amounts are generally lowest in the bottom tiers, and get more expensive as you move into higher tiers.

Although each Medicare Part D Prescription Drug Plan arranges its price tiers differently, most use some version of the four-tier structure:

- Tier 1 is generally for low-cost generic drugs these usually have very low copays or coinsurance percentages.

- Tier 2 is for preferred brand-name medications and non-preferred generic drugs these have a low-to-moderate copayment or coinsurance amount.

- Tier 3 is for non-preferred brand-name prescription drugs and has moderate-to-high copayments.

- Tier 4 is for the most expensive specialty drugs these drugs have high to very high copayments.

Hereâs how your Medicare Part D costs can vary even within the same planâs formulary. For example, you may have a $0 copayment for your generic high blood pressure medicine, but make a $45 copayment for your brand-name diabetes medication. If your doctor prescribes a brand-name drug in a higher tier, ask about generic alternatives to lower your costs.

You May Like: Does Medicare Cover Grab Bars