How To Find The Right Medicare Advantage Coverage For You

If youre approaching the age of 65, navigating another qualifying event or reviewing plan options ahead of the Medicare Advantage Open Enrollment period, there are several details to consider when comparing Medicare Advantage plans. To make that process easier, we created the downloadable checklist below.

Who Is Eligible For Medicare Part C

To enroll in a Medicare Part C plan, you must be enrolled in Medicare Part A and Part B , and you must live in the service area of the Part C plan.

Before 2021, Medicare Part C was generally unavailable to Medicare beneficiaries who had end-stage renal disease . But that changed as of 2021 due to the 21st Century Cures Act. As a result of that legislation, Medicare beneficiaries are eligible for any Medicare Advantage plan available in their area, regardless of whether they have end-stage renal disease.

Most areas of the country have Medicare Part C plans available. But there are 65 rural counties, mostly in the Western U.S., where there are no Part C plans available as of 2022.

If you’re in one of those counties, your only option is Original Medicare, which means you’ll get Medicare Part A and Part B directly from the federal government.

Assuming Medicare Advantage plans are available in your area, you can enroll in Medicare Part C when you’re first eligible for Medicare during your initial enrollment period.

Or, you can switch to a Medicare Part C plan during the annual open enrollment period in the fall, which runs from October 15 to December 7. In that case, the Part C coverage will take effect on January 1. That window can also be used to switch from one Part C plan to another.

Medicare Part C Vs Part D: Whats The Difference

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

-

You can buy a Medicare Part C, or Medicare Advantage, plan instead of Original Medicare.

-

Medicare Part C plans can cover both health care and prescription drugs.

-

You can buy a Medicare Part D plan as an addition to Original Medicare.

-

Medicare Part D plans cover only prescription drugs, not health care.

There are two ways to get prescription drug coverage with Medicare: Medicare Part C and Medicare Part D. Your choice of Original Medicare or Medicare Advantage determines whether you get prescription drug coverage through Medicare Part C or Part D.

Regardless of whether you choose Medicare Advantage with prescription drug coverage or Original Medicare with a stand-alone Part D plan, you’ll be responsible for paying the Medicare Part B premium, which is $170.10 per month in 2022 . This is in addition to the premiums for each plan type. Other costs will differ depending on your choice of plan.

Here’s what you need to know about the differences between Medicare Part C and Medicare Part D.

Read Also: Does Blue Cross Blue Shield Medicare Supplement Cover Silver Sneakers

Enrollment Period For Medicare Part B

Youre eligible to enroll in Medicare Part B during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including your birthday month, and lasting up to three months after. This is called your Initial Enrollment Period . Enrollment in Part B is automatic if you are receiving Social Security or Railroad Retirement Board benefits.

What Affects Medicare Part C Premiums

Some variables that can affect the cost of a Medicare Part C premium include:

- Plan typeThere are several different types of Part C plans, each of which can vary in cost. For example, HMO plans tend to have lower premiums than PPO plans.

- LocationLocal market competition and cost-of-living can have an effect on the cost of a plan.For example, the average Medicare Advantage plan premium in South Carolina in 2022 is only $38 per month, while the same average premium in New York in 2022 is $71 per month.1

- CoverageSome Medicare Part C plans can include a variety of extra benefits that arent covered by Original Medicare .Most Medicare Advantage plans cover prescription drugs, and some plans may offer coverage for dental and vision care, hearing care, fitness club memberships, non-emergency transportation and more. Plans that offer more extra benefits may cost a little more than plans that offer less coverage.

- Cost-sharingSome Part C plans may charge a higher premium but feature a lower deductible or coinsurance, while other plans may pair a lower premium with higher cost-sharing requirements.

- Insurance companiesEach insurance company is free to set their own price for a Medicare Advantage plan. You may find two similar plans sold by two different companies in the same zip code, at very different prices. A licensed insurance agent can help you compare plans that are available where you live in order to find the premium costs that fit your budget.

Also Check: Is Mutual Of Omaha A Good Medicare Supplement Company

When Can You Sign Up For Medicare Advantage

There are specific times during the year when you can sign up for a Medicare Advantage plan. These are HMO and PPO plans or Part D coverage plans that you can sign up for with a private health insurance carrier. In addition, you can only make changes to your coverage during certain parts of the year. Initial enrollment periods are as follows:

| If youre | ||

| Turning 65 for the first time | Enroll in a Medicare Advantage plan for the first time | During the 7-month period surrounding your 65th birthday |

| Under 65 and disabled | Enroll in a Medicare Advantage plan for the first time | Beginning 21 months after you start receiving SSI or Railroad Retirement benefits and ending the 28th month you get those benefits |

| Already enrolled in Medicare due to disability and you turn 65 | Enroll in a Medicare Advantage plan for the first time -OR-

Switch from one MA plan to a different one -OR- Drop your Advantage plan entirely |

During the 7-month period surrounding your 65th birthday |

| Already enrolled in Medicare Part A but sign up for a Part B plan for the first time during the Part B general enrollment period | Enroll in a Medicare Advantage plan for the first time | From April 1 through June 30 |

The above table is for initial enrollment periods. There are other times when you can make changes to your Medicare Advantage plans or enroll in an MA plan from an existing Original Medicare plan. Alternate enrollment periods are as follows:

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Also Check: Who Pays The Premium For Medicare Advantage Plans

What Medicare Part C Covers

Medicare Part C plans offer all the benefits of Medicare Part A and Part B, with a few exceptions:

-

Clinical trials .

-

Hospice services .

-

Some new Medicare benefits, which temporarily are covered by Original Medicare.

Most Medicare Advantage plans include Medicare Part D prescription drug coverage. And the majority offer additional benefits that Original Medicare doesnt offer, such as cost help with dental and vision care, fitness benefits, transportation to doctor visits and over-the-counter drug allowances.

Medicare Part C isnt required to cover services that arent deemed medically necessary under Medicare.

Prescription Drug Coverage With Medicare Part C

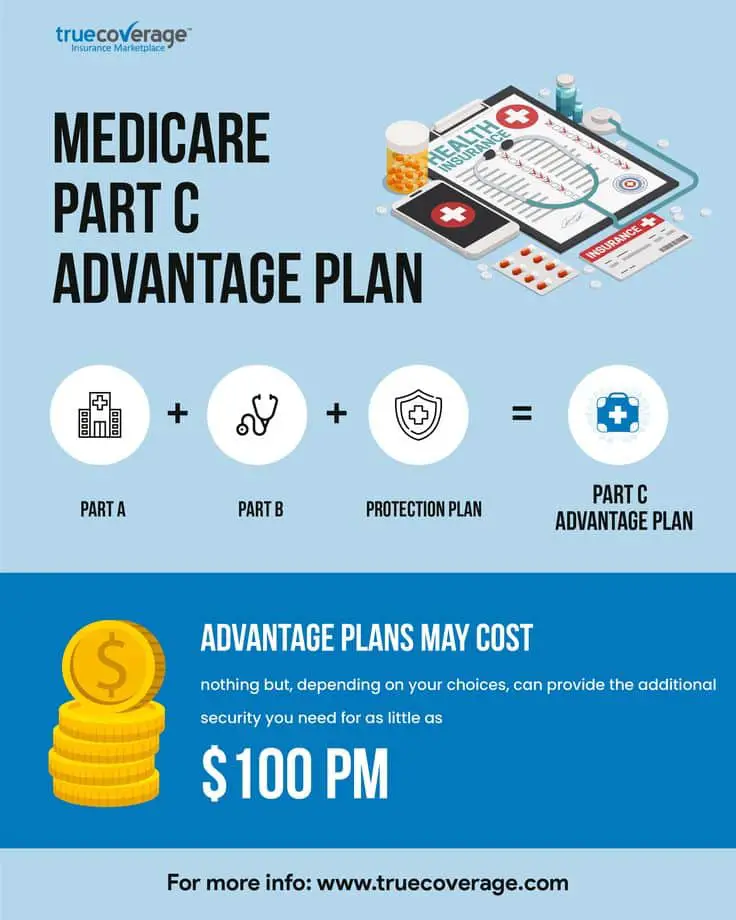

Medicare Part C, or Medicare Advantage, is a bundled alternative to Original Medicare. When you buy a Medicare Advantage plan from a private insurance company, you get your benefits from that company rather than Medicare Part A and Part B.

Costs and benefits differ between Medicare Part C plans, but they must cover at least the same benefits as Medicare Part A and Part B. Most Part C plans also include prescription drug coverage, and many offer added benefits, which may include some coverage for dental, hearing and vision care.

Also Check: How Much Does Medicare Part C And D Cost

Some Medicare Advantage Plans May Feature $0 Premiums

Your Medicare Part C plan premium is the cost you must pay typically monthly to belong to the plan.

In 2022, the average premium for a Medicare Part C plan is around $63 per month. This varied from plans with premiums as low as $38 per month in Maine and South Carolina to as high as over $100 per month in North and South Dakota, Massachusetts, Michigan and Rhode Island.1

Its important to note that many areas of the U.S. may feature $0 premium plans. In fact, over half of all beneficiaries of Medicare Advantage plans with prescription drug coverage pay no premium for their plan.2

What’s The Average Cost Of Medicare Part C

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month.

There’s a wide range of plan costs. Many enrollees choose low-cost or free plans, and $0 Medicare Part C plans are available in 49 states. On the high end, some plans can cost several hundred dollars per month. Expensive plans usually provide better benefits such as a broader network of medical providers, more coverage for specialized care or better cost-sharing benefits.

An HMO plan is generally cheaper than a PPO plan. A Medicare Part C HMO plan costs about $23 per month, while local PPO plans average $43 per month. The most expensive plans are Regional PPO plans, which average $80 per month, and Private Fee-for-Service plans, which average $77 per month.

|

Medicare Part C plan type |

# of plans offered |

|---|

Medicare Part C enrollees also pay for Original Medicare

Even though Medicare Part C unifies your coverage and benefits, your monthly costs are managed separately. This means Medicare Part C enrollees will pay for Original Medicare as well as the cost of a Medicare Part C plan.

- Medicare Part A: Usually free

- Medicare Part B: $170.10 per month deducted from Social Security

- Medicare Part C: $33 average cost paid to insurance company

Cost of Medicare Part A

Most people get Medicare Part A for free because theyve been in the workforce for at least 10 years and paid Medicare taxes as a payroll deduction.

Cost of Medicare Part B

Yes, you can get $0 Medicare Part C plans

| State |

|---|

Also Check: What Is The Current Cost Of Medicare

Medicare Program Savings And Employer

Between 1997 and 2003 Medicare continued to lose money on those beneficiaries who enrolled in MA plans, partly because of the payment floors and partly because of favorable selection into Part C. Indeed, the continued favorable selection overwhelmed the ability of risk adjustment to pay less for less expensive beneficiaries. An analysis of the Medicare Current Beneficiary Survey found that in the early 2000s, MA enrollees were less likely than TM enrollees to report that they were in fair or poor health, that they had functional limitations, or that they had heart disease or chronic lung disease . But the analysis found no difference in reported rates of diabetes or cancer.

The evolution of Medicare and commercial insurance also continued to differ. On the private side, traditional indemnity insurance had all but disappeared in the private market, a stark contrast from Medicare . Moreover, the BBA’s treatment of Part C suffered from bad timing because of a halt in the downward trends in the growth of health spending achieved by managed care in the private market in the mid-1990s.

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Recommended Reading: Do I Have To Have Part D Medicare

What Is The Medicare Advantage Out

One of the advantages of a Medicare Part C plan is that they are required by law to include an annual out-of-pocket limit. An out-of-pocket limit is the highest amount that you will be required to pay for covered care out of your own pocket over the course of the year. Once that limit is reached, the plan then pays for 100% of covered care for the remainder of the year.

For 2022, the highest out-of-pocket limit allowed by law was $7,550, but the average in-network maximum out-of-pocket spending limit was $4,972.2

Original Medicare does not have an out-of-pocket limit.

Failed Attempt At Savings: 19972003

The BBA’s goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans , centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit . Debate centered on the idea of premium support, in which Medicare beneficiaries would be given a lump sumin effect, a voucherthat could be used to pay for a private plan or for the premium for TM, a model used by some private employers as well as the Federal Employees Health Benefit Program . Aaron and Reischauer , among others, argued that such a policy would promote competition and efficiency in Medicare, give beneficiaries a choice, and capture some of the managed care dividend for Medicare.

After an intense debate, Congress passed the BBA, in which Medicare’s at-risk contracting with health plans was formally designated as Part C of Medicare and named Medicare+Choice . The intent was to encourage competition and the growth of managed care in the Medicare program, with the hope that this would save Medicare funds. Most Democrats, however, vehemently opposed the defined-contribution initiative and succeeded in having the topic assigned to a bipartisan commission for study. In the meantime, Medicare remained a defined benefit program.

Read Also: What Age Qualifies You For Medicare

Beneficiaries’ Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries’ choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans’ mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans’ availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrigs disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If youre eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you dont sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didnt enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicares website to find out more.

You May Like: When Can I Apply For Medicare In California

Recommended Reading: Does Medicare Cover Rotator Cuff Surgery

Trailing The Private Sector 19851997

In the Medicare program, Part C plans were required to offer a minimum set of benefits equivalent to that provided by Medicare Parts A and B. The plans were paid by capitation, and Medicare uses formal risk adjustment, setting a per-member-per-month payment for each beneficiary, which is called the average adjusted per-capita cost and is calculated by a formula based on costs in TM and some beneficiary demographic characteristics such as age and gender. The rates are county specific and based on a five-year moving average lagged by three years . The resulting amount was reduced to 95 percent of the Medicare average, thereby returning a savings to the Medicare program . The presumption was that private Part C plans could, and would, economize on care and that by reducing by 5 percent the amount that Medicare paid the plans, the government would share in the savings.

In principle, paying 95 percent of the local risk-adjusted TM average cost could achieve the goals of both expanding choice and reducing program cost. Any supply of HMOs at the regulated price would increase the options for at least some beneficiaries, relative to those before 1985. And if the risk-adjusted formula captured the average costs for those beneficiaries who actually enrolled in MA, as opposed to the beneficiaries remaining in TM, the 95 percent rule would save Medicare money.