I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

How Much Do You Pay With Medicare Part D

Medicare Part D is a prescription drug program that helps seniors and people with disabilities afford their medications. Depending on your income, you may be required to pay part or all of the costs for your medications. In this article, well explore the different types of payments you can make with Medicare Part D and how much they cost.

Contents

Also Check: How To Order Another Medicare Card

How Much Will Part D Cost In 2022

In 2021 the average Part D plan premium is between $15-$25 per month. Similar to your Part B premium, this plan can also be subject to your income.

The chart below shows the premium increases due to your income for Part D plans. These amounts would be in addition to your Part D plan premium.

| If your yearly income in 2020 was | You pay |

| $77.10 + your plan premium |

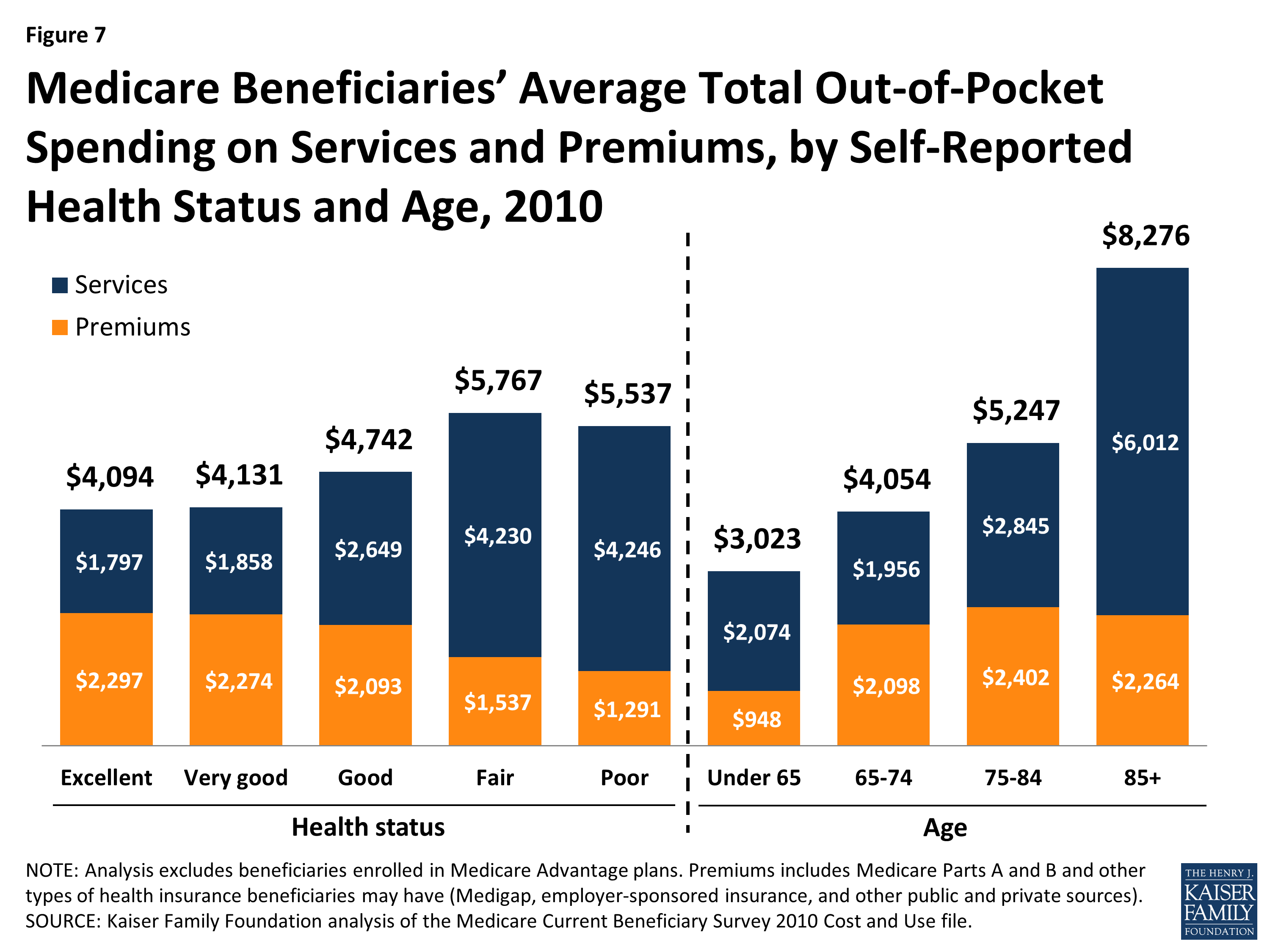

Is There A Limit On Out

There is no out-of-pocket spending limit with Original Medicare .

Medicare Advantage plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses.

While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2022. Some plans may set lower maximum out-of-pocket limits.

Medicare Advantage plans are offered by private insurance companies. When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

Most Medicare Advantage plans provide prescription drug coverage, which is not typically covered by Original Medicare.

Some Part C plans also offer other benefits that Original Medicare doesnt cover, which may include:

- Routine hearing, dental and vision coverage

- Non-emergency transportation to approved locations

- Over-the-counter medication allowances

- Health and wellness programs, such as SilverSneakers

Depending on where you live, you may be able to find $0 premium Medicare Advantage plans.

You May Like: Can I Buy Into Medicare

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

Don’t Miss: How Do I Change My Primary Care Physician With Medicare

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Recommended Reading: What Is The Cost Of Medicare B

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youll pay any of those premiums, too.

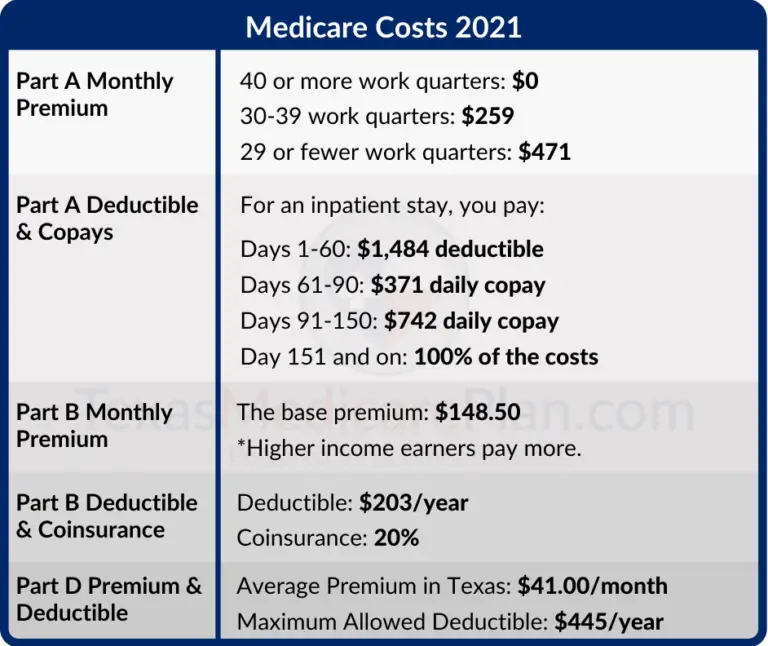

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youve hit the Medicare Part D coverage gap, or donut hole. After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the donut hole here.

What Is Medicare Part B

Some people automatically get. Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don’t sign up for Part B when you’re first eligible, …

Don’t Miss: Are Medical Alert Systems Covered By Medicare

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

Recommended Reading: Can You Get Medicare Early

Who Pays Medicare Taxes And Why

Almost every employee in the United States whether they work for an American or foreign employer pays Medicare taxes. All employers in the U.S. must also match the amount of Medicare taxes their employees pay with certain limitations on additional Medicare taxes for high earners.

Self-employed workers also have to pay Medicare taxes.

Money not subject to Medicare taxes includes:

- Wages or salary paid to an ordained, commissioned or licensed minister of a church so long as its for work done in the course of their ministry.

- Money paid to a child under the age of 18 working for a parent if the child is paid under certain conditions.

- Money for services performed as a student nurse if they are paid under certain conditions.

Foreign residents working in the United States on certain types of work visas or student visas are also exempt from having to pay Medicare taxes.

The United States has agreements with foreign countries to make sure that people from one country working in the other are subject to taxes only for one country or the other. These are called totalization agreements.

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

Read Also: Does Medicare Pay For Multifocal Lens

Total 2022 Monthly Medicare Costs

When we total up all of your monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B â

- Get a quoteâ¯for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

How Much Will Medicare Pay In 2021

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

Don’t Miss: Will Medicare Pay For Therapy

How Much Is Part D Insurance In 2021

In 2021 the average Part D plan premium is between $15-$25 per month. Similar to your Part B premium, this plan can also be subject to your income. The chart below shows the premium increases due to your income for Part D plans. These amounts would be in addition to your Part D plan premium. If your yearly income in 2019 was.

B Deductible Also Increased For 2022

Medicare B also has a deductible, which increased to $233 in 2022, up from $203 in 2021. The Medicare Part B deductible only has to be paid once per year, unlike the Part A deductible, which has to be paid once per benefit period.

After the Part B deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services for the remainder of the year. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Also Check: How Much Does Medicare Pay For Urgent Care Visit

Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Ways To Pay Your Medicare Part B Premium

If youre like most people, you dont pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . You will need to make arrangements to pay this bill every month.

If you are required to pay a Part D income-related monthly adjustment amount , you will also need a way to make your payment.

Read Also: What Does Medicare Part D Do