What Can You Do If Your Deductible Or Copay Changes And You Can No Longer Afford Medication

You can sign up for Extra Help, as mentioned, and you can also look for other ways to lower your costs. Using discounts, such as those offered by GoodRx, may bring prices down to less than your Medicare Part D drug copay. In addition, some drug manufacturers have programs that provide medication at low or no cost to those who cant afford it.

When open enrollment season rolls around, you have the option of switching to a different prescription drug plan. Spend some time evaluating plans, then choose one with a formulary that charges lower copayments for your medications. Also check to see which pharmacies your plan lists as preferred, as those will typically lower copayments further for plan enrollees.

When Do I Leave The Coverage Gap

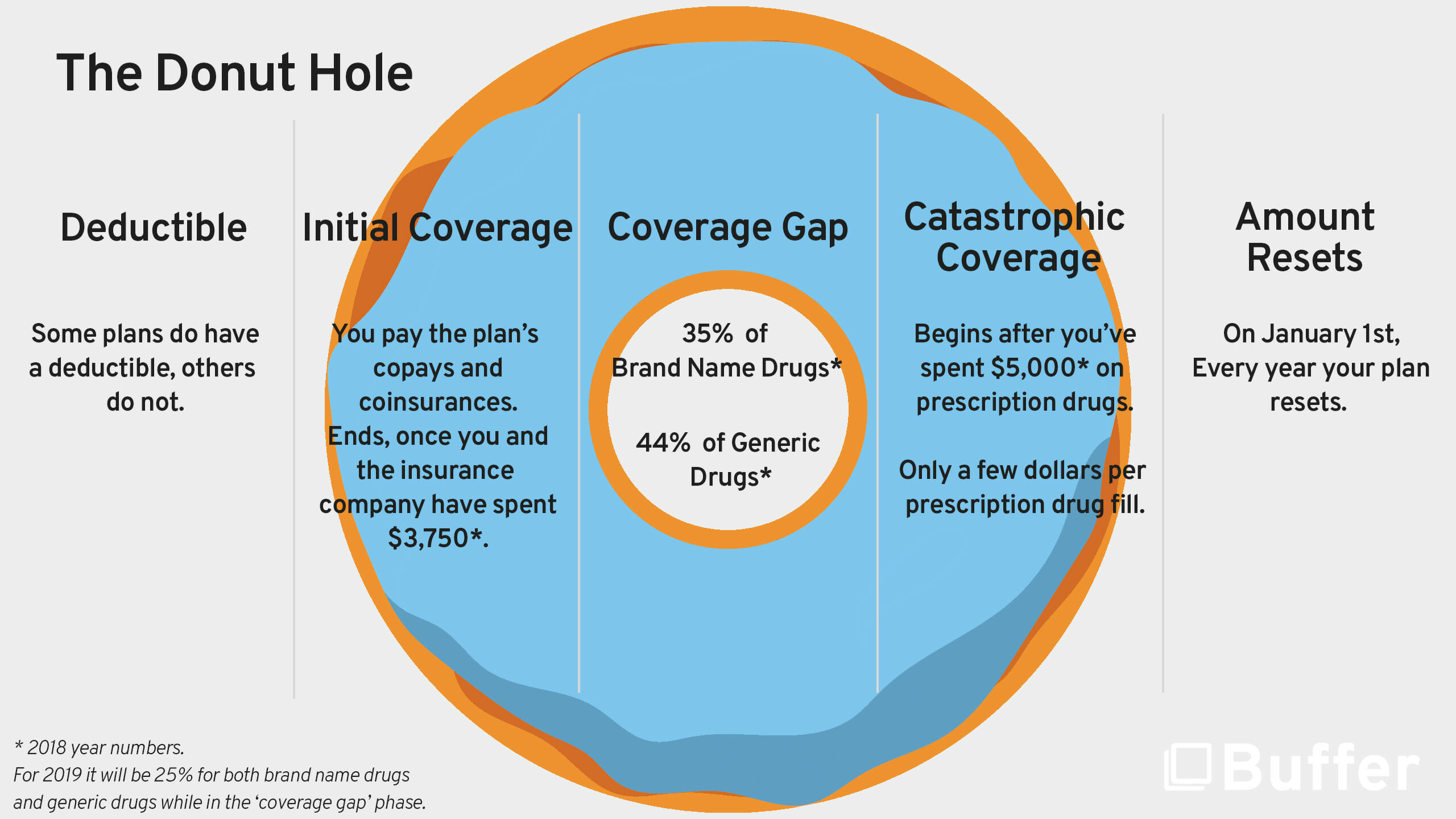

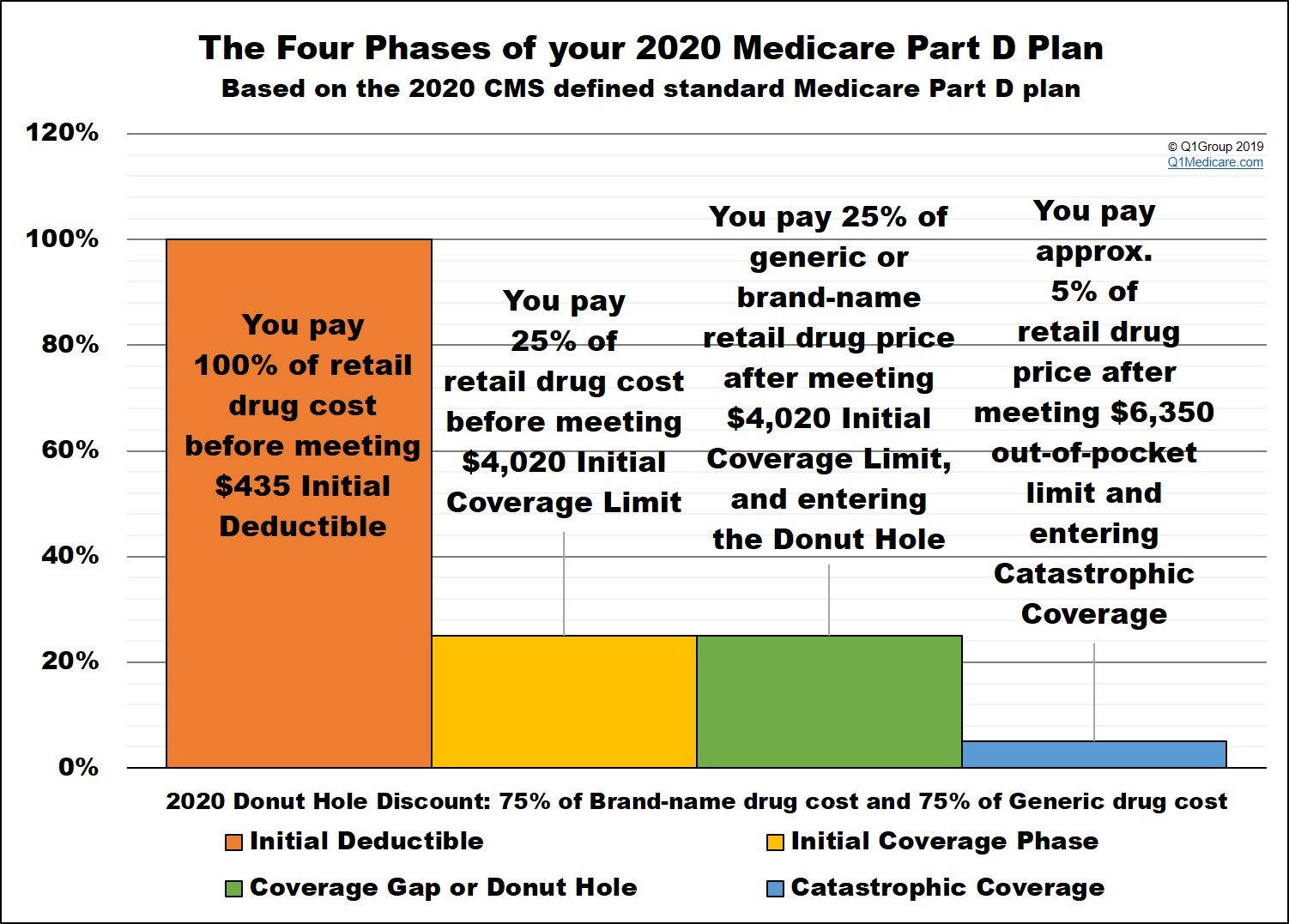

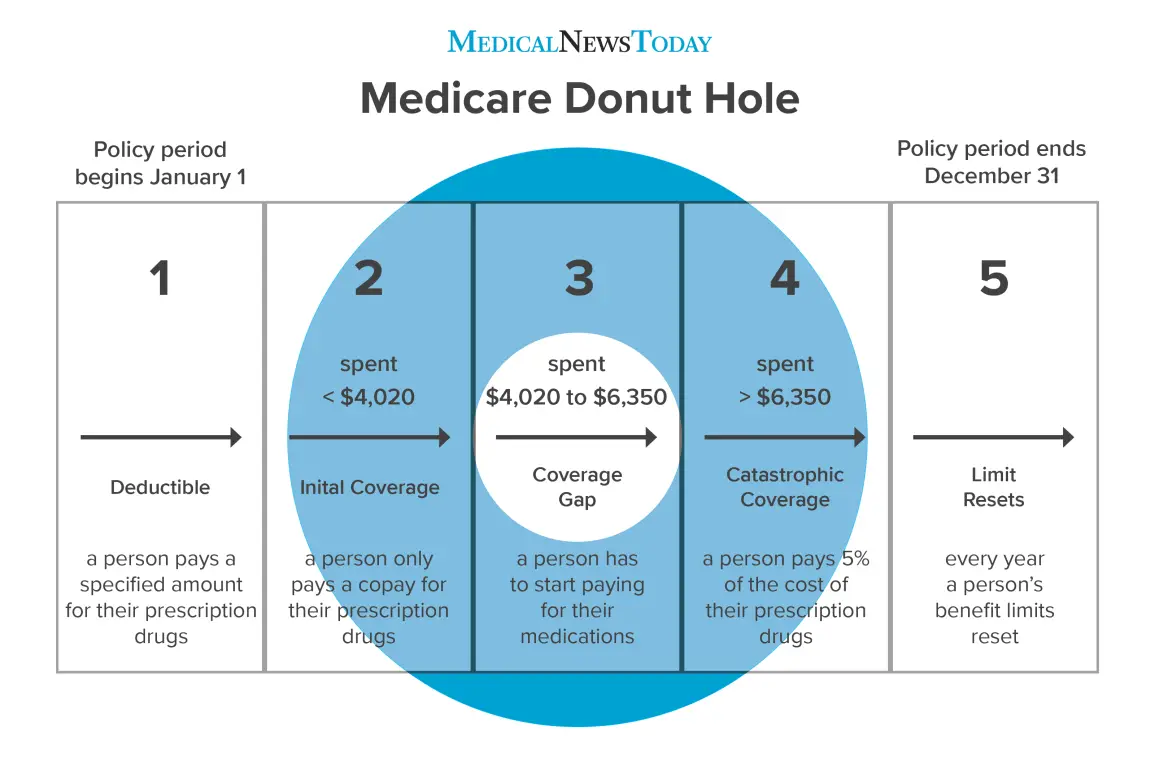

Youll remain in the coverage gap until your out-of-pocket expenses reach the amount set by CMS. For 2021, that amount is $6,550. To help you move through the coverage gap more quickly, these out-of-pocket expenses include the costs that you have paid toward your drug coverage for the year, like your deductible, copays and/or coinsurances, as well as a portion of the cost of brand name drugs paid by the manufacturer.

Your plans premium and what you pay for drugs that arent covered by your plan do not count towards your out-of-pocket expenses.

After you leave the coverage gap, you enter the catastrophic coverage stage where you only pay whichever is more for the rest of the year: 5% of drug costs, or a copay of $3.70 for generic drugs/$9.20 for brand-name drugs. Your Medicare Part D coverage resets to the pharmacy deductible stage on Jan. 1 of each new year.

Does The Medicare Donut Hole Affect Everyone With Medicare Prescription Drug Coverage

No. Not everyone will enter the Medicare donut hole stage. The Part D donut hole begins after you and your Medicare prescription drug plan have spent a certain amount for covered prescription drugs during the calendar year. If your prescription drug costs during the year are less than the pre-defined amount, you wont enter the Medicare donut hole stage. Your Part D expenses might not reach this limit in situations such as the following:

- If you dont take many prescription drugs, or those you take are lower-cost generic medications

- If you have other prescription drug coverage from an employer or union that pays a portion of your prescription drug costs

If you receive Extra Help paying Part D costs, you wont enter the Medicare Part D donut hole.

Recommended Reading: Do I Have To Use Medicare When I Turn 65

Is The Medicare Donut Hole Ending

So, when does the donut hole end? Although it has shrunk, it hasnt ended quite yet.

Since the Affordable Care Act passed back in 2010, the donut hole has been slowly closing. It used to be that when you hit that point, you would pay 100% of the costs of your prescription drugs while you were in the gap.

However, the government has been reducing that percentage steadily, and as of 2021, the percentage of the cost that you pay for prescriptions during the Medicare donut hole is no more than 25%.

Get more Medicare help on our Facebook community page.

How Do I Know If I Will Reach The Medicare Donut Hole

Your Part D company sends out a statement, or explanation of benefits , each month. This statement tells you exactly how much you have already spent on covered medications and how many dollars are left before you reach the coverage gap. Likewise, after you reach the gap, your insurance company will continue to send you notices that track your gap spending. They will calculate how many dollars are left before you reach catastrophic coverage.

Also Check: Do All Medicare Plans Have A Deductible

What Is The Donut Hole In Medicare

The donut hole is the coverage gap in Medicare prescription drug plans. During this period the beneficiary has a temporary limit on their Part D coverage. This means that after spending a specific amount on a drug plan, youre responsible for copayments for prescriptions. Then, youre responsible for costs up to a specific limit.

Medicare Coverage Gap 4 Part B Medical Insurance

For medical visits and treatments covered by Medicare, you will pay:

- A yearly deductible

- Twenty percent of the Medicare approved amount

- Fifteen percent of the amount charged above the Medicare approved amount*

- Twenty percent of the total charges for some outpatient services.

*For Medicare Part B, Medicare pay a fixed amount for medical services. Your provider may agree to this amount. If they do not, you are responsible for 15% of the added cost.

Medicare A and B do not offer any drug coverage. This is another coverage gap. You can get drug coverage through Medicare Part D. Another choice for drug coverage is through a Medicare Advantage plan .

Read Also: Which Medicare Supplement Plans Offer Silver Sneakers

How Does The Coverage Gap Discount Work With Brand

Companies who manufacture brand-name drugs sign contracts with Medicare, stating they will abide by Medicares Coverage Gap Discount Program. Once you reach the coverage gap, you will receive a set discount on the name-brand drugs that you purchase from a pharmacy.

While you are in the coverage gap, although you only pay a portion of the drug price, your cost and the manufacturers cost of the drug will count towards the catastrophic drug phase.

This discount you receive is recalculated annually. Each October, new guidelines come out for the following year. Since the prescription drug plans and guidelines change from year to year, it is recommended to review your Medicare Part D plan each year during the Annual Enrollment Period to ensure you enroll in the best plan for your needs.

Stage 4catastrophic Coverage Stage

In this last phase of Part D plan coverage, youll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year.

When your new plan year is beginning, you start over at stage 1 .

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN_2021_A

Also Check: Can An Employer Pay For Medicare Premiums

What Costs Dont Count Towards Getting Out Of The Coverage Gap

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs dont count towards getting you out of the coverage gap:

- The monthly premium for your Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan

- The costs you pay for prescription drugs that arent covered by your Medicare plan

What Is Medicaid Expansion

To understand the coverage gap, it helps to know the history of Medicaid eligibility and how the ACA changed the rules.

Before 2014, Medicaid eligibility was quite limited and depended on more than just income. To be eligible, a person had to have a low income and also fall into one of the following categories:

- Age 65 and older

- Pregnant

- Parent of a minor child

In most states, the income limits for adults tended to be quite low, and there were also asset limits .

The ACA called for expanding eligibility to ensure that all adults under the age of 65 would be able to enroll in Medicaid if their household income didn’t exceed 138% of the poverty level.

In 2022, that amounts to $18,754 in annual income for a single adult in the continental United States . The limits are higher in Alaska and Hawaii, and limits are also higher when the household has additional family members.

But a lawsuit over the ACA was soon launched, challenging various parts of the law. In 2012, the Supreme Court ruled that the ACA itself was constitutional. But the Supreme Court ruled that the Medicaid expansion provision in the ACA would be optional for states.

Under the ACA, a state that refused to expand Medicaid would have lost its regular federal Medicaid funding, but the Court ruled that this would not be allowed.

So although the federal government paid the full cost of Medicaid expansion from 2014 through 2016 , only about half the states opted to expand Medicaid eligibility right away in 2014.

Also Check: What Is The Best Medicare Advantage Plan In Washington State

Medicare Part D: A Brief Overview

Before we jump into the Part D donut hole, heres a quick rundown on Medicare Part D.

- You dont get this coverage automatically, in most cases. If you want Part D coverage, you need to sign up for it.

- You can get Medicare prescription drug coverage in two different ways.

- A stand-alone Medicare Part D prescription drug plan can work alongside your Original Medicare coverage.

- A Medicare Advantage prescription drug plan provides your Medicare Part A and Part B benefits, and prescription drug coverage as well.

Exemptions From The Coverage Gap

Sometimes people ask us if their Medigap plan will cover the coverage gap in their drug plan. The answer is no. Medigap plans help to pay for inpatient and outpatient services only. Drugs fall separately under Part D.

Every year we have clients ask us to help them find a Part D drug plan with no coverage gap. Such a plan does not currently exist in most states. The are no Medicare Part D plans without the donut hole. There is no separate insurance plan that you can buy to cover you in the Medicare donut hole either. Read more on why that is here.

However, certain people with low incomes and limited assets may qualify for the low-income subsidy, called Extra Help for Part D. If you qualify, then Medicare will waive the gap for you. Also, your ordinary copays on your prescriptions will decrease quite a bit. You can apply for the subsidy at your local Social Security office or online at their website.

Read Also: How Much Do Medicare Plans Cost

How To Know If I Qualify For The Medicare Coverage Gap Discount Program

To understand the discount program, it is best to speak with a licensed agent. Our licensed agents are experts in all things Medicare. We will be able to answer all your questions on the first interaction, clearing any confusion you may have.

To contact a Medicare expert, you can simply call the number at the top of the page. Cant talk now? Complete our online rate form and we will reach out to you. We are available six days a week to help you get on the right track with your Medicare coverage.

Compare Drug Formularies Before Enrolling

Each Part D plan has its own drug formulary. Covered medications are placed on different tiers in the formulary. The cost of the drug increases for higher tiers. Youll want to choose plan with a formulary that includes mostif not allof your medications and puts your medications on lower tiers. Its also important to choose a plan with the fewest restrictions, such as prior approval or step therapy, if possible. Search medicare.gov if you need specific information on the medications that are covered by your Medicare program.

You May Like: What Is The Deadline For Medicare Supplemental Insurance

Reaching The Other Side Of The Medicare Donut Hole

Where the donut hole beginsGetting to the other side of the coverage gap

- The Part D plan’s yearly deductible, coinsurance and copayments

- The discount received on the brand-name drugs while in the coverage gap

- What you pay in the coverage gap

don’t

- The Part D plan premium

- Pharmacy dispensing fee, if any

- What is paid for uncovered drugs

Post-donut hole drug coverageLearn more about Medicare and avoiding the donut hole at a free seminar on Understanding How Medicare Works. To register, call or visit sharp.com/newtomedicare.

I Want To Be Sure I Understand The Part D Doughnut Hole Or Coverage Gap Could You Tell Me How It Works

En español | Part D prescription drug plans require monthly premiums, often a deductible and variable cost-sharing for each prescription drug. In 2016, if your total drug costs exceed $3,310, then you will fall into the coverage gap .During this gap in coverage, you continue to pay your premiums, and you will be responsible for a much greater cost of each prescription than before you entered the gap. The cost of prescriptions are discounted, however: in 2016, youll pay no more than 45 percent of brand name drugs price percent discount on brand-name drugs, and will pay 42 percent of the generic prescription drug price. If your out-of-pocket costs exceed $4,850 in 2016, then you would enter the catastrophic coverage phase, during which you are responsible for 5 percent of your prescription drug costs for the rest of the year.Through gradually increasing discounts on brand and generic prescriptions filled during the doughnut hole, it is being phased out by 2020. Persons who qualify for an Extra Help program will not face additional cost-sharing for prescriptions filled in the doughnut hole.

Also Check: Does Medicare Cover Nursing Care At Home

How Does Medicares Standard Drug Benefit Work

Medicare Part D is the Medicare program that covers prescription medications. Once you become eligible for Medicare, youll need to purchase a Part D plan unless you have creditable drug coverage from another source. If you wait too long, youll owe a penalty when you do enroll.

Medicare Part D plans are sold by insurance companies but must meet requirements set by Medicare. For example, each plan must provide a formulary, or approved drug list, that covers all disease states and has at least two chemically distinct drugs in each class.

You pay your monthly Part D premium to the company running the plan.

How Do I Know If I Reach The Coverage Gap

The coverage gap begins when you reach a set amount of spending for prescription drugs through your Medicare Part D or Medicare Advantage prescription drug plan for the calendar year. Each month, you should receive a benefit statement from your Medicare Part D or Medicare Advantage carrier explaining your out-of-pocket costs and how far you are from the next coverage phase.

Recommended Reading: When Does Permission To Contact Expire Medicare

How To Avoid The Coverage Gap

There are a few ways to avoid the coverage gap all together, primarily through keeping your prescription drug costs low. Here are a few ways you can avoid reaching the coverage gap threshold:

- Buy generic prescriptions. Generic drugs are typically less expensive, and in most cases the same as their brand-name alternative. They are required by the Food and Drug Administration to have the same ingredients, at the same dosage, be administered the same way, and have the same effect.

- Order prescriptions by mail. Many drug plans offer a discount if you order a three-month supply by mail instead of a 30-day supply from the pharmacy.

- Ask for drug manufacturer discounts. Some pharmaceutical companies offer products at a discount directly to consumers or through the doctors office. Ask your doctor when they prescribe a medication to you if there are any discounts available.

- Shop for a new Part D plan. Each year when you receive your Annual Notice of Coverage, check to see if your prescription drug coverage or costs have changed. Compare Part D plans available in your area to learn if another plan has better coverage or lower costs.

- Plan ahead. If you can, plan ahead and estimate your annual drug costs, as well as how you will pay for them if you do enter the coverage gap. This is especially important if you take a lot of brand-name or high-cost medications, or have chronic conditions that must be managed by medications.

Medicare Star Quality Ratings

Kaiser Permanente Medicare Advantage health plan is rated 5 out of 5 Stars in Washington for 2022. The Medicare Star Rating is based on quality, service, and member satisfaction. Our high rating means you can have peace of mind knowing that you’re getting high-quality care and coverage all in a single plan at a great value.1

Recommended Reading: Does Medicare Cover Erectile Dysfunction Pumps

Costs In The Coverage Gap

Most Medicare drug plans have a coverage gap . This means there’s a temporary limit on what the drug plan will cover for drugs.

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022 , you’re in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs wont enter the coverage gap.

Solution : Cost Transparency Tools

Patients are often first exposed to the price of a medication at the pharmacy counter, where they may be surprised about the price of their medication and feel limited in what options they have. A real-time benefit check tool enables patients to learn about their cost options in real-time before they visit the pharmacy.

For patients in the Medicare deductible or coverage gap phases, real-time benefit checks take the confusion and surprise of an increased out-of-pocket cost out of the picture. Pharmaceutical manufacturers can harness real-time benefit check tools, such as truCheck, to help tailor messaging and payment options to engaged users at the moment when they investigate the drugs cost.

Don’t Miss: How Do You Qualify For Medicare Part A And B