Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

Some potential benefits of having a Medicare Advantage plan include:

- All Medicare Advantage plans have an annual out-of-pocket spending max, which Original Medicare does not offer.

- Some Medicare Advantage plans offer $0 premiums.

- Many Medicare Advantage plans offer prescription drug benefits and some of the additional benefits listed above, which are not covered by Original Medicare.

Some potential downsides of a Medicare Advantage plan can include:

- Certain types of Medicare Advantage plans may limit you to a provider network. If so, youll be required to visit health care providers who are in the plan network for your care to be covered.

- The provider networks in some Medicare Advantage plans may be small limited to a certain geographic region. This could be an issue if you travel frequently or live in different parts of the country during certain times of the year.

Whether or not a Medicare Advantage plan is a good fit for you will depend on your personal health care and budget needs.

How To Choose Between Medigap And Medicare Advantage

When considering whether to buy a Medigap policy or enroll in a Medicare Advantage plan, the key decision is whether you want to get your coverage from the federal government through original Medicare or a private insurer that provides Medicare Advantage plans.

If you choose original Medicare, you can use any doctor and facility that accepts Medicare. But youll have to buy separate Medigap and Part D drug coverage to fill in the gaps.

If you choose Medicare Advantage, you may have low or no premiums beyond your monthly Part B premiums. But the additional expenses that you pay out of pocket will likely be different, especially as you use more medical services. You usually need to use a provider network. If you go to an out-of-network doctor, the visit might not be covered or you might have a higher copayment.

Most Medicare Advantage plans include prescription drug coverage. Those without are designed for enrollees who have drug coverage from a previous or present employer or another source. You wont have to buy a separate Part D.

Keep in mind

If you enroll in a Medicare Advantage plan, you cannot use a Medigap policy to cover your out-of-pocket expenses. So youll have to pay any deductible, copays or coinsurance yourself. Its illegal for an insurance company to sell you a Medigap policy if youre enrolled in a Medicare Advantage plan.

Read Also: What Age Can You Begin Medicare

You Cant Enroll In Both Medigap And Medicare Advantage

You cant join a Medigap plan if youre already enrolled in Medicare Advantage. If you enroll in a Medicare Advantage plan, you cant use a Medigap policy to cover your out-of-pocket health care expenses.

Medigap can be only be purchased by people enrolled in Original Medicare. If you have Medicare Advantage and want to join a Medigap plan, you have to switch to Original Medicare before you can buy a Medigap policy. Contact your Medicare Advantage Plan carrier to see if you can disenroll.

If you already have a Medigap policy and want to join a Medicare Advantage Plan, you must drop your Medigap policy.

Getting Coverage Beyond Medicare

Why do the overwhelming majority of seniors choose to complement their Medicare coverage with a backup plan?

For many, it’s because Medicare isn’t enough. Opting for Medicare alone means that you’ll be left uninsured against certain essential healthcare needs — like dental care, vision care, or extended hospital stays.

Medicare also comes with significant deductibles, coinsurance , and other cost-sharing charges. In fact, the average Original Medicare beneficiary spent $5,460 on out-of-pocket costs — and this was back in 2016. In a year when you need access to a high volume of healthcare services, these uncovered costs can easily add up to tens of thousands of dollars or more.

That’s because coverage under Medicare doesn’t come with out-of-pocket maximums. Unlike private health insurance plans — which cannot legally have annual out-of-pocket limits exceeding $8,700 for individuals or $17,400 for families in 2022 — there’s theoretically no limit to the amount of money you can be on the hook for in any given year under Medicare.

Most seniors will find it necessary to have coverage outside of Medicare. But which should you get — Medigap or Medicare Advantage?

Recommended Reading: How To Apply For Medicare In Alaska

Pros & Cons Of Medicare Advantage And Medigap Plans

There are pros and cons for both Medigap and Medicare Advantage plans based on each individuals financial situation and health circumstances.

You should compare the differences between the Medigap and Medicare Advantage plans you are considering before deciding which one you want to purchase.

Can You Enroll In Medicare Anytime

Timing is the first step when initially enrolling in Medicare.

There is a seven-month window around your 65th birthday called the Initial Enrollment Period when you can sign up for Medicare for the first time.

“That is not obvious to a lot of people,” said Cobi Blumenfeld-Gantz, CEO of Medicare startup Chapter. “Most people think that, ‘Oh, if I’m 65, but I’m still working, I don’t need to sign up for Medicare.'”

In some cases that’s correct.

But if you defer signing up for Medicare prescription drug benefits and don’t have what’s called creditable coverage through your employer, you will be penalized.

Blumenfeld-Gantz said some small businesses may fall short.

“So if you work in a small business that’s 15 people and they give you health insurance and you’re 66, you’re actually accruing penalties from the government,” he said.

MEDICARE:Enrollment123 is streamlining a complex program and making it user-friendly

The penalties exist to encourage people to sign up as soon as they are eligible for Medicare, ensuring cost savings for the government by having the maximum number of people enrolled.

According to CMS, late enrollment penalties go up the longer you wait to sign up, are added to your monthly premium and are charged for as long as you have that coverage.

For most people that becomes a lifetime penalty. For example, your premium goes up 10% for each year you are late in signing up for Part B coverage and stays at that higher rate forever.

Read Also: Is Medicare Part D Worth It

Are Medicare Supplements And Medicare Advantage Ppo Plans The Same

Are Medicare Supplements and Medicare Advantage PPO Plans the Same?

Dear Toni,

What is the difference between a Medicare Supplement and a Medicare Advantage PPO Plan? I am turning 65 and I am being bombarded with marketing material. Friends have told me that a Medicare Advantage PPO Plan is the same as a Medicare Supplement because both have a network of doctors to pick from. My retiree employeer medical plan now has a Medicare Advantage PPO. I am concerned if a medical incident happens will the providers I am seeing now accept this Medicare Advantage PPO Plan?

Stephen, from Denver

Stephen,

Your friends have given you wrong information regarding Medicare. This can lead you to choose the wrong plan! Medicare Supplements and Medicare Advantage Plans are completely different types of Medicare policies.

With a Medicare Supplement, there is not a network of any kind. You have the freedom to use any healthcare provider or facility that will bill Medicare. The Medicare Supplement will pay what your Medicare Parts A and B will not.

With a Medicare Advantage PPO Plan, there are lower cost in-network providers or facilities as well as out of network benefits that will cost you more. In 2022, a popular Medicare Advantage PPO Plan has a maximum ranging from $5,400 to $7,550 in-network, while out of network costs range from $7,550 to $11,300.

Lets take a look at the key differences in the two plans:

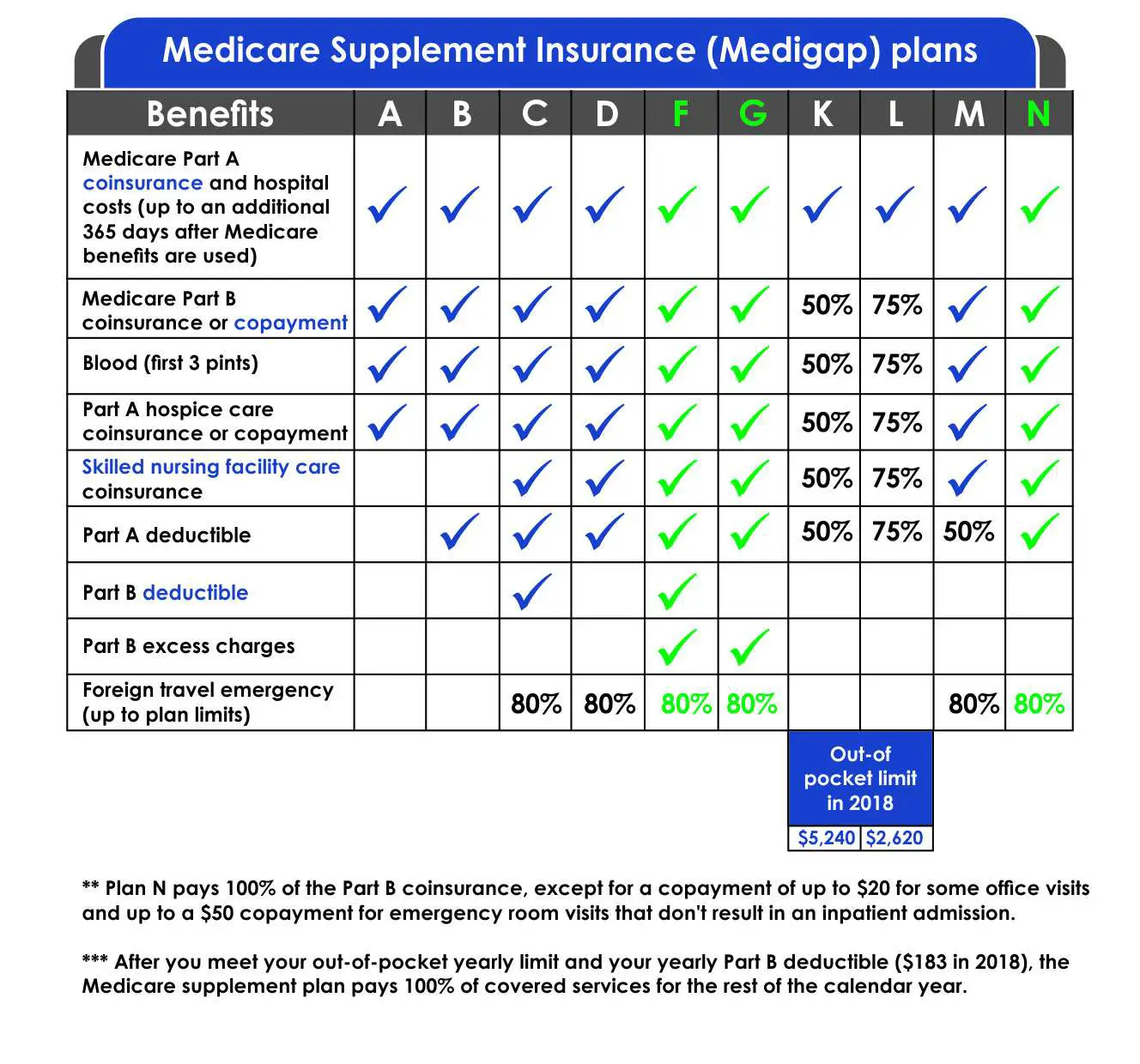

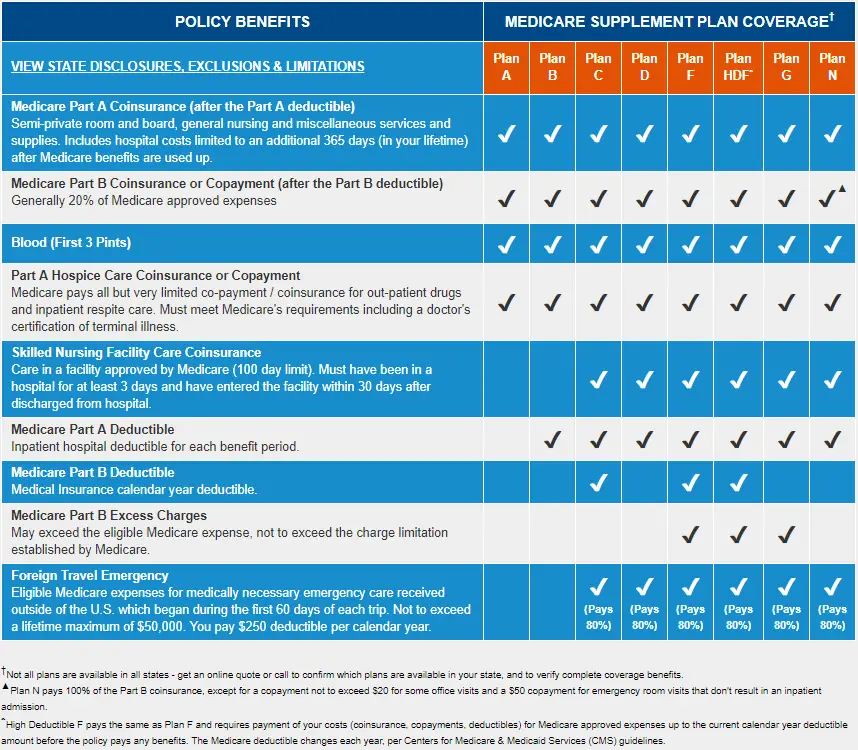

Medicare Supplement Insurance Plan Options

In most states, there are 10 standardized Medigap plans to choose from labeled Plan A, B, C, D, F, G, K, L, M and N.

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

Each plan type offers a different variation of basic health benefits coverage. Insurance companies that sell Medigap plans are required to offer the same basic benefits for same-type plans. This means that one insurers Plan G must offer the exact same basic benefits as another companys Plan G option.

Policy costs and additional benefits vary based on the insurance company, but the basic benefitscovered by each are the same for each type of plan regardless of where you live and what company sells the policy.

|

NOTE: If you live in Massachusetts, Minnesota or Wisconsin. plans are standardized differently in your state. |

Each type of Medigap policy helps pay for some variation of the following Medicare-related health care expenses:

-

Medicare Part A coinsurance and hospital costs

-

Medicare Part B coinsurance or copayment

-

First three pints of blood

-

Part A hospice care coinsurance or copayments

-

Part A deductible

-

Skilled nursing facility care coinsurance

-

Foreign travel emergency care

Thefour benefits listed in bold above are included in each type of Medigap policy. The remaining five basic benefits may or may not be included, depending on which plan type you buy.

Use the chart below to compare the basic benefits of each type of Medigap plan.

You May Like: How Can I Find Out If I Have Medicare

When Might You Be Able To Switch Between Medicare Advantage And Medicare Supplement

You may wonder why you cant enroll in a Medicare Supplement plan if you have already enrolled in a Medicare Advantage plan. The answer is simply that Medicare Supplement plans are designed to work alongside the federal government-sponsored program, Medicare Part A and Medicare Part B, not with Medicare Advantage plans.

Nonetheless, if you had a Medicare Supplement plan before you enrolled in a Medicare Advantage plan, you wont be forced to cancel your Medicare Supplement plan. Why? If you drop your Medicare Supplement plan, you might not be able to get it back.

There are a few exceptions to this rule. You may have special rights to purchase a new Medicare Supplement plan. For example, if you move out of your Medicare Advantage plans service area, or your plan stops serving your area, you generally have a guaranteed-issue right to buy a Medicare Supplement plan within a certain limited time period.

Another example of guaranteed-issue rights is called a trial right. Suppose you had a Medicare Supplement policy that you dropped to enroll in a Medicare Advantage plan for the first time, or to purchase a Medicare SELECT policy for the first time. If you decide to leave your Medicare Advantage plan or Medicare SELECT policy within the first 12 months of enrollment and return to the federally-sponsored Medicare Part A and Part B, you may be able to get back your Medicare Supplement plan if it is still available or sign-up for a new Medicare Supplement plan.

New To Medicare?

How Are Medicare Supplement Plans Different

Medicare Supplement plans are also offered through private insurance companies. Yet, they must include the same coverage regardless of carrier. Medicare Supplement plans pick up the remaining cost-sharing for which you would normally be responsible with only Original Medicare.

Medicare Supplement plans give you the ability to predict your costs. Because all plans have the same benefits, you will always know your out-of-pocket limits. When enrolled in a Medicare Supplement plan, there is no network of doctors to which you must adhere. You can receive coverage from any doctor or hospital that accepts Original Medicare across all U.S. states and territories.

Additionally, some Medigap plans such as Medicare Supplement Plan G cover excess charges in states that allow them. Meaning if the doctor does not accept Medicare assignment, you will not need to pay extra because your Medigap plan protects you.

Also Check: How To Get Medicare Part D Deducted From Social Security

How Does Medicare Supplement Insurance Work

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest.

If your Part B policy says it covers 80% of a doctors visit, Medicare will pay that. Medigap kicks in for the other 20%. Lets suppose your Medigap Plan says that it will pay 75% of your Part B coinsurance. That means you will only pay one-quarter of the total cost of your doctors visit.

Heres an example with numbers: if the doctors visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5. If you didnt have Medigap, you would be responsible for paying the entire $20 that were left over after Medicare paid its share.

Depending on the plan you select, Medicare Supplement Insurance can help you pay for the Part A and Part B deductibles. It can also help you pay for medical expenses if you have a medical emergency outside of the United States.

Is It Better To Have Medicare Advantage Or Medicare Supplement

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

- Do you prefer to have all your coverage rolled into one plan? If so, a Medicare Advantage Plan may be the way to go. Many include Part D drug coverage, as well as vision, dental, and hearing, depending on the plan.

- Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesnt cover.

- Do you need a plan that provides coverage for disabilities or long term care facilities? If so, Medicare Advantage offers Special Needs Plans that provide this type of coverage.

- Do you want the freedom to see any doctors you choose? If so, Medicare Supplement plans have no required network and you can see any doctor that accepts Medicare, even if youre away from home or traveling. Some Medicare Advantage plans may also allow you to see doctors and hospitals that are not in the plans network, giving you additional freedom to choose your doctors.

Learn more about Choosing a Medicare Plan

Also Check: Can You Change Medicare Part D Anytime

How Much Do Medicare Supplement Insurance Plans Usually Cost

The next factor in determining the best Medicare Supplement insurance plan for you is cost. Keep in mind that different insurance companies may charge different premiums for the same policy. Medicare Supplement insurance plans are rated or priced in 3 ways.

- The first way, âcommunity-rated,â does not depend on age. People of different ages pay the same premium. Premiums may go up because of inflation and other factors but not because of your age.

- The second way, âissue-age-rated,â sets the rate depending on the age of the person when he or she purchases the policy. Premiums may go up because of inflation and other factors but not because of your age.

- The third way,âattained-age-rated, sets a premium at your current age and continues to go up as you get older. Premiums may also go up because of inflation and other factors.

Other factors may influence the price of the policy, such as if the health insurance company offers discounts to non-smokers or married people and if it uses medical underwriting. Medical underwriting could use a pre-existing health condition as a basis for charging a higher premium.

Once you understand your eligibility, what benefits you want covered, and pricing differences, you will be able to determine what the best Medicare Supplement insurance plan is for you.

Read Also: What Is The Disadvantage Of A Medicare Advantage Plan

Medigap And Medicare Advantage Plans Both Allow You To Complement The Coverage You Receive From Original Medicare But Which Should You Choose

In 2018, about two in 10 Medicare beneficiaries overall carried a self-purchased Medigap policy. Four in 10 Medicare recipients were enrolled in a Medicare Advantage plan, while another three in 10 had coverage through their employer, Medicaid, or another provider.

In total, this means that 90% of all Medicare beneficiaries have some form of healthcare coverage outside of Medicare. Collectively, these insurance plans help plug in the gaps left open by Medicare Parts A, B, and D.

Image source: Getty Images.

Also Check: Does Medicare Cover Tdap Vaccine

Your Health Care Needs

- Do you take prescription drugs?

- Do you wear eyeglasses or hearing aids?

- Do you visit the dentist regularly?

If so, you might consider the benefits of enrolling in a Medicare Advantage plan.

- Do you have a health condition that requires frequent trips to the doctor or the use of medical equipment in your home?

- Do you expect to undergo surgery or other major procedures in your near future?

- Do you frequently travel outside of the U.S.?

If so, certain types of Medicare Advantage plans might be a good choice for you.

How And When To Shop For A Medigap Policy

You can buy a Medigap policy anytime you have Medicare Parts A and B. This insurance doesnt have an open-enrollment period during certain times of year, like Medicare Advantage and Part D plans.

But insurers can reject you or charge more if you have preexisting conditions unless you buy a policy during certain times, such as within six months of enrolling in Medicare Part B if youre 65 or older. Medigap insurers must also offer you a policy regardless of preexisting conditions in other situations, such as if you had been enrolled in a Medicare Advantage plan and you move outside of the plans service area.

If you qualify for Medicare before age 65 because of a disability, federal Medigap rules dont protect you from being rejected or charged more because of your health. But some states have extra protections for people who are younger or older than 65 who might find it difficult to get the lowest prices. Contact your State Health Insurance Assistance Program to find out more about the rules in your area.

You can find out more about Medigap plans available in your area at Medicare.gov or your state insurance department.

You May Like: Are Medicare Advantage Plans Hmos