What Is The Medicare Part B Premium For 2022

The standard monthly Medicare Part B premium for 2022 is $170.10, which is up $21.60 from 2021. Medicare Part B helps pay for doctor visits and outpatient care.

Most people will pay the standard Part B premium amount, but you could pay more based on your income. Medicare uses your reported income from two years ago to determine what youll pay. And while the Part B premium increased by $21.60, the COLA amount also increased, rising to 5.9 percent for 2022.1

Medicare adds an income-related monthly adjustment amount to Part B premiums for individuals with an adjusted gross income over $91,000 and for couples with income over $182,000. High earners could pay up to $578.30 per month for Part B in 2022.

Other Part B costs include a deductible and coinsurance for those who have Original Medicare . The 2022 Part B deductible is $233, which is an increase of $30 from 2021.

Medicare Part A And Part B Premiums Increase In 2022

Medicare Part A premiums will remain at $0 for most beneficiaries. Thats because most beneficiaries haver premium-free Part A because they paid Medicare taxes for at least 40 quarters , which is a benchmark that remains unchanged for 2022.

But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 . And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.

The standard Medicare Part B premium is also on the rise in 2022. The 2022 Medicare Part B premium is $170.10 per month, which is up from $148.50 in 2021.

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

Read Also: Is It Mandatory To Take Medicare At 65

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

Medicare Part D Costs And Coverage

Medicare Part D, which is provided through private insurers like Medicare Advantage, covers prescription drugs. All Part D drug plans must provide a minimum coverage level set by Medicare. However, the type of drugs covered depends on the formulary, which is a list of prescription drugs covered. Formularies vary from plan to plan.

Formularies are broken into tiers. Each tier has a different cost-sharing amount. For example, Tier I drugs may include low-cost generic medications while Tier III drugs may include non-preferred name-brand medications. Part D coverage is often included in Medicare Advantage plans.

The cost of a Part D plan varies depending on cost and which drugs it covers. If you live in a high-income household, you may have to pay an extra cost to your standard Part D premium due to the income-related monthly adjustment amount .

If you do not sign up for Part D coverage when you first enroll in Medicare, you can still sign up later. But you will pay an ever-increasing penalty unless you have other creditable prescription drug coverage or you receive certain other assistance from the state or federal government.

The penalty, which applies if you dont have some form of drug coverage 63 days after your initial Medicare enrollment period ends, is based on how long you waited to enroll in a prescription drug plan. It adds a cost for each month you went without enrolling on to all future monthly premium payments.

Read Also: Does Medicare Cover Out Of Country Medical Expenses

Medicare Part A Premiums For 202:

The Part A premium is only paid by individuals who worked less than 40 quarters with coverage. The Part A premiums for 2022 are as follows:

·$274 for individuals who had at least 30 quarters of coverage, or who are married to someone with 30 quarters of coverage

·$499 for certain uninsured individuals or with less than 30 quarters of coverage, and for people with disabilities who have exhausted other entitlement

Medicare Part A covers hospital and inpatient care.

If you have a Medicare Advantage plan , the Part A deductible and other Part A costs usually wont apply. Each plan sets its own cost-sharing terms for hospitalizations. For example, you may have daily copays for a set number of days or a flat cost per hospitalization. After that, plans usually pay 100% of hospital costs. Check plan details for exact costs.

Medicare Part B Premiums

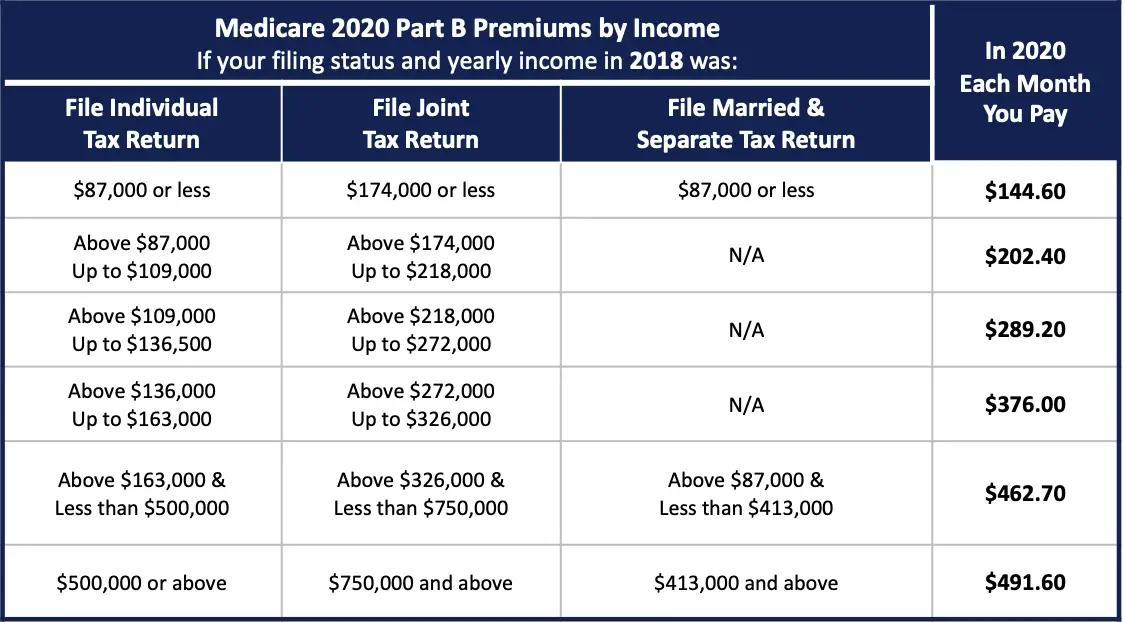

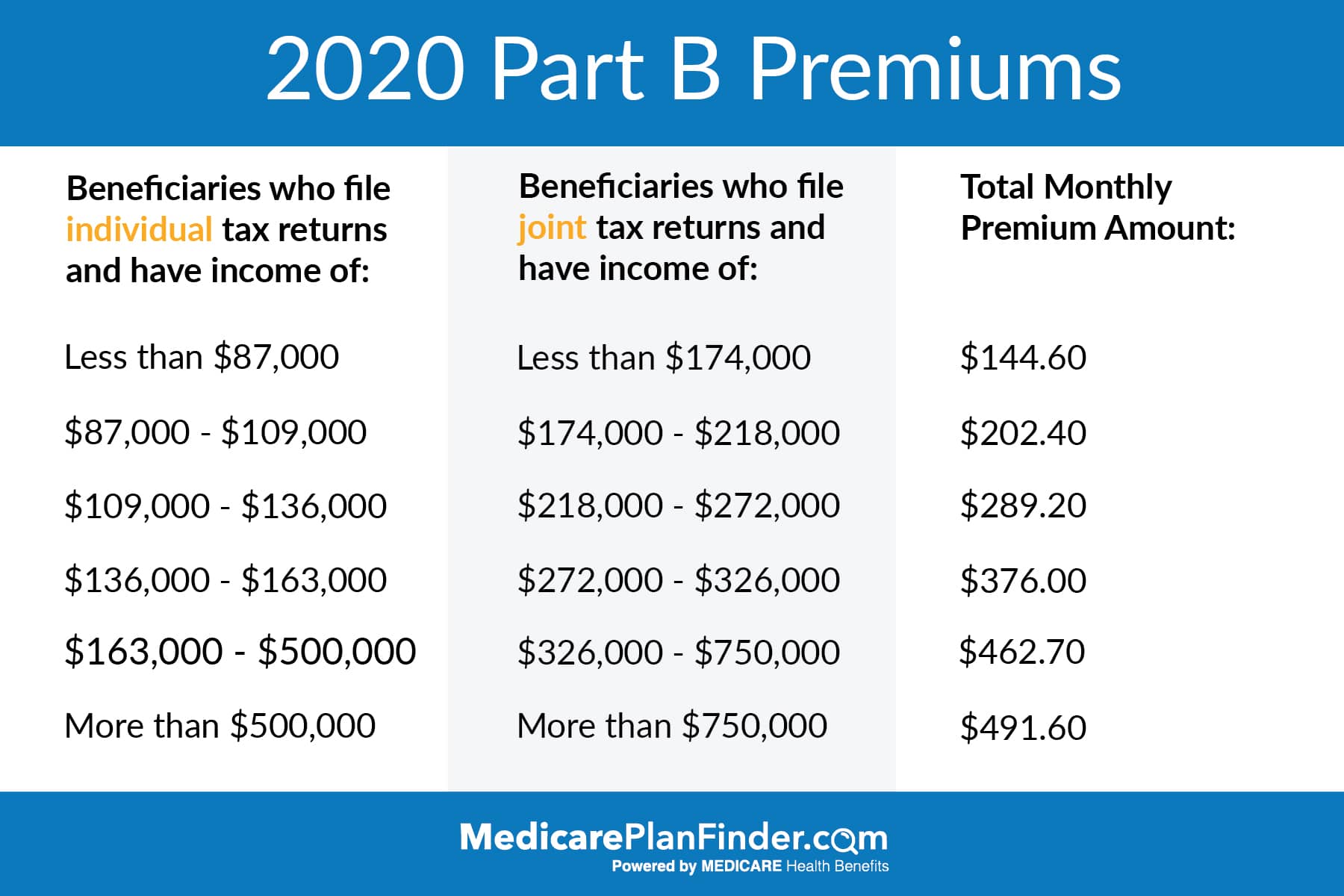

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Recommended Reading: What Is A Medicare Part D Pdp Plan

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

What Is The Average Cost Of Medicare Part D In 2022 By State

The chart below lists the average monthly premiums for Medicare Part D prescription drug plans by state.1

- The lowest average Part D premiums were for plans in Mississippi, Kentucky, Indiana and Oklahoma, with average premiums around $41 or less per month.

- California, Florida, Pennsylvania and West Virginia had Part D plans with the highest average premiums, around $52 or more per month.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Recommended Reading: When Can You Get Medicare Health Insurance

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Recommended Reading: Does Medicare Cover Disposable Briefs

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

How Much Does Medicare Part A Cost

Medicare Part A usually doesnt require a monthly premium payment if you or your spouse paid Medicare taxes while working. If you have to purchase Medicare Part A, it can cost up to $499 per month.4

What it is: Medicare Part A provides coverage for hospital services and care. This includes expenses for care received during stays in hospitals, skilled nursing facilities, hospice or home health care facilities.

Also Check: What Does Medicare Part B Include

How Much Do Medicare Part A And Part B Cost In 2022

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $499 per month in 2022.If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

- The standard Part B premium is $170.10 per month in 2022.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2022.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

Read Also: Is Tori Removal Covered By Medicare

Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

You May Like: Is Medicare The Same As Ahcccs

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Medicare Taxes For The Self

Even if you are self-employed, the 2.9% Medicare tax applies.

Typically, people who are self-employed pay a self-employment tax of 15.3% total which includes the 2.9% Medicare tax on the first $142,800 of net income in 2021.2

The self-employed tax consists of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. If youre unsure of how to do this, a tax professional may be able to help.

Recommended Reading: Is Root Canal Covered By Medicare

Compare Medigap Plan Costs In Your Area

Bear in mind that the premium averages listed above are just that averages. There may be plans available in your area that cost less than the average listed above for your age.

Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates.

A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan that fits your coverage needs as well as your budget.

Compare Medigap plan costs in your area.