What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

If Your Income Has Gone Down

If your income has gone down and the change makes a difference in the income level we consider, contact us to explain that you have new information. We may make a new decision about your income-related monthly adjustment amount for the following reasons:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

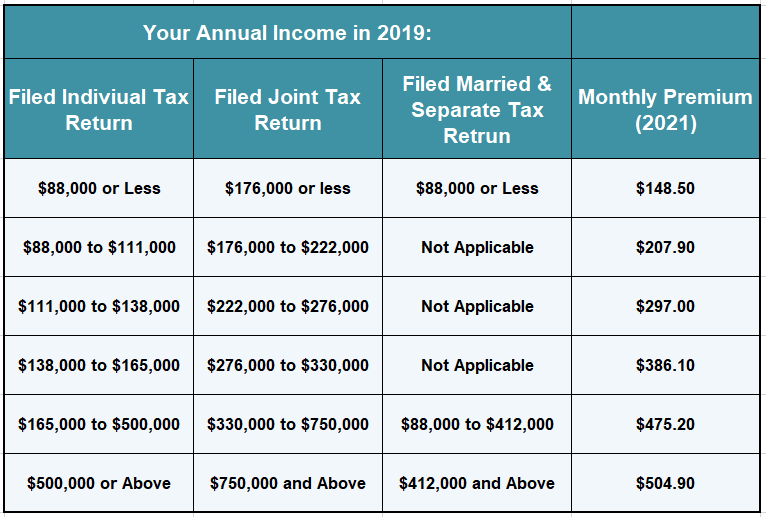

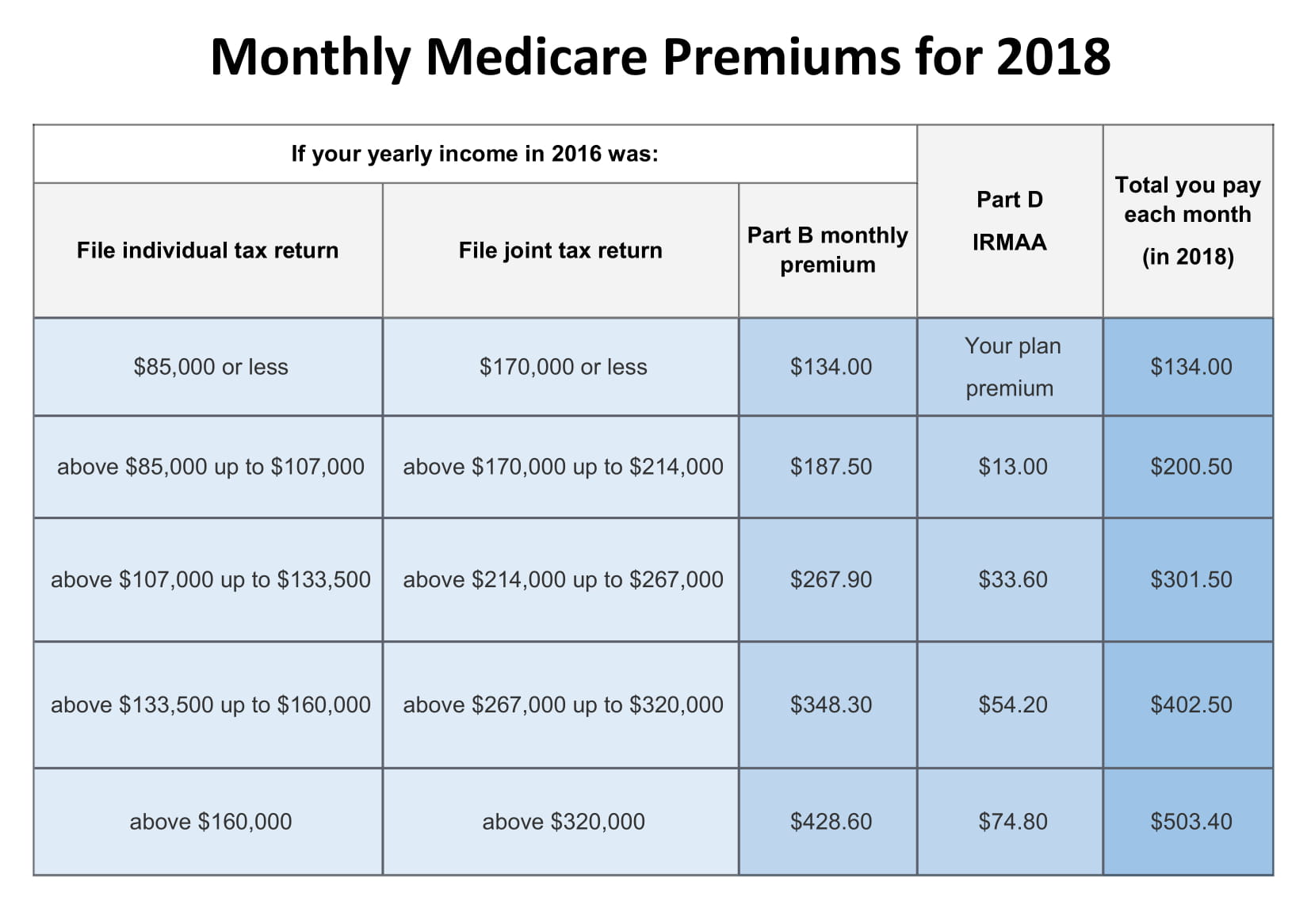

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

You May Like: How To Sign Up For Aetna Medicare Advantage

Unearned Income Medicare Contribution Tax

There is also an additional tax on unearned income, such as investment income, for those with AGIs higher than the thresholds mentioned above. It is known as the unearned income Medicare contribution tax or the net investment income tax . Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans. It also applies to passive income from taxable business activity and to income earned by day traders.

This tax is applied to the lower of the taxpayers net investment income or modified AGIexceeding the listed thresholds. This tax is also levied on income from estates and trusts with income exceeding the AGI threshold limits prescribed for estates and trusts. Deductions that can reduce the amount of taxable net investment income include early withdrawal penalties, investment interest and expenses, and the amount of state tax paid on this income.

When the NIIT legislation was enacted in 2010, the IRS noted in the preamble to its list of regulations that this was a surtax on Medicare. The Joint Committee on Taxation specifically stated: “No provision is made for the transfer of the tax imposed by this provision from the General Fund of the United States Treasury to any Trust Fund.” This means that the funds collected under this tax are left in the federal government’s general fund.

Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Filing Individual Tax Returns Total Monthly Part B Premium

$91,000 or less

Total Monthly Part B Premium

$170.10

$544.30

$578.30

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

| Total Monthly Part B Premium |

|---|

|

$91,000 or less |

$91,000 or less

Total Monthly Part B Premium

$170.10

Also Check: When Should I Sign Up For Medicare

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

How Much Does Medicare Part A Cost

For the vast majority of Medicare beneficiaries, Part A will have a zero-premium. This is called premium-free Part A. This was paid as tax deductions from your paycheck throughout your working years. If you did not work at least 10 years, sometimes referred to as 40 quarters, you will pay for your Part A.

The cost for Part A will depend on how many quarters you worked and paid into the Medicare system. If you have not worked or paid in at all, youll be responsible for the entire $499 a month. For those who worked at least 30 quarters, your monthly premium will be $274 monthly.

If you did not work, but your spouse worked 40 quarters, you may also qualify for a zero-premium for Part A.

Part A hospital insurance costs include a per benefit period deductible and a fixed daily cost once you hit your 61st day in the hospital. From days 61 to 90, there is a per-day copay of . If you use up your lifetime reserve days youll pay each day in the hospital thereafter.

| Days | |

|---|---|

| $778 | 100% |

If you need skilled nursing, youll not have to pay for the first 20 days. Youll have a per day copay from days 21 through 100 of $194.50 a day. There is no coverage for days 101 or after.

You May Like: Is Everyone Eligible For Medicare At 65

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

Medicare Part A : Out

Most people don’t need to pay monthly premiums for Part A. You won’t pay a premium if you or your spouse paid Medicare taxes for at least 10 years while working.

However, you will need to help cover the cost of some fees when you receive care. These expenses come in the form of deductibles and copayments.

If you are admitted to the hospital, you should expect to pay the following:

A deductible is the amount you pay before your insurance pays.

For Part A , the deductible is $1,556 per benefit period.1

Don’t Miss: Do Most Doctors Accept Medicare Assignment

Medicare Costs In 2022

Get A Free Medicare Quote

Original Medicare is health insurance for Americans aged 65 and older, or under 65 with certain health conditions. Today well discuss the different cost-sharing associated with the different parts of Medicare. After that, well go over some frequently asked questions. Finally, well cover how to get help with Medicare plans to offset some of the costs associated with Medicare.

How Much Does Medicare Cost In 2022

- Part A: Most people can get Medicare Part A for a zero-dollar premium.

- Part B: Medicare Part B has a standard monthly premium of $170.10 in 2022.1

- Part C: Medicare Part C has an average monthly premium of $19 in 2022.2

- Part D: Medicare Part D stand-alone plans are projected to have an average monthly premium of $33.3

There are four different parts of Medicare labeled A and B , C , and D . Each comes with its own set of expenses.

Lets take a closer look with a detailed breakdown of the costs associated with each part of Medicare.

You May Like: Does Costco Take Medicare For Hearing Aids

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

How Much Does Medicare Part C Cost Per Month

You may be surprised how affordable Plan C coverage can be.

Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A , Part B , and prescription drug coverage, Medicare Advantage plans allow you to bundle your coverage together into one simple insurance plan.

However, Medicare Part C isnt run by the government, so youll have to pay for Medicare Advantage plans. How much does Medicare Part C cost per month? While your actual cost is dependent on several factors, you may be surprised by how affordable Medicare Advantage Plans can be. According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020.

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans.

While the average cost for Medicare Part C is $25 per month, its possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.

However, prices for Medicare Advantage plans can range widely. According to the National Council on Aging, plans can range from $0 to $270 per month. How much youll pay is dependent on your MA plan type.

In general, the lower your deductible, the higher your premium will be.

Read Also: Does Medicare Cover Ct Scans

Medicare Part D Prescription Drug Plans

Like Part C plans, Part D plans are also offered by private insurance companies. Part D plans offer prescription drug coverage, and you can purchase them if you have Original Medicare or a Medicare Advantage plan that doesnt cover prescription drugs.

Like Part C, Part D premiums will vary, and you will have to get a quote to check the price. However, Part D plans also have something known as the Income-Related Monthly Adjustment Amount, or IRMAA. This is an amount that you will pay to the federal government each month in addition to your monthly premium, depending on your income.

See the chart above to see what surcharge you owe for Part D if you’re a high-earner.

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Recommended Reading: How Do I Get Dental And Vision Coverage With Medicare

You May Like: How Can A Provider Check Medicare Eligibility

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

How Much Does Medicare Part C Cost

Part C is also called Medicare Advantage. If you elect to enroll in a Medicare Advantage plan, itll take over your Medicare Parts A, B, and in most cases D. These all-in-one plans are another way to receive your Medicare Benefits. You must continue to pay your Part A and B costs in order to enroll in Part C.

The costs for Medicare Part C will vary depending on where you live. In many areas, there are options with a zero-dollar plan premium. But they can also be more than $100 a month.

In addition to the premium amount, you can expect to pay co-pays, deductibles, or coinsurance depending on the service. Since these plans arent standardized all coverage and costs could be different. Be sure to review your summary of benefits from the plan to ensure you know the costs.

Recommended Reading: Does Medicare Cover Foreign Travel Emergencies

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Is It Possible To Keep My Doctor On Medicare

If you have Medicare Part B coverage, you can go to any health care provider who takes Medicare and is taking new Medicare customers. You should inquire with your doctor about becoming a new Medicare patient.

However, not all providers accept Medicare as payment in full. Medicare divides healthcare providers into three categories:

Accepting Medicare and Medicare-approved payment for services: They accept Medicare and Medicare-approved payment for services.

Nonparticipating: They accept Medicare but may charge more for services than Medicare allows.

Opt-out: They do not take Medicare and patients are responsible for all medical expenditures.

Read Also: Does Medicare Pay For Orthotics

Medicare Costs For Medicare Part B

Your Medicare Part B premium is part of your Medicare cost. The base Medicare Part B premium in 2022 is $170.10. However, that cost is based on your monthly adjusted gross income from the last two years. This can be found on your tax return. If your income exceeds a specific threshold, the standard Medicare Part B cost increase. Thus, higher earners have higher monthly premiums. This is known as IRMAA.

The Income Related Monthly Adjustment Amount is a predetermined amount added to your monthly Medicare Part B premium based on your income bracket from two tax returns ago.

So, you may be wondering How much does Medicare cost if I exceed the threshold? To see if your annual income will necessitate a higher premium, refer to the IRMAA chart below for Part B premiums.

Get A Free Quote

| $409,001 + | $587.30 |

If you are assessed an IRMAA charge as part of your Medicare costs and recently had a decrease in income due to an event such as retirement or the loss of your spouse, you can file an IRMAA appeal for your local Social Security department to review.

Along with the monthly premium, you will want to be aware of the Medicare Part B deductible. For 2022, the Medicare Part B deductible amount is $233. This means, you will need to pay the first $233 of your health care costs out-of-pocket before your Medicare Part B benefits will kick in.