Each Medicare Plan Is Costing More In 2022 Meaning You Will Need To Pay A Greater Deductible Before You Can Access The Care You Need

The announced increase in the price of Medicare deductibles is here, and it’s not good news for those already under pressure from the cost of living squeeze.

The deductibles for Part A and Part B are both increasing, as well as a whole host of other aspects of Medicare. This refers to the amount someone is expected to pay before their Medicare coverage helps them. The higher it is, the more you have to pay.

Medicare Part A Costs

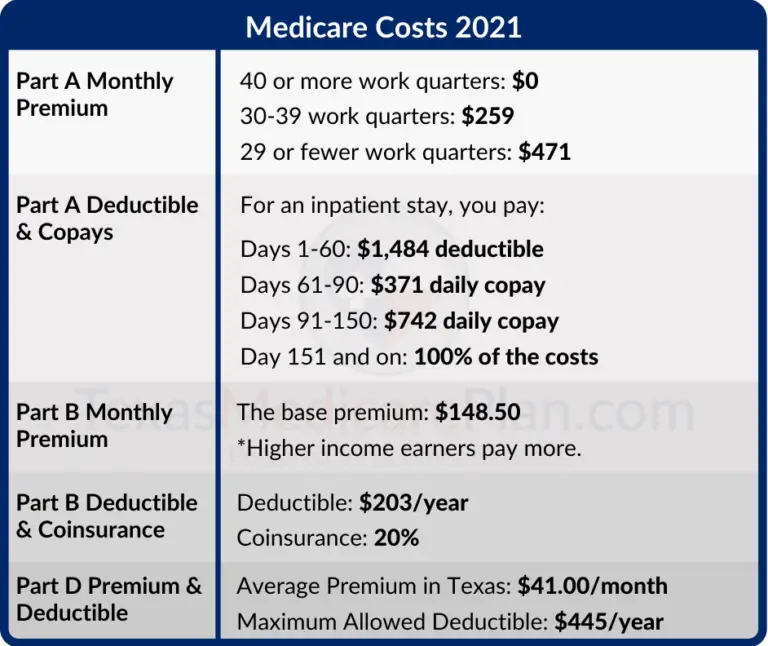

For Part A, there are also costs both for coverage and for services. Unlike with Part B, though, most people dont pay a monthly premium for Part A. Instead, you pay for this coverage during your working years through payroll taxes. If you work long enough , youll be able to claim Part A without paying a monthly premium.

If for some reason you dont qualify for premium-free Part A, you have the right to sign up anyway and pay a monthly premium.

When you actually use your Part A benefits, youll have to pay a share of the cost. These costs come mainly in two forms for the most common Part A services:

- Part A deductible

- Part A co-insurance

For 2022, the Part A deductible is $1,556 . This amount also increases each year. Once youve paid the Part A deductible, youre covered for fairly long term hospital or skilled nursing home stays. Youll have to pay a daily co-payment if your stay exceeds:

- 60 days of hospital stays

- 20 days of skilled nursing care

We mentioned before that the Part A deductible works differently than the Part B deductible although rare, it is possible to pay the Part A deductible more than once in a year. This fact brings us to the most important thing you need to know about your out of pocket spending under Medicare: there is no annual cap on how much you can spend. This is a major deficiency in Original Medicare, and perhaps the primary reason that most people elect to enroll in a private Medicare Insurance plan to work with their Medicare benefits.

What Kinds Of Out

Medicare Part C, or Medicare Advantage plans do have a few low out-of-pocket costs to keep in mind:

- Monthly Medicare Advantage premiums vary from plan to plan, but some start at $0!

- You can find out the copayment or coinsurance information before you sign up for the Medicare Advantage plan as they may be different for Medicare Advantage and Original Medicare plans.

- Medicare Advantage does have out-of-pocket maximums that vary on the amount between each plan.

- Some Medicare Advantage plans have separate deductibles for medical care and prescription drugs. If your Medicare Advantage plan has a network, only in-network care may apply towards the deductible.

Also Check: Is Shingrix Vaccine Covered By Medicare

Why The Hospital Benefit Period Matters For Your Part A Deductible

With Medicare Part A, you could end up paying the deductible more than once a year if you have multiple hospitalizations that fall in different hospital benefit periods.

For example, if you complete your three-day hospitalization on June 3 but are readmitted to the hospital on Aug. 10, more than 60 days after you were discharged on June 3, you will have to pay the Part A deductible again because you are in a new hospital benefit period.

Deductibles For Original Medicare

Medicare premiums, deductibles and coinsurance rates for Original Medicare are adjusted each year. Original Medicare includes Medicare Part A hospital insurance and Part B medical insurance. Each has different deductibles.

You can find out if youve met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

You May Like: Does Medicare Pay For Revitive

What Our Clients Are Saying About Us

-

Dianna Firth has helped me for years with my Medicare supplements. She is very thorough and has saved me a ton of money, finding the best rate for me. She has provided me with an education of the different plans and benefits that I could not have gotten elsewhere. I highly recommend her and Medisupps.com!

Maureen T.Austin, TX

Read Also: Does Medicare Supplement Cover Drugs

How Much Does Medicare Part B Cost

Medicare consists of several different parts, including Part B. Medicare Part B is medical insurance and covers medically necessary outpatient care and some preventative care. Together with Medicare Part A , it makes up whats called original Medicare.

If youre enrolled in Part B, youll pay a monthly premium as well as other costs like deductibles and coinsurance. Continue reading to take a deeper dive into Part B, its costs, and more.

Also Check: Who Can Help With Medicare Enrollment

Who Is The Largest Medicare Advantage Provider

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Do You Have To Pay A Deductible With Medicare

Youve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

If you have Original Medicare , you will have deductibles that must be paid, either by you or your Medigap plan.

If you prefer not to pay deductibles, considering a Medicare Advantage Part C plan may make sense.

Part C and Part D plans may or may not have annual deductibles. And while you are still responsible for your Part B deductible if you switch to a Part C plan, some Part C plans help pay your Part B deductible.

Check with your plans provider to find out if the plan youre interested in has a deductible of $0 or more. And, if you need our help, just reach out. GoHealth is here for you.

Recommended Reading: What Is Medicare Part B Monthly Premium

What Is The Maximum Cost Of Medicare Part B

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that’s for individuals reporting half a million dollars or more in income in 2020.

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Read Also: Are Canes Covered By Medicare

Can Medicare Part D Be Deducted From Social Security

You can have your Part C or Part D plan premiums deducted from Social Security. Youll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

Do prescriptions go towards your deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plans designated amount. This doesnt mean your prescriptions will be free, though.

What Caused Cei Stock To Drop

Do I need Medicare Part D if I dont take any drugs? Even if you dont take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What Medicare drug plan does not have a deductible? Medicare sets a limit on the total Part D deductible amount. The maximum Medicare Part D deductible in 2022 is $480. Some Medicare Part D prescription drug plans do not have a deductible. If you do have a deductible, you will pay the full price for your medications until your deductible is met.

Recommended Reading: How To Qualify For Medicare Disability

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Additional Charges For 2021

- Bands of income

- In 2021, Medicare will adjust income limits. Your income levels impact a lot of concerns, such as your tax rate and Medicare costs.

- In 2007, income categories were established. Individuals incomes began at $85,000, and couples incomes began at $170,000. That threshold will be $88,000 for individuals and $176,000 for couples in 2021.

Read Also: Does Plan N Cover Medicare Deductible

What Is The Medicare Part D Deductible For 2022

For 2022, the maximum deductible for Medicare Part D is $480. When you enroll in a Part D plan, youll receive a summary of benefits. This is where you can find your deductible amount. Youll also receive a monthly explanation of benefits when you file a claim or pick up a prescription. Your EOB will include how much of your annual deductible has been met thus far.

Did The Medicare Part B Deductible Increase For 2022

Q: Did the Medicare Part B deductible increase for 2022?

A: Yes. The Part B deductible increased by $30 for 2022, to $233.

The deductible for Part B was steady at $147 from 2013 to 2015 . It then increased to $166 in 2016 far less than the $223 it would have been without the budget that Congress passed in November 2015, which included a loan for Medicare.

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203. And for 2022, the increase was fairly significant, pushing the deductible to $233.

The larger-than-average increase in the Part B deductible and premiums for 2022 was due in part to uncertainty about how Aduhelm, a new Alzheimers medication, might affect Part B spending.

Recommended Reading: Do You Have To Work To Get Medicare

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

Medicare Part D Costs In 2022

Medicare Part D may be worth considering if youre taking prescription medication on a regular basis when you reach retirement age.

You can choose from two options to get prescription medication coverage. You can either sign up with a private insurance company that you can compare on the Medicare website, or you can get prescription drug coverage through your Part C program.

Like Part C, each plan has different coverage, deductible, and copayment options. Part D is generally included in your plan premium, but unmarried individuals with reported incomes of more than $91,000 pay an additional amount in 2022. This threshold increases to $182,000 for married filers of joint tax returns. The average Part D premium is $33 per month.

Make sure that it covers the drugs you take in one of the lower tiers before you sign up with a company. It will help keep your costs under control.

Other types of benefits, insurance, and social services can sometimes influence Part D benefits.

You must have Medicare Part A and/or Part B or Part C to enroll in Part D.

Recommended Reading: How To Get Dental With Medicare

Medicare Part C Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage. Medicare Advantage plans are required by law to cover everything found in Medicare Part A and Part B, and many Medicare Advantage plans may typically include benefits not covered by Original Medicare such as dental, vision, hearing, prescription drugs and more.

Medicare Advantage plans are sold by private insurance companies and dont have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs.

Medicare Premiums And Deductibles: What Youll Pay In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The costs and deductibles associated with the different parts of Medicare may change each year. The Centers for Medicare & Medicaid Services, or CMS, releases the new costs for Medicare Parts A and B and income-related monthly adjustment amounts every fall for the following year.

Medicare is the federal government health insurance program for people age 65 and older and younger people living with certain illnesses or disabilities. Medicare comes in four parts Part A, Part B, Part C and Part D. Theres also Medigap, or Medicare Supplement Insurance, which is an optional add-on to Original Medicare.

Below are Medicares premiums and deductibles for 2022.

Read Also: Is Oral Surgery Covered Under Medicare

Cost Sharing For Medicare Part A

Once youve paid your Part A deductible, Medicare will pay your costs for a set number of days before you have to pay anything for Part A services. Paying your deductible allows you to stay:

- 60 days in the hospital

- 20 days in skilled nursing care

When you have stays lasting longer than that, youll be responsible for paying a daily co-payment according to this schedule:

- $389 per day for hospital stays longer than 60 days, up to 90 days

- $194.50 per day for skilled nursing care stays longer than 20 days, up to 100 days

If your health requires you to stay in a facility longer than that, youll then face these charges:

- $742 per day for hospital stays longer than 90 days, as long as you have lifetime reserve days available

- Full cash price for skilled nursing facility stays longer than 100 days

If youve used up all of your lifetime reserve days, but still need to stay in the hospital, youll be responsible for the full cash price.

Note that these are the costs for a specific benefit period. If you had a 65 day hospital stay, lasting from January into March, youd pay the Part A deductible and five days of co-insurance. If you go back to the hospital in September, youd pay the Part A deductible again, but youd also get 60 more days you wouldnt pay co-insurance again unless you stayed longer than 60 days again.

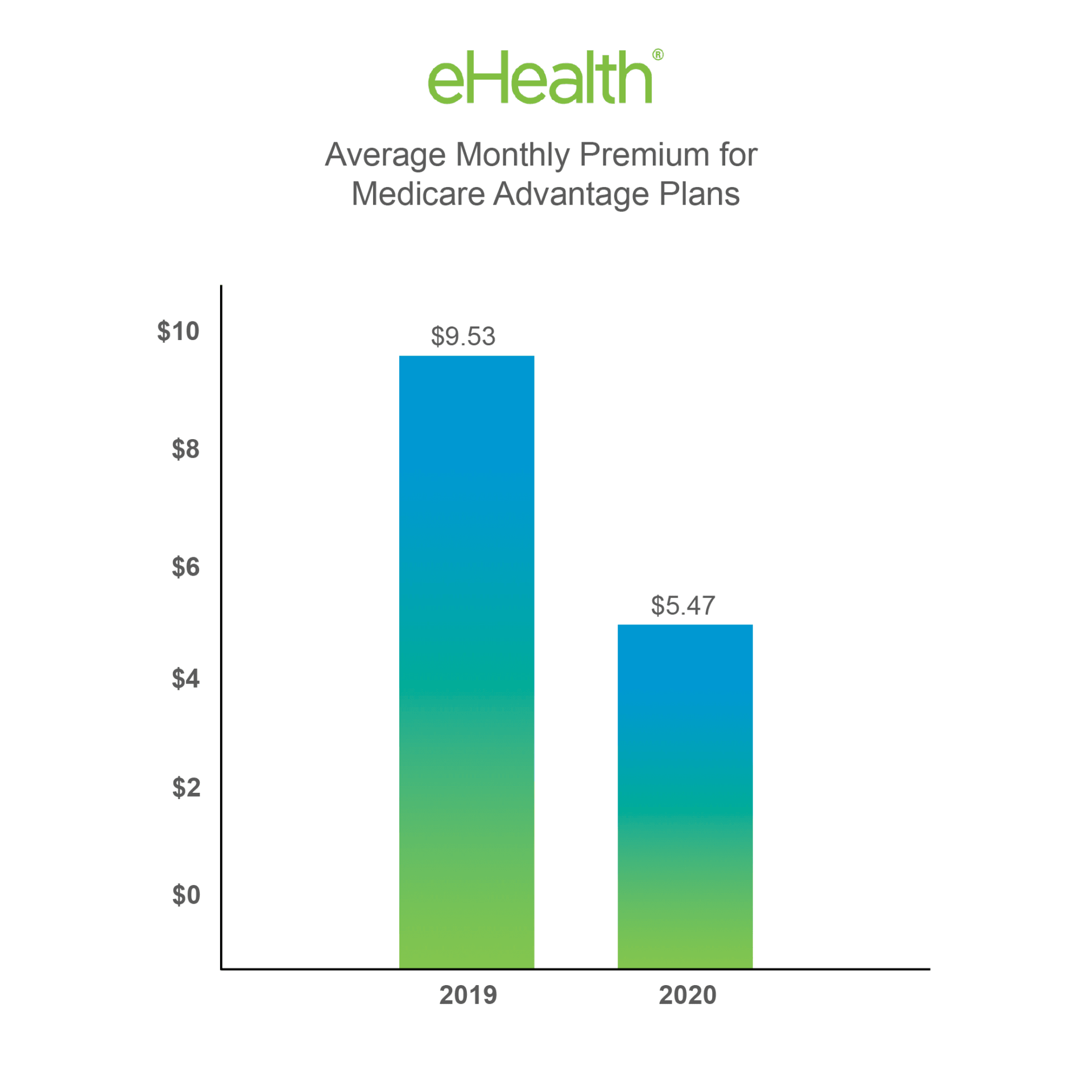

Premiums Paid By Medicare Advantage Enrollees Have Declined Since 2015

In 2022, the average enrollment weighted MA-PD premium, including among those who do not pay a premium, is $18 per month. However, average MA-PD premiums vary by plan type, ranging from $16 per month for HMOs to $20 per month for local PPOs and $49 per month for regional PPOs. Nearly 6 in 10 Medicare Advantage enrollees are in HMOs , 38% are in local PPOs, and 3% are in regional PPOs in 2022. Regional PPOs were established to provide rural beneficiaries with greater access to Medicare Advantage plans.

Average MA-PD premiums have declined from $36 per month in 2015 to $18 per month in 2022. The reduction is driven in part by the decline in premiums for local PPOs and HMOs, that account for a rising share of enrollment over this time period. Since 2015, a rising share of plans are bidding below the benchmark, which enables them to offer coverage without charging an additional premium. More plans are bidding below the benchmark partly because Medicare Advantage benchmarks relative to traditional Medicare have increased over time, and when benchmarks increase, plans are able to keep more for Part A and B services as well as for extra benefits. Further, rebates paid to plans have increased over time, and plans are allocating some of those rebate dollars to lower the part D portion of the MA-PD premium. Together, these trends contribute to greater availability of zero-premium plans, which brings down average premiums.

Don’t Miss: How To Be Eligible For Medicare And Medicaid

How Do I Apply For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. If you are not collecting Social Security benefits, you will need to enroll yourself. You can apply for Medicare Part B online, over the phone, or in person.

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll in the future.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today