Cms Encourages The Packaging Of Observation Services

Observation services are reimbursed by Medicare in accordance with the APCcomposite system. CMS will use this composite APC to expand the packaging of related services under the OPPS. When billing for observation services, the Outpatient Claim Form 13X or 85X will be filled out. Revenue code 0762, as well as the code G0378, are reported in observations. When the patients observation status changes from inpatient to outpatient or vice versa, the appropriate discharge code is 99217 for inpatients and 99238 or 99239 for outpatients.

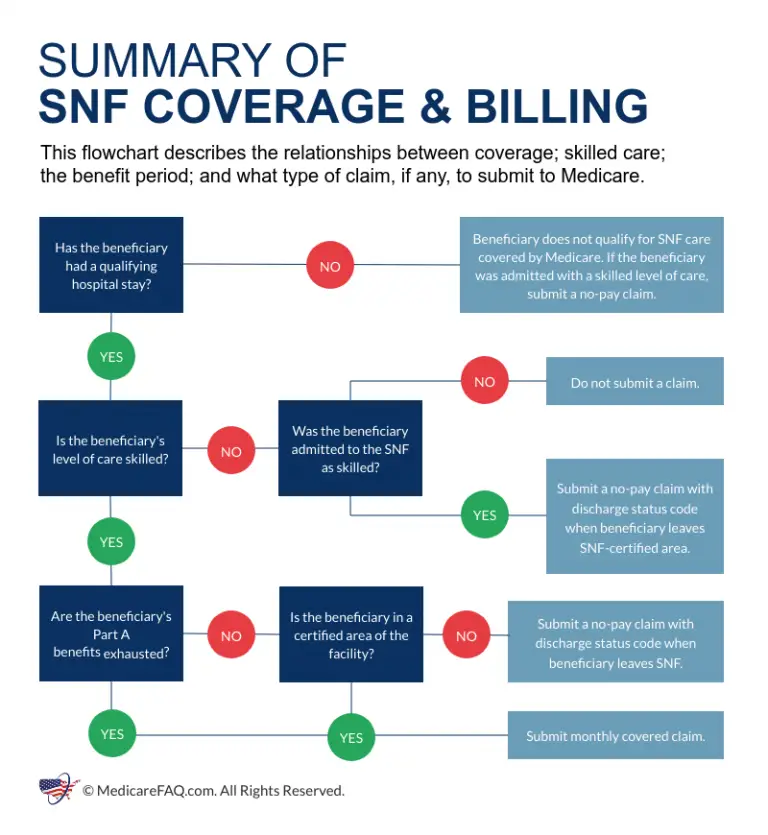

Are There Any Special Rules For Medicare Coverage For Skilled Nursing Facility Or Nursing Home Residents Related To Covid

In response to the national emergency declaration related to the coronavirus pandemic, CMS has waived the requirement for a 3-day prior hospitalization for coverage of a skilled nursing facility for those Medicare beneficiaries who need to be transferred as a result of the effect of a disaster or emergency. For beneficiaries who may have recently exhausted their SNF benefits, the waiver from CMS authorizes renewed SNF coverage without first having to start a new benefit period.

Nursing home residents who have Medicare coverage and who need inpatient hospital care, or other Part A, B, or D covered services related to testing and treatment of coronavirus disease, are entitled to those benefits in the same manner that community residents with Medicare are.

Medicare establishes quality and safety standards for nursing facilities with Medicare beds, and has issuedguidance to facilities to help curb the spread of coronavirus infections. In the early months of the COVID-19 pandemic, the guidance directed nursing homes to restrict visitation by all visitors and non-essential health care personnel , cancel communal dining and other group activities, actively screen residents and staff for symptoms of COVID-19, and use personal protective equipment .

Topics

Does Medicare Cover Hospital Stays

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Part A covers hospitalizations, but youre responsible for the Part A deductible. After 60 days youll have to pay coinsurance, and the amount increases based on the length of your stay.

Recommended Reading: Does Medicare Supplement Cover Medicare Deductible

Which Medicare Plans May Be Best For You If You Know You Need A Hospital Bed At Home

You can get coverage for hospital beds through a few different parts of Medicare.

If you use Medicare parts A and B, together called original Medicare, your coverage will be through Medicare Part B. Thats because Medicare Part A covers inpatient stays and care you receive in hospitals and skilled nursing facilities.

- emergency room care

- medical equipment

Part B will cover 80 percent of the Medicare-approved amount of your hospital bed. Youll pay the remaining 20 percent.

You can also get coverage through a Medicare Part C plan. Part C plans, also known as Medicare Advantage plans, are offered by private companies that contract with Medicare.

Theyre required to provide the same coverage as original Medicare. Plus, many Advantage plans go beyond the coverage of original Medicare to offer additional covered services.

So, since original Medicare covers hospital beds, all Advantage plans will also cover hospital beds. Your cost might be more or less than with original Medicare, depending on your plan.

Medicare Part D is prescription drug coverage. It wont help you pay for any DME, including hospital beds.

Medigap, however, can help you pay for a hospital bed. This is Medicare supplement insurance. It covers some of the out-of-pocket costs of using original Medicare, like copayments and coinsurance amounts.

So, if you use Medicare Part B to get a hospital bed, a Medigap plan could cover the 20 percent coinsurance amount youd normally need to pay.

How Much Does Observation In Hospital Cost With Medicare

If you receive hospital observation services but are not admitted as an inpatient, your doctors services are covered by Medicare Part B.

You typically must pay a 20 percent coinsurance for your Part B-covered care after you meet the Part B deductible .

Theres no limit to how much you might be charged for the Part B 20 percent coinsurance.

If you have a Medicare Advantage plan, however, your plan includes an out-of-pocket spending limit. This could potentially save you money in out-of-pocket Medicare costs related to your hospital stay.

Speak with your doctor for specific cost and coverage information related to your observation services.

Don’t Miss: When Am I Required To Sign Up For Medicare

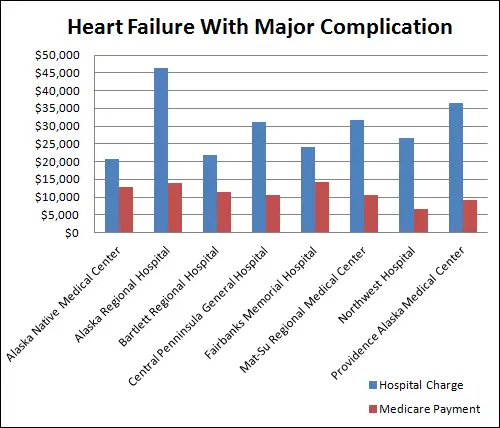

How Can Medigap Insurance Protect You

Fortunately, Medicare beneficiaries seeking financial protection against a long hospitalization can purchase a Medigap insurance policy. Also known as Medicare Supplement Insurance, Medigap policies are designed to pick up the healthcare costs not covered under Original Medicare Part A and Part B.

To avoid perhaps paying tens of thousands of dollars out-of-pocket during an extended hospital stay, more than 30% of Original Medicare beneficiaries purchase Medicare Supplement Insurance . These policies cover the cost of Part A coinsurance plus, they provide beneficiaries with 365 additional lifetime reserve days. Some plans also cover Medicare beneficiaries Part A hospital deductible. Others pay for healthcare expenses that Original Medicare does not cover, such as out-of-hospital prescription drugs.

To be sure, most people dont spend more than a week in the hospital. However, Medigap coverage is especially helpful for patients who have a chronic illness and therefore run the risk of needing extended hospital care. Purchasing a Medigap policy can protect them from racking up costly hospital bills, especially if they need to be hospitalized over 90 days in any one benefit period.

Medigap picks up the costs not covered under by Original Medicare.

Do You Need Medicare Part D

Most people will need Medicare Part D prescription drug coverage. Even if youre fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Read Also: What Does Part B Cover Under Medicare

Recommended Reading: Does Medicare Cover Gastric Balloon

Medicare Program Part B Inpatient Billing In Hospitals

MEDICARE PROGRAM PART B INPATIENT BILLING IN HOSPITALSPROPOSED RULE AND ADMINISTRATOR RULING

On March 13, 2013, the Centers for Medicare & Medicaid Services released a proposed rule that would allow Medicare to pay for additional hospital inpatient services under Medicare Part B. Specifically, the proposed rule would allow additional Part B payment when a Medicare Part A claim is denied because the beneficiary should have been treated as an outpatient, rather than being admitted to the hospital as an inpatient.

The proposed rule, Medicare Program Part B Inpatient Billing in Hospitals, proposes that if the beneficiary is enrolled in Part B, Medicare would pay for all reasonable and necessary Part B hospital inpatient services when a Part A inpatient admission is denied as not reasonable and necessary, instead of just the limited list of Part B inpatient services currently allowed in these circumstances. The reasonable and necessary standard is a prerequisite for Medicare coverage in the Social Security Act. The statutory timely filing deadline, under which claims must be filed within 12 months of the date of service, would continue to apply to the Part B inpatient claims.

Background

Proposed Part B inpatient billing policy

The proposed rule updates hospital Part B inpatient billing policy consistent with the statute and payment regulations:

Beneficiary impact

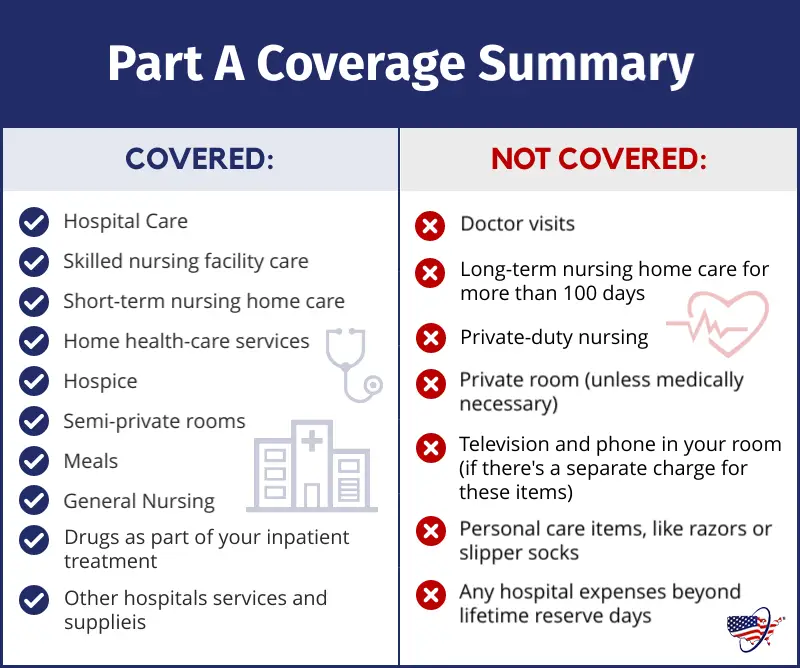

What Does Medicare Part A Cover

What is covered under Medicare Part A:

- Skilled nursing care on a part-time basis

Medicare Part A will not cover a private room, private nursing, or any personal care items. After the Medicare Part A deductible is met, Medicare pays the first 60 days of your benefit period in full.

For days 61-90, you must pay a hospital coinsurance of $400per day. Then, Medicare will cover up to 60 extra lifetime reserve days.

For days 91 and beyond, the coinsurance is $800 per day. After 60 days over your lifetime benefit, ALL costs are your responsibility.

To start a new benefit period, you must stay out of the hospital for at least 60 consecutive days. Additionally, beginning another benefit period means paying the Part A deductible again.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You May Like: What Is Aarp Medicare Complete

Medicare Part A Covers

- Certain care in a skilled nursing facility

- Certain home health services

- Certain hospice care

You will not pay a Part A monthly premium if you are eligible for Social Security retirement benefits or Railroad Retirement benefits. If you have 30-39 quarters of Social Security credits, you may buy Part A coverage and pay a monthly premium of $278 in 2023. If you have 0-29 quarters of Social Security credits, you may buy Part A coverage and pay a monthly premium of $506 in 2023.

Who Qualifies For Medicare Part A

If you receive disability benefits, you become eligible for premium-free Medicare Part A after two years of receiving those benefits. Also, if you or your spouse has Medicare-covered government employment, you get premium-free Part A.

Those with amyotrophic lateral sclerosis do not need to wait two years before becoming eligible for Medicare. Medicare Part A and Medicare Part B benefits begin immediately and automatically. Those with end-stage renal disease can apply upon diagnosis, but Medicare enrollment isnât automatic.

Read Also: Does Medicare Cover Dermatology Services

When Should I Enroll In Medicare Part A

In addition, when you should enroll in Medicare Part A depends on whether your employer is large or small. When you work for a small employer, you may HAVE to get Medicare Part A and Part B as soon as youâre Medicare-eligible. It is best to talk to the benefits administrator at your place of employment to figure out your options

Does Medicare Cover Treatment For Covid

Patients who get seriously ill from the virus may need a variety of inpatient and outpatient services. Medicare covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care under Part A. If an inpatient hospitalization is required for treatment of COVID-19, this treatment will be covered for Medicare beneficiaries, including beneficiaries in traditional Medicare and those in Medicare Advantage plans. This includes treatment with therapeutics, such as remdesivir, that are authorized or approved for use in patients hospitalized with COVID-19, for which hospitals are reimbursed a fixed amount that includes the cost of any medicines a patient receives during the inpatient stay, as well as costs associated with other treatments and services. Beneficiaries who need post-acute care following a hospitalization have coverage of SNF stays, but Medicare does not cover long-term services and supports, such as extended stays in a nursing home.

Medicare covers outpatient services, including physician visits, physician-administered and infusion drugs, emergency ambulance transportation, and emergency room visits, under Part B. Based on program instruction, Medicare covers monoclonal antibody infusions, including remdesivir, that are provided in outpatient settings and used to treat mild to moderate COVID-19, even if they are , prior to full FDA approval.

Recommended Reading: Who Can I Call About Medicare Questions

Skilled Nursing Facilities And Home Health Care

Under some circumstances, Medicare will cover some of the cost of inpatient treatment in a skilled nursing facility or visits from a home health care agency. Your stay in a skilled nursing home facility or home health care is covered by Medicare Part A only if you have spent three consecutive days, not counting the day of discharge, in the hospital. Your skilled nursing stay or home health care must begin within 30 days of being discharged. For more information, see our articles on Medicare coverage of skilled nursing facilities and Medicare coverage of home health care.

Do I Have To Pay For Medicare Part A

On the other hand, if you or your spouse did not work at least ten years in the United States paying Medicare tax, you will not be eligible for premium-free Part A. In this case, you could be responsible for up to $506 each month in Medicare Part A premiums.

If you did not work at least ten years paying Medicare tax, the premium you pay is based on the number of years you did work. If you worked more than 7.5 years but fewer than ten, your Medicare premium is $278 each month. Those with fewer than 7.5 years of contributing to Medicare taxes are responsible for the full Medicare Part A premium of $506 monthly.

Read Also: How To Compare Medicare Supplement Plans

What Constitutes One Spell Of Illness

A spell of illness, called a “benefit period,” refers to the time you are treated in a hospital or skilled nursing facility, or some combination of the two. The benefit period begins the day you enter the hospital or skilled nursing facility as an inpatient and continues until you have been out for 60 consecutive days. If you are in and out of the hospital or nursing facility several times but have not stayed out completely for 60 consecutive days, all your inpatient bills for that time will be figured as part of the same benefit period .

Can Medicare Supplement Insurance Help

Medicare Supplement Insurance, or Medigap, can help reduce the hospital expenses that Medicare Part A and Part B dont cover. Depending on the Medigap plan type, you can purchase a policy that covers the Part A deductible, Part A coinsurance and hospital costs, and the first three pints of blood for a transfusion.

Medigap plans are standardized, so you get the same Medicare benefits from any company offering the specific plan type. However, the premiums and available plan types can vary depending on your location, so its important to shop around to find the most affordable plan that best suits your health needs.

» MORE:Best Medicare Supplement Insurance companies in 2022

Recommended Reading: How Do I Find Out What My Medicare Number Is

What Is A Medicare Outpatient Observation Notice

If you receive observation services in a hospital for more than 24 hours, the hospital should provide you with a Medicare Outpatient Observation Notice .

This document lets you know that youre receiving observation services in the hospital as an outpatient, and that you havent been formally admitted as an inpatient. It should explain why youre receiving observation services rather than being treated as an inpatient.

The MOON should also detail how your outpatient status affects how much you will be expected to pay for your care.

Skilled Nursing Facility Care

Medicare covers up to 100 days of care in a skilled nursing facility for each benefit period if all of Medicares requirements are met, including your need of daily skilled nursing care with 3 days of prior hospitalization.

Medicare pays 100% of the first 20 days of a covered SNF stay. A copayment of $200 per day is required for days 21-100 if Medicare approves your stay.

Recommended Reading: Does Medicare Cover Oral Surgery Biopsy

What Medicare Doesnt Cover

While Medicare covers a wide range of care, not everything is covered. Most dental care, eye exams, hearing aids, acupuncture, and any cosmetic surgeries are not covered by original Medicare.

Medicare does not cover long-term care. If you think you or a loved one will need long-term care, consider a separate long-term care insurance policy.

How Much Does Medicare Part A Pay For Hospital Costs

En español | Medicare Part A covers inpatient stays in hospitals and skilled nursing facilities, some home care and end-of-life hospice care

After you pay the Part A deductible, Medicare pays the full cost of covered hospital services for the first 60 days of each benefit period when you are an inpatient, which means you are admitted to the hospital and are not there for observational care. Part A also pays a portion of the costs for longer hospital stays.

Read Also: Is Xarelto Covered By Medicare Part D

How Much Do Medicare Beneficiaries Pay For Covid

Under the Biden Administrationâs initiative for Medicare to cover the cost of up to 8 at-home COVID tests per month for Medicare beneficiaries with Part B, Medicare beneficiaries can get the tests at no cost through eligible pharmacies and other entities during the COVID-19 public health emergency. According to other actions announced by the Biden Administration in December 2021, beneficiaries can also access free at-home tests through neighborhood sites such as health centers and rural clinics and can request four free at-home tests through a federal government website.

Medicare beneficiaries who get a lab test for COVID-19 are not required to pay the Part B deductible or any coinsurance for this test, because clinical diagnostic laboratory tests are covered under traditional Medicare at no cost sharing. Beneficiaries will also not face cost sharing for the COVID-19 serology test, since it is considered to be a diagnostic laboratory test.

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

Recommended Reading: Will Medicare Pay For A Patient Lift