How Can I Reduce My Medicare Premiums And Costs

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

For those seeking additional help paying for Medicare, here are a few resources and programs dedicated to helping those who need financial assistance. If you find yourself in this situation, you might consider one or more of the following options:

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

Know Your Open Enrollment Period

How much does Medicare cost at age 65? Medicare has a specific enrollment timeframe, which allows you to sign up for any plan you desire with guaranteed acceptance. This period is known as your Open Enrollment Period and starts during the first three months before you turn 65, the month of your birthday, and three months after you turn 65.

If you are still working and choose to defer enrollment, your enrollment period will begin when you quit working and stop receiving medical benefits through your employer. If you delay and sign up after your specific enrollment period, you will face an enrollment penalty. If you enroll within the appropriate timeframe, you wont incur this penalty.

Read Also: Does Medicare Cover Aba Therapy

If You Disagree With Our Decision

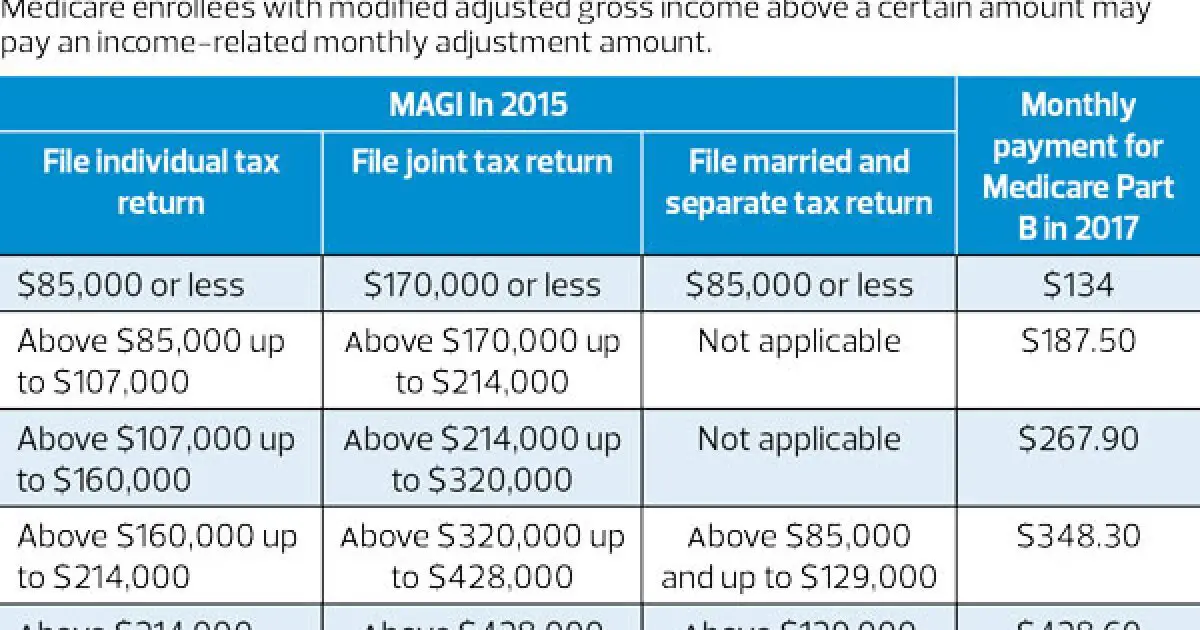

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Medicare Part D Costs

For aâ¯Medicare Part D plan, also called a Prescription Drug Plan , the monthly cost varies depending on the prescriptions you take.

The average monthly premium for a Medicare Part D plan is around $30 per month in 2022.

If you do take medications, youâll have other costs, like a deductible, copays, and coinsurance.

We recommend that youâ¯follow our Medicare Part D Cheat Sheet to determine your actual drug plan costs.â¯You can do this directly on Medicare.gov.

â.

Read Also: Is A Psa Test Covered By Medicare

Employer/union Coverage And Part D Irmaa

| Note |

|---|

|

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. Youre required to pay the Part D IRMAA, even if your employer or a third party pays for your Part D plan premiums. If you dont pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back. |

Medicare Advantage In : Premiums Cost Sharing Out

Medicare beneficiaries have the option of receiving their Part A and Part B Medicare benefits through a private Medicare Advantage plan. Since 2011, the federal government has required Medicare Advantage plans to cap out-of-pocket spending, and these plans may provide additional benefits or reduced cost sharing compared to traditional Medicare. They are also permitted to limit provider networks, may require prior authorization for certain services, and sometimes carry an additional premium on top of the monthly Part B premium all Medicare beneficiaries pay. This brief provides current information about Medicare Advantage premiums, cost sharing, out-of-pocket limits, and supplemental benefits, as well as trends over time. Two companion analyses examine trends in Medicare Advantage enrollment and Medicare Advantage plans star ratings and federal spending under the quality bonus program.

Don’t Miss: What Does Medicare Part B

How Does Medicaid Expansion Affect State Budgets

Expansion has produced net savings for many states, according to the Center on Budget and Policy Priorities. Thats because the federal government pays the vast majority of the cost of expansion coverage, while expansion generates offsetting savings and, in many states, raises more revenue from the taxes that some states impose on health plans and providers.

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while it’s easy to argue that seniors will still come out ahead financially, let’s also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes won’t take seniors’ entire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. That’s a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.

Also Check: Does Medicare Cover Dexcom G5

What Plan G Does Not Cover

It covers 100% of the gaps in Medicare. Plan G’s coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $233 in 2022. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums.

What Is Medicare Part B

The Medicare card calls Part B coverage medical coverage. But that is a very broad definition.

In general terms, I like to think of Medicare Part B as the piece of the Medicare program that covers services provided on an outpatient basis. This includes things like clinic visits, laboratory testing, home health care, and ambulance services. It even covers more intensive services provided on an outpatient basis like surgeries, diagnostic imaging, chemotherapy, and radiation therapy. Even if these services are provided in the hospital setting, if it is an outpatient service, generally, Medicare Part B will be responsible for covering the service.

I dropped generally a few times up there for a reason. Medical necessity and other rules governed by the Centers for Medicare and Medicaid can cause reason for non-coverage. These are things we couldnt possibly cover in one blog post , so lets keep that in mind.

I do need to go ahead and call one thing out here, though. If we are in the hospital in an observation status, those services are considered outpatient Part B services. If a qualified practitioner does not order us inpatient, Medicare Part B is paying for those services, not Medicare Part A. It needs to be medically necessary for us to be ordered as an inpatient for Medicare Part A to cover the hospital stay. This impacts our out-of-pocket costs and I will discuss it exhaustively in a later post because it is a huge point of confusion.

You May Like: Does Medicare Cover Orthovisc Injections

Is It Possible To Keep My Doctor On Medicare

If you have Medicare Part B coverage, you can go to any health care provider who takes Medicare and is taking new Medicare customers. You should inquire with your doctor about becoming a new Medicare patient.

However, not all providers accept Medicare as payment in full. Medicare divides healthcare providers into three categories:

Accepting Medicare and Medicare-approved payment for services: They accept Medicare and Medicare-approved payment for services.

Nonparticipating: They accept Medicare but may charge more for services than Medicare allows.

Opt-out: They do not take Medicare and patients are responsible for all medical expenditures.

Read Also: Does Medicare Pay For Orthotics

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Medicare’s supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Medicare Part D benefits, and program administration expenses. The standard monthly premium set by the CMS for 2022 for Medicare Part B is $170.10 , although that number increases for higher-income earners. Premiums for Medicare Part D, which covers prescription drugs, will average $33 per month in 2022, up from $31.47 in 2021.

Benefit payments made by Medicare cover the following services:

- Home healthcare

The CARES Act expands Medicare’s ability to cover treatment and services for those affected by COVID-19 including:

- Providing more flexibility for Medicare to cover tele-health services

Don’t Miss: What Year Did Medicare Start

Unearned Income Medicare Contribution Tax

There is also an additional tax on unearned income, such as investment income, for those with AGIs higher than the thresholds mentioned above. It is known as the unearned income Medicare contribution tax or the net investment income tax . Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans. It also applies to passive income from taxable business activity and to income earned by day traders.

This tax is applied to the lower of the taxpayers net investment income or modified AGIexceeding the listed thresholds. This tax is also levied on income from estates and trusts with income exceeding the AGI threshold limits prescribed for estates and trusts. Deductions that can reduce the amount of taxable net investment income include early withdrawal penalties, investment interest and expenses, and the amount of state tax paid on this income.

When the NIIT legislation was enacted in 2010, the IRS noted in the preamble to its list of regulations that this was a surtax on Medicare. The Joint Committee on Taxation specifically stated: No provision is made for the transfer of the tax imposed by this provision from the General Fund of the United States Treasury to any Trust Fund. This means that the funds collected under this tax are left in the federal governments general fund.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

You May Like: How Long Does It Take For Medicare To Become Effective

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2022, most people earning no more than $91,000 will pay $170.10/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The standard Part B premium increase for 2022 amounts to nearly $22/month, and is higher than the premium that had been projected in the Medicare Trustees Report.

CMS noted that the higher Part B premiums are due to a variety of factors, including costs associated with the COVID pandemic, the 2020 legislation that kept 2021 Part B premiums lower than they would otherwise have been , and potential costs related to new drugs that might be covered under Part B in the near future .

As described below, the Social Security cost-of-living adjustment can sometimes limit the increase in Part B premiums, but thats not the case for 2022. Although the premium increase is significant, the Social Security COLA was historically large for 2022, and adequate to cover the additional Part B premiums.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2021 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Most enrollees in individual Medicare Advantage plans are in plans that provide access to eye exams and/or glasses , hearing exams/and or aids , telehealth services , dental care , and a fitness benefit . Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer plans do not submit bids, and data on supplemental benefits may not be reflective of what employer plans actually offer.

Also Check: Does Medicare Cover Dental Root Canals

How Much Does Medicare Part B Cost In 2022

The premium for Medicare Part B in 2022 is $170.10 per month. You may pay less if youre receiving Social Security benefits. You also may pay more up to $578.30 depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $233 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

How Much Does Medicare Part D Cost

The average monthly premium for a stand-alone Part D plan is $33.00.3 The exact cost of your Part D coverage will depend on the plan you choose.

What it is:

Medicare recipients can choose to add a Part D Prescription Drug Plan to Original Medicare.

- If a Medicare Advantage plan does not include drug coverage, you may not add a Part D plan to it. In fact, enrolling in a PDP un-enrolls you from your Medicare Advantage plan.

- However, if your Private Fee-for-Service plan does not have drug coverage, you can add coverage without losing your Medicare Advantage plan.

Read Also: When Can I Enroll In Medicare

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

You May Like: How Can A Provider Check Medicare Eligibility