The Cost Equation: Will Medicare Save You Money

If your employer requires you to pay a large portion of the premium on your group health insurance, you may find Medicare cheaper and the coverage adequate. So compare your current coverage and out-of-pocket expenses including premiums, deductibles, copays and coinsurance with your costs and benefits under Medicare, which may also pay some expenses not covered by your group plan.

Also Check: What Age Can I Collect Medicare Benefits

If Your Employer Is Small

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

However, it may be more cost-effective in this situation to drop the employer coverage and pick up Medigap and a Part D plan or, alternatively, an Advantage Plan instead of keeping the work plan as secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,470, according to the Kaiser Family Foundation. However, employees contribute an average of $1,243 or about 17% with their company covering the remainder.

At small firms, the employees share might be far higher. For example, 28% are in a plan that requires them to contribute more than half of the premium for family coverage, compared with 4% of covered workers at large firms.

Why You May Consider Signing Up For Medicare At 65

If youre approaching age 65 and any of the following situations apply to you, then you need to enroll during what’s known as your Medicare Initial Enrollment Period .

If you dont enroll during your IEP, you could face financial premium penalties for enrolling late.

Your IEP is a 7-month window that generally includes the month of your 65thbirthday, the 3 months before and the 3 months after For example, if your 65thbirthday is on June 20, then your IEP starts on March 1 and ends on September 30.

This is the time to learn about yourMedicare coverage options and get what you do or dont need coverage for. Most who have to get Medicare at age 65 will get Part A , Part B and some form of prescription drug coverage through either a stand-alone Part D plan or a Medicare Advantage plan.

Here are some helpful resources to learn how to avoid the Part B and Part D late penalties:

Recommended Reading: Does Medicare Part B Cover Home Health Care Services

Do You Have To Be On Medicare At 65

When you turn 65 years old, youâre eligible to sign up for Medicare.

Original Medicare is made up of 2 main parts: Part A and Part B .

As long as youâve worked at least 10 years and paid Medicare taxes, Medicare Part A is actually free to have, meaning that you donât have a monthly premium to pay. Thereâs really no downside to having Part A when you turn 65.

Do you have to have Part A when you turn 65? No. Is there any downside to having Part A when you turn 65? No. Thatâs why you donât actually have to sign up for Part A.

Three months before you turn 65, youâll be mailed your Medicare card, and youâre automatically enrolled in Part A. Youâll also be automatically enrolled in Part B unless you send the card back explaining that you donât want it.

Which brings us to our next question â is Medicare Part B mandatory at age 65?

Our team of licensed agents can help you determine which route would save you the most money, so if youâre not sure, be assured that we can help. Call us any time at 833-801-7999.

And Still Working: Should You Enroll In Medicare

Dear Carrie,

I’m planning to continue to work past age 65, and wondering if I should stick with my employer’s health insurance or move over to Medicare. How do I decide?

A Reader

Dear Reader,

This is becoming a common question as more and more people decide to work past age 65. In fact, according to the Bureau of Labor Statistics, in 2020, 26.6 percent of people aged 65-74 remained in the workforceand those numbers are projected to continue to grow. This can be seen as a positive since it means we’re redefining aging. At the same time, though, adequate health insurance remains essential.

So it’s an important questionand the answer largely depends on the size of your employer, as well as the cost and coverage of your current plan as compared to Medicare. You’ll need to familiarize yourself with the pertinent Medicare regulations and deadlines to ensure the most seamless transitionwhether that happens at age 65 or later.

Also realize that once you file for Social Security, you’re automatically enrolled in Medicare Parts A and B when you turn 65. However, you have the option to opt out of Part B, which you may want to do if you are covered by an employer plan.

If you haven’t filed for Social Security, you can choose to enroll in just Medicare Part A or both Parts A and B . Alternatively, you can postpone enrolling until you stop working. Let’s take a look at some Medicare basics as well as some of the factors that can help you decide.

Read Also: Does Medicare Cover Cgm For Type 2 Diabetes

How Does The Medicare Program Work

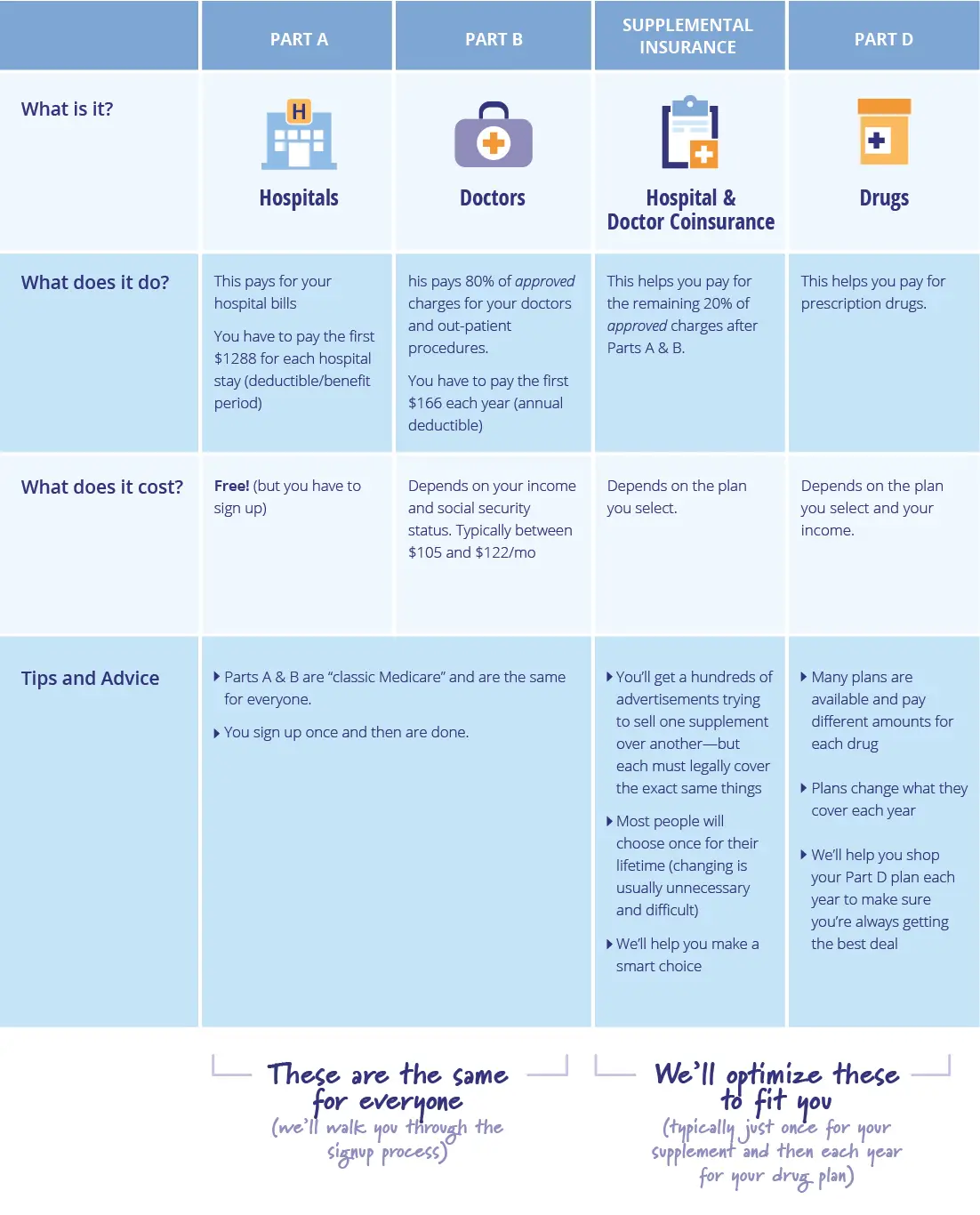

The Original Medicare program consists of two main parts — Part A for hospital insurance and Part B for general medical insurance — along with supplemental private insurance for prescription drugs.

Part A. All Americans who have had Medicare taxes deducted from their paychecks for 40 calendar quarters receive Part A coverage at no cost. If you don’t qualify for free Part A coverage you can purchase it for $278 per month in 2023 if you’ve paid Medicare taxes for more than 30 calendar quarters, or $506 per month if not.

Part A covers surgeries, hospital stays, skilled nursing facilities and hospices, inpatient rehabilitation, lab tests and some home health care.

Part B. For Part B coverage, all Medicare participants must pay a monthly premium, which starts at $164.90 in 2023 but rises with higher incomes. The cost is deducted from your Social Security payment or billed every three months. Part B is optional if you receive Part A for free, but if you need to pay for Part A, you’ll also need to enroll in Part B.

Part B covers doctor and health provider services, outpatient treatment, medical equipment, preventive services and other medical and health services not covered by Part A.

Part C. Medicare Advantage plans are privately held insurance programs that must offer at least equivalent coverage to Original Medicare Part A and Part B and often include Part D benefits as well .

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

Recommended Reading: Is A Walk In Tub Covered By Medicare

Medicare Part C An Alternative To Original Medicare

When you enroll in Medicare, you have the option to choose a Medicare Advantage plan as an alternative to Original Medicare, which includes Medicare A and B. Medicare Advantage is a type of Medicare health plan offered by a private company that provides all Part A and B benefits.

On the plus side, a Medicare Advantage plan also usually provides Part D benefits as well as sometimes providing extras like vision and dental at a lower total cost. On the minus side, you generally have to choose doctors within a particular medical network and get a referral to see a specialist. Another caveat: in some cases, joining a Medicare Advantage plan could cause you to lose your employer plan. Be sure to check with your benefits administrator.

Do You Have To Sign Up For Medicare If You Are Still Working

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because theyre still working, theyre likely covered under their employers health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance including health insurance provided by employers or unions and wont prevent you from enrolling.

However, if you are not collecting Social Security retirement benefits at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually sign up for Medicare when youre ready to enroll.

Many people choose to delay their Social Security retirement benefits until a later age when they can collect the full amount. If you choose to delay your retirement benefits, you must still sign up for Medicare manually once youre eligible in order to avoid any late enrollment penalties .

Some people who are still working sign up for Medicare anyway, because Medicare can work as extra insurance along with an employer group health insurance plan. Some people may decide that Medicare is more affordable than their employers insurance, so they may continue working but disenroll from their group plan and enroll in Medicare instead.

Don’t Miss: Does Medicare Cover Gastric Balloon

Questions To Ask Your Employer Benefits Manager Include:

- Will my health insurance change if I enrolled in Medicare? If so, how?

- How much is deducted from my paycheck for my employer health insurance?

- Do I have through my employer?

- How will my covered dependents be impacted if I choose to get Medicare?

This information will help you weigh your choices and decide whats best for you. You may decide to enroll in Medicare Part A, Part B or both. Or you may be able to and want to delay enrolling in Medicare all together until you retire.

Im Working Past 65 But My Health Coverage Is From My Spouses Employer

A pretty common situation to face, if your health care coverage is from a spouses employer, you may be able to delay Medicare or you may need to enroll when you first become eligible. In this case, the employer still needs to have 20 or more employees. However, the big difference is thatemployers can have rules for covered dependents 65 and older that may require the individual to get Medicare at 65 in order to remain on the employer plan.

Therefore, if you have employer coverage through a spouses employer, you need to ask the employers benefits administrator directly about your Medicare enrollment choices.

Recommended Reading: How Does Medicare Work In Texas

The Bottom Line: Know Your Options Enroll On Time

Dont delay making Medicare decisions and dealing with Medicare enrollment. Learn about the choices you have can you delay, must you enroll and then understand the implications of both as they relate to your overall health and financial well-being.

Late-enrollment penalties for Medicare Part B and Medicare Part D are permanent and can have a meaningful impact on your finances so think carefully about what you do and when.

Not sure where to start? A good first step for anyone approaching Medicare eligibility is to know when your enrollment dates are. You can quickly find your dates for your Initial Enrollment Period using our enrollment date calculator.

Footnote

Medicare Eligibility Age Requirements

So, at what age can you get Medicare? There are a couple of requirements that must be met for you to qualify for Medicare. First, you must be 65 or older. Next, you must be a U.S. citizen or permanent resident. Younger individuals may qualify for Medicare, but they must meet one of the disability criteria, like kidney failure, mentioned in the previous section.

Your initial enrollment period for Medicare benefits begins three months before the month in which you turn 65. It runs through your birthday month and covers three months past your birthday month. During this time, you can enroll in Medicare Part A, Medicare Part B, Medicare Part C, and Medicare Part D without any late enrollment penalties. Since Medicare Part B carries a monthly premium, you might decide to opt out of this coverage. However, signing up for Part B coverage later might require the payment of a late penalty unless you qualify for a special enrollment period.

If you are already receiving benefits from the Social Security Administration or Railroad Retirement Board upon reaching the age of 65, you will be automatically enrolled in Medicare coverage. Remember that the Medicare age and Social Security retirement age are not the same. The full retirement age for Social Security is 66 or 67 for most people. If you are not already receiving your Social Security benefits, you will need to apply for Medicare when you turn 65.

Also Check: What Do You Need To Sign Up For Medicare

Also Check: What Is The Best Medicare Advantage Plan In Ohio

Some Important Considerations Before Making Your Choice

If you work for a large company, compare your employer coverage and costs with Medicare. Be sure to look carefully at premiums for Parts B and D as well as the cost of a Medigap policy that would cover whatever Original Medicare doesn’t . If you’re happy with your current plan, you may well be better off staying with that and delaying Medicare enrollment until you retire.

Another thing to be aware of is that once you enroll in Medicare , you’re no longer eligible to contribute to a health savings account . Therefore, if you want to continue to boost pre-tax savings with an HSA, you may want to postpone. In fact, to avoid an IRS penalty, you must stop contributions to an HSA 6 months prior to enrolling in Medicare Part A or claiming Social Security benefits after age 65.

If you work for a small company, you should probably sign up for Parts A, B, and D as soon as you’re eligible. In this case, you most likely won’t need a Medigap policy under Original Medicare, since your employer coverage will pick up costs not covered by Medicare. Check with your employer to see the impact of enrolling in Medicare Advantage.

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Recommended Reading: What Is Deductible On Medicare

Will I Get Medicare At 62 If I Retire Then

No. Even if your spouse is eligible for Medicare when you retire at 62 , youâre not eligible unless you qualify by disability.

if you retire before age 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you might want to visit healthcare.gov, or your state insurance agency on your stateâs official website, to learn about your options.

Can You Have Medicare And Medicaid

The short answer is yes. If you receive coverage from both Medicaid and Medicare, youre a dually eligible beneficiary. If you are dual eligible, you may be enrolled in Medicare and then qualify for Medicaid, or enroll first in Medicaid but later qualify for Medicare. Medicaid assists seniors with limited income and people with disabilities also enrolled in Medicare.

How does dual eligibility work?

Dual-eligible beneficiaries can have:

- Medicare Part AMedicare Part A, also called hospital insurance, covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services. Medicare Part A is part of Original Medicare.

- Medicare Part BMedicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called medical insurance, Part B helps pay for the Medicare-approved services you receive.

- Both Part A and Part B

- Full Medicaid benefits

- State Medicare Savings Programs

Medicare benefits always pay first, and Medicaid benefits assist with costs not fully covered by Medicare.

Medicaid will pay premiums and out-of-pocket expenses for dual-eligible Medicare beneficiaries. Medicare and Medicaid work together to cover costs, including long-term services. If you do not have full Medicaid benefits, Medicare Savings Programs may help cover some of those costs:

Are you eligible for cost-saving Medicare subsidies?

Home / FAQs / General Medicare / Are Any Parts of Medicare Mandatory

Find Medicare Plans in 3 Easy Steps

You May Like: Does Plan F Cover Medicare Deductible