Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

How Does Medicaid Expansion Affect State Budgets

Expansion has produced net savings for many states, according to the Center on Budget and Policy Priorities. Thats because the federal government pays the vast majority of the cost of expansion coverage, while expansion generates offsetting savings and, in many states, raises more revenue from the taxes that some states impose on health plans and providers.

Medicare Part A Is Typically Free For Enrollees But That’s Only One Piece Of The Overall Puzzle

Millions of seniors get health coverage through Medicare once they retire. But many make one big mistake going into their golden years: They assume that Medicare is free.

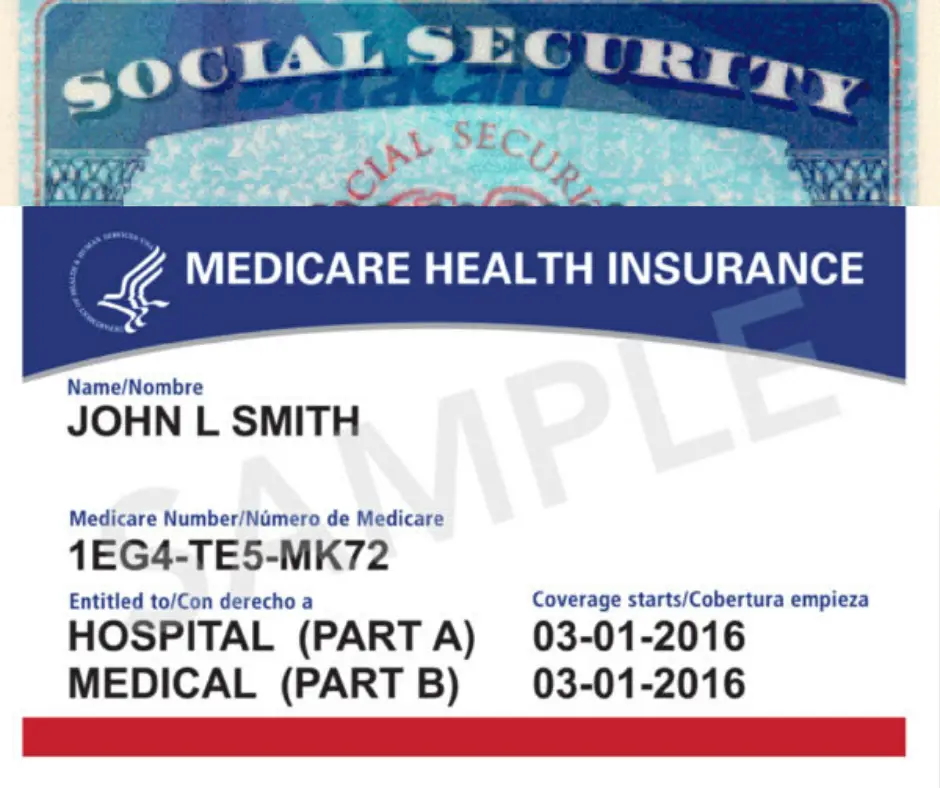

Medicare is actually made up of several distinct parts, but only one of them — Part A — is free. Part A covers hospital care, and technically, some people do need to pay for it, but it’s free for most enrollees.

Parts B and D, however, which cover doctor visits and prescription drugs, respectively, charge enrollees a premium. The standard monthly premium for Part B is $135.50 this year, but higher earners face a surcharge that brings this number up. The cost of Part D, meanwhile, varies from plan to plan.

Then there’s Part C, or Medicare Advantage, which is an alternative to original Medicare. Your premium costs under Part C will depend on the plan you choose, but either way, you’re not getting that coverage for free.

Remember that in addition to your premium costs, you’re also responsible for things like deductibles, coinsurance, and copays. The standard Part B deductible for 2019, for example, $185 per year. Once that deductible is met, you’ll typically pay 20% of the Medicare-approved amount for the services you receive.

Read Also: Is Insulin Pump Covered By Medicare

Medicare Covers The Elderly In 1965

I am one of your old retired teachers that has been forgotten. I am 80 years old and for 10 years I have been living on a bare nothing, two meals a day, one egg, a soup, because I want to be independent. I am of Scotch ancestry, my father fought in the Civil War to the end of the war, therefore, I have it in my blood to be independent and my dignity would not let me go down and be on welfare. And I worked so hard that I have pernicious anemia, $9.95 for a little bottle of liquid for shots, wholesale, I couldn’t pay for it.

Hearings of the Subcommittee on Problems of the Aged and Aging of the Committee of Labor and Public Welfare, 1959

When Medicare was enacted in 1965, America was in many ways a different place than it is today.

Is Medicare Part A Free

Medicare Part A seems free, but its one of those benefits you have actually paid for through the taxes you paid during your working years. Many people will pay no monthly premium for Medicare Part A, which covers inpatient hospital and hospice care, as well as limited skilled nursing and home healthcare services.

Exact costs for Part A depend on your situation and how long you worked. You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply:

- You receive retirement benefits from Social Security.

- You receive retirement benefits from the Railroad Retirement Board.

- You or your spouse worked for the government and received Medicare coverage.

You may also qualify for premium-free Medicare Part A if you are under age 65 and any of these apply:

- You have received Social Security disability benefits for 24 months.

- You have received Railroad Retirement Board disability benefits for 24 months.

If you do not quality for premium-free Medicare Part A, you will pay a premium based on the number of quarters you worked in your lifetime.

| Amount of time worked |

|---|

Also Check: How Much Is Medicare Cost For 2020

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Enrolling In Medicare While Working Abroad

You can delay enrollment in Medicare Part B and avoid its premiums without a late enrollment penalty if you have health care coverage from any of the following:

- An employer for which you or your spouse actively work and that provides group health insurance for you or both of you.

- The public national health system of the country where you live, regardless of whether you or your spouse works for an employer or is self-employed. This delay applies only if either of you is still working, not if you have retired.

- The sponsoring organization of voluntary service you provide abroad for example, the Peace Corps.

When you or your spouse stops working or loses your coverage, youll be eligible for an eight-month special enrollment period to sign up for Medicare without having to pay a late enrollment penalty. But if youre volunteering, the special enrollment period is only six months long.

If you stop working or volunteering but dont return to the United States within that time, youll have the same dilemma that non-working people abroad face: Either sign up for Part B and pay premiums for coverage you cant use or delay enrollment until your return to the U.S. and then become liable for permanent late penalties.

Don’t Miss: How Much You Pay For Medicare

What Is The Average Cost Of Medicare Part D In 2022 By State

The chart below lists the average monthly premiums for Medicare Part D prescription drug plans by state.1

- The lowest average Part D premiums were for plans in Mississippi, Kentucky, Indiana and Oklahoma, with average premiums around $41 or less per month.

- California, Florida, Pennsylvania and West Virginia had Part D plans with the highest average premiums, around $52 or more per month.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

How Do I Qualify For Medicare Financial Assistance

Income limits change every year, so if you arenât sure about your qualification, donât count yourself out yet!

Each type of Medicare Savings Program has a different monthly income limit that varies based on marital status. Here are this yearâs limits to qualify for all the different programs*:

- QMB program: $1,094/month and $1,472/month

- SLMB program: $1,308/month and $1,762/month â

- QI program: $1,469/month and $1,980/month â

- QDWI program: $4,379/month and $5,892/month

*Income limits can be slightly higher in Alaska and Hawaii, so be sure to talk to a trusted agent to learn more about your specific qualifications.

Aside from income, there are also resource limits to qualify for Medicare Savings Programs. Countable resources include:

- Money in checking or savings accounts

- Stocks

However, the following resources are exempt:

- One home

- Up to $1,500 in set-aside burial expenses

- Furniture

- Any other household and personal items

All of these programs have personal qualifications, from age to disability status, so be sure to check with your agent or our team here at Medicare Allies to learn more about the best program for you.

Don’t Miss: Does Medicare Cover A Portable Oxygen Concentrator

Is Medicare Advantage Free

Medicare Advantage or Medicare Part C is a plan that combines the services of Medicare Part A and Part B, as well as some additional services, such as prescription drug coverage. Some plans also cover vision and dental services. Medicare Advantage is available through private health insurance companies.

When a person is shopping for Medicare Advantage plans, they may find that some offer free monthly premiums. The exact price will vary depending on the Advantage plans available in a certain area.

However, a person will still pay a premium for Medicare Part B. People may also find that the plans offering free premiums have higher out-of-pocket costs.

Private health insurance companies can offer premium-free services in some instances because they receive money from Medicare.

The insurance companies then use this money to negotiate costs with their network of physicians, hospitals, and healthcare organizations. As a result, they can pass along cost savings to their plan members.

As with other aspects of Medicare, having a Medicare Advantage plan does not mean a person will not pay for healthcare costs at all. Medicare Advantage plans often have specific deductibles and copayments for certain services.

The cost-effectiveness of an Advantage plan depends upon the types of healthcare services a person normally uses.

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

Don’t Miss: What Does Medicare Part B

Detailed Medicare Cost Information For 2022

- Monthly premium:Learn more about Part A costs.

Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

- Late enrollment penalty:

- If you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

Part A costs if you have Original Medicare

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Also Check: What Is Covered Under Medicare Part B

This Is Your Movement

Bernie is counting on all of us to continue fighting for our progressive agenda. There is only one way we will transform this country and that is together.

Add your name to tell Bernie you’re in.

By providing my phone number, I consent to receive periodic text message alerts from Bernie Sanders and his affiliated campaigns, including Friends of Bernie Sanders. Friends of Bernie Sanders will never charge for these updates, but carrier message & data rates may apply. Text STOP to 67760 to stop receiving messages. Text HELP to 67760 for more information.Terms & Conditions

Learn

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Medicare’s supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Medicare Part D benefits, and program administration expenses. The standard monthly premium set by the CMS for 2022 for Medicare Part B is $170.10 , although that number increases for higher-income earners. Premiums for Medicare Part D, which covers prescription drugs, will average $33 per month in 2022, up from $31.47 in 2021.

Benefit payments made by Medicare cover the following services:

- Home healthcare

The CARES Act expands Medicare’s ability to cover treatment and services for those affected by COVID-19 including:

- Providing more flexibility for Medicare to cover tele-health services

Read Also: How Do I Get Part A Medicare

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Penalties If You Don’t Enroll

If you fail to sign up for Part B when you’re supposed to, you’ll face a 10 percent penalty for each year that you should have been enrolled. The amount gets tacked on to your monthly premium.

While Part D prescription coverage is optional, the penalty for not enrolling when you were first eligible is 1 percent for every month that you could have been signed up unless you have qualifying coverage through an employer’s plan.

“We advise people even if they don’t take medicine right now, at least sign up for the cheapest drug plan just so you don’t face a penalty,” Roberts said. “And if something bad happens, you’re making sure you aren’t caught with no coverage.”

More from Personal Finance:Tread carefully when lending money to family and friends

Read Also: What Are The Different Medicare Supplement Plans

What If Ive Worked But Not Long Enough

You can still get Medicare Part A coverage, even if you dont fully meet the work requirement of 40 credits. Heres what youll pay in 2022:

- If you have 30 to 39 credits, your Part A premium will cost $274 per month.

- If you have fewer than 30 credits, your Part A premium will cost $499 per month.

- If youre able to continue working and you accumulate 40 work credits, you wont have to pay the monthly premium for Part A coverage.

Part A is the only part of Medicare that requires a specific amount of work history. You can enroll in Medicare parts B, C, and D without a work history.