How Old Do You Have To Be To Get Original Medicare

The typical age to enroll in Original Medicare is 65 years or older. However, in certain cases, you may be eligible to enroll in Medicare at a younger age.

To be eligible for Medicare at age 65, you must be an American citizen for at least five years.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Are you wondering if you can get Medicare before age 65? You may be eligible for Medicare before age 65 if you receive Social Security Disability benefits or if you have specific diagnoses. To receive Original Medicare before age 65 you must meet one of the following qualifications:

- Receiving Social Security Disability Income for 24+ months

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Do You Automatically Get Medicare When You Turn 65

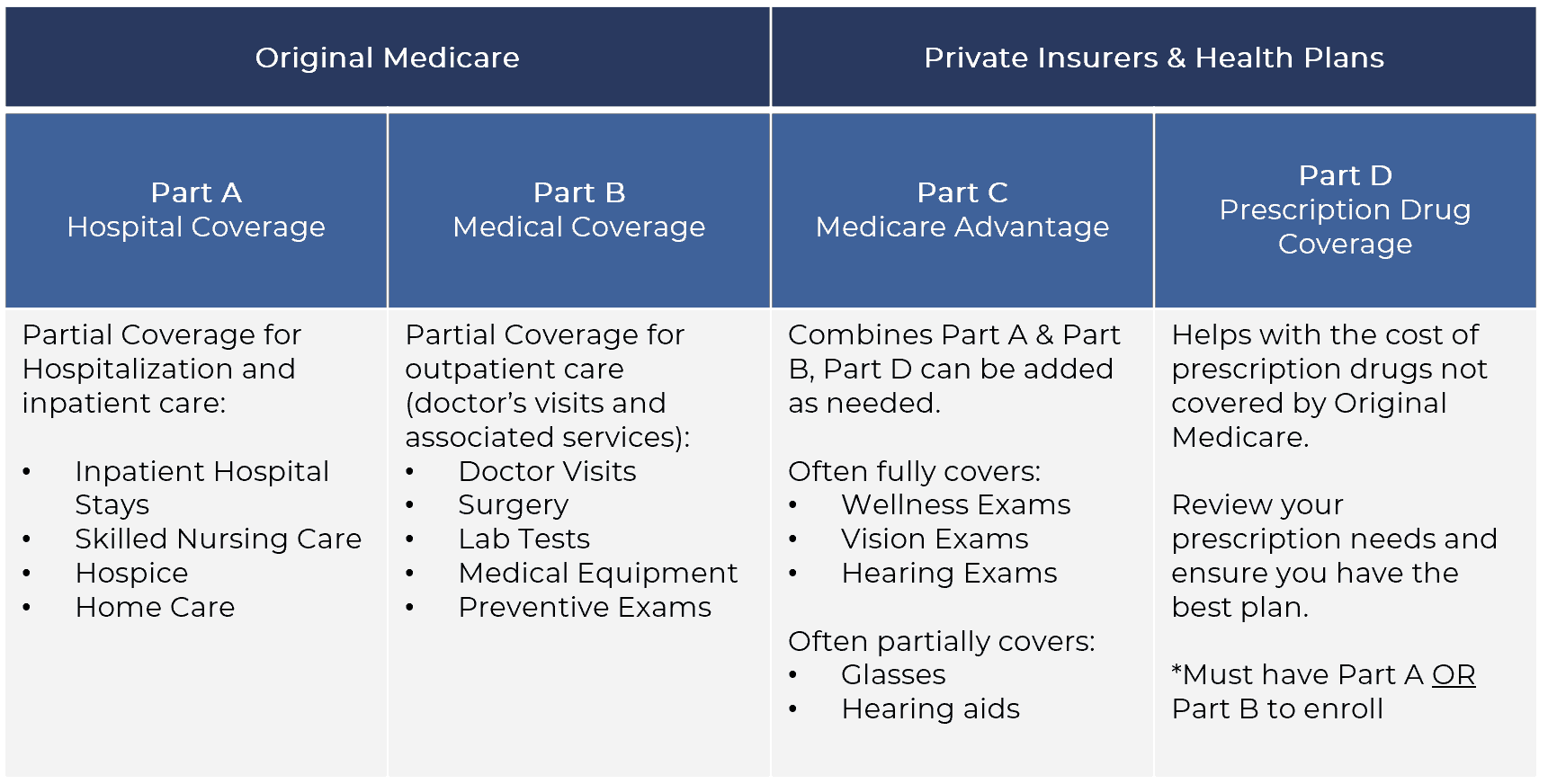

There are certain situations where you may be automatically enrolled in Medicare. It is important to note there are four parts of Medicare that cover specific services:

- Part A covers hospital care.

- Part B covers medical and doctor services.

- Part C is Medicare Advantage. Once you have Parts A and B, you can enroll in a Medicare Advantage plan. Private companieslike Priority Healthmanage Medicare Advantage plans .

- Part D is prescription drug coverage.

While you may be automatically enrolled in one part, you may still need to manually sign up for others.

If you are already receiving social security, retirement benefits or Railroad Retirement Board benefits before you turn 65, then you will be automatically enrolled in Medicare Parts A and B, also called Original Medicare. You will receive your Medicare card in the mail three months before your 65th birthday. Your coverage will automatically begin the first day of your birthday month.

Recommended Reading: What Is The F Plan For Medicare

When Is Trail The Best Choice

We prefer the simplicity and depth-of-coverage Medicare Supplements offer seniors. You get to utilize the Original Medicare benefits youâve been paying into for years.

While we do recommend a Medicare Supplement to the majority of retired teachers we meet, there are always going to be exceptions.

If you take a rare, very expensive medication, weâd encourage you to stay on TRAILâs Medicare Advantage plan. As you saw earlier, their drug coverage is very simple and very good. The most youâd ever pay for a drug is a $100 copay. Youâre probably not going to find another drug plan out there like it.

The other scenario is if youâre covered through the VA. One of our clients is eligible for 100% coverage through the VA. He kept the TRAIL plan, because he knew if he ran into a scenario where he wasnât covered, he could always fall back on the VA. He could go to the VA hospital in Jacksonville if the TRIP option left him hanging.

So those are the two most common situations where weâd recommend you stay on TRAIL: you have a very expensive drug or you also get coverage through the VA.

Recommended Reading: How Do I Get Part A Medicare

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Also Check: How To Sign Up For Medicare Part B Online

How Old Do You Have To Be To Get Medicare

Home / FAQs / General Medicare / How Old Do You Have To Be To Get Medicare

When you think about Medicare, the first thing that comes to mind is typically retirement. Those who have Medicare are often of an age old enough for retirement. However, this is not always the case. Medicare not only covers those who have retired from the workforce, but also those disabled or who meet other specific criteria.

Get A Free Quote

Find the most affordable Medicare Plan in your area

So, how old do you have to be to get Medicare?

Below, we review the age for you to get Medicare and how you may qualify for coverage and not even know yet.

When Does Medicare Coverage Start If You Sign Up For A Medicare Supplement Insurance Plan

Details of your coverage start date might vary. Call your Medicare Supplement insurance plan for information.

If you would like to learn more about your Medicare coverage options in your area, youre welcome to use the plan finder tool on this page. Just enter your zip code and click the button.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

You May Like: What Month Does Medicare Coverage Begin

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Recommended Reading: Does Medicare Cover Prolia Injections

Read Also: Can A Green Card Holder Apply For Medicare

What Plans Provide Gap Coverage

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans arent available everywhere and may have a higher premium. Plans are available by location, if you dont live in the service area, youre not eligible for that policy.

Online you can compare the total annual cost of your medications with all the plans in your area to find your most affordable option. You can even see if youre expected to hit the gap based on your prescriptions, the pharmacy you use, and the available policy.

If youre unsure how to compare plans or want an expert opinion, working with an insurance agent is a great way to discover the most cost-effective plan for you.

What Is Included In Your Medicare Coverage

First, we need to explain what your Medicare coverage entails, so you understand what we mean by Parts A, B, C, and D.

Original Medicare includes two parts:

- Medicare Part A is sometimes called hospital insurance. It covers inpatient services received in a hospital or skilled nursing facility .

- Medicare Part B is also known as medical insurance. It covers outpatient services such as doctor visits, lab work, and durable medical equipment .

Prescription drug coverage is not included in Original Medicare. To get that, you need to sign up for Medicare Part D. Once you enroll in Part A and/or B, you can join a Part D prescription drug plan .

Medicare Part C is more commonly known as Medicare Advantage . All Advantage plans must provide the same benefits you get with Original Medicare, but most offer additional coverage. Common add-ons include prescription drug coverage, fitness programs, and routine vision and dental care.

An MA plan that covers prescription medications is called a Medicare Advantage Prescription Drug plan . These all-in-one plans combine your Parts A, B, and D benefits in a single Medicare policy. Around 90 percent of Medicare Advantage plans provide prescription drug coverage.

Recommended Reading: Does Medicare Cover Tooth Extraction

Districts Participating In The Retired Municipal Teachers Program

For questions about your coverage or premium, contact the Group Insurance Commission at 617-727-2310.

If your school district is not listed in the Retired Municipal Teachers Program , your health care coverage after retirement will be administered by your local employer.

The health insurance options available to you under this plan will vary according to the insurance plans negotiated within your local community. In most cases, your local community will give you the option of an indemnity plan or a choice of an HMO.

An important notice for charter school employees and inactive members: Be aware that school districts have different rules for providing insurance coverage to active members and retired members, and your district may or may not provide you with insurance benefits in retirement. Accordingly, if you are either an employee of a charter school, or you are not employed by a school district, as soon as you start thinking about retiring, investigate your eligibility for retiree health coverage, as your districts rules may affect your retirement decisions.

Make Changes To Your Medicare Plan Coverage During The Right Time Of Year

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period, or AEP.

The Medicare AEP lasts from every year. During this time, Medicare beneficiaries may do any of the following:

- Change from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage back to Original Medicare

- Switch from one Medicare Advantage plan to another

- Enroll in or drop Medicare Part D coverage

- Switch from one Part D plan to another

Outside of AEP, your opportunities to make changes to your Medicare plan can be limited.

Another time you may be able to change your Medicare plan include:

- Special Enrollment Periods You could potentially qualify for a Special Enrollment Period at any time throughout the year, if you meet one of a set of certain circumstances. This can include moving out of the area serviced by your current plan, losing your current plan because it is no longer offered in your area, and a number of other certain circumstances.

Recommended Reading: Does Medicare Cover Home Delivered Meals

At What Age Do I Qualify For Medicare

Medicare eligibility for seniors begins at age 65 . Your initial enrollment period for Medicare begins three months before the month of your 65th birthday, and ends three months after the month you turn 65.

If you miss your initial Medicare enrollment window, you can sign up during the general enrollment period of January 1 through March 31 of each year. But holding off too long could cost you. If you wait too long to sign up for Medicare Part B, youll face a 10 percent increase in your Part B premiums for every year-long period you were eligible to enroll but didnt. There are also financial implications associated with waiting too long to sign up for a Part D drug plan.

That said, if youre still working and have coverage under a group health plan during the seven-month period surrounding your 65th birthday, youll get a special enrollment period that begins when you separate from your employer or your group coverage ends. As such, you wont have to worry about the aforementioned penalties provided you sign up during your special enrollment period.

When Does Medicare Start If You Enroll During The General Enrollment Period

If you delay your Original Medicare benefits or only enroll in Medicare Part A and do not have creditable coverage in place for Medicare Part B, you will need to wait until the General Enrollment Period to pick up coverage.

Unlike the Initial Enrollment Period, which is unique to you, the General Enrollment Period is the same for everyone. This enrollment period lasts from January 1 to March 31 each year.

Get A Free Quote

Find the most affordable Medicare Plan in your area

When you enroll in Original Medicare during this time, your coverage will not be effective until June 1. This means you will not have coverage in the meantime.

However, this also means that you will be responsible for paying the Medicare Part B late enrollment penalty since you did not have creditable coverage. is health benefits that are at least equal to Original Medicare.

You May Like: How Do I Get A Medicare Explanation Of Benefits

When Is My Medicare Effective Date

Summary:

Your Medicare effective date depends on when your Medicare coverage begins. For many people, this date is the first day of the month in which they turn 65. Your Medicare Part A and Medicare Part B effective dates may be different. You know you are eligible for Medicare at age 65 or the 25th month of receiving disability benefits, but when exactly does your Medicare coverage start?

Read Also: Do I Need Medicare If I Have Tricare

Medicare Requirements Impacting Your Calpers Health Coverage

If you’re Medicare eligible and you lose your Part A and/or Part B, you’ll be disenrolled from the CalPERS Medicare health plan. Your disenrollment from Part A and/or Part B may result in cancellation of your CalPERS health coverage.

CMS requires members to live in the approved plan service area and list a residential address. Post Offices Boxes are not permitted. If CalPERS is unable to verify your permanent residential address, your enrollment may be subject to cancellation, or you may be administratively enrolled in a Medicare Supplement plan to continue your CalPERS health coverage.

CMS must approve your enrollment in a Medicare Advantage plan and Medicare Part D plan. CalPERS and/or your CalPERS Medicare health plan may contact you to obtain additional information required by CMS to complete your enrollment. If you’re contacted for additional information, respond immediately to protect your health coverage.

You may be enrolled in only one Medicare Advantage plan at one time, as well as one Medicare Part D plan at one time. If you’re enrolled in a CalPERS Medicare health plan and later enroll in another Medicare health plan, you’ll be disenrolled from the previous Medicare health plan.

Recommended Reading: Can You Sign Up For Medicare Anytime

Medicare Scooter Evaluation What Is Involved

There is a required on-site evaluation of the patients home performed before or at the time of the scooter delivery. A written report accompanies the evaluation.

The person conducting the evaluation confirms that the patient can maneuver their scooter inside the home, considering the physical layout, the doorways thresholds and width, and the surfaces.

Keep Location In Mind

Many retirees consider relocating during their retirement years, and if youre struggling to come up with a plan of action for your health care coverage, you have the option to move to a state with more affordable options. According to US News and World Report, the states with the most affordable health care are:

Don’t Miss: Does Medicare Cover Any Dental Surgery

Ways To Get Dental Coverage On Medicare

Dental health affects more than just your teeth. In fact, Harvard Health notes that those with gum disease have an increased risk of heart attack, stroke, and other serious cardiovascular health events. Yet Original Medicare does not cover routine dental care, dental implants, or fillings. But that doesnât mean that dental care is completely out of the question. These options can help you get the dental coverage you need while on Medicare.

Mobility Scooters For Disabled Veterans

There is no quick answer to whether VA benefits will cover a mobility scooter. The decision is made on a case-by-case basis, the same as with Medicare and Medicaid coverage for scooters. Each veteran is entitled to an evaluation to see if they qualify for coverage of a scooter or other power mobility device.

A notice sent to physicians and clinicians established protocol related to the criteria for potentially qualifying for a scooter or other DME. It also stated that a motorized wheeled mobility device is not to be prescribed solely for recreational use.

Read Also: Is Mutual Of Omaha A Good Company For Medicare Supplement

Retiree Health Plan Part B Reimbursement Options

If youre retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

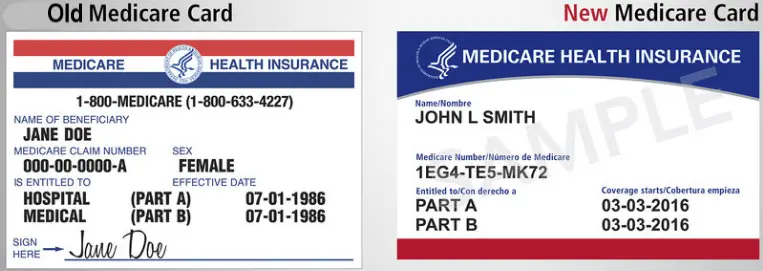

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.