B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

What Is The Medicare Part B Give Back Benefit

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan. You might also hear the Give Back plan called the Part B premium reduction. Here is how it works.

When you sign up for a Medicare Advantage plan that includes the Medicare Give Back benefit, the Advantage plan carrier will pay for a portion of your Part B premium. In some cases, they might even pay for your entire monthly premium. However, you will not receive a rebate check each month from your insurance company. You will see a reduction in the amount of your premium by the give back amount. For instance, if you pay the standard premium amount of $170.10 each month and your give back amount is $70, then you would only pay $100.10 each month. Most people have their Medicare premium automatically withdrawn from their Social Security check. In that case, you would see a deduction of $100.10 per month instead of the full $170.10.

I Have Insurance Through The Affordable Care Act Marketplace Should I Apply For Medicare Too

If you have insurance through the ACA’s marketplace, you do not need to sign up for Medicare unless you want to. You should evaluate your costs and coverage with the ACA plan vs Medicare. To help here is a Kidney Care Insurance Worksheet which is designed to help compare plans offered in the health insurance marketplaces established by the Affordable Care Act, so you can choose the most affordable and comprehensive plan. It is also important to note that if you apply for Medicare you will lose any subsidies you receive from your ACA Marketplace coverage. If you chose not to enroll in Medicare when your kidneys fail, you will have penalties with higher premiums if you chose to enroll later.

Remember Medicare only pays 80% of dialysis treatment so you will need a supplemental plan so you should also calculate this cost into your assessment. For people under 65 years old there may not be a supplement plan available in your state. To find out what supplemental policies are available in your state contact your State Health Insurance Assistance Programs .

You May Like: What Is The Best Medicare Advantage Plan In Arizona

Can I Get Medicare Part A If I Dont Have Enough Credits

If you dont have enough credits, you can still enroll in Medicare Part A, but you may have to pay the Part A premium.

In 2021, the premium for Medicare Part A is $471 each month if you have less than 30 credits and $259 if you have 30 to 39 credits.

Typically, if you choose to buy Part A, you must also enroll in Medicare Part B and pay premiums for both Part A and Part B. In 2021, the standard Part B premium amount is $148.50. You may pay more, though, depending on your current income.

Whether or not you have enough credits for premium-free Medicare Part A, you still have to meet basic Medicare eligibility requirements including:

- being 65 years old or over

- being a U.S. citizen or a permanent legal resident who has lived in the United States for a minimum of 5 years

When Can I Enroll In Medicare Part D

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

As mentioned above, most people who select Medicare Advantage must receive their Part D prescription benefits as part of that same Medicare Advantage plan . Medicare Savings Account plans do not include Part D coverage, nor do some Private Fee-for-Service Medicare plans. If you have an MSA or a PFFS and it doesnt have Part D coverage included, youre allowed to purchase a stand-alone Part D plan to supplement it.

As with Part B, you are still eligible for Part D prescription drug coverage if you dont enroll when youre first eligible, but you may pay higher premiums if you enroll later on, unless you had during the time that you delayed enrollment in Part D.

Don’t Miss: How To Get A Wheelchair From Medicare

I Applied For Medicare When Will My Medicare Coverage Begin

The effective date of Medicare based on ESRD is dependent upon the type of treatment you choose:

- For hemodialysis patients Medicare is effective the 4th month of treatmentFor example, if hemodialysis is begunin May, Medicare becomes effective August 1.

- For home dialysis patients Medicare is effective the first month of treatment.

- For transplant recipients Medicare is effective

- the month youre admitted to the hospital for a kidney transplant or for health care needed prior to a transplant if the transplant takes place that same month or within the following two months.

- Two months prior to transplant if the transplant is delayed more than two months after you are admitted to the hospital in anticipation of transplantor related health services

You May Like: What Is Medicare Id Number

How Do Medicare Benefit Periods Work

Its important to understand the difference between Medicares benefit period from the calendar year. A benefit period begins the day youre admitted to the hospital or skilled nursing facility.In this case, it only applies to Medicare Part A and resets after the beneficiary is out of the hospital for 60 consecutive days. There are instances in which you can have multiple benefit periods within a calendar year. This means youll end up paying a Part A deductible more than once in 12 months.

Recommended Reading: Are Medicare Advantage Premiums Deducted From Social Security

Other Ways To Get Medicare Coverage At Age 65

If you dont qualify for premium-free Medicare Part A coverage, you may be eligible to buy coverage. However, you must still be a U.S. citizen or a permanent resident for at least five years to qualify.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. Premium costs vary based on how long you have worked and paid into Medicare.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. Your premium will be the standard rate and would depend upon the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

Medicare Supplement Plan Eligibility

Like Medicare Advantage, Medicare supplemental insurance often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B is also purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

You must meet one of these qualifications to be eligible for Medigap coverage:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been entitled to Social Security or U.S. Railroad Retirement Board disability payments for at least 24 months.

- You have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

You May Like: Do You Have To Pay For Part B Medicare

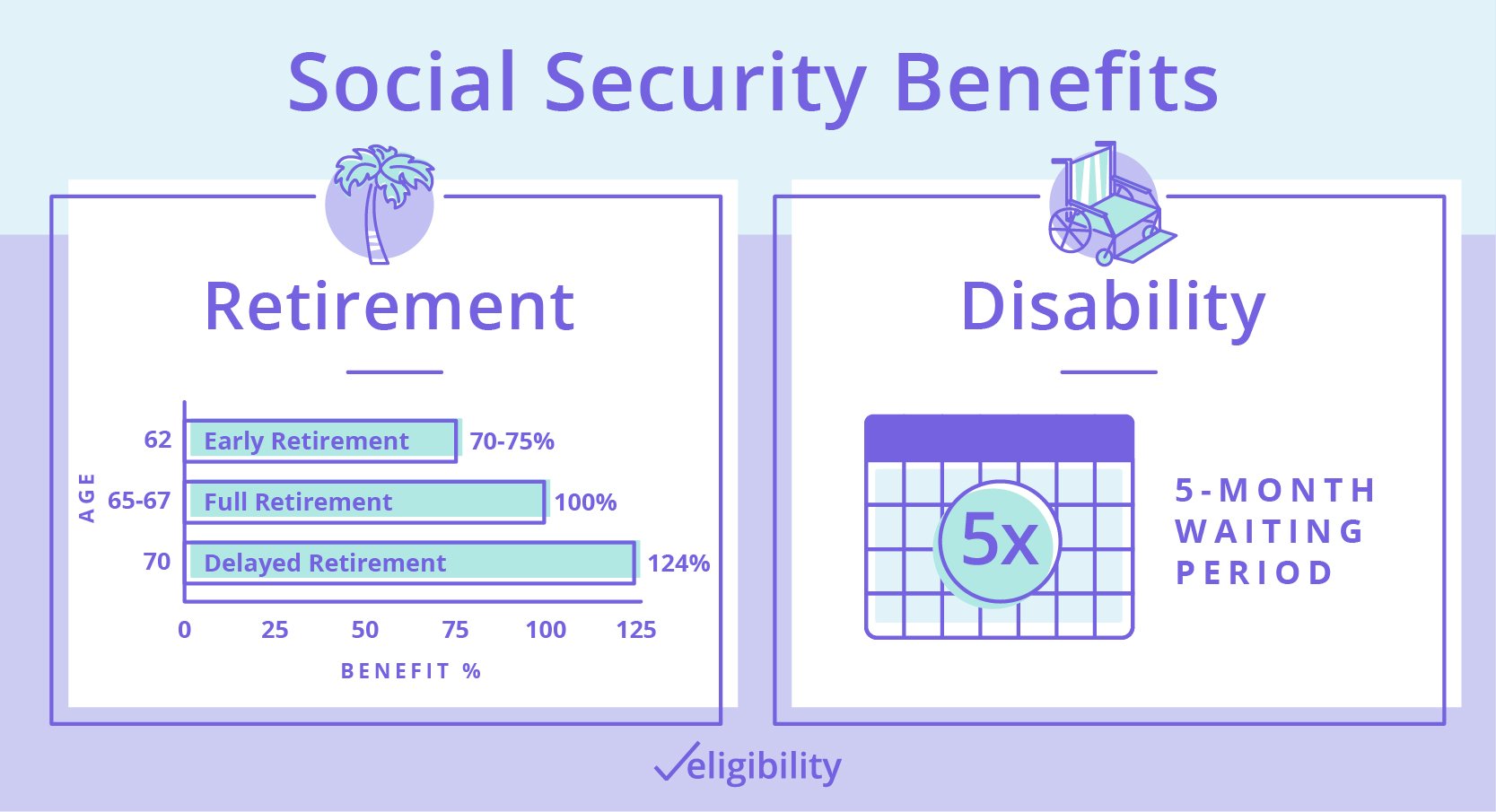

How Many Social Security Credits You Need To Qualify For Ssdi

Because the number of social security credits for eligibility for SSDI varies by age. If you are between 31 and 42 years you will need 20 work credits to qualify for disability benefits.

f you are under 24 years old, you will require 6 work credits. If you are between 24 and 30 years old the number of social security credits required is 8 with number of years of work set at 2 while a 30 year old will need 18 credits and 4 and a half years of work.

If you are 27 years old, this would give you a potential of 6 years of work time since reaching 21 years. You will be required to earn work credits for half of those years so you will need to have 3 years of work credits to qualify for disability benefits.

Each year you may earn a maximum of 4 social security credits which is 4 credits earned each year for 3 years which means that you will need 12 work credits to qualify for disability benefits if you become disabled when you are 27 years old. If you are over 62 years you will need 40 social security credits and 10 years spent working.

How Do I Know If I Have Worked Enough To Qualify For Mediare

You earn 1 work credit for earning a specific amount of money from work in a 3-month quarter. The chart below gives a general guide to number of work credits needed to qualify for Medicare at a particular age. To find out how many work credits you have, call Social Security at 1-800-772-1213.

|

Your Age Now |

Number of Work Credits Needed to Qualify for Medicare |

|

Under 24 |

6 credits in the last 3 years before kidney failure |

|

24-30 |

Worked at least half the time from age 21 until kidney failure For example, if you are 30, you must have at least 18 credits (9 yers of work x2 quarters each year = 18. |

|

31-43 |

20 credits in the 10 years before kidney failure |

|

44-61 |

20 credits in the last 10 years, plus 2 credits for every 2 years age 44 and older. For example, if you are 58, you must have at least 36 credits (10 years of work x 2 quarters each year = 20, plus 8 two-year periods since age 44 x 2 credits each year = 16 |

|

62 & older |

40 credits |

Also Check: Is Medicaid Or Medicare For The Elderly

Options If Not Enough Quarters Worked

Options are available to obtain Medicare Part A if a person did not earn enough working quarters.

Medicare Savings Programs are federally funded assistance programs that each state administers to help with the costs associated with Medicare.

There are four different Medicare Savings programs. Most of the programs help pay for Medicare Part B premiums.

The Qualified Medicare Beneficiary Program helps pay for premiums and other costs of Part A. Income limits apply to qualify for the assistance programs.

Do You Have To Apply For An Msp During Medicare’s Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

Also Check: How Do I Contact Medicare Part B

What Are Employment Quarters

One employment quarter is equal to three months. There are four quarters in a year. For example:

The Social Security Administration also refers to a quarter of coverage as a Social Security credit. You cannot earn more than 4 QCs in one year.

In 2022, you must earn at least $1,510 in a quarter for that quarter to count as a qualified quarter credit. You must typically have 40 quarter credits to earn Social Security retirement benefits.

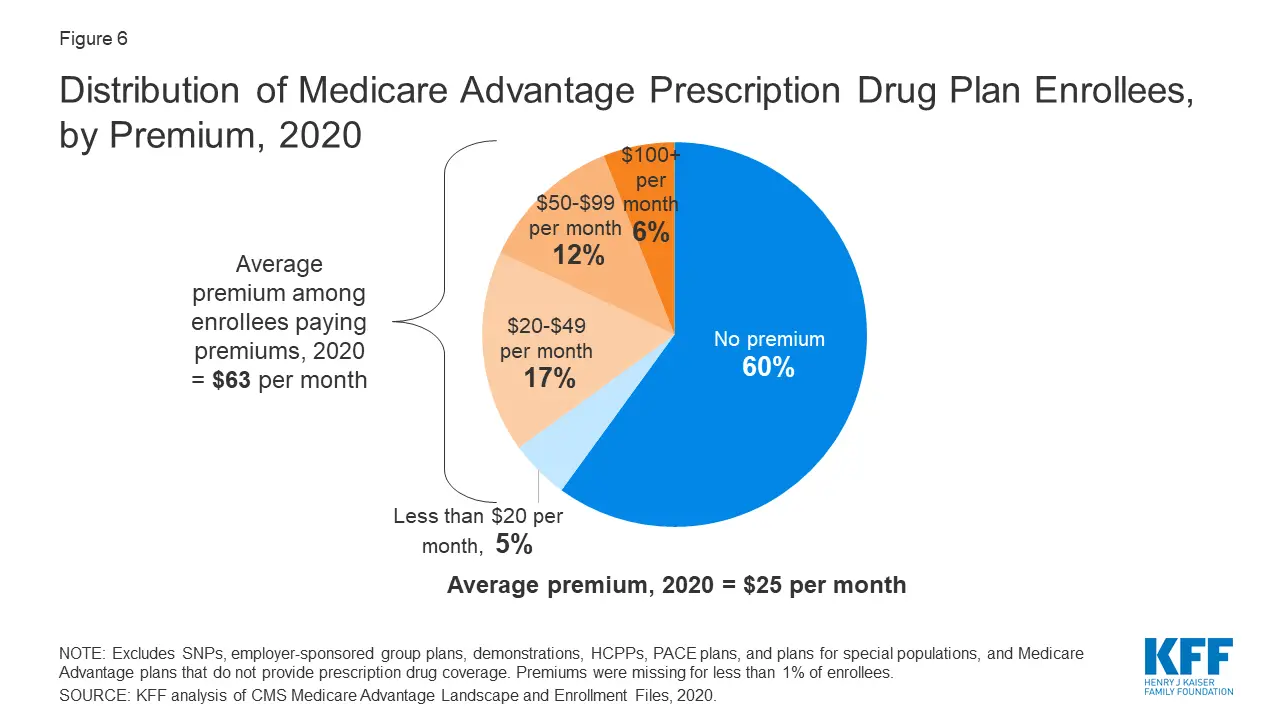

How Much Does Medicare Advantage Cost Per Month

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Read Also: How Do I Get Part A Medicare

Medicare Eligibility: Key Takeaways

- Generally, youre eligible for Medicare Part A if youre 65 and have been a U.S. resident for at least five years.

- When youre notified youre eligible for Part A, youll be notified that youre eligible for Medicare Part B.

- You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage.

- To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both.

- If youre enrolled in both Medicare Part A and B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy.

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday.

But your eligibility to receive Medicare coverage without having to pay a premium and your eligibility for other Medicare plans depends on such factors as your work history and your health status. Heres what you need to know:

Medicare Coverage For People Who Never Worked

Your Medicare Part A coverage is essentially paid for while in the workforce since you pay taxes for Medicare while employed. If you never worked, you likely will not be eligible for premium-free Part A, which covers inpatient care and hospital stays.

You can still get Part A without any work history to do so, youll have to pay a monthly premium like any other form of insurance. That premium could be reduced if you spent some time in the workforce.

For example, if you were employed for years but put your career on pause to be a stay-at-home parent or for any other reason, you could be eligible for a reduced premium.

If you never worked, then your Part A premium for 2022 will be $499. But if you spent at least 30 to 39 quarters in the workforce and paid Medicare taxes, your premium could be reduced to $274.

Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

Read Also: What Is Oep In Medicare

How Credits Are Earned

Since 1978, when you work and pay Social Security taxes, you earn up to a maximum of four credits per year.

The amount of earnings it takes to earn a credit may change each year. In 2021, you earn one Social Security or Medicare credit for every $1,470 in covered earnings each year. You must earn $5,880 to get the maximum four credits for the year.

During your lifetime, you might earn more credits than the minimum number you need to be eligible for benefits. These extra credits do not increase your benefit amount. The average of your earnings over your working years, not the total number of credits you earn, determines how much your monthly payment will be when you receive benefits.

Read our publication, “How You Earn Credits,” for more information.

Is It Possible To Be Eligible For Medicare And Medicaid

Yes. Medicaid is a joint federal-state health insurance program that states run to help those with limited income and resources pay medical bills. Enrollment in both Medicare and Medicaid is called having dual eligibility. Coverage varies by state.

Individuals with full Medicaid can get help paying for services that Medicare doesnt cover or only partially covers, such as nursing home care and long-term supports and services. In most cases, Medicaid will pay your Medicare Part B premium and may help with deductibles and other costs. This may be through a Medicare Savings Program, a state-based program that can help you pay for out-of-pocket Medicare expenses. Contact your state Medicaid program or ask your SHIP counselor if you qualify.

With Medicare and full Medicaid, youll automatically qualify for Extra Help, financial assistance for Medicare Part D drug coverage costs.

Most dually eligible beneficiaries qualify for full Medicaid benefits, according to the Kaiser Family Foundation. You may be eligible for Medicaid if you have a limited income and:

-

Are 65 or older

-

Are caring for a child

Read Also: Is Chantix Covered By Medicare