What Will Happen If Medicare Runs Out Of Money

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Medicare Part B Premium For 2023

In 2023, the standard Part B premium is $164.90 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $97,000 and $194,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2023 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Total monthly Part B premium by tax return| Filing individual tax returns | Total monthly Part B premium |

|---|---|

|

$97,000 or less |

|

|

$750,000 or more |

$560.50 |

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.1

Total Part B monthly premiums by tax return for married filing separately| Total monthly Part B premium |

|---|

|

$97,000 or less |

|

$560.50 |

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Also Check: How To Sign Up For Medicare Part D

Who Pays More For Medicare Part B

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

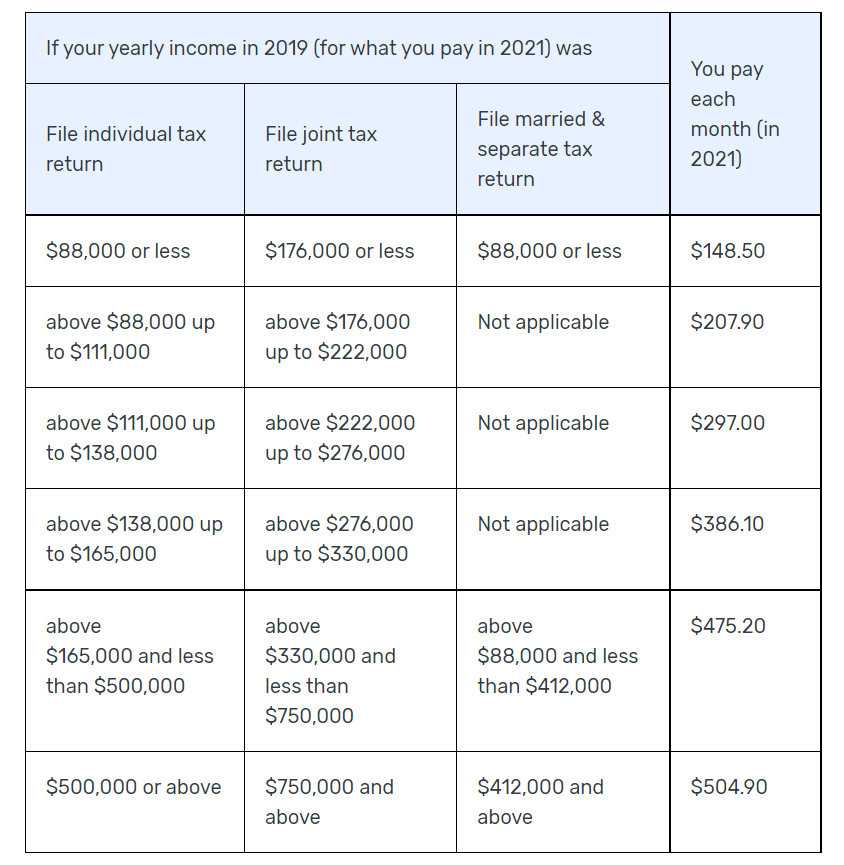

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

If your income is above those levels, the government shifts more of the premium cost to your personal balance sheet. Instead of covering 75% of the premium cost, the government pays anywhere from 65% to as little as 15% of the premium, based on your IRMAA.

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Read Also: How Much Are Medicare Premiums Per Month

I Am About To Turn 65 And Go On Medicare And My Income Is $125000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $97,000 for individuals and $194,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2023 income-related premium, Social Security will use information from your tax return filed in 2022 for tax year 2021. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2023, you would pay around $4,735 in annual Medicare premiums combined for Part B and Part D .

Find A $0 Premium Medicare Advantage Plan Today

| TTY 711, 24/7

1 Fuglesten Biniek, J. et al. . Medicare Advantage 2021 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/report-section/medicare-advantage-2021-spotlight-first-look.

2 MedicareAdvantage.com’s The Average Cost of Medicare in 2022 report. .

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

For California residents, CA-Do Not Sell My Personal Info, .

Don’t Miss: Does Medicare Plan G Have A Deductible

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

How Much Will Medicare Cost In 2023

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies. The good news in 2023 is the cost of Medicare Part B was reduced to $164.90 per month.

You May Like: How Old To Get Medicare Part B

How Much Does Medicare Part C Cost

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or plus a variety of coverages and benefits not offered by Original Medicare .

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Recommended Reading: What Is A Medicare Discount Card

How Do I Pay The Medicare Part B Premium In 2023

Suppose you receive benefits from Social Security, the Railroad Retirement Board, or the Office of Personnel Management. In that case,your premium for Medicare Part B is automatically taken from your monthly benefit check.

If you are enrolled in Medicare Part B but are not collecting benefits, you will receive a quarterly bill for your Medicare Part B premium in 2022. You can either pay this directly to Medicare from your bank or have the Medicare Part B premium deducted from an annuity.

You can pay directly from a bank account by utilizing your online bill payment service throughMyMedicare. However, if you are uncomfortable with that, you can pay by check, money order, credit card, or debit card.

You can do this by simply sending the payment to:Medicare Premium Collection Center. PO Box 790355. St. Louis, MO 63179-0355

If the credit or debit card you use only has a month and year, leave the day field blank on the payment coupon. You must submit payments with the completed form to the address above. Any incomplete payment forms will not be processed.

Medicare Open Enrollment Presents Choices

Medicare Open Enrollment will be Oct. 15 through Dec. 7. During this time, Medicare enrollees are encouraged to review their coverage to determine if their needs have changed.

Medicare Part B is the general insurance that covers items like doctors and other health care providers, outpatient and home health care, as well as medical equipment and preventive services like vaccines and yearly wellness visits.

Part A covers inpatient hospitalizations, care in skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. It generally does not impose a premium.

Part D provides prescription drug coverage through private insurance companies

The other option is known as Part C or Medicare Advantage. This is a private insurance plan that takes the place of Part B and often Part D.

According to CMS, the projected average premium for 2023 Medicare Advantage plans is $18 per month, a decline of nearly 8% from the 2022 average premium of $19.52.

Read Also: What Is The Best Medicare Advantage Plan In Alabama

Cost Of Medicare Part B

- Standard cost in 2023: $164.90 per month

- Annual deductible in 2023: $226

For most people, the cost of Medicare Part B for 2023 is $164.90 per month. This rate is adjusted based on income, and those earning more than $97,000 will pay higher premiums.

For high earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $560.50 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2023, the Medicare Part B deductible is $226, which means you would need to pay $226 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022 and 2023:

- An annual deductible of $1,600 in 2023 for in-patient hospital stays .

- $400 per day coinsurance payment in 2023 for in-patient hospital stays for days 61 to 90 .

- After day 91 there is a $800 daily coinsurance payment in 2023 for each lifetime reserve day used .

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

Also Check: Does Medicare Cover Prolia Injections

Does Medicare Increase Every Year

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you’re being charged and follow up with Medicare or the IRS if you have questions.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Read Also: How Do You Sign Up For Medicare Part B Online

How Are Medicare’s Costs Changing Next Year

Original Medicare consists of two parts — A and B. Part A is hospital insurance and this kicks in if you need to stay in the hospital or a long-term care facility. Part B is medical insurance and this covers most standard doctor visits and outpatient care.

Part B’s 2022 premium is $170.10 per month for most people, but higher earners pay more. The deductible is currently $233. In 2023, the typical monthly premium will fall to $164.90 and the deductible will drop to $226.

But Part A’s costs are rising a little next year. Most people don’t have to pay a premium for this, but the deductible will climb from $1,556 to $1,600 in 2023. This may not matter to you if you don’t have to use your Part A coverage in 2023, but there are no guarantees.

Health issues can crop up unexpectedly, leading you to spend more on healthcare than you anticipated. Even a single hospital stay could negate any savings benefit you get from the small dip in Part B expenses.

You could also wind up paying more next year if you have a Medicare Advantage or a Medicare Part D plan for prescription drug coverage. These plans are offered by private health insurers and their prices can vary. If yours goes up, you could still spend more on Medicare in 2023 than you did this year.

Premium Surcharge Is Based On 2021 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2021 tax returns were filed in 2022, so those are the most current returns available when income-related premium adjustments are determined for 2023.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

You May Like: Does Medicare Cover Nerve Blocks

See The 2023 Income Breakdown Below:

Both Medicare Part A and B must be in place and active before you can enroll in any Medicare Supplement, Medicare Advantage or Medicare Part D Rx plan.

Medicare Part A will automatically start when when you turn age 65. Part B may not automatically start especially if you are on an employer health insurance plan or have decided to not take your social security benefits at the time of your 65th birthday.

Always check with Social Security and verify your Medicare start dates. the earliest you can notify Social Security is 3 months prior to your 65th birthday.

Interested in looking into either Medicare Supplement or Medicare Advantage plan.

No Cost Help there is no charge for my services. The insurance companies provide a fee for me to help with coverage options, enrollment and service.