People Who Have Both Medicare & Medicaid

People who have both Medicare and full Medicaid coverage are dually eligible. Medicare pays first when youre a dual eligible and you get Medicare-covered services. Medicaid pays last, after Medicare and any other health insurance you have.

You can still pick how you want to get your Medicare coverage: Original Medicare or Medicare Advantage . Check your Medicare coverage options.

If you choose to join a Medicare Advantage Plan, there are special plans for dual eligibles that make it easier for you to get the services you need, include Medicare coverage , and may also cost less, like:

- Special Needs Plans

- Medicare-Medicaid Plans

- Program of All-Inclusive Care for the Elderly plans can help certain people get care outside of a nursing home

D Prescription Drug Plans

A Part D prescription drug plan is a way to get your medications covered if you have Medicare Part A and/or Part B or a Medicare Advantage plan without drug coverage. Humana offers three plans: Humana Basic Rx Plan, Humana Walmart Value Rx Plan, and Humana Premier Rx Plan. With Humana Premier Rx, you’ll pay small copays on generic drugs in the Medicare coverage gap. Neither of the other plans offer additional gap coverage, but the Humana Walmart Value Rx plan is a budget-friendly option for people who take generics, with a low premium and a $0 deductible for Tier 1 and Tier 2 drugs.

Humanas prescription drug plans have a relatively high Medicare star rating and are widely available, earning Humana a spot in our review of the Best Medicare Part D Providers.

While Humana has a broad network of pharmacies, including Walmart, Kroger, Publix, Sams Club, and Costco, you should make sure you have access to an in-network pharmacy in your area.

More Articles About Humana Plans

1 $0 premium plans may not be available in all areas.

2 Humana Inc. Humana Reports First Quarter 2022 Financial Results Raises Full Year 2022 Adjusted EPS Financial Guidance. . Retrieved from .

3 Humana. Learn more about Humana Medicare Advantage plans. Retrieved from www.humana.com/medicare/products/medicare-advantage.

4 Humana. Humana prescription drug plans . Retrieved from www.humana.com/medicare/products/drug-plan.

5 Humana. Medicare Supplement Insurance plans. Retrieved from www.humana.com/medicare/products/supplement.

6 TZ Insurance Solutions LLC/TruBridge licensed agents who may call you are not direct employees of Humana and are not connected with or endorsed by the U.S. Government or the federal Medicare program.

7 According to internal data from TZ Insurance Solutions in 2021.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC is a licensed and certified representative of Medicare Advantage HMO, PPO and PFFS organizations and stand-alone prescription drug plans with a Medicare contract. Enrollment in any plan depends on contract renewal.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

To learn more about a plans nondiscrimination policy, please click here.

Recommended Reading: What Age Can You Get Medicare Part B

Is Humana A Good Health Insurance Provider

| What we like about Humana health insurance plans: | The drawbacks of Humana health insurance plans: |

|---|---|

|

|

Supporting You In An Emergency Or Disaster

We are here to support you during public health emergencies or disasters. We partner with organizations and agencies in Florida to make sure our members have the resources they need, from access to healthy food to in-person and phone support from care coaches.

See what steps we take to make sure you are covered.

Recommended Reading: How Much Is Premium For Medicare

Medical Benefits Under Humana Medicare Advantage Plans

All Medicare Advantage plans offer Part A and Part B coverage, according to the Centers for Medicare and Medicaid Services. This means that you’ll get the same hospital and medical care benefits as Original Medicare with Medicare Advantage. However, many Medicare Advantage plans, including Humana Medicare Advantage plans, also offer additional benefits.

Depending on the Humana plan you enroll in, you may be eligible for:

- Dental coverage

- Prescription drug coverage similar to or more expansive than what you would get with Medicare Part D

- Coverage for annual preventive care with no additional copay

- Coverage for certain alternative and complementary modalities, such as acupuncture

There is no single Humana Medicare Advantage plan. Instead, Humana offers a wide range of plans in different insurance markets. Therefore, the specifics of your benefits will depend on the type of plan you sign up for, as well as the particular plans available in your area.

Among Humana’s Medicare Advantage offerings are health maintenance organization plans, preferred provider organization plans, private fee-for-service plans, and special needs plans . You can use the official Humana website to compare the coverage and benefits of each type of plan and view the specific plans available in your zip code.

What Do Humana Medicare Advantage Plans Offer

Humana Medicare Advantage Plans offer private insurance to Medicare beneficiaries. As with all Medicare Advantage plans, these plans offer the same coverage that Original Medicare Parts A and B provide, but may also come with additional benefits, like dental and vision care as well as a variety of non-medical perks. Read on for more about Humana’s Medicare Advantage offerings.

Recommended Reading: Do I Have To Pay For Part B Medicare

Data Collection And Verification

Our data was collected through third-party rating agencies, official government websites and databases, and directly from companies via websites, media contacts, and existing partnerships. Our sources include: AM Best, the National Committee for Quality Assurance , J.D. Power, and the Centers for Medicaid and Medicare Services .

Data was verified to ensure data integrity and accuracy by cross-referencing the records and citation corresponding to each data point with our primary sources.

Humana Medicare Advantage Star Ratings

Other notable facts about Humanas Medicare Star Ratings include:2

- 3 Humana Medicare Advantage plan contracts received a 5 out of 5-star rating for 2022, including plans in 3 states covering approximately 356,000 members.

- 7 Humana Medicare Advantage plan contracts offered in 46 states and Puerto Rico received 4.5-star ratings for 2023.

You May Like: Does Medicare Help Cover Assisted Living

Humana Ranked Number 1 Among Health Insurers For Customer Experience

Humana won the No. 1 customer service ranking among health insurance companies for the second year in a row in 2022, according to the Forresters 2022 U.S. Customer Experience Benchmark survey.3 The ranking is based on over 96,000 survey respondents in the U.S.

In the report, Humana ranked highest for:

- Providing clear communication

- Providing transparent premiums, copays and fees

- Supporting customers with excellent customer service

What Are Medicare Part D Prescription Drug Plans From Humana

Original Medicare, Part A and Part B, doesnât cover most prescription medications you take at home its coverage of prescription drugs is very limited. If you decide to stay with Original Medicare , you can enroll in a stand-alone Medicare Part D Prescription Drug Plan from Humana to help cover your medications.

If you are enrolled in Medicare Part A and/or Part B, you can enroll in any stand-alone Medicare Prescription Drug Plan as long as you live within the planâs service area⦠However, you can only enroll during certain election periods. If you sign up for a stand-alone Medicare Part D Prescription Drug Plan as soon as you are eligible for Medicare, you can avoid the Part D late-enrollment penalty. This is a penalty you would pay along with your monthly Part D premium, and youâd pay the penalty as long as you have Medicare prescription drug coverage. Medicare charges this penalty if you go without creditable prescription drug coverage for at least 63 days in a row after your Medicare Initial Enrollment Period has ended.

Medicare Part D Prescription Drug Plans use formularies, or lists of approved medications, to determine benefits. If you take prescription drugs on a regular basis, be sure to check the plan formulary before you decide to enroll. Humana provides this tool to help you search for your medications. Plans may change their formularies at any time, but you will receive notice from your plan when necessary.

Don’t Miss: Does Medicare Pay For Oral Surgery

Us Department Of Justice Lawsuits

The U.S. Department of Justice filed lawsuits on July 21, 2016, to halt the proposed mergers between Humana and Aetna as well as Cigna and Anthem. The lawsuits arose from concerns that the proposed mergers would limit competition in the health insurance market, raise health insurance premiums, and create challenges for the Affordable Care Act.

If allowed to proceed, these mergers would fundamentally reshape the health insurance industry, said Attorney General Loretta Lynch. They would leave much of the multi-trillion dollar health insurance industry in the hands of three mammoth insurance companies, drastically constricting competition in a number of key markets that tens of millions of Americans rely on to receive health care.

All four health insurers fought the lawsuits. According to Reuters, Humana and Aetna stated that they would “vigorously defend the companies pending merger.”

U.S. District Court Judge John Bates issued a ruling to block the merger between Aetna and Humana on January 23, 2017.

Humana Gold Plus Integrated Coverage Area

File a grievance or appeal with the Centers for Medicare & Medicaid Services, opens new window.

Humana Gold Plus Integrated may terminate or not renew its contract or decide to reduce its service area. The effect of any of these actions may affect your benefits and/or enrollment.

Humana Inc. and its subsidiaries comply with all applicable federal civil rights laws and do not discriminate on the basis of race, color, national origin, ancestry, religion, sex, marital status, gender, gender identity, sexual orientation, age, or disability. See our full accessibility rights information and language options.

Don’t Miss: What Is The Best Supplemental Insurance To Medicare

Customer Satisfaction: 45/5 Stars

The customer satisfaction rating considers Humanas Better Business Bureau, National Committee for Quality Assurance, and Consumer Affairs ratings.

Humana has an A+ rating from the Better Business Bureau. Although Humana has had over 200 total complaints in the last three years, 65 were closed in the last year, and the company typically addresses complaints promptly.

According to the National Committee for Quality Assurance, satisfaction ratings for Medicare plans issued by Humana range from 2.5 to 4 stars, with more than 30 plans receiving higher performance ratings.

Humana received 4 out of 5 stars from Consumer Affairs, with more than 2,000 consumer reviews recorded. Beneficiaries boasted about the beneficial customer service representatives and appreciated its Silver Sneaker program, low deductibles, zero-dollar premiums, and extensive provider networks.

Humana Gold Plus Integrated Medicare

Illinois residents who are eligible for Medicare and Medicaid coverage and benefits can get it all through Humana Gold Plus® Integrated Medicare-Medicaid in Illinois. Through Humana Gold Plus Integrated, your Medicare and Medicaid coverage and benefits are combined into one planPLUS you get prescription drug coverage.

Read Also: Is Revlimid Covered By Medicare

Extra Perks And Benefits

Some Humana Medicare Advantage plans come with additional perks and benefits. Availability will vary based on your plan type and your location.

- SilverSneakers membership: A fitness membership that grants you access to live online fitness classes, participating gym and fitness center locations, and in-person exercise classes designed for seniors.

- Insulin Savings Program: Members pay just $35 or less at all in-network pharmacies for a 30-day supply of insulin. Some plans have $0 insulin copays.

- OTC allowance: Some plans include an allowance that you can use for vitamins, pain relievers, cold medicines, first-aid supplies, and other OTC medications and supplies.

- Healthy Foods Card: Receive $25 to $50 each month to shop for approved healthy foods at participating stores. The balance doesn’t roll over from month to month.

- Well Dine meal delivery program: Following an inpatient stay in the hospital or a skilled nursing facility, members may receive a set number of free meals delivered to their home. Seniors with Humana SNPs can also receive 20 meals per eligible condition each year.

- Wigs: Select plans include up to a $500 maximum benefit per year to cover the cost of a wig .

- Transportation: Get a $0 copay for up to 24 one-way trips per year. Locations must be plan approved, and you must contact Humana’s transportation vendor to arrange your ride.

What We Like About Humana Medicare Advantage

- Nationwide availability: Humana’s plans are available in all 50 states and Washington, D.C.

- All-in-one coverage options: Many plans include Medicare Part A, Part B, and Part D

- Wide range of extra perks: Extra plan benefits may include dental care, vision care, hearing care, transportation, SilverSneakers fitness program, meal delivery, an OTC allowance, and an insulin savings program.

- Variety of plan types: Humana offers four different plan types: HMO, PPO, SNP, and PFFS.

- $0 premium plans available

- User-friendly website: Humana’s website lets you find plans, pricing, and benefits based on your ZIP code and easily compare your options.

Read Also: Do You Have Dental With Medicare

Dental And Vision Insurance

Dental insurance through Humana is available in three tiers of coverage: Dental Savings Plus, Preventive Value and Dental Preventive Plus.

| Plan name | |

|---|---|

| $1,000 | $20.99 |

The main difference between these policies will be the provider networks. Dental Savings Plus may be the cheapest policy among Humana’s offerings but will only provide discounts if you visit in-network dentists. On the other hand, Preventive Value and Preventive Plus will offer more flexibility for networks.

Vision insurance can also be purchased through Humana’s website, but only one plan is offered: Vision Focus Plan. The policy has a monthly premium of $14.99 with a one-time enrollment fee of $35. Humana’s vision insurance will aid you in paying for services such as routine eye exams, contact lenses and frames.

Financial Strength: 5/5 Stars

Humanas financial strength rating is based on ratings issued by A.M. Best, a credit rating agency that specializes in the insurance industry. A.M. Best assesses the creditworthiness of insurance companies. It uses a ranking system to provide consumers, investors, and financial professionals with a qualified assessment of an insurance companys financial health and the likelihood of it defaulting on its obligations.

As of 2020, Humana has an A-minus, or excellent, rating from A.M. Best, indicating the company has demonstrated strong operating performance and is financially stable and able to meet its obligations.

You May Like: How To Qualify For Dual Medicare And Medicaid

The History Of Medicare

On July 30, 1965, President Lyndon B. Johnson signed into law the bill that led to Medicare and Medicaid. The original Medicare program included Part A and Part B , which are called Original Medicare today.1

Other important milestones include:2

- 1966 Medicare was implemented and more than 19 million individuals enrolled by July 1.

- 1972 Medicare eligibility was extended to individuals under age 65 with long-term disabilities and to individuals with ESRD.

- 1980 Medicare Supplement insurance, also called Medigap, was brought under federal oversight.

- 2001 The Health Care Financing Administration was renamed the Centers for Medicare & Medicaid Services .

- 2003 The Medicare Prescription Drug, Improvement, and Modernization Act made the most significant changes to Medicare since the program began, including a new, optional, outpatient prescription drug benefit.

- 2010 The Patient Protection and Affordable Care Act , commonly known as the Affordable Care Act, was signed into law and prohibited health insurance companies from denying or charging more for coverage based on an individuals health status.

- 2013 The Health Insurance Marketplace opened and Americans were able to shop for health coverage without being denied or charged more because of a preexisting condition.

Humana Medicare Advantage Plans

Like all Medicare Advantage plans, Humana Medicare Advantage plans provide the same coverage as Original Medicare , and some plans may include additional benefits coverage, such as:

- Prescription drug coverage

Certain Humana Medicare Advantage plans also offer other benefits such as fitness programs, access to mail-order pharmacy services, and caregiver support.3

You may be able to enroll in a plan with an affordable or, in some areas, a $0 monthly premium.1

Over 5 million people are enrolled in a Humana Medicare Advantage plan.2

Humana offers four Medicare Advantage plan types:

A Humana HMO plan requires you to choose an in-network primary care doctor. The plan offers affordable copayments and generally has a lower out-of-pocket maximum than Humanas PPO and PFFS plans.

A Humana PPO plan lets you visit any Medicare-approved doctor who accepts Humanas plan terms and agrees to bill the plan. The plan offers affordable copayments and has mid-range out-of-pocket maximum compared to Humanas HMO and PFFS plans.

A Humana PFFS plan lets you visit almost any Medicare-approved doctor who accepts Humanas plan terms and agrees to bill the plan. The plan offers affordable copayments and has a higher-range out-of-pocket maximum compared to Humanas HMO and PPO plans.

Your plan options may vary depending on your location.

Recommended Reading: Will Medicare Pay For Diapers

Humana Medicare Advantage 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

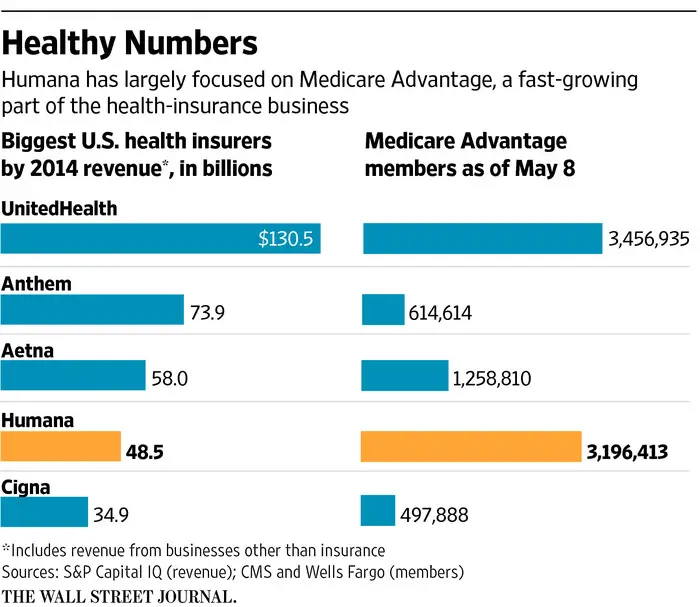

Humana was the second-largest provider of Medicare Advantage plans in 2021

Although most of Humanas Medicare beneficiaries are in high-rated plans, some contracts get lower scores than others, so its worth doing your research before you sign on.

Heres what you should know about Humana Medicare Advantage.