Order Your Medications By Mail And In Advance

Many Medicare Part D prescription drug plans offer medications at a discount if you order a three-month supply by mail instead of picking up a 30-day supply at the pharmacy. Sometimes, a local pharmacy can even offer a 90-day supply of your prescription at the same price as the mail-order plan. Its worth looking into the different options and comparing the per-pill cost of the bulk options. Some drugs cant be prescribed in larger supplies, but for those that can, you may find valuable cost savings.

Shop Around For A New Prescription Drug Plan

Every fall, your plan will send you an Annual Notice of Coverage. Take a look at it and see if your plan has changed your prescription drug coverage or costs.

Even if your plan coverage hasnt changed, you might want to compare Medicare prescription drug plans in your area. You might be surprised to find a plan with better coverage for your needs. An eHealth study found that the vast majority of people with Medicare prescription drug plans could save money by switching to a different plan. Among those surveyed:

- Only about 9% of people with Medicare Advantage prescription drug plans were enrolled in the plan that could save them the most money an average savings of $1,144 per year.

- Only about 8% of people with stand-alone Medicare Part D prescription drug plans were enrolled in the plan that could save them the most money an average savings of $798 per year.

How My Mom Prepares For The Medicare Part D Donut Hole

A few years ago my mom developed a health problem and started taking regular medicine every day. The medicine wasnt cheap, so she hit the Medicare donut hole for the first time. Heres how she plans for the donut hole:

1. My mom is retired and on a fixed income. We figure out the cost of her medicine and keep track of the Part D stages. This helps know how much it will cost in the coverage gap. She sets aside money throughout the year for the cost of her medicines so shes ready if she hits the donut hole.

2. She pays close attention to the Explanation of Benefits document she gets each month from her Medicare plan. It tells how much more money you have to spend before you hit the donut hole and, later, how much you have left to spend before you get out of it.

3. She takes steps to lower her medicine costs. She switched to getting her regular prescription through the mail, in larger quantities. When she sees her doctor each year, she asks about each of her medicines to see if she still needs to take them, if there are cheaper options, or if she can take them less often.

Recommended Reading: How Can I Enroll In Medicare Part D

How Do You Get Out Of The Donut Hole

In 2022, you leave the Medicare Part D coverage gap once you have paid $7,050 in out-of-pocket costs for covered drugs. At this point, you enter what is known as catastrophic coverage, where you only pay a small copayment or coinsurance for medications.

This only applies to direct costs to you, not the amount your plan has paid. So, if you are in the coverage gap and paying $1,500 a month for your prescriptions, you would exit the donut hole after five months.

Once youre in the catastrophic coverage stage, you remain there for the remainder of the year.

Avoiding The Donut Hole

Four ways to avoid or delay entering the donut hole:

You May Like: Is It Mandatory To Have Medicare Part D

Need More Help Check Out These Resources:

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions.

Visit medicare.gov or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Our monthly Medicare newsletter delivers helpful tips straight to your inbox.

Connect with experts

Seven Tips To Avoid The Medicare Donut Hole

Getting the best prices on medicines is always good and it may be extra helpful for people on Medicare Part D who hit the donut hole. Some people find that with savvy shopping skills, they can lower their prescription costs enough that they dont hit the donut hole at all.

These seven tips can help you save time, money and frustration when trying to understand Medicare prescription drug costs.

Read Also: What Is Medicare Id Number

Why The Donut Hole Is Dreaded

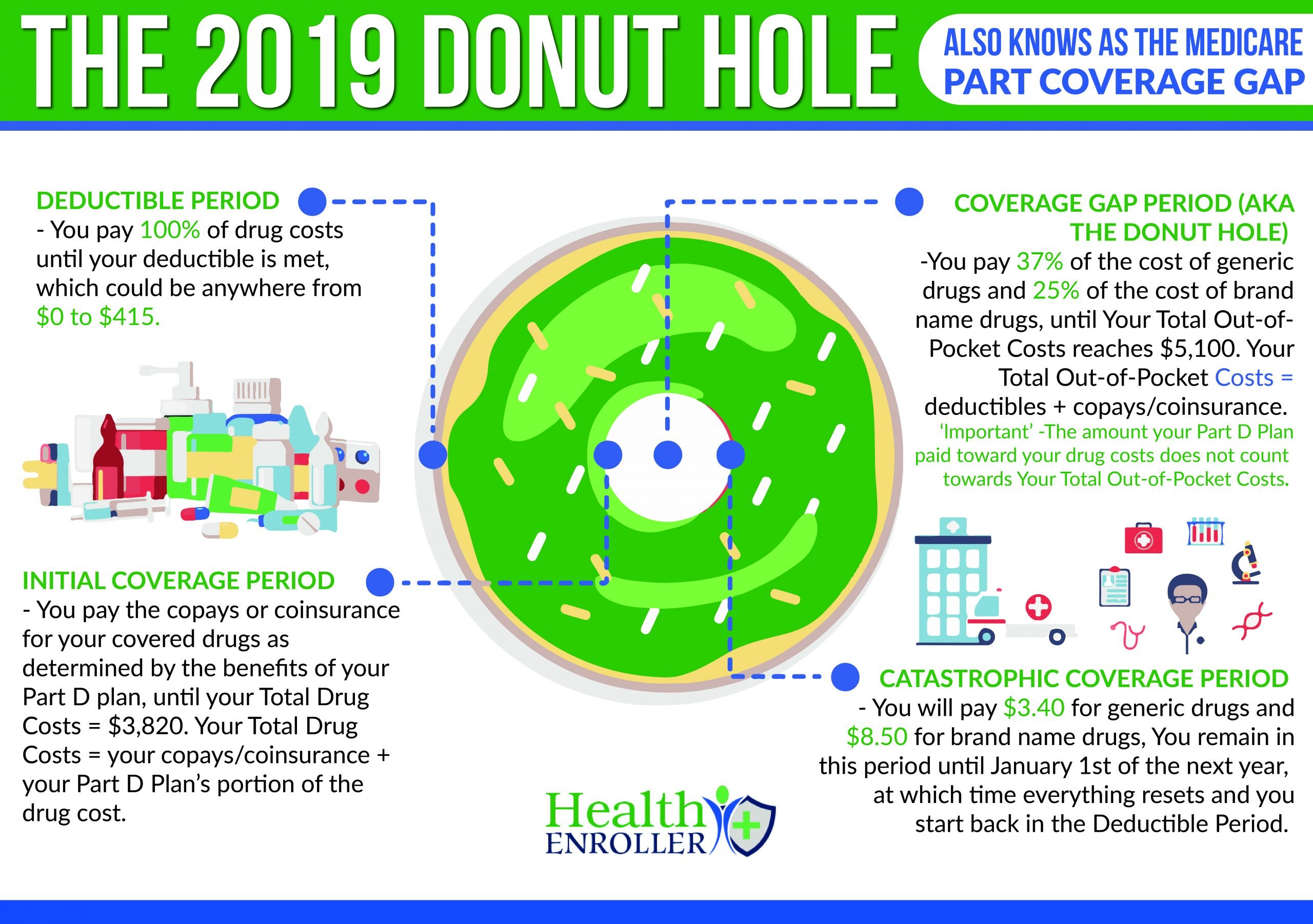

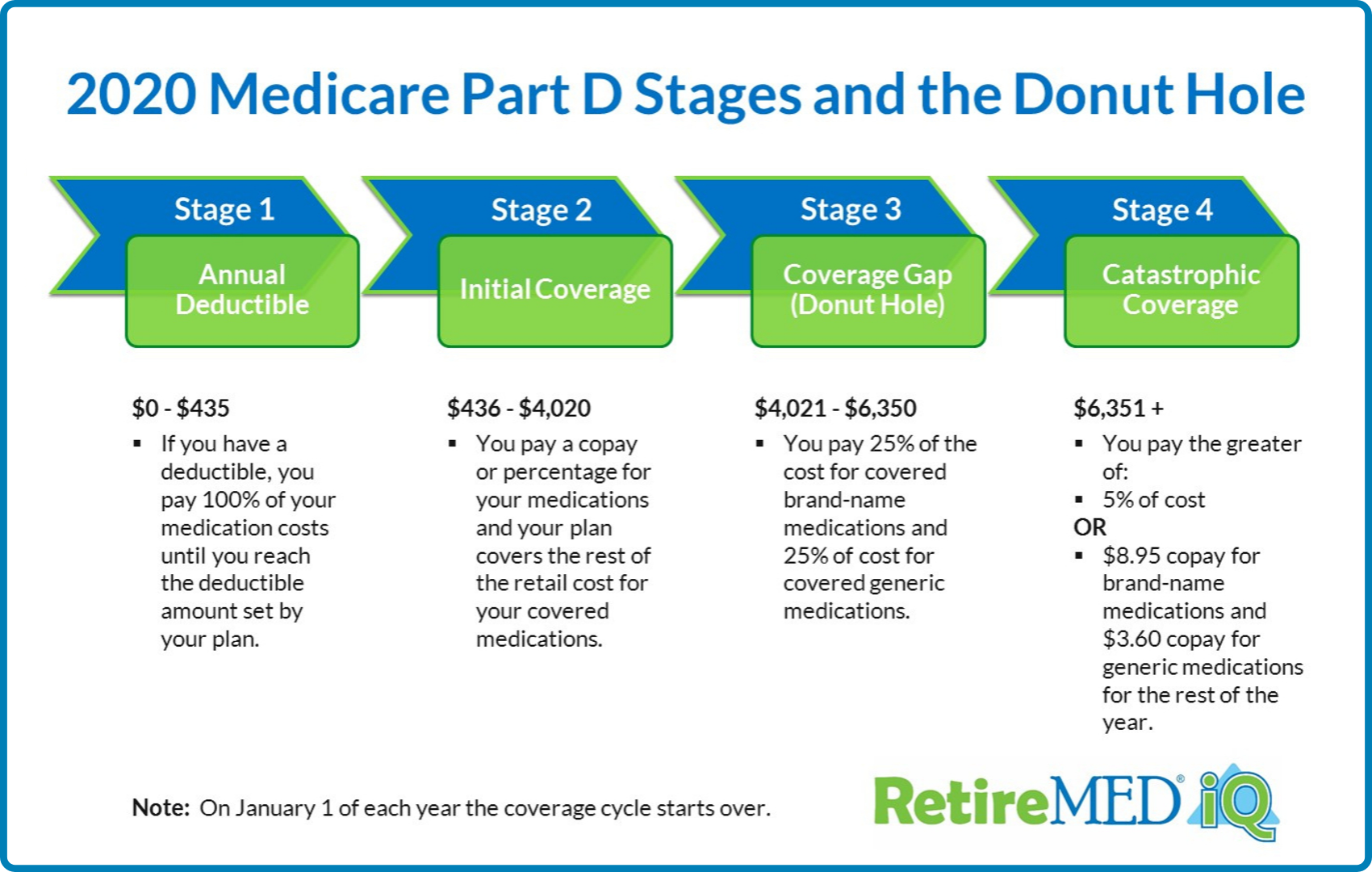

The chief reason Medicare recipients dread entering the donut hole is reflective of the change in their cost of drugs during this stage. Once in the donut hole, standard copays and coinsurance are no longer relative and Medicare beneficiaries become responsible for 25% of the retail cost of both generic and brand-name drugs. In many cases, this 25% is an increase from the costs paid while in Stage 2 initial coverage.

Example: Jim takes one $100 generic drug and pays a $10 copay while in Stage 2. He takes one brand-named drug that costs $350 and pays a copay of $45 while in Stage 2.

Once Jim enters the Stage 3 donut hole, he will pay 25% of the cost of both drugs. He will pay $25 for his $100 generic drug, up from his $10 copay, and $87.50 for his $350 brand-named drug, up from the $45 copay during Stage 2. Jims out-of-pocket drug cost will go from $55 in Stage 2 to $112 in Stage 3. Thats just for two average-cost medications.

The 2021 Doughnut Hole For Medicare Part D Explained

- 0

- 0

Most plans with Medicare prescription drug coverage have a coverage gap referred to as a “donut hole. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for your prescriptions up to a yearly limit. Once you have spent up to the yearly limit, your coverage gap ends, and your drug plan helps pay for covered drugs again.

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 . At that point, youre in the doughnut hole, where youll now receive a 75% discount on both brand-name and generic drugs. Prescription drug manufacturers pick up 70% of that tab and insurers 5%.

You pay the remaining 25%. Catastrophic coverage, with the government picking up most costs, begins when a patient’s out-of-pocket costs reach $6,550, the maximum spending limit for beneficiaries in 2021, which is $200 higher than 2020s cap. Any deductible paid before you entered the doughnut hole counts toward that annual maximum as does the 25% you contributed while in the doughnut hole and the 70% that pharmaceutical companies paid on your behalf.

Also Check: When Do I Apply For Medicare Benefits

What Are The Medicare Donut Hole Rules For 2022

Previously, being in the donut hole indicated you need to pay out-of-pocket costs until you reached the threshold value for more drug coverage. Nevertheless, the donut hole has been closing due to the introduction of the Affordable Care Act.

Several changes are planned for 2022 to reduce your out-of-pocket costs during the coverage gap. It includes:

- You will spend no more than 25% of the cost of brand-name medications.

- The nearly total price of the medicine will count toward closing the coverage gap.

- You must pay a dispensing fee for your medication. Your plan will cover 75% of the cost, while you will cover the remaining 25%.

- Fees that do not count toward your OOP funding include 5 percent that your coverage pays and 75 percent that your plan spends toward the dispensing fee.

Some programs even offer significant discounts when youre in the coverage gap phase. Its critical to carefully read your plan to see if this applies to you.

Lets look at the examples to see how this works.

How Does The Medicare Donut Hole Work And When Does It End

So when exactly does the donut hole begin and end for 2022? The short answer is, that varies depending on the Part D plan you choose and how much you spend on prescription medications. Some people pay less for their medications when they enter the donut hole while others pay more.

Here are more facts about the Medicare donut hole.

Also Check: Can A 60 Year Old Get Medicare

Phase : The Deductible

Some prescription drug plans have an annual deductible. You will need to meet this deductible before your insurance coverage begins. However, most insurance plans do not apply the deductible to tier one medications, which typically includes the more common, generic prescriptions. In 2021, all deductibles were limited to a maximum of $445.

Ask Your Insurance Company If You Can Get Better Prices

Did you know you may be able to get better prices on prescriptions at a different pharmacy, by mail or by getting a different quantity ? Your Medicare plan service team can help you find the best option.

If you need short-term medicine, like a weeks worth of antibiotics for a sinus infection, call your insurance company to ask for the least expensive place to get them, instead of just going to the closest drugstore.

If youre at the pharmacy checkout and your prescription costs more than you think it should, stop and dont pay for it. You cant return prescriptions, even if theres a mistake. Call your health insurance company and ask about the cost to make sure its right before you finish checking out.

You May Like: Does Medicare Pay For Prostate Cancer Treatment

Ask For Drug Manufacturers Discounts

Some pharmaceutical companies offer their products at a discount directly to consumers or through doctors offices. This is more common for brand-name and specialty drugs, which can be expensive. Ask your doctor or health-care provider when you get the prescription if any discounts are available or if there is a pharmaceutical assistance program. You can also search online as the drug manufacturers website may have more information.

Is There Any Insurance That Covers The Donut Hole

There is no insurance that provides coverage exclusively for the Part D donut hole.

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help .

Also Check: What Does Medicare Part A And B Not Cover

Can I Avoid The Medicare Donut Hole

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,430 in 2022. Once you hit that amount, you enter the Medicare coverage gap.

With that said, there are several ways to manage out-of-pocket costs to try and avoid the coverage gap. One way is to switch from a brand name drug to a generic drug or from a brand name to a less expensive brand name drug, if possible. Ask your physician whether this is possible based on your specific medical condition and health history.

Another option is to use mail-order pharmacies or take advantage of Pharmaceutical Assistance Programs provided by your state or .

One caveat is that people with specific income and resource limits may qualify for the Extra Help program, in which case they would not enter the donut hole.

The Catastrophic Coverage Phase

You enter the catastrophic coverage phase once your total out-of-pocket spending reaches $7,050 in 2022. This includes money you paid for covered prescriptions during the deductible phase. In addition, the manufacturer discount on brand-name prescription drugs counts toward your total out-of-pocket for Part D coverage .

The monthly premium for your Part D or Medicare Advantage Prescription Drug plan does not count toward this total cost. Neither does the cost of over-the-counter medications.

Once you reach the catastrophic coverage phase, your Part D copayments for the rest of the year are only 5 percent of covered drug expenses. Your plan pays 15 percent and the government pays the remaining 80 percent of prescription drug costs.

Recommended Reading: Where Can I Get Medicare Information

Who Is Affected By The Donut Hole

The federal government sets coverage phases for Medicare Part D consumers for how their drugs will be paid for throughout the year.

In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430. At this point, you will pay a percentage of medication costs while youre in the Medicare donut hole.

The donut hole wont affect all Medicare beneficiaries. If you have Original Medicare only and dont have a Medicare prescription drug plan , the donut hole wont affect you. If you do have a Medicare prescription drug plan but total drug costs dont reach $4,430 on covered medications, you wont be affected by the donut hole. Also, if you qualify for Extra Help, the donut hole wont affect you.

If you find yourself in the Medicare donut hole and want out, youll need to hit your out-of-pocket threshold. Once you meet this cost, which is $7,050 in 2022, you will only have to pay 5% of your prescription drug costs or $3.70 for generic drugs and $9.20 for brand-name drugswhichever is greater. There are specific costs that are counted toward meeting this threshold that gets you out of the Medicare coverage gap.

How To Get Out Of The Donut Hole

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements. These include:

- Extra Help:Extra Help is a Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple. They must also have less than $14,390 as a single person or $28,720 as a married couple in resources. Resources include savings, stocks, or bonds.

- Medicaid: Medicaid is a federal program that helps low income individuals pay for healthcare. People who qualify for Medicaid are automatically enrolled in the program.

- State Health Insurance Assistance Program : These state-specific programs can provide additional assistance for people in funding healthcare costs, including medications.

Many pharmaceutical manufacturers also offer prescription assistance programs that can reduce costs. A doctor or pharmacist can often make suggestions for contacting the drug company.

Don’t Miss: How To Apply For Medicare In San Diego

Costs That Count Toward Getting Out Of The Coverage Gap Include:

- Your plans deductible.

- Copayments and coinsurance for your prescription drugs.

- Manufacturer discounts you may get from brand-name drugs during the donut hole period. To illustrate, if you have a manufacturer coupon for $50 off, this $50 will still be applied to your total paid costs.

- Whoever else who has paid on your behalf.

- Funds paid by state pharmaceutical assistance programs.

Stage 4 Catastrophic Coverage

Once you have reached the coverage gap limit $5,000 in 2018 your catastrophic coverage automatically begins. Your plan will begin to contribute more, and you will only pay a small coinsurance or copayment amount for covered drugs for the rest of the year. These costs will depend on whether you are using generic or brand name drugs, but some plans pay as much as 95% of the costs during the catastrophic coverage stage. Check with your health insurance provider to learn the details of your plans catastrophic coverage.

Get an online quote for Medicare plans that fit your health care needs today! Or call 815-3313 TTY 711 to get answers and guidance from an experienced licensed sales agent.

Related Information:

You May Like: What Is The Medicare G Plan

Leaving The Part D Donut Hole

In order to leave the donut hole, your total out-of-pocket costs much reach $6,550. If you hit this number, then you enter the catastrophic payment stage. Your plan pays most of the cost for your drugs in the catastrophic stage. You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year.

Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits. Other amounts that contribute to reaching the limits include:

- What your plan pays for your drugs in the initial coverage stage

- Discounts provided by drug manufacturers in the coverage gap stage

- Amounts paid by others on your behalf, such as financial assistance programs, in any payment stage

Costs In The Coverage Gap

Most Medicare drug plans have a coverage gap . This means there’s a temporary limit on what the drug plan will cover for drugs.

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022 , you’re in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs wont enter the coverage gap.

Don’t Miss: Does Medicare Cover In Home Help