The Medicare Magi Used For Calculating If You Owe Irmaa

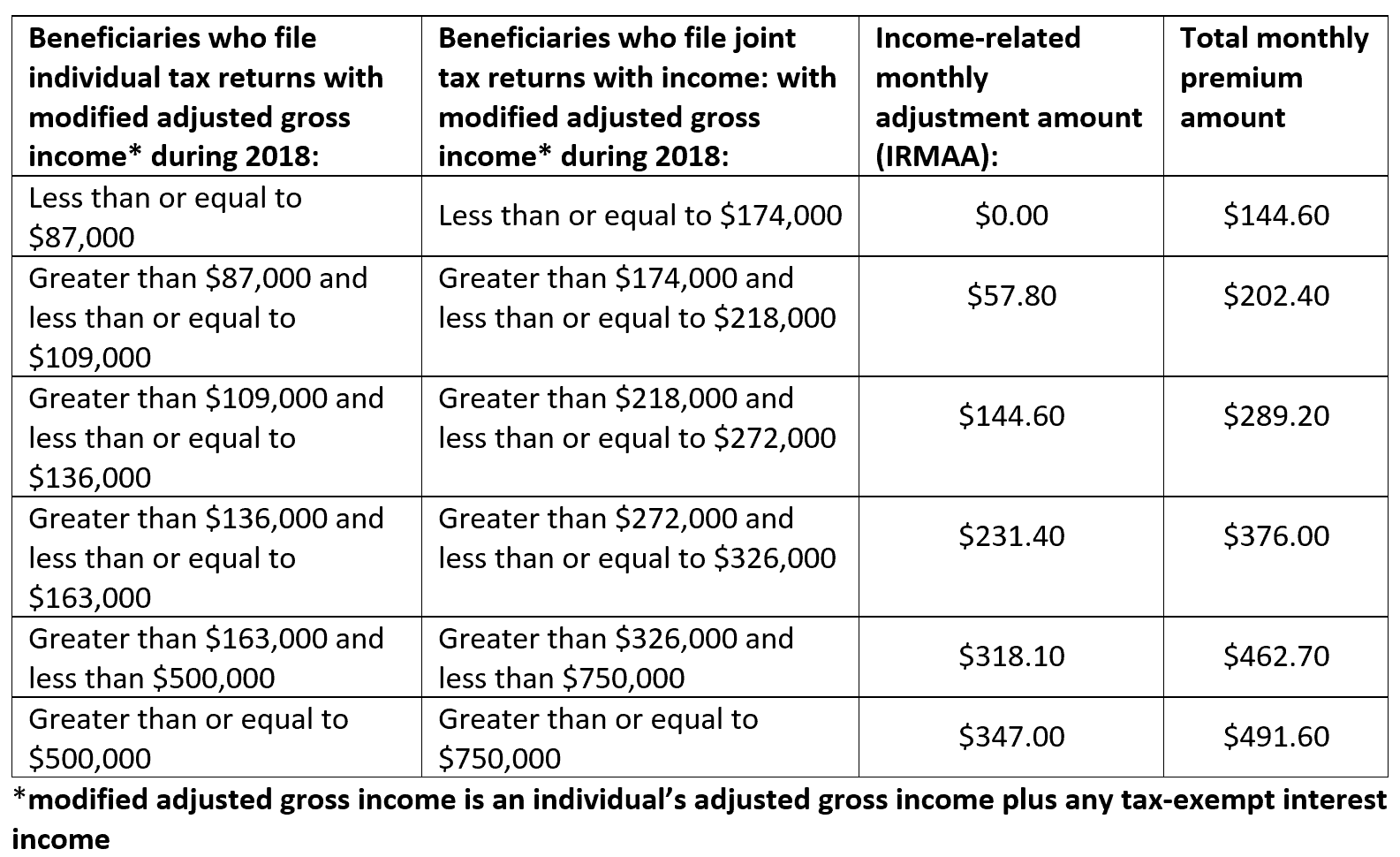

Throughout our maddening tax code there are instances where the rules are based on MAGI. There are different MAGI formulas for different programs. For purposes of figuring out your Medicare Part B premium, MAGI is your adjusted gross income plus any tax exempt bond interest . Add the two together and thats your MAGI that will be used to determine if you will owe any IRMAA.

Dont Miss: How Can I Get My Medicare Card Number

What Is Medicare Supplement

A Medicare Supplement insurance plan, sold by private companies, can help pay some of the out-of-pocket health-care costs that Medicare Part A and Part B donât pay, such as coinsurance, copayments, and deductibles. Some Medicare Supplement insurance plans may also help with costs of emergency medical care outside of the U.S. However, a Medicare Supplement insurance plan cannot be used to pay another planâs premium, or to pay your Medicare Part A or Part B premium.

Similarly, Medicare doesnât pay for a Medicare Supplement insurance plan. If you have a Medicare Supplement insurance plan, you will need to pay the private insurance company for your Medicare Supplement premium as well as pay Medicare for your monthly Part B premium. If you receive Social Security benefits, in most cases your Part B premium is automatically deducted from your benefit payment.

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Don’t Miss: How To Apply For Medicare In Illinois

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

How Much Does It Cost

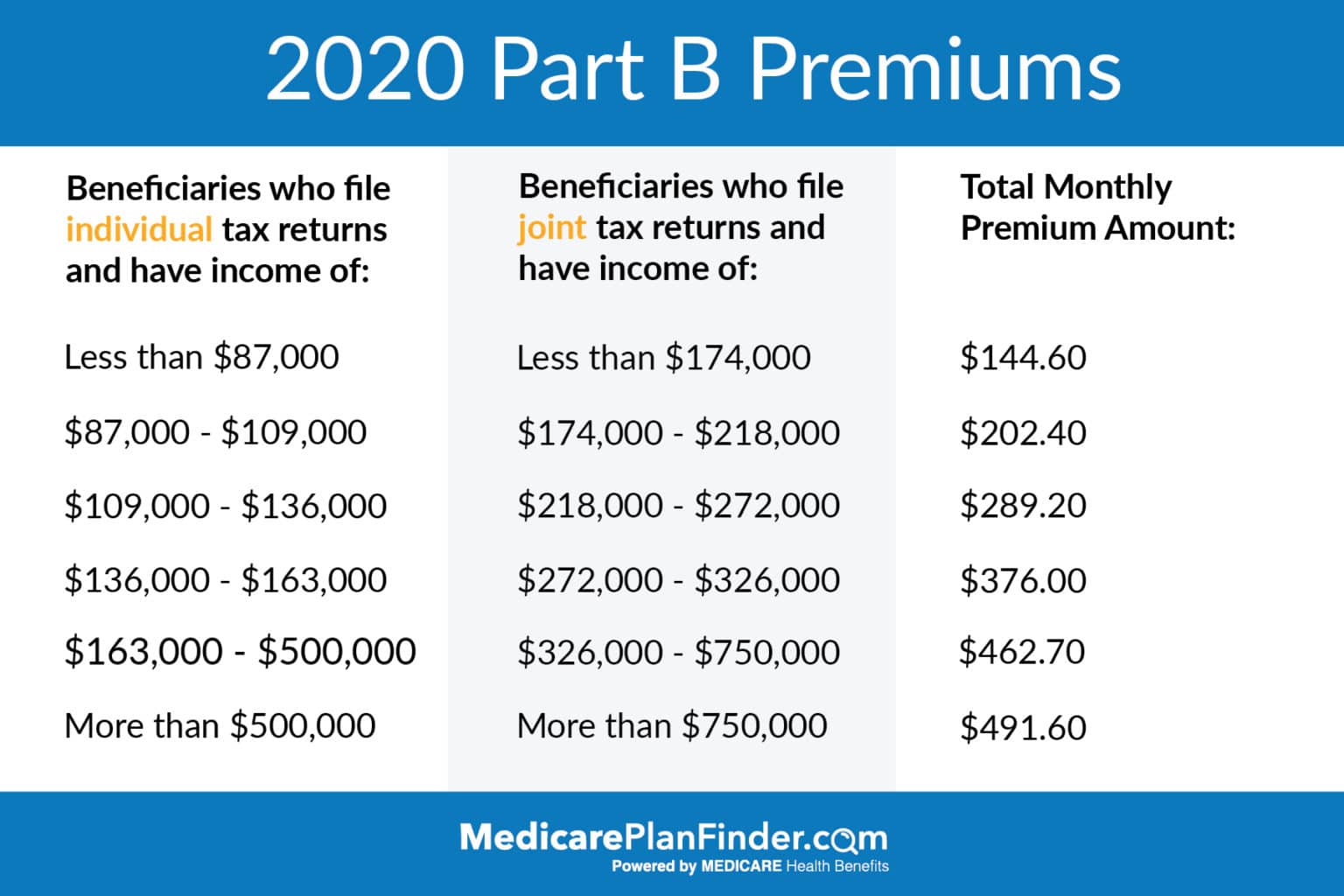

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if youre enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

Be sure to enter your zip code below and compare Medicare costs to ensure you have the best and most affordable coverage.

Don’t Miss: How To Find Out If I Have Medicare

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

Recommended Reading: When Does A Person Sign Up For Medicare

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $170.10/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $322.10/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Recommended Reading: Does Medicare Pay For Drug Rehab

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2022 IRMAA |

|---|

| Individual |

Source: CMS

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation .

You May Like: How To File Medicare Claims For Providers

B Deductible Also Increased For 2022

Medicare B also has a deductible, which increased to $233 in 2022, up from $203 in 2021. The Medicare Part B deductible only has to be paid once per year, unlike the Part A deductible, which has to be paid once per benefit period.

After the Part B deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services for the remainder of the year. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

You May Like: Do You Have Dental With Medicare

Medicare Part B Premium Reduction Wont Happen This Year

- About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer’s drug Aduhelm.

- The cost of Aduhelm was cut in half after the premium was determined, and treatment is limited to certain patients.

- Any savings that result from lower-than-estimated spending this year will be applied to the calculation for the 2023 Part B premium, which will be set later this year.

Your Medicare Part B premiums won’t be reduced this year, the government has announced.

After being directed by Health and Human Services Secretary Xavier Becerra in January to reassess this year’s $170.10 standard monthly premium a bigger-than-expected 14.5% jump from $148.50 in 2021 the Centers for Medicare & Medicaid Services has released a report determining that a mid-year correction is not feasible. Instead, any savings that result from lower-than-estimated spending this year will be applied to the calculation for the 2023 Part B premium.

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite actuaries not yet knowing the particulars of how it would be covered because Medicare officials were still determining that.

More from Personal Finance:There’s an ‘un-retirement’ trend amid this hot job market

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Read Also: What Do The Different Parts Of Medicare Cover

Also Check: What Is The Monthly Charge For Medicare

Medicare Part B Deductible

Medicare Part B comes with an annual deductible amount that must be met before coinsurance or copay benefits kick in. In 2022, the deductible amount is $233, meaning that after you pay out of pocket for expenses that total $233, cost sharing begins.

Typically, after you reach the deductible for the year, you are required to pay 20% of Medicare Part B approved expenses out of pocket.

For example, say you went to the doctor for a screening that cost you $150, then had a separate therapy visit that cost you $83. The total cost of these medical expenses adds up to $233, meaning you would have met your Medicare Part B deductible for the year. Then, later in the year you had another screening that cost you $150. Since you already met your deductible, you would pay just 20%, or $30 , while Medicare would pay the remaining $120.

What Else Should I Know About Medicare Supplement Insurance Plans

- Medicare Supplement insurance plans that may cover the Medicare Part B deductible are being phased out. This affects Medicare Supplement Plans C and F . If you were already eligible for Medicare on December 31, 2019 or earlier, you can keep your Plan C or Plan F, or apply for the plan. But if you qualified for Medicare on or after January 1, 2020, you wonât be able to buy Plan C or Plan F.

However, Plan G is very similar to Plan F. Like Plan F, Plan G has a high-deductible version. Plan G doesnât cover the Medicare Part B deductible.

- Keep in mind that Medicare Supplement insurance plans only work with Medicare Part A and Part B. You canât use a Medicare Supplement insurance plan to pay for Medicare Advantage costs.

- Types of coverage that are not Medicare Supplement insurance plans include: TRICARE, veteransâ benefits, long-term care insurance policies, Medicare Advantage plans and stand-alone Medicare Part D Prescription Drug Plans.

Read Also: What Is The Average Medicare Supplement Premium

How To Tell If Part B Covers What You Need

1. Consult with your doctor or health care provider to find out if Medicare covers your needed services or supplies.

In some cases, you may require something that is typically covered by Medicare but your provider isnt sure if coverage will extend in your specific situation. If this happens, you can sign a notice that says you may be required to pay for the test, item, or service.

2. You can also always search your Medicare coverage by test, item, or service at this Medicare.gov Coverage Page.

Remember: Your Medicare coverage will be based on federal and state laws, national coverage decisions by Medicare, and local coverage decisions made by Medicare claims processors in each state.

To get a fuller understanding of your Medicare Part B costs, coverage, and more, read our Comprehensive Guide to Medicare Part B.

Helpful Resource:

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Also Check: Is Cobra Creditable Coverage For Medicare

Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Filing Individual Tax Returns Total Monthly Part B Premium

$91,000 or less

Total Monthly Part B Premium

$170.10

$544.30

$578.30

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

| Total Monthly Part B Premium |

|---|

|

$91,000 or less |

$91,000 or less

Total Monthly Part B Premium

$170.10

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2022, most people earning no more than $91,000 will pay $170.10/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

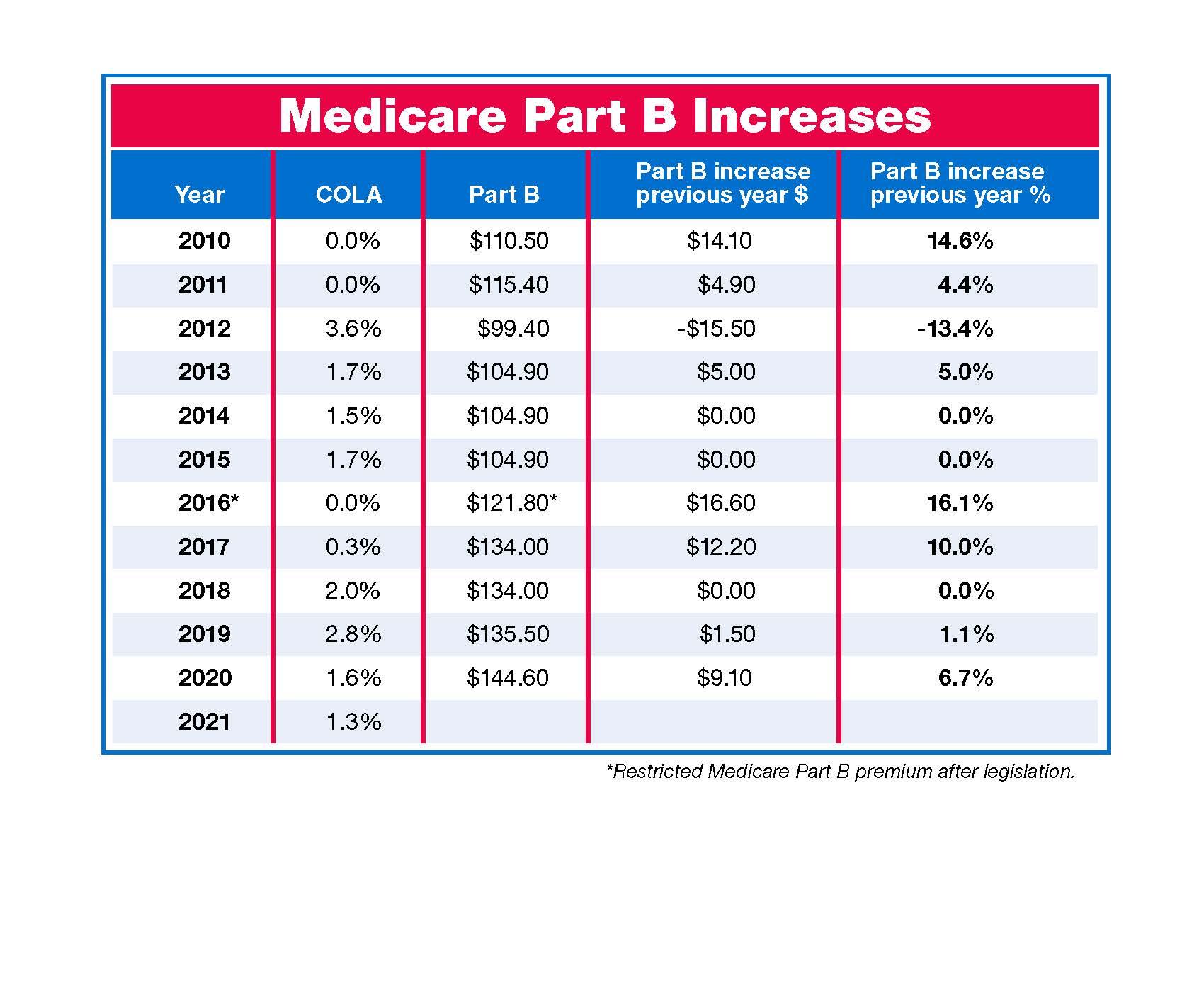

The standard Part B premium increase for 2022 amounts to nearly $22/month, and is higher than the premium that had been projected in the Medicare Trustees Report.

CMS noted that the higher Part B premiums are due to a variety of factors, including costs associated with the COVID pandemic, the 2020 legislation that kept 2021 Part B premiums lower than they would otherwise have been , and potential costs related to new drugs that might be covered under Part B in the near future .

As described below, the Social Security cost-of-living adjustment can sometimes limit the increase in Part B premiums, but thats not the case for 2022. Although the premium increase is significant, the Social Security COLA was historically large for 2022, and adequate to cover the additional Part B premiums.

Read Also: What Is Medicare Part B Deductible Mean

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrigs disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If youre eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you dont sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didnt enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicares website to find out more.