Do All Medicare Part D Plans Have A Donut Hole

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

What Is A Part D Deductible

The Medicare Part D deductible is the amount youre responsible for paying before your plan begins covering your prescription drugs. It is what you pay towards during your plans primary phase. While the maximum amount for 2023 is $505, your plans deductible may be less. Some plans charge the full deductible, while others charge a reduced deductible or have no deductible at all.

Stage 3 Medicare Part D Coverage Gap

This stage is where the Medicare âdonut holeâ occurs. A temporary limit on what Part D will cover for prescription drugs occurs for some, but not all such as members who get Extra Help to pay for their Part D costs. You pay no more than 25% of brand-name and generic prescription drug costs, even though the full cost of these medications will move you closer to the final stage, Catastrophic Coverage.

Also Check: Does Medicare Cover Home Care Aides

How Does The Medicare Donut Hole Work

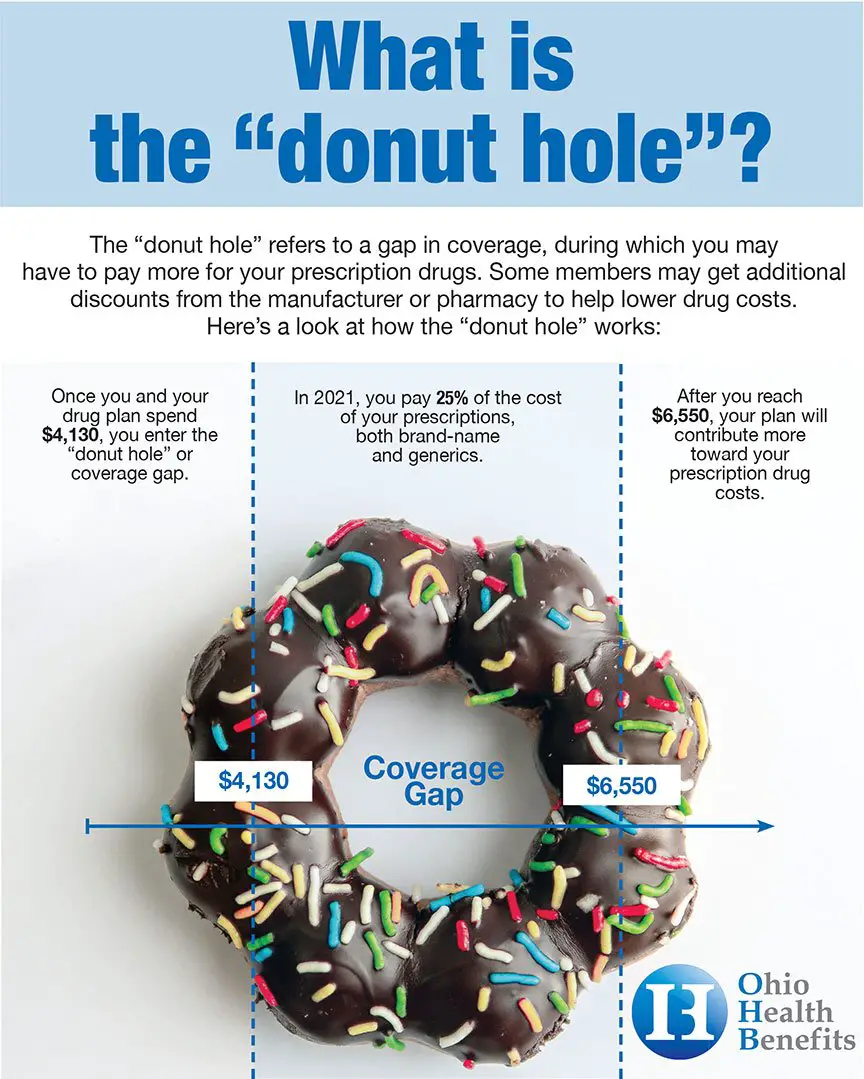

Once you spend a certain amount out of pocket on your prescriptions as a Medicare Part D beneficiary, you leave whats known as the initial coverage stage and enter the coverage gap stage, or donut hole. At this point, youre responsible for 25% of the cost of your drugs up to total annual expenditure of $7,050, says Amanda Reese, Medicare department manager at Hafetz and Associates in Linwood, New Jersey.

While the spending threshold that leads to the coverage gap varies from year to year, plans and their beneficiaries have to spend a total of $4,430 in 2022 to reach the donut hole.

Depending on the cost of your drugs, you can hit the donut hole stage in a single month or never, says Scott Maibor, managing director of Senior Benefits Boston, a Medicare advisory group in Massachusetts.

Compare Top Medicare Plans From Blue Cross Blue Shield, a Forbes Health 5-Star Rated Carrier

What Happens When Youre In The Donut Hole

When you reach the coverage gap what you pay will differ for the brand-name drugs and generic drugs covered by your Medicare plan.1

For brand-name drugs:

- Youll pay no more than 25% of the cost of the drug and 25% of the dispensing fee.

- Youll pay a discounted rate if you buy your medications at a pharmacy or through the mail.

- What you pay and what the drug manufacturer pays will count towards out-of-pocket spending that helps you eventually get out of the donut hole.

For generic drugs:

- Youll pay 25% of the price. Medicare pays 75% of the price.

- Only the amount you pay will count towards getting you out of the donut hole.

NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plans coverage has been applied to the drugs price.

Don’t Miss: What Part Of Medicare Covers Diabetic Supplies

What Is The Medicare Donut Hole Or Part D Coverage Gap

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Big changes are coming to Medicare Part D prescription drug coverage following the passage of the Inflation Reduction Act of 2022, which gives Medicare the power to negotiate for lower prescription drug prices. The act also includes caps on out-of-pocket spending, limits on increases in Medicare Part D premiums and drug prices, and more.

Certain changes will take effect in 2023, while others start as late as 2026.

» Read more:What the Inflation Reduction Act means for your Medicare coverage

If you have a Medicare Part D prescription drug plan, theres a gap in coverage after youve spent a certain amount on covered drugs the Medicare “donut hole.” While potential costs associated with the donut hole went down substantially in 2020, theres still a coverage gap that may affect what you pay for prescription drugs.

Heres what you should know about the Medicare Part D donut hole.

Medicare Part D Donut Hole

Home / Original Medicare / Medicare Parts / Part D / Medicare Part D Donut Hole

It is vital to understand how out-of-pocket costs are determined when you use your Medicare benefits. One example is the donut hole in Medicare Part D prescription drug plans. Below, we explain the donut hole phases, how to prepare for them, and everything else beneficiaries should know about the coverage gap.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: What Is Medicare Dual Complete

Donut Hole: Former Coverage Gap Payments

You will enter what was formerly known as the donut hole or the Part D coverage gap if you spend more than the required amount during the initial coverage period. Although this gap was formally filled in 2020, you are still liable for 25% of the price of your generic and name-brand medications throughout this time.

To avoid paying a late enrollment fee, you must sign up for Part D insurance within nine months of first being eligible or within five months of turning 65 .

The Part D Donut Hole What Is It

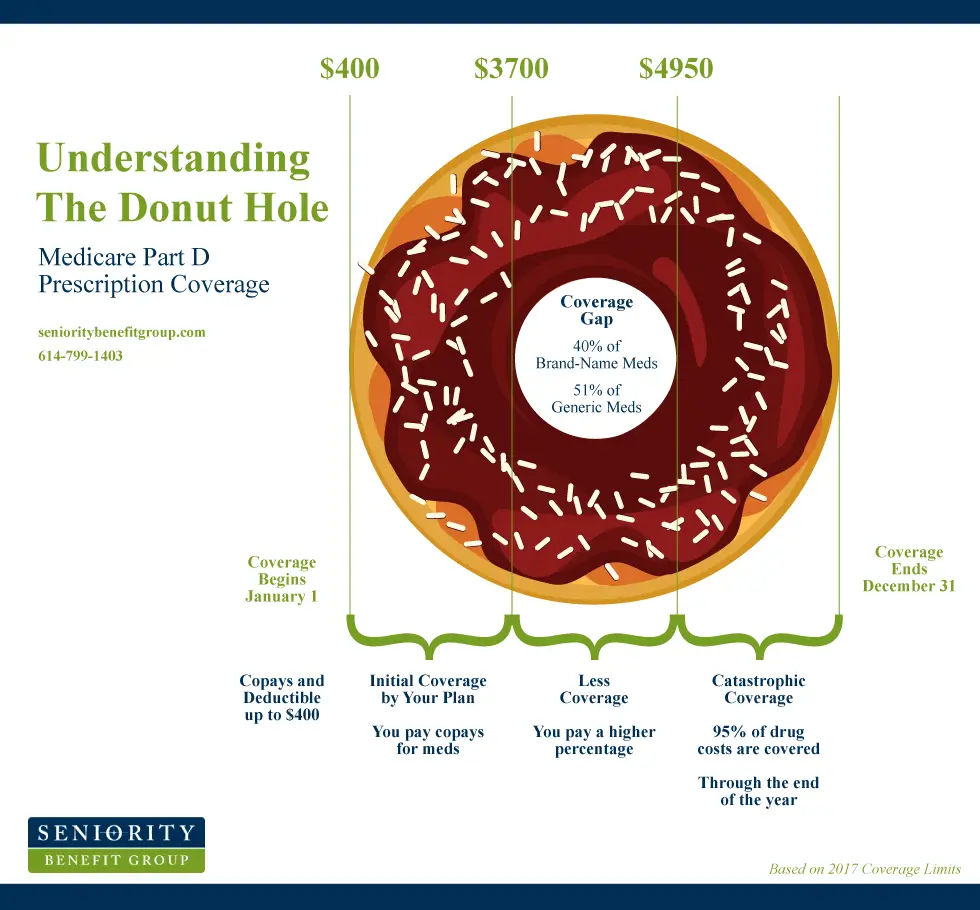

If Medicare Part D prescription drug coverage is new to you, or you havenât used many prescription drugs under your Part D coverage, you may wonder what the Medicare donut hole is. Put simply, the Medicare donut hole refers to the third of four progressive payment stages in Medicare Part D prescription drug coverage. These four payment stages are:

You may have had Medicare Part D coverage for many years and never experienced some of these stages and their related out-of-pocket expenses. For example, you may select a Medicare plan with prescription drug coverage that doesnât have a deductible. In that case, you skip the deductible stage and go immediately to the initial coverage stage. Or you may take generic prescription drugs. If so, the cost you and your Medicare Part D plan pay for your medications may never reach amounts that put you in the Medicare donut hole or catastrophic coverage stages.

But if you do have high prescription drug costs, you could still enter the âcoverage gapâ phase once you and the Medicare Part D plan have spent a certain amount .

Youâll pay no more than 25% of the cost of your covered medications during this phase.

Then, if your spending on covered medications reaches $7,400 , youâll enter the catastrophic coverage stage. Your Medicare prescription drug plan will pay most of the cost of your covered medications for the balance of the year.

Also Check: What Does Medicare A And B Not Cover

Phase : Catastrophic Coverage

When youve reached the out-of-pocket limit, catastrophic coverage kicks in and you pay new copays or coinsurance amounts, which are generally lower than you paid before.

-

When it starts: After your qualifying out-of-pocket costs for covered prescription drugs have reached $7,050 in 2022 .

-

What you pay: 5% of the cost of your covered prescription drugs, with a minimum of $3.95 for generic drugs or $9.85 for brand-name drugs in 2022 .

-

When it ends: The end of the year.

Note: If you’re part of a Medicare program called Extra Help, your drug costs will be different, and there’s no coverage gap.

How Does The Donut Hole Work In Medicare

The donut hole in Medicare is a coverage gap that occurs when you and your drug plan reach a certain spending threshold. To get out of the donut hole, your out-of-pocket costs must exceed a specific dollar amount. Costs that can be applied toward closing the donut hole include deductibles, co-insurance, co-payments, discounts for brand-name drugs, and amounts you pay while youre in the gap.

Also Check: Is Stem Cell Treatment Covered By Medicare

Impact On Medicare Beneficiaries

| This section needs to be . The reason given is: it does not reflect benefit changes following passage of the Patient Protection and Affordable Care Act of 2010. Please help update this article to reflect recent events or newly available information. |

The U.S. Department of Health and Human Services estimates that more than a quarter of Part D participants stop following their prescribed regimen of drugs when they hit the doughnut hole.

Every Part D plan sponsor must offer at least one basic Part D plan. They may also offer enhanced plans that provide additional benefits. For 2008, the percentage of stand-alone Part D plans to offer some form of coverage within the doughnut hole rose to 29 percent, up from 15 percent in 2006. The percentage of Medicare Advantage/Part D plans plans offering some form of coverage in the coverage gap is 51 percent, up from 28 percent in 2006. The most common forms of gap coverage cover generic drugs only.

Among Medicare Part D enrollees in 2007 who were not eligible for the low-income subsidies, 26 percent had spending high enough to reach the coverage gap. Fifteen percent of those reaching the coverage gap had spending high enough to reach the catastrophic coverage level. Enrollees reaching the coverage gap stayed in the gap for just over four months on average.

| 25% | 25% |

As of January 1, 2020, the coverage gap has closed.

Will There Be A Medicare Donut Hole In 2022

In 2022, youll enter the donut hole when your spending + your plans spending reaches $4,430. And you leave the donut hole and enter the catastrophic coverage level when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Don’t Miss: Who Pays For Assisted Living Facilities Does Medicare

When Does The Donut Hole End

The donut hole, or coverage gap, begins when you spend enough on prescription drugs to reach the Part D coverage maximum. It ends when you reach your Part D out-of-pocket maximum. Once the donut hole ends, catastrophic coverage automatically begins. During this period, you pay a smaller amount for your coverage until the end of your plan year. After this, everything resets, and the cycle begins again with a new deductible.

What You Should Know About Medicare Part D Plans And The Notorious Donut Hole

The Medicare donut hole is the gap in prescription drug benefits that occurs when Medicare Part D policyholders reach their yearly maximum coverage amount but still have not reached the point where the catastrophic part of their coverage kicks in. Not everyone will experience this expensive lapse in coverage, but understanding how Medicare covers prescription drugs is crucial for choosing the right plan and minimizing out-of-pocket costs.

Also Check: Is Aetna Medicare Good Insurance

What Are The Rules About The Medicare Donut Hole For 2022

Originally, being in the donut hole meant that you had to pay OOP until you reached the threshold for more drug coverage. However, since the introduction of the Affordable Care Act, the donut hole has been closing.

There are several changes for 2022 aimed to limit your out-of-pocket costs in the coverage gap. These include:

- You will pay no more than 25 percent of the price for brand-name drugs.

- The nearly full price of the drug will count toward getting you out of the coverage gap.

- You are responsible for a dispensing fee for your medicine. Your plan pays 75 percent while you pay 25 percent.

- The fees that dont count toward your OOP spending include the 5 percent your plan pays plus the 75 percent toward the dispensing fee your plan pays.

Some plans offer even deeper discounts when youre in the coverage gap. Its important to carefully read your plan to see if this is true for you.

Lets see how this works in some examples below.

How Long Does The Donut Hole Last In Medicare

According to the Centers for Medicare and Medicaid Services, â In 2021, Medicare Part D provides affordable prescription drug coverage to over 48.8 million Americans. The Affordable Care Act eliminated the Coverage Gap in the original Part D benefit, reducing patient cost-sharing responsibility for covered medications from 100% to 25%â.

You May Like: When Do I Enroll In Medicare Part D

How Does Medicare Part D Work

Whether your prescription drug coverage is through an MA-PD or a standalone Part D plan, there are four coverage phases:

If you qualify for Extra Help, you will never enter the coverage gap phase.

Whats The Donut Hole In Medicare

So what exactly is the Medicare donut hole?

donut hole used to be a much more noticeable feature of Part D plans before 2010, says , an assistant professor of Health Policy at Stanford School of Medicine and a Faculty Fellow at Stanford Institute for Economic Policy Research. The idea was that once you reached a pre-specified amount of spending on your prescription drugs, you had to pay for 100% of your prescriptions until you reached another pre-specified amount. Today, the donut hole starts much later. You have to spend $4,430 in total on drugs in 2022 to get to the donut hole. And if you get there, you pay 25%, not 100%, for your prescriptions.

You may be wondering why Medicare would have a donut hole at all. While the coverage gap has closed in past years thanks to the Affordable Care Act , it was intended as a way to keep the cost of the program down when first passed by Congress. Here is a breakdown of what you can expect in 2022 and what prices have been in previous years.

Also Check: Does Medicare Cover Dry Needling

Is The Medicare Donut Hole Closed

It depends what you mean by closed. Theres still a coverage gap, but its less costly than it used to be.

When Medicare Part D was created, the coverage gap was just like the deductible phase: You were responsible for 100% of drug costs until your out-of-pocket costs hit the catastrophic coverage threshold.

The Affordable Care Act, or ACA, reduced Medicare beneficiaries cost-sharing requirements in the coverage gap starting in 2011

What Costs Count Toward The Catastrophic Coverage Threshold

You enter catastrophic coverage when your out-of-pocket costs for covered drugs hit $7,050 in 2022 . Figuring out when youll hit that threshold can be a little complicated, though what counts as out-of-pocket spending most likely isnt equal to what you actually spend.

The good news: Your Medicare Part D statements should show you what phase you’re in, a running total of your drug costs and what it will take to move into the next phase

What counts toward your out-of-pocket total:

-

Your annual deductible, coinsurance and copayments.

-

95% of the cost of covered drugs you get during the coverage gap , except for dispensing fees.

-

25% of the cost of pharmacy dispensing fees for covered drugs you get in the coverage gap .

What doesnt count toward your total:

-

Part D drug plan monthly premiums.

-

The portion of the costs and pharmacy dispensing fees that your Part D insurance company pays for when youre in the coverage gap.

-

Anything you pay for drugs that arent covered by your plan, including the cost of covered drugs from pharmacies that arent in your plans network.

Read Also: Is Medicare Plan F Still Available

When Does The Medicare Donut Hole End

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2023, the donut hole will end when you and your plan reach $7,400 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole. So, your out-of-pocket will be somewhat less than that.

So how do you get out of the donut hole? Unfortunately, its by paying for medications through the donut hole until you reach catastrophic coverage level.

Understanding The Medicare Donut Hole

The Medicare Part D donut hole, also known as the coverage gap, is a stage in Part D prescription drug coverage that may temporarily limit what your Medicare prescription drug plan will cover. Not everyone will enter the Medicare coverage gap. During this stage of coverage, you may start paying more for covered prescription drugs than what you paid earlier in the year. The dollar amount when you enter the donut hole stage may change each year. The coverage gap begins once you and your plan have spent $4,430 on covered medications in 2022, varying from year to year.

If your Medicare Part D health plan requires a deductible to be met, you must pay the entirety of the cost of your medication until your deductible has been met . After your deductible has been met, your Initial Coverage stage begins.

Changes in the dollar threshold for the Medicare Part D donut hole, as well as the cost-sharing amount you pay during this coverage stage, result from the Affordable Care Act . The Medicare donut hole officially closed in the year 2020. You might still reach this threshold, also called the initial coverage limit, but you wonât pay more than 25% of the cost for any covered prescription drugs.

Read Also: How Much Is Part B Deductible For Medicare