Medicare Enrollment With Gic Health Coverage

When to enroll in Medicare Part A and Part B if you have GIC health coverage

This depends on your employment status with the state or a participating GIC municipality:

If you do not enroll in, cancel, or do not pay Medicare Part B within the required time, or cancel Part B and re-enroll at a later date, you will be ineligible for health coverage through the GIC. Also, you may be subject to pay federal government penalties.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

D Late Enrollment Penalty

The Part D late enrollment penalty is similar to the Part B late enrollment penalty, in that you have to keep paying it for as long as you have Part D coverage. But its calculated a little differently. For each month that you were eligible but didnt enroll , youll pay an extra 1% of the national base beneficiary amount.

In 2020, the national base beneficiary amount is $32.74/month. Medicare Part D premiums vary significantly from one plan to another, but the penalty amount isnt based on a percentage of your specific planits based instead on a percentage of the national base beneficiary amount. Just as with other parts of Medicare, Part D premiums change from one year to the next, and the national base beneficiary amount generally increases over time.

So a person who delayed Medicare Part D enrollment by 27 months would be paying an extra $8.84/month , on top of their Part D plans monthly premium in 2020. A person who had delayed their Part D enrollment by 52 months would be paying an extra $17.02/month. As time goes by, that amount could increase if the national base beneficiary amount increases . People subject to the Part D late enrollment penalty can pick from among several plans, with varying premiums. But the Part D penalty will continue to be added to their premiums for as long as they have Part D coverage.

Also Check: Does Humana Medicare Cover Incontinence Supplies

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Things You Should Know

How to find out whether or not you are eligible for Medicare Part A and Part B benefits if you are retired and under age 65 and your spouse or you are disabled

If you or your spouse is disabled and receiving Social Security disability benefits, contact Social Security about Medicare-eligibility. If eligible, contact the GIC at 617.727.2310 to request a Medicare Plan enrollment form.

If you have been a state employee and have never contributed to Social Security

You may still be eligible for Medicare benefits through your spouse. When you turn age 65, visit Social Securitys website or call Social Security to apply to see if you are eligible.

What happens to your spouse’s coverage if you enroll in a GIC Medicare Supplemental Plan

Your spouse will continue to be covered under in a GIC non-Medicare plan if he/she is under age 65 until he or she becomes eligible for Medicare. See the Benefit Decision Guide for under and over age 65 health insurance products. If your spouse is over age 65, he/she must enroll in the same Medicare supplemental plan that you have joined.

What you need to do at age 65 if your spouse or yourself was not eligible for Medicare Part A for free, but now, you and your spouse have subsequently become eligible for Medicare Part A for free

You or your spouse must notify the GIC in writing when you become eligible for Medicare Part A. The GIC will notify you of your coverage options. Failure to do this may result in loss of GIC coverage.

Read Also: Do I Really Need A Medicare Advantage Plan

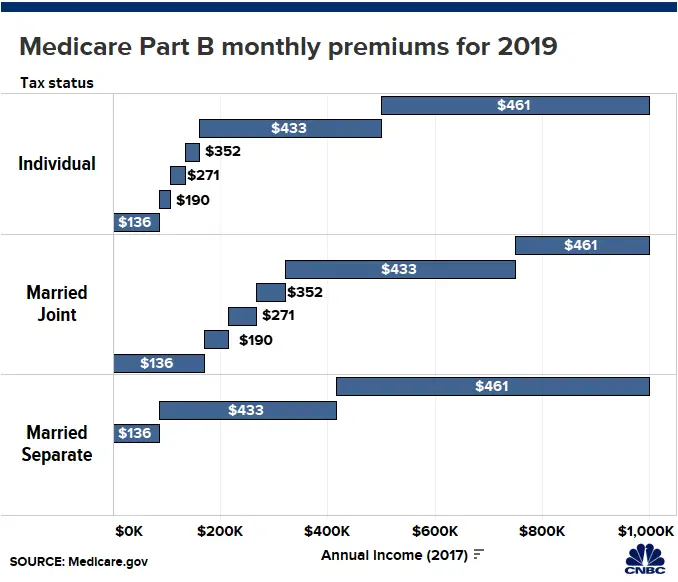

Is Medicare Part B Based On Income

Yes,Medicare Part B pricing is based on income. However, coverage is federally regulated, which means that Medicare Part A is usually a $0 premium, but Part B requires a monthly premium that is based on your tax filings.

âThe most common monthly Part B premium is $148.50. If you have a high income, you’ll pay more.

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

Don’t Miss: Can I Enroll In A Medicare Advantage Plan Anytime

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Read Also: Does Medicare Pay For Repatha

Is Medicare Supplement Ever Free

Medigap policies are available through private insurance companies. They are not free but may help you save money on other Medicare program costs.

Some Medigap plans cover the costs of the Medicare Part B deductible. However, in 2015 a law was passed that made it illegal for Medicare Supplement plans to pay for part B deductibles for new enrollees beginning in 2020.

While people who already had a plan that paid this premium keep their coverage, since January 1, 2020, new Medicare enrollees could not sign up for supplement plans that pay for the Part B premium. However, if you were already enrolled in Medicare and had a Medigap plan that pays the part B deductible, you can keep it.

Medicare offers an online tool to find Medigap programs in your area. You can compare premium costs and what copays and deductibles apply. Medigap benefits kick in after basic Medicare programs like Part A and Part B coverage is exhausted.

When Can You Get Free At

If you have a Medicare Advantage Plan, you are enrolled in Medicare Parts A and B. You must be enrolled in both before you can join a Medicare Advantage Plan. The free at-home COVID-19 tests may not be available as a benefit through your Medicare Advantage Plan, but you can still get up to eight free at-home tests monthly through Medicare Part B. You can contact your plan to see if it offers free at-home tests. Even if it does, you are still eligible for the free tests through this Medicare initiative.

Also Check: Will Medicaid Pay My Medicare Premium

Does Medicare Part D Cover Prescriptions

Medicare Part D provides prescription drug coverage. For those with Medicare Advantage, these services are a part of the monthly premium. People with traditional Medicare policies who want to purchase Medicare Part D from a private insurance company will pay a monthly premium for their prescription drug costs.

Medicare Eligibility At Age 65

- You are at least 65 years old

- You are a U.S. citizen or a legal resident for at least five years

In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security or Railroad Retirement Board benefits, which requires working and paying Social Security taxes for at least 10 full years .

Learn more about Medicare eligibility at and before age 65 by referring to this helpful chart and reading more information below.

Read Also: How Much Does Open Heart Surgery Cost With Medicare

Is Medicaid Based On Income

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children. Learn more about the difference between Medicare and Medicaid.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Dont Miss: Can Medicare Take My Settlement

You May Like: Is Entyvio Covered By Medicare Part B

The Whats Covered App

In 2019, Medicare debuted a free app called Whats Covered. You can use the app to look up medical goods and services and find out whether Medicare covers them.

If you dont want to download the app or dont have a smartphone or internet-connected tablet, you can use a computer to access Medicare.govs Your Medicare Coverage tool, which also lets you search for an item or service and find out whether its covered.

During A Special Enrollment Period

This SEP is available only if you have health insurance from an employer for which you or your spouse actively works. It allows you to delay enrolling in Part B until the employment or the coverage ends whichever occurs first.

The SEP actually lasts throughout the time you have coverage from current employment and for up to eight months after it ends. If you enroll at any point during this time frame, your Medicare coverage will begin on the first day of the following month, and you will not be liable for late penalties regardless of how old you are when you finally sign up.

Be aware that an IEP always trumps an SEP if the two should happen to overlap. For example, if your IEP ends on Aug. 31, and you retire on the same date, you will not be entitled to an SEP. Therefore, if you delayed enrollment until after Aug. 31, you would not be able to sign up until the following general enrollment period and your coverage would not begin until July 1 so you would be left for almost a year without coverage. Even if you signed up during the final months of your IEP, your coverage would still be delayed by two or three months. But, to continue this example, if you retired on Sept. 1, under the rules of the SEP, you could enroll in August and receive Medicare starting Sept. 1 with no loss of coverage.

Two other Medicare enrollment scenarios have different rules.

Read Also: How Do I Apply For Medicare In Missouri

Is Medicare Enrollment Automatic At Age 65

Medicare enrollment is only automatic at age 65 if youre currently collecting Social Security benefits. If not, youll need to affirmatively enroll during your Medicare Initial Enrollment Period. Your Medicare Initial Enrollment Period is a seven-month window that starts three months before your birthday month and will continue for three months after your birthday month.

Do Seniors On Social Security Have To Pay For Medicare

Social Security and Medicare are both federal programs, so itâs easy to see why they would intersect somehow. Because individuals have to pay their dues for Medicare, most plans are income dependent.

While Medicare Part A is normally $0 premium, Medicare Parts B and D require monthly payments that are based on an individualâs household income.

To determine the amount that an individual owes for Medicare, Social Security analyzes their income and benefits from the past two years, on an individual basis.

You May Like: What Do You Need To Sign Up For Medicare

What If You Worked 10 Years Or Less

Most people will qualify for coverage by paying Medicare and Social Security taxes for 10 years through any combination of employers. Youll need to have spent 10 years doing taxable work to enroll in Medicare Part A for free. If youve worked for less than 10 years in the US, youll need to pay monthly premiums for Medicare Part A.

However, if your spouse who is 62 or older has enough quarterly credits or receives Social Security benefits, then youll still qualify. You may also be able to qualify based on your spouses work record if youre widowed or divorced.

Read Also: What Is The Annual Deductible For Medicare Part A