So How Do I Decide Which Company To Choose

Selecting a company can be confusing, but there are two factors that can help you narrow down your decision. We recommend that you check the AM Best ratings for the companies you are comparing to ensure that the company has a positive standing, and then select the company that offers the lowest premium. To make this process easier for you, GoMedigap agents only work with top-rated companies, and we pride ourselves in finding low premiums for our clients.

Recommended Reading: When Is Open Enrollment For Medicare

Why Should I Enroll In A High

High-deductible Plan F policies usually have lower premiums than standard Plan F policies. As a result, if you need or want to keep your monthly payments to a minimum, this might be your best option as far as Medicare Supplement policies are concerned.

Just know that youll have to deal with higher out-of-pocket costs if you get sick or otherwise need medical care. Given that, people who are fairly healthy are the best candidates for high-deductible Medigap Plan F coverage.

Medical Expenses For People Who Are Permanently Disabled

If youre incapable of performing everyday tasks due to an accident or disability, Medicaid will cover various medical treatments and supplies needed to keep you alive. Benefits vary depending on the severity of your impairment and how much money your spouse receives in social security benefits. For example, if you or your spouse meets one of the Social Security Administrations criteria for permanent disability, they could get up to $4,100 in monthly cash benefits. That amount increased yearly until 2016, when it reached $2,000 per month. For example, if you meet the requirements and your annual household income was between $50,250 and $62,500 before taxes in 2017, youd get approximately $11,300 in benefits annually.

If you qualify for Medicare but dont know where to start, we have licensed insurance agents ready to answer your questions and help you enroll in Medicare Advantage, Medicare Supplement Insurance, and Prescription Part D plans. Or call 1-855-980-4104

Don’t Miss: Can You Get Medicare If You Are Still Working

What Is The Difference Between Plan F And Plan F High Deductible

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

As a reminder, your deductible is the out-of-pocket cost you must pay toward covered health services before your insurance company starts paying for care. Both insurance plans have identical coverage.

Who Can Enroll In Plan F

Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

If your 6-month period has ended and you dont qualify for a Special Enrollment Period you can apply to enroll in Plan F by completing an application that asks about your health history. The insurance company can decline your application and/or request medical records to determine whether it will accept you.

Recommended Reading: How To Apply For Dual Medicare And Medicaid

How Much Does Medicare Supplement Plan F Cost

Like all Medigap plans, Supplement Plan F is available to buy from private insurers that are approved by Medicare. The cost for Plan F may vary by insurer. Your zip code, as well as the carrier you choose, can impact the cost of your plan. In some instances, people who smoke cigarettes or use other tobacco products may be required to pay higher monthly premiums for Plan F.

Because it offers the highest level of coverage, Plan F tends tobe more expensive than other Medigap plans.

There are two versions of Plan F:

- standard Plan F

- high-deductible Plan F

Each plan covers the same benefits. However, high-deductible Plan F requires that you pay all fees incurred for medical expenses until your deductible is met. In 2020, the deductible for Plan F was $2,340. In 2021, the deductible for Plan F is $2,370. High-deductible Plan F often has a lower monthly premium than standard Plan F.

Help choosing a Medigap Plan

These sources provide information about Medigap plans:

Deductible Amount For Medigap High Deductible Options F G & J For Calendar Year 2022

Summary:

Medicare supplemental Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses that a beneficiary must pay before these policies begin paying benefits. CMS updates the deductible amount for plans G, F and J each year, after release of the August Consumer Price Index for all Urban Consumers figures by the Bureau of Labor Statistics, which generally occurs in mid-September.

Calculation of the Deductible:

For Further Information:

Contact: Martha Wagley at 410-786-3778 for actuarial issues or Derrick Claggett at 786-2113 for policy related issues.

Also Check: How Does Medicare Work When You Turn 65

Medicare Hospital Serviceswhat Plan G Pays

Semi-private room and board, general nursing, and miscellaneous services and supplies.

Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital.

Pain relief, symptom management, and support services for the terminally ill. You must meet Medicares requirements, including a doctors certification of terminal illness.

Plan F Coverage Of Medicare Part A Expenses

Plan F covers the Medicare-approved expenses not covered under Medicare Part A . Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

Generally, Medicare covers approved charges for hospitalization at 80%. This leaves the remaining 20% of expenses to be the responsibility of the Medicare patient. Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as:

- Part A hospital deductible and coinsurance

- Hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Part A Hospice care coinsurance or copayment

- Blood

- Other Medicare-approved expenses associated with Part A hospitalization

Read Also: How Much Is Medicare Cost For 2020

Medicare Medical Serviceswhat Plan F Pays

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physicians services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an excess charge. Medicare puts a 15% limit on the extra amount a doctor can charge.

When Can I Enroll In Medicare

If you’re turning 65, you can enroll in Medicare from the period that extends 3 months before to 3 months after the month of your 65th birthday. For example, if you turn 65 on July 4, you can enroll anytime between April 1 and October 31.

Watch our Medicare Minute Videos to learn more about initial enrollment and working past 65.

Once youre enrolled in Medicare, you can change your Medicare coverage during the Annual Election Period from October 15 to December 7. If you enroll during AEP, your coverage will begin January 1st of the following year.

You may be able to join or switch plans under special circumstances that grant a Special Election Period. View our Medicare Advantage Timeline to learn more.

Don’t Miss: What Are All The Parts Of Medicare

Medicare Supplement Plan F Premium Increase

Each year, Medigap plan premiums are subject to rate increases. This is especially true for Medicare Supplement Plan F due to its phasing out. As fewer people enroll each year, the risk for the insurance carrier grows, making premiums increase at a higher rate than other Medigap plans.

It is beneficial to research rate increase histories and pricing methods when choosing a plan. Over the past five years, Medicare Supplement Plan F rate increases have been between 3% and 6%. However, that number is quickly rising.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Ask your agent what the rate increase history is for the Medicare companies with which you are considering enrollment. You will want to research carrier reviews before making a choice.

What Happens To Your Medicare Supplement Plan F When You Move To A New State

When you move to a new state, you can keep your current Medicare Supplement plans. In most cases, all you must do is contact your carrier and submit your new address. Since Medicare Supplement plans are standardized, your benefits will not change. However, your premium may increase or decrease depending on your new ZIP Code.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Recommended Reading: Does Everyone Go On Medicare At 65

Disadvantages Of Medigap Plan F

On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if youre newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Tips for shopping for a Medigap plan

Follow the tips below while shopping for a Medicare supplement plan:

- Pick a plan. There are several Medicare supplement plans to choose from. The extent of coverage can vary by plan. Review your health-related needs to decide on one thats right for you.

- Compare policies. Once youve decided on a plan, compare the policies offered by different companies, as costs can vary. Medicares website has a helpful tool to compare the policies offered in your area.

- Consider premiums. Providers can set their premiums in different ways. Some premiums are the same for everyone, while others may increase based on your age.

- Remember high deductible options. Some plans have a high deductible option. These plans often have lower premiums and may be a good choice for someone who doesnt anticipate a lot of medical expenses.

How Much Does Aarp Plan F Cost

Because Plan F offers the most coverage of any Medigap plan, and because Plan F applicants must be slightly older than those of other plans due to the eligibility rule, premiums for Plan F tend to be higher than other Medicare Supplement plans.

AARP/UnitedHealthcare Plan F premiums can be affected , gender and age. Below is a sampling of AARP/UnitedHealthcare Plan F costs for various types of customers based on the companys online quote tool.

Please note these are example quotes and may not reflect the plan availability or plan costs for the options available where you live. Rates can also be affected by when you enroll, whether you must undergo medical underwriting and more.

| Customer | |

|---|---|

|

75-year-old female in Portland, ME |

$264.00 |

AARP/UnitedHealthcare offers a few small discounts on premiums when multiple members of the same household have a policy or when premiums are paid through electronic funds transfer. No such discounts were applied to the rates above.

Its also worth noting that you must be an AARP member to enroll in AARP Plan F. An annual membership with AARP is $16.

Don’t Miss: Are Podiatrists Covered By Medicare

Medicare Supplement Plan F

Medicare has several options, or parts, you can enroll in to obtain health insurance coverage.

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isnt a part of Medicare. Its actually one of several Medicare supplement insurance plans.

Medigap comprises several plans you can buy to help pay for things that original Medicare doesnt.

Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

25 percent of people who have original Medicare are also enrolled in a Medicare supplement plan.

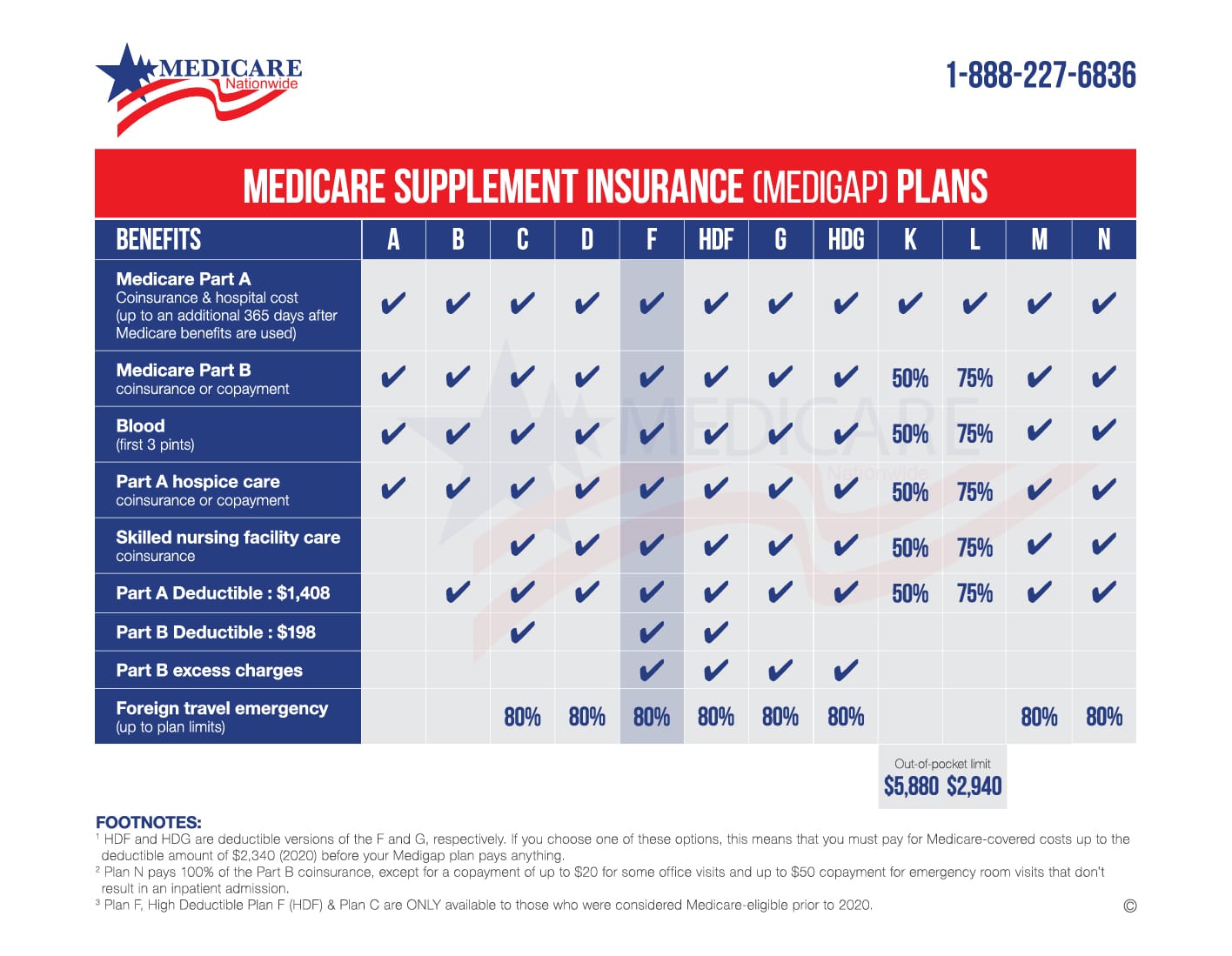

Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans. Youll see them designated as letters: A through D, F, G, and K through N.

Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered. For example, a Plan F policy offered by Company A must include the same basic benefits as a Plan F policy offered by Company B.

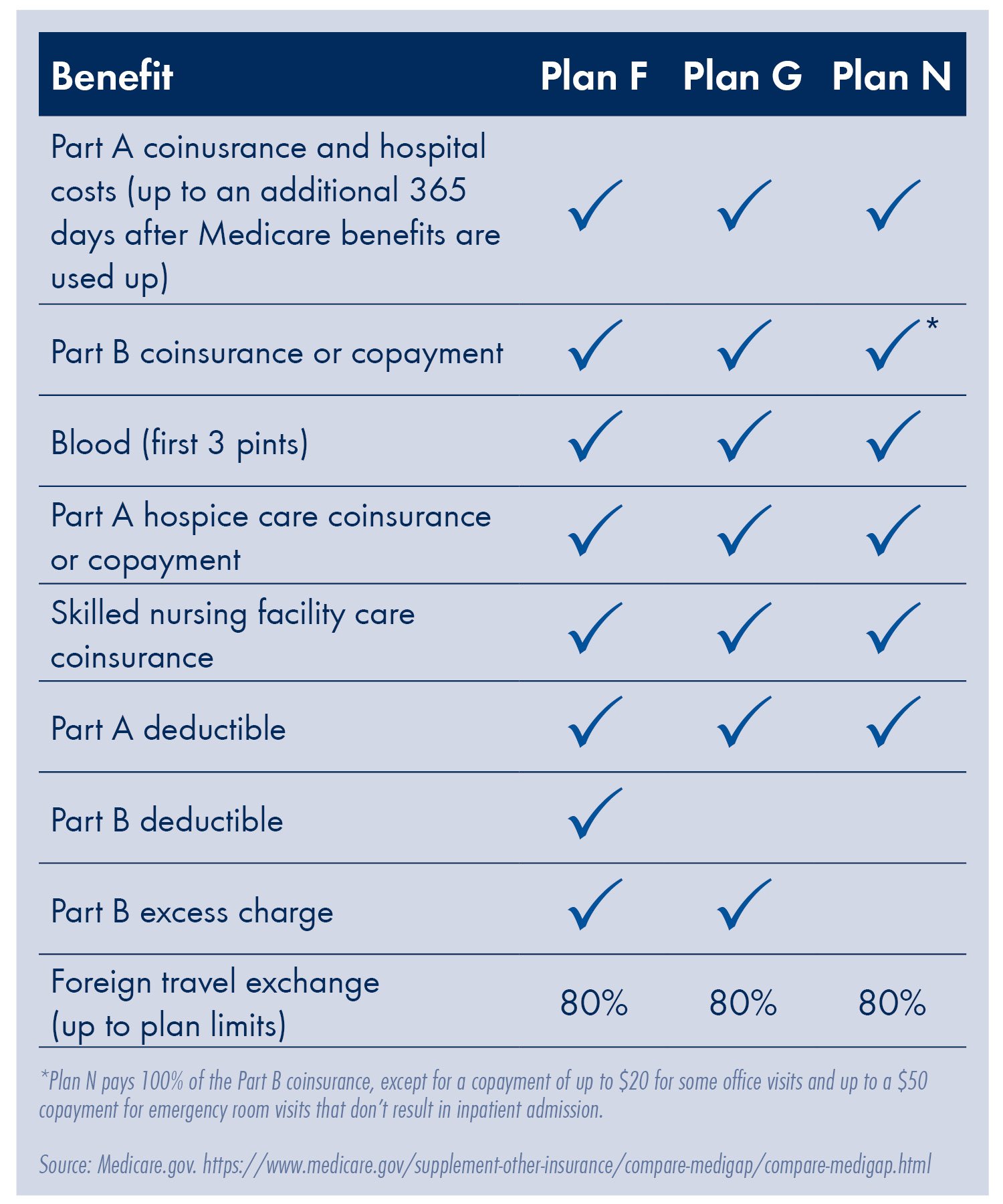

The various Medicare supplement plans each offer different benefits. Some plans offer more benefits than others. Plan F is generally considered to be the most comprehensive.

What Medigap Plan G Covers

Heres what Medigap Plan G covers, according to Medicare.gov:

-

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

-

Part A deductible.

-

Blood transfusion .

-

Skilled nursing facility care coinsurance.

-

Medically necessary emergency health care service for the first 60 days when traveling outside the U.S. Deductible and limitations apply.

You May Like: Will Medicare Cover Walk In Tubs

Is Medicare Supplement Plan F Worth The Price

Medicare Supplement Plan F provides the most comprehensive coverage out of all 10 plans available to Medicare recipients, but its also the most expensive. Read this post to learn if its worth the price.

Of the 10 Medicare Supplements available, Plan F is the most popular of the entire alphabet soup of Medigap plans. Touted as the Cadillac of Medicare Supplements, nearly 60 percent of individuals who purchase a Medigap or Medicare Supplement insurance plan choose Plan F, according to the American Association for Medicare Supplement Insurance.

What makes Plan F so popular and enticing?

Plan F provides total coverage that leaves members with zero out-of-pocket expenses, and even covers the annual Medicare Part B deductible of $183 in 2018.

The only costs to Plan F members are the monthly Part B and Plan F premiums the latter of which is Plan Fs only downside.

Traveling Internationally With Medicare Advantage

Medicare Advantage is an optional plan that allows enrollees to receive their Medicare benefits in a way thats more like employer-sponsored coverage. Advantage plans cover everything Original Medicare covers . But Medicare Advantage plans can also include extras such as prescription drugs, vision, dental, hearing, and fitness.

Some Medicare Advantage plans cover enrollees while traveling internationally in more situations than Original Medicare will. Each policy varies, so contact your insurance company to learn more. If your plan wont cover much travel or you dont have Medicare Advantage, speak with a licensed Medicare agent to go over your options.

Read Also: How To Check Medicare Status Online

Where Can You Buy Medicare Supplement Plan F

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

You can also look at the companies that offer each plan and how they set their monthly premiums. Because the cost of a Medigap policy can vary by company, its very important to compare several Medigap policies before selecting one.

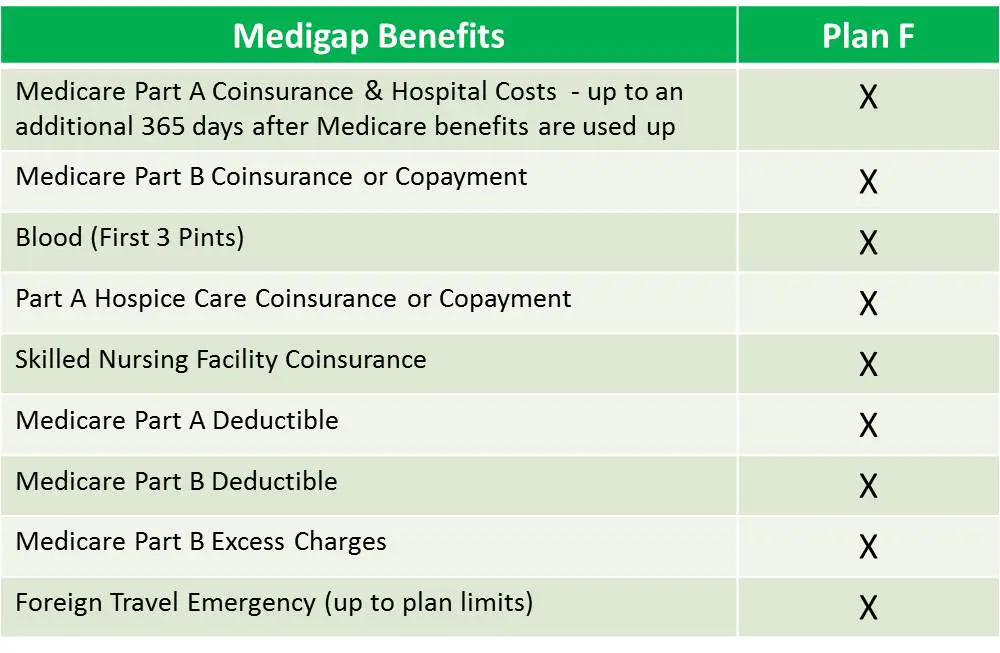

What Does Medigap Plan F Cover

What exactly is covered in Medigap F plan? As mentioned above, Plan F is the most comprehensive Medigap plan. With Plan F, you would not have a charge for anything covered by health insurance. Medicare pays its share, then Plan F takes the rest. Here is a list of the benefits that are included in all F plans:

Health insurance Part A Co-insurance and hospital expenses

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B Excess charges

- Foreign travel emergency

These benefits fill the gaps in the original medicare . The benefits for all schemes are visible in the Medigap coverage table.

Also Check: What Is The Deadline For Changing Medicare Plans

Foreign Travel For People On Medicare

People with Original Medicare can travel anywhere in the United States and all of its territories and still have access to medical care from almost any doctor or hospital. This means that if you are travelling to the Virgin Islands, Guam, Puerto Rico or any other American territory, you are covered! But what about foreign travel for people on Medicare? Does Medicare cover international travel?

Medicare generally does not provide for care outside of the U.S. There are some limited exceptions, such as care on a cruise ship while in U.S. territorial waters or emergency care that occurs while you are en route to the U.S. and the closest hospital is in another country, such as Canada. However, its best to plan ahead and not assume any benefits from Medicare while you are outside of the country.

So how can you protect yourself if you have travel plans out of the country? Fortunately, both types of Medicare health insurance options offer some foreign travel emergency benefits.

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F only covers services that are covered by original Medicare . If you receive a medical treatment that Medicare does not cover, such as acupuncture, Plan F will also not cover it. Plan F also does not cover medications under most circumstances, since these are covered by Medicare Part D.

After your Plan F deductible has been met, you can expect Plan F to pay the following:

You May Like: When Will I Get Medicare