How Do I Apply For Medicare In Texas

If you are 65 or soon will be, here are a few ways to sign up for Original Medicare.

- Or call 1-800-772-1213

You have a seven-month eligibility timespan to enroll, called your Initial Enrollment Period.

Enrollment in Medicare Part A and Part B is automatic if you already receive disability benefits through Social Security or Railroad Retirement.

If you dont enroll in Part B when youre first eligible, you can sign up from Oct. 15 through Dec. 7 during the Open Enrollment Period.

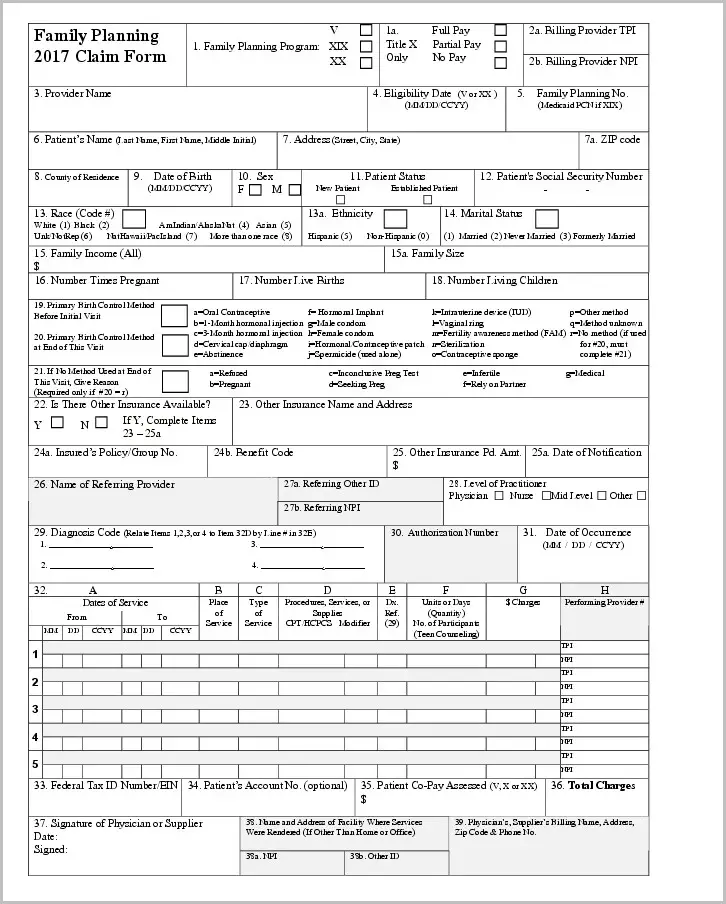

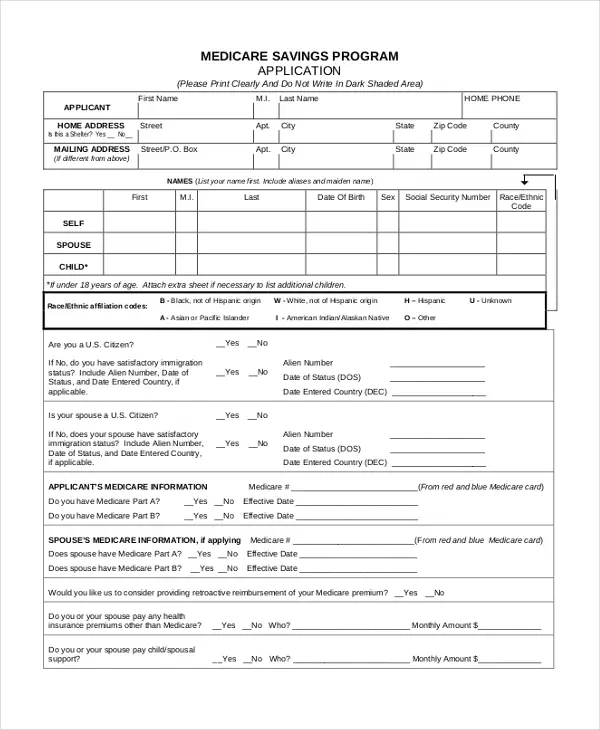

Texas Medicare Savings Program

The Medicare Savings Program can help you pay for some or all of your monthly Medicare payments, co-pays, and deductibles. The Medicare Savings Program is managed by the Texas State Health Insurance Assistance Program.

Contact the Texas Medicare Savings Program

Texas Medicare Savings Program Phone Number: 1-800-252-9240Directory of Services

Medicare Part D In Texas

Medicare Part D, also known as Medicare prescription drug coverage, is a federal program that offers Medicare beneficiaries prescription drug coverage whether you live in Texas or elsewhere. You must be enrolled in Medicare Part A and/or Part B and live in the Part D plans service area to qualify.

If you choose to enroll in Medicare Part A & B, youll likely need Medicare Part D coverage because it fills the requirement of having creditable coverage. However, if you enroll in a Medicare Advantage plan, you could have creditable coverage through a Medicare Advantage Prescription Drug plan. You cannot have both an MA-PD and Medicare Part D.

Yes, you must have prescription drug coverage at all times. In fact, if your creditable coverage through your group health plan ends, you must enroll in Part D within 63 days of losing that coverage. Or you could incur a permanent late enrollment penalty when you do decide to enroll in Medicare Part D. And that penalty will be in place for the entire length of your Medicare coverage.

Extra Help for Prescription Drug Coverage

You may qualify for financial assistance for prescription drug costs through a program called Extra Help. The Social Security Administration and the Centers for Medicare & Medicaid Services work together to provide the benefit. In 2022, 28% of Texans with a stand-alone Medicare prescription drug plan receive Extra Help, also known as low-income subsidy or LIS.

When and How to Apply for Medicare Part D in Texas

Read Also: What Is The Monthly Premium For Medicare Plan G

Medicare Plans In Texas

Know your options for Medicare plans in Texas, whether youre looking for Original Medicare or Medicare Advantage.

Texas has 4,355,781 people enrolled in Medicare and the number of plan options is also growing. Comparing the different plans is key to finding the best plan for you.

- Original Medicare

- Medicare Advantage

- Medicare Part D

You may also elect to add a Medicare Supplement Plan to go along with Original Medicare to help with additional out-of-pocket expenses.

Before you pick a plan, learn about your costs, coverage, and choosing the best Medicare plan for your needs.

- Average costs of Medicare in Texas: In 2022, Medicare Advantage premiums decreased 3.85% from $11.11 to $10.68. The lowest Part D plan in Texas is $6.90.

- Average expenditure per enrollee: In Texas, the average Medicare spending per enrollee is $11,463.

- Number of enrollees in Texas: As of 2022, 4,355,781 individuals enrolled in Medicare are in the state of Texas. Approximately 1.7 million individuals are on a Medicare Advantage Plan.

- Medicare Advantage availability: Texas has had a 16.6% increase in Medicare Advantage Plans since 2021.There are 337 Texas Medicare Advantage Plans available in 2022, which is an increase from 289 plans in 2021.

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

You May Like: How Many Days Does Medicare Pay For Nursing Home Care

Texas Medicare Eligibility Requirements In 2022 For Private Medicare Insurance Plans

When you first become eligible for Medicare, youll also have the right to sign up for a private Medicare Insurance plan. This is the time to enroll in a Medicare Advantage plan or a standalone Prescription Drug Plan . You can get either of these coverages at any age, even if you start Medicare before you turn 65.

The rules in Texas for Medicare Supplement Insurance, which is also called Medigap, are a little more complicated. The minimum age at which you can get Medigap isnt regulated at the federal level, so each state can set its own rules. In some states, Medigap isnt available at all to people under 65.

In Texas, all Medigap insurers are required to offer at least one standardized Medigap plan to people under 65. However, this means that there are very few options, and they can be very expensive for people under 65. If you enter Medicare before age 65 in Texas, you may want to consider using Medicare Advantage until you turn 65. Once youre 65, youll have an Open Enrollment Period to enroll in any Medigap plan you choose, and youll have many more options at 65. Plus, the premiums will be more affordable.

Participating sales agencies do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1800MEDICARE to get information on all of your options.

Overview Of Medicare In Texas

Medicare is the United States federal health insurance program enacted in 1966 to cover hospital and medical expenses for beneficiaries. Over the years, Medicare has expanded its program to offer even broader coverage, often referred to as Medicare Part C and Medicare Part D coverage. In addition, Medicare coverage is delivered not only by the federal government, but also by private insurance companies that are contracted by Medicare to provide benefits to beneficiaries. With so many connecting parts and providers of coverage, choosing your Medicare coverage may seem a daunting exercise. To help you, weâve pulled together some facts about the parts of Medicare and how they can work together in Texas to help you evaluate which Medicare coverage options are best for you.

Also Check: Does Medicare Pay For Glucose Meters And Test Strips

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

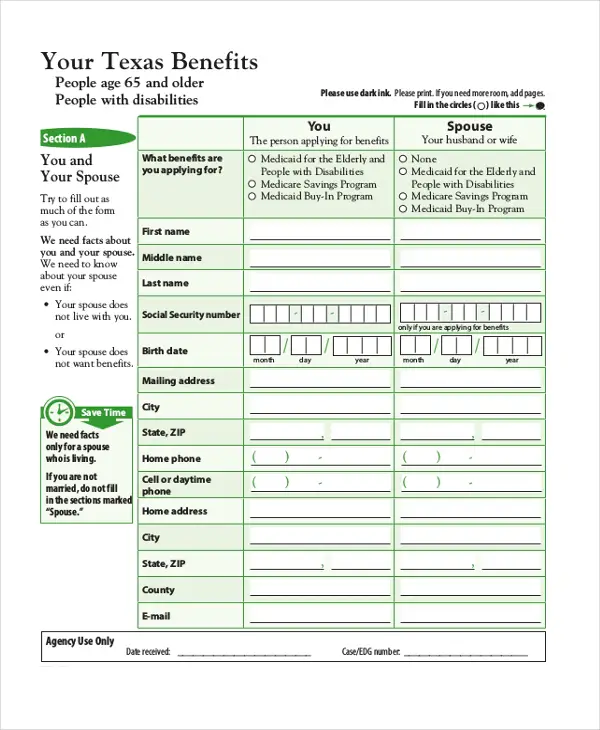

What Is The Income Limit For Medicaid In Texas

The monthly income limit to be eligible as a Qualified Medicare Beneficiary is $1,153 for individuals and $1,546 for couples for 2022. The QMB program covers Medicare Part A and Part B. To be eligible as a Specified Low-Income Medicare Beneficiary, the monthly income limit is $1,379 for individuals and $1,851 for couples for 2022.

Recommended Reading: Does Medicare Cover Naturopathic Doctors

Can You Have Medicare And Medicaid In Texas

You can have Medicare and Medicaid at the same time. Medicaid can provide benefits not covered by Medicare, such as nursing home care.

Texas Health and Human Services offer the Dual-Eligible Project for people who qualify for Medicare and Medicaid. The Dual Eligible Project could make it easier for people to receive care. You are eligible if you are age 21 or older, get Medicare Part A, Part B, Part D, receive full Medicaid benefits, and are enrolled in the Medicaid STAR+PLUS program.

Medicare Resources In Texas

Making Medicare decisions can be overwhelming at times. It is good to utilize the resources and tools available in Texas. Medicare support organizations have people knowledgeable in the programs specific to your state. Most of the services provided are free. For example, the Texas Consumer Assistance advocacy organization can help you gather information about health insurance and get answers to questions or assistance with issues.

Never be afraid to ask questions. Get started with these Texas Medicare resources:

Texas Medicare Resources

Tammy Burns is an experienced health insurance advisor. She earned her nursing degree in 1990 from Jacksonville State University, obtained her insurance billing and coding certification in 1995, and holds a health and life insurance license in Alabama, Georgia, Iowa, Mississippi, and Tennessee. Burns is Affordable Care Act -certified for health insurance and other ancillary, life, and annuity products. She maintains an active nursing license and practices private-duty nursing.

You May Like: How Much Do They Take Out For Medicare

What Is Medicare Called In Texas

Medicare is overseen by the Texas Health and Human Services Commission. The department offers Medicare Savings Programs, including the Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiaries, the Qualifying Individuals Programs, and the Qualified Disabled and Working Individual Program.

Medicare Plan Options In Texas

Of the nearly 4.3 million Texans enrolled in Medicare, 2.5 million are enrolled in Original Medicare Parts A and Part B alone. The remaining 1.7 million are enrolled in a Medicare Advantage plan .

Texans enrolled in a Medicare Advantage plan have increased by 228%, up from 18% in 2010 to 41% in 2020 .

Youre likely about to or have made a similar enrollment choice:

After you enroll in Original Medicare, you should review your options for expanding your Medicare coverage.

Continue reading to learn more about Medicare Parts A, B, C, D, and Medigap options to uncover whats suitable for your health and budget needs.

Also Check: Does Medicare Cover Rosacea Treatment

Medicare Eligibility In Texas

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

More than 4 million Texans are enrolled in Medicare as of 2020,1 which is 14% of the states total population.2

But what does it take to qualify? Learn about your Medicare eligibility in Texas and the coverage options that are available to you.

And if youre ready to start comparing Medicare Advantage plans in Texas, you can do so with our innovative FitScore® technology right now! Get started reviewing your options.

Signing Up For Medicare Supplement Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan anytime. However, your Medicare Supplement Open Enrollment Period is the best time to enroll.

You can enroll in any Medicare Supplement plan when you become eligible, with no health underwriting questions during the Medicare Supplement Open Enrollment Period. Thus, you will not face denial due to pre-existing health conditions. Read more about Medicare Supplement Open Enrollment.

Don’t Miss: How Old To Get Medicare Benefits

How Much Do Medicare Advantage Plans Cost

Medicare Advantage plan costs vary, but some people are able to join plans that do not require monthly premiums. However, even with a zero premium and zero deductible plan, you will still have to pay your monthly Part B premium to Medicare.

Additionally, Medicare Advantage plans set yearly limits on your out-of-pocket costs for medical services. Once you reach the limit, you do not have to pay anything for covered services. Unfortunately, every plan has different limits, and the limits change from year to year.

Enrollment Deadlines In Texas

Do you know when to enroll in Medicare? There are six enrollment periods that you need to know. Two happen only once, three happen every year, and one occurs only under special circumstances. Read below to learn about each of these enrollment periods.

One-Time Enrollment Periods

Initial Enrollment Period

Most people become eligible for Medicare enrollment during their Initial Enrollment Period . The Initial Enrollment Period begins three months before your 65th birthday, the month you turn 65, and ends three months after your 65th birthday. You have this seven-month window to enroll in Medicare for the first time.

Your Initial Enrollment Period is one of the most critical enrollment periods. If you miss it, you may have to wait until the General Enrollment Period to enroll in Medicare. This could result in late enrollment penalties for your lifetime.

Be sure you know when your Initial Enrollment Period is. Take our eligibility quiz to find out and to receive enrollment reminders.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is the best time to buy a Medigap plan, also known as a Medicare Supplement plan. Youll likely get better pricing and greater plan options during the Medigap Open Enrollment Period. Its also when you can sign up for any Medigap plan regardless of preexisting health conditions.

Enrollment Periods That Occur Every Year

Annual Enrollment Period

Once youve reviewed your plan with an agent, you have six possible coverage changes:

Also Check: What Does Medicare Part B

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In Texas

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in Texas includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Do I Have To Join Medicare At Age 65

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

Keep Your Information Current

Its important to keep your enrollment information up to date. To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days:

- a change in ownership

- an adverse legal action

- a change in practice location

You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS. If you applied using a paper application, youll need to resubmit your form to update information.

Also Check: When Should I Receive My Medicare Card

Texas State Health Insurance Assistance Program

The State Health Insurance Assistance Program provides unbiased counseling and assistance with making decisions about Medicare. The program offers Medicare education, help with Medicare eligibility and enrollment, information about long-term care insurance, and more.

Contact the State Health Insurance Assistance Program

Texas Health Information, Counseling, and Advocacy Program Phone Number: 1-800-252-9240Directory of Services

Medicare Supplement In Texas

Medicare Supplement plans, also known as Medigap plans, are used with Original Medicare and are not stand-alone plans. Because Original Medicare does not have a cap on out-of-pocket costs, these plans can assist you in paying for some or all of the expenses you would otherwise have to pay for under Part A & B Original Medicare.

Many Medicare enrollees have some sort of supplemental coverage. In fact, in Texas, according to AHIP analysis, there were 918,619 Texas Medicare beneficiaries with Medicare Supplement coverage in 2022.

Read more about the ten types of Medicare Supplement plans available in Texas, plus additional details about eligibility and enrollment in Medicare Supplement Plans in Texas.

When and How to Apply for Medicare Supplement in Texas

The best time to enroll in a Medicare Supplement plan in Texas is during your Medigap Open Enrollment Period. That occurs the first month you are enrolled in Medicare Part B, and youre older than 65.

The Medigap Open Enrollment Period lasts six months, and the period only happens once. It cannot be changed or repeated. Should you miss this period, you might be able to purchase a Medigap policy, but it will likely cost more due to past or present health problems.

Want help enrolling in a Medicare Supplement plan in Texas? Speak with a local Medicare agent who can guide you through your Medigap options. Call or find your Medigap plan online.

Also Check: Does Medicare Cover Home Health Care For Seniors