Benefits Received Before 65

For those who do qualify for benefits before age 65, there are restrictions. People in these categories qualify for free Part A benefits. According to medicare.gov, this is what Part A covers:

- Inpatient care in a hospital

- Skilled nursing facility care

- Inpatient care in a skilled nursing facility

- Hospice care

- Home health care

Most people qualify to not pay a monthly premium for Part A. This is true for those who have worked and paid Medicare taxes for at least ten years.

If Your Check Is Lost Or Stolen

- Lost: Please check the Pension payment schedule for the dates on which your pension checks are mailed. If you do not receive your retirement check after one week of the check mailing date, send us a letter stating that your check has been lost and requesting that we stop payment on the check. Please allow two weeks for the replacement to be sent.

- Stolen: Please call our immediately, at 617-679-MTRS .

Also Check: What Is Medicare Insurance Plans

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you dont qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

Don’t Miss: How Does Medicare Work In Texas

Keep Location In Mind

Many retirees consider relocating during their retirement years, and if youre struggling to come up with a plan of action for your health care coverage, you have the option to move to a state with more affordable options. According to US News and World Report, the states with the most affordable health care are:

Make Your Decisions Independently

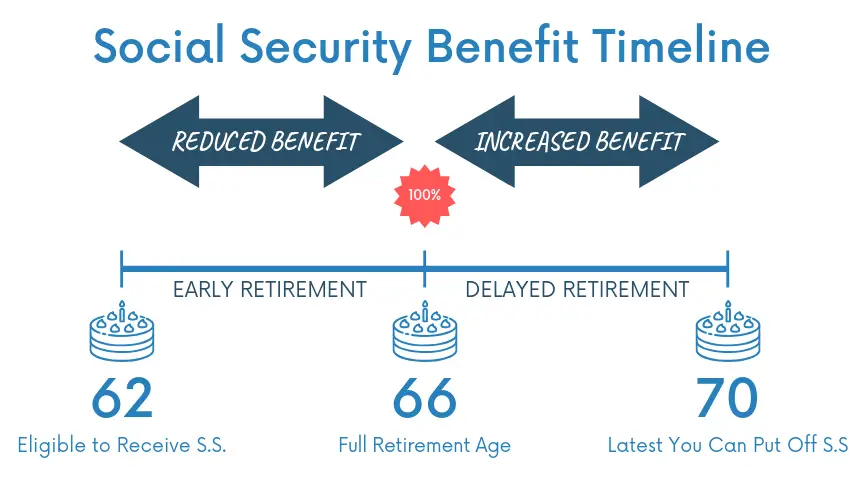

Collecting Social Security is by no means a prerequisite to getting Medicare. In fact, its often advisable to sign up for Medicare as soon as youre eligible but wait on Social Security to avoid a reduction in benefits, or boost them as much as possible.

The only downside to signing up for Medicare alone is having to make your premium payments directly, as opposed to having them deducted from your Social Security benefits, but its a small price to pay for the upside of a higher lifetime income stream.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

Also Check: Does Medicare Pay For Stem Cell Treatment

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Can A 62 Year Old Widow Get Medicare

When can I receive Medicare benefits? Medicare is the federal health insurance program for people age 65 and older. Generally, individuals are automatically eligible for Medicare if they are 65 years old and have 40 quarters of work credit in Social Security covered employment, or their spouse is eligible for Medicare.

Recommended Reading: Can Medicare Take Your House

You May Like: How To Apply For Medicare In Ga

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

When Is Trail The Best Choice

We prefer the simplicity and depth-of-coverage Medicare Supplements offer seniors. You get to utilize the Original Medicare benefits youâve been paying into for years.

While we do recommend a Medicare Supplement to the majority of retired teachers we meet, there are always going to be exceptions.

If you take a rare, very expensive medication, weâd encourage you to stay on TRAILâs Medicare Advantage plan. As you saw earlier, their drug coverage is very simple and very good. The most youâd ever pay for a drug is a $100 copay. Youâre probably not going to find another drug plan out there like it.

The other scenario is if youâre covered through the VA. One of our clients is eligible for 100% coverage through the VA. He kept the TRAIL plan, because he knew if he ran into a scenario where he wasnât covered, he could always fall back on the VA. He could go to the VA hospital in Jacksonville if the TRIP option left him hanging.

So those are the two most common situations where weâd recommend you stay on TRAIL: you have a very expensive drug or you also get coverage through the VA.

Recommended Reading: How Do I Get Part A Medicare

You May Like: Is Ingrezza Covered By Medicare

How Long Do You Receive Social Security Survivor Benefits

Social Security survivor benefits are payable to the surviving spouse for the remainder of their life. Restrictions apply for divorced spouses eligible to receive benefits.

Benefits for surviving children end at age 18 or age 19 and 2 months if still pursuing their elementary or secondary education. For surviving children who became disabled before age 22, their benefits continue for life.

Read Also: Is The Medicare Helpline Legit

Tips For Getting Retirement Ready

- A financial advisor can be a big help in figuring out how medical expenses will affect your retirement. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets free financial advisor matching tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Medical costs arent the only expenses youll need to grapple with in retirement. Think about where youll want to retire to see how cost of living could impact your lifestyle. SmartAssets cost-of-living calculator can help you figure out your costs so youll know how much youll need to save. And our retirement calculator can help you see if youre on track with those savings.

Recommended Reading: What’s The Cost Of Medicare Part B

To Transfer Your Existing Direct Deposit Of Your Retirement Or Survivor Benefit

- to another bank or to another account within the same bank, complete and return a new Direct Deposit Authorization form. Please note: You should not close your old account until the first deposit has been made to your new bank or you receive a retirement check at home. The process of changing your direct deposit from one account to another takes approximately two months to complete. Occasionally, before the changeover is completed, one check may be mailed to the address shown on the Direct Deposit Authorization form.

If the new account is a checking account, please attach a voided check to your correspondence.

You May Like: How To Disenroll From A Medicare Advantage Plan

How To Enroll For Medicare

If you meet the requirements for those 65 and older, you can receive Medicare Part A without paying any premiums. However, if you or your spouse did not pay Medicare taxes, you may have to pay for Part A. Medicare Part A covers hospital insurance. Medicare part B covers things like outpatient care, preventive services and medical equipment. It can also cover part-time home health services and physical therapy. Should you decide you also want Medicare Part B, you must pay a monthly premium.

If you have received Social Security disability benefits for 24 months, you will automatically be enrolled in Medicare at the start of the 25th month. If you have Lou Gehrigs disease, you are automatically enrolled the first month you begin receiving benefits. For these situations, enrollment includes both Medicare Part A and Part B. However, if you have end-stage renal disease, your Medicare benefits are determined on a case-by-case basis. In this case, you will need to manually apply.

Also Check: Who Is Eligible For Medicare In Georgia

Check Out Our Recent Facebook Live About This Very Topic

I interviewed my mom, Sharon Slovak, who two years ago retired after 30 years in the classroom. After teaching grades from kindergarten through 12th grade English, she found her niche in upper elementary and spent 24 years teaching 4th 6th grades. Read on for 10 surprising and enlightening items about teacher retirement.

1. August/September will always feel like the beginning of the year.

Even if you do not have a classroom to ready or a seating chart to prepare, Labor Day weekend will always be your time for personal resolutions and a fresh start.

2. You will love having the entire calendar year to make plans.

After years of traveling only during winter, spring and summer breaks, you will love the freedom of 52 whole weeks in which to visit new places and old friends.

3. You will still find yourself obsessed with school supply sales.

You will not be able to help yourself from pawing through the racks and bins of supplies on sale. However, you will be able to skip the worries of not locating 35 identical copies of your favorite finds.

4. You will miss creating new learning units.

My mother says that she was surprised to realize how much she misses mapping new themes for a class. She did not foresee how much nostalgia she would feel for research, choosing books and artwork, and locating artifacts.

5. You will miss introducing new authors to students.

6. You will not miss bells.

7.Looking back, the years you had to switch grades ended up being awesome.

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Read Also: Which Medicare Plans Cover Silver Sneakers

Are There Any Situations In Which The Mtrs Would Increase My Member

Yes. are granted to retirees and survivors on an ad hoc basis by a vote of the Massachusetts Legislature. A retiree is eligible to receive a cost of living adjustment, if any, in the second fiscal year following his or her retirement date if the retiree has already completed this eligibility period, then the survivor is eligible for any cost of living adjustments immediately upon their being granted by the Legislature.

Also Check: How To Prevent Medicare Fraud

How Old Do You Have To Be To Get Medicare

Home / FAQs / General Medicare / How Old Do You Have To Be To Get Medicare

When you think about Medicare, the first thing that comes to mind is typically retirement. Those who have Medicare are often of an age old enough for retirement. However, this is not always the case. Medicare not only covers those who have retired from the workforce, but also those disabled or who meet other specific criteria.

Get A Free Quote

Find the most affordable Medicare Plan in your area

So, how old do you have to be to get Medicare?

Below, we review the age for you to get Medicare and how you may qualify for coverage and not even know yet.

Also Check: Where Can I Find My Medicare Number

If I Enroll Earlier Than Age 65 Is My Medicare Coverage Reduced

You donât have to worry about this, because you canât enroll in Medicare before youâre eligible.

If you qualify for Medicare before age 65 due to disability:

- You can get full Original Medicare benefits.

- If you want to buy a Medicare Supplement insurance plan , some states will let you do this and others wonât. You can check with your stateâs State Health Insurance Assistance Program agency to find out if you can get a Medicare Supplement insurance plan if youâre disabled and not yet 65.

Automatic Enrollment And Applying

Those who are already qualified for Social Security benefits or Railroad Retirement Board benefits will typically be automatically enrolled for Medicare.

Those who have not qualified for those benefits will have to fill out paperwork to be enrolled. Dont let the process of applying for a government-funded program scare you. The process for enrolling is pretty simple, and you can start it seven months before you become eligible. This seven month period is called your Initial Enrollment Period .

As mentioned above, the Initial Enrollment Period can change based on circumstances. For those qualifying due to a disability, the IEP begins in the 22nd month of receiving social security benefits. For those who qualified before age 65 and are requalifying at age 65, there is a second IEP that begins seven months before that birthday.

Don’t Miss: Does Medicare Cover Out Of Country Medical Expenses

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Also Check: Is Unitedhealthcare Dual Complete A Medicare Plan

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Don’t Miss: When To Sign Up For Medicare Part B

Can I Get Medicare At Age 55

Like those who retire at 62, those who retire at age 55 are not eligible for Medicare. While you may be eligible for Social Security benefits, this is not the same as Medicare healthcare coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

The only time you qualify for Medicare before age 65 is if you have been diagnosed with specific conditions or have been receiving Social Security disability benefits for 24 months.

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Also Check: Does Medicare Cover Laser Surgery

You May Like: How Can I Enroll In Medicare Part D

More Resources For Medicare Beneficiaries

When approaching the age to qualify for Medicare benefits, visit the official Social Security Administration Medicare website to determine your eligibility and calculate your premium. In the meantime, read more about when and how to apply for Medicare and visit medicare.gov to prepare for when that time comes.

What Are The Typical Age Requirements For Medicare Coverage

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs. If you are not eligible for premium-free Part A because you have not worked and paid Medicare taxes, but are a citizen with permanent residency and are 65, you can pay premiums to have Part A coverage. If your spouse has worked long enough to qualify for premium-free Part A, your Part A premiums will be free after your spouse turns 62.

When you meet the requirements for Part A, you also qualify for Medicare Part B which helps cover medical out patient costs such as doctors visits, urgent care, durable medical equipment , some preventive care, and more. If you have Part B, there is a monthly premium you pay, which is $148.50 for 2021, and an annual deductible of $203.

Also Check: Does Medicare Pay For Cpap Cleaner Machine