B Deductibles Copayments And Coinsurance

Part B also comes with a $233 annual deductible in 2022. Part B will not cover anything until you pay that amount each year that you use the coverage.

In addition to the annual deductible, you must pay for a portion of the services covered by Part B. Usually, you must pay 20% of the Medicare-approved amount for a service. Part B covers the other 80%.

So if your doctor charges Medicare $100 for a service covered by Part B, you could have to pay $20. Part B will pay for the remaining $80.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Ial Medicare Part B Premium Reimbursement

Service retirement and disability benefit recipients who are enrolled in an STRS Ohio medical plan and provide proof of Medicare Part B enrollment may receive partial reimbursement to offset the standard monthly premium charged by Medicare for Part B coverage.

Partial reimbursement of the benefit recipientâs future standard Medicare Part B premium cost will begin after STRS Ohio receives proof of Medicare Part B enrollment. If STRS Ohio receives proof by the 15th of the month, partial reimbursement will begin the first of the following month. If verification is received after the 15th of the month, partial premium reimbursement will begin the first day of the second following month. Partial reimbursement is not applied retroactively based on your Medicare effective date. You will receive reimbursement for future monthly premiums only after you submit proof of Medicare Part B coverage.

If you are eligible to receive a Medicare Part B premium reimbursement through more than one Ohio public retirement system, specific guidelines apply. Its your responsibility to contact STRS Ohio to determine which system is responsible for providing your reimbursement you may not receive more than one Part B premium reimbursement. Please call STRS Ohio for Medicare Part B premium reimbursement guidelines.

Also Check: Which One Is Better Medicare Or Medicaid

Recommended Reading: Does Medicare Cover Massage Therapy

Im A Retiree Under Age 65 Since Im Not Yet Eligible For Medicare Im Enrolled In A Uc Non

If youre a retiree and covered by a UC medical plan, UC will send you a Medicare information packet with enrollment instructions three months before your 65th birthday. The same is true for anyone you cover who is about to turn 65. In general, Medicare and UC require enrollment at age 65. You need to enroll in Medicare Part A and B. Medicare Part D enrollment will be handled by your plan, except for the plan without prescription drug coverage.

What Does Medicare D Pay For

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans to supplement traditional Medicare and Medicare Advantage prescription drug plans …

You May Like: How Much Does Medicare Part D Cost A Month

What Are Other Differences Between Ucs Medicare Plans And How Do I Choose Whats Best For Me

Kaiser Permanente Senior Advantage is a Medicare Advantage Health Maintenance Organization plan with a closed network of providers. This is a good fit if you want lower out-of-pocket costs, like having one doctor manage your care, and if you are comfortable with out-of-network coverage only in emergencies.

UC Medicare Choice is a Medicare Advantage Preferred Provider Organization plan that offers access to any provider, in-network or out-of-network, at the same cost to you . Because this is a Medicare Advantage plan, your physician may need prior authorization from UnitedHealthcare for some services. This is a good fit for those who want lower premium and out-of-pocket costs and want the flexibility to see providers both in and out-of-network for the same out-of-pocket costs.

UC High Option Supplement to Medicare , is a Medicare Supplement PPO plan. It usually has the highest premium of UC’s plans, because it covers 100% of the cost for Medicare-covered services .

UC Medicare PPO is also a Medicare Supplement PPO plan. Its a best fit if you want direct access to Medicare providers without need for referrals and you are willing to pay variable costs per service .

UC Medicare PPO without Prescription Drugs is offered to those who have Medicare-coordinated health insurance that covers prescription drugs through a non-UC plan . It is similar to the UC Medicare PPO, except your Part D coverage comes from another plan. You must provide proof of your Part D coverage to enroll.

Frequently Asked Questions About Medicare

Were answering frequently asked questions about Medicare in case youve forgotten some of the details since you enrolled, or youre under 65 and still learning about Medicare and how it works with UC-sponsored plans. You can learn more about Medicare at medicare.gov. Keep this background in mind when you consider your health plan choices during Open Enrollment in the fall. Even if youre happy with your current plan, its always a good idea to understand all of your options.

Don’t Miss: Does Aetna Follow Medicare Guidelines

Why Should I Choose A Uc Medicare Plan Instead Of One Of The Other Medicare Plans I See Advertised

You may already be receiving ads for commercial health plans and you can probably just recycle them. If youre eligible for UC retiree health benefits, a UC Medicare plan is likely to be your best option.

Because UC values its retirees and their service, it is projected to contribute over $300 million to health plans for retirees and their family members in 2021. UC has also negotiated with insurance companies on your behalf to ensure these plans offer as much protection as possible, with an upper limit on your out-of-pocket costs and help with appeals if you need it.

Medicare Part D for prescription drugs is folded into your UC Medicare plan . If you enroll in these commercial Medicare health and/or Medicare Part D prescription plans, your UC Medicare plan will be terminated automatically.

Why Would I Opt Out Of Medicare

Part B comes with a premium in most cases. Some people delay enrollment in Medicare Part B to avoid paying the premium â especially if they have other coverage. The same can be true of Part A, for people that must pay a premium for it.

If you delay enrollment in Part B or Part A, make sure you plan it well to avoid problems. For example:

- Group health plans may have different coverage rules if youâre eligible for Medicare coverage. Check with your plan and ask how it would work with and without Medicare.

- You might face a late enrollment penalty if you delay Part B and/or Part A coverage. To avoid a penalty, make sure you enroll in Medicare promptly when your employment ends, or when the group health coverage ends. After the month coverage or employment ends , you might have an 8-month Special Enrollment Period to enroll in Medicare without a penalty. Ask your benefits administrator, or contact Medicare.

Don’t Miss: Is The Watchman Device Covered By Medicare

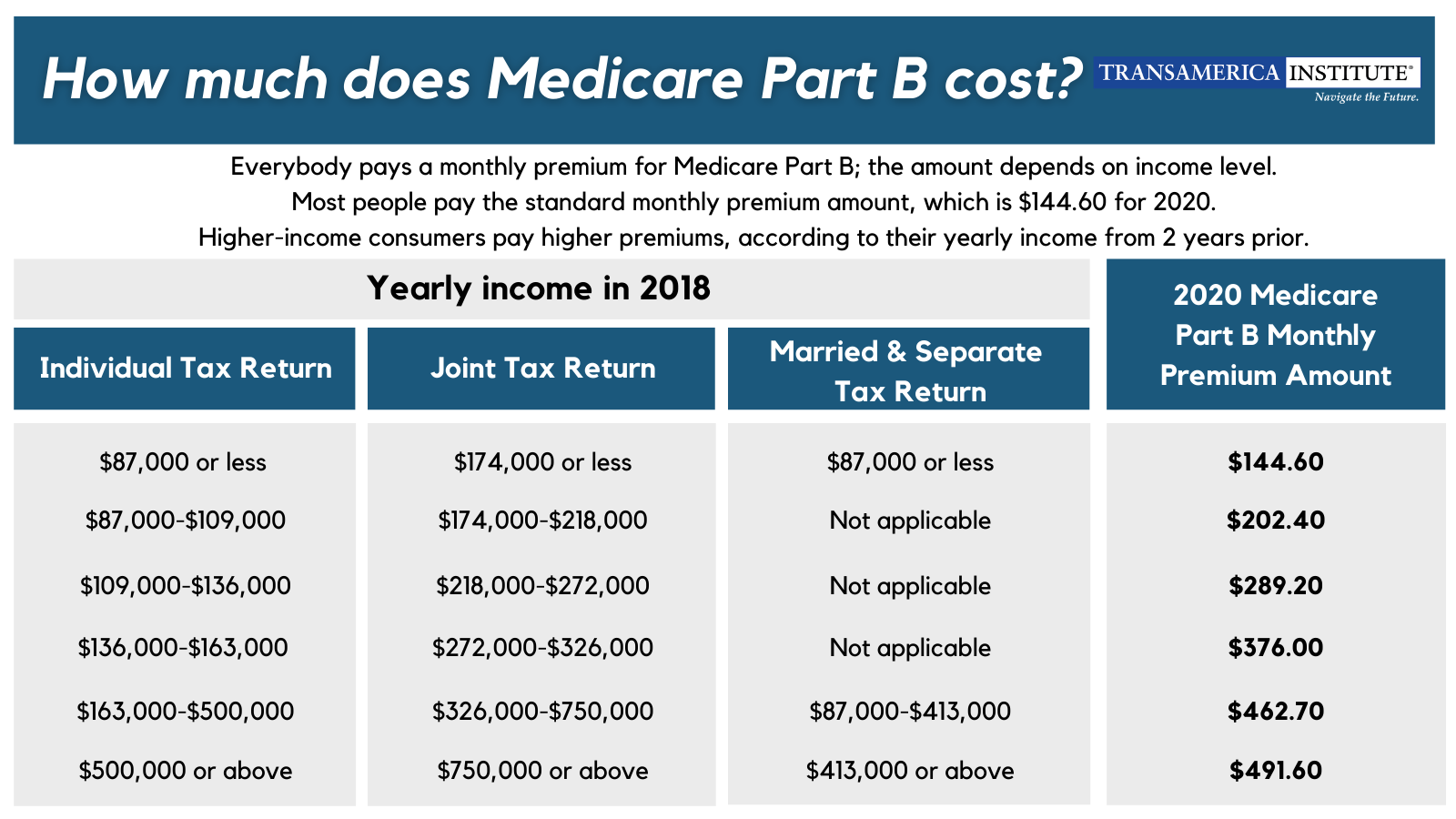

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2022 is $170.10.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2022, your income amount is calculated from your 2020 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

Transitioning To A Medicare Health Plan

When you retire, become Medicare eligible, and enroll in Medicare Part A and Part B, you’ll have the option to choose a new Medicare health plan. If you do not choose one, CalPERS will enroll you in a CalPERS Medicare health plan.

| If… | |

|---|---|

| Your current health carrier offers a CalPERS-sponsored Medicare health plan | CalPERS will enroll you in your current health carrier’s Medicare health plan |

| Your current health carrier does not offer a CalPERS-sponsored Medicare health plan | CalPERS will enroll you in the UnitedHealthcare Group Medicare Advantage PPO Plan. |

Recommended Reading: How To Find A Medicare Number For A Patient

The Medicare Part B Premium

Most seniors pay a standard monthly premium for Medicare Part B. In 2022, that standard premium is $170.10 per month. It can be higher depending on your income.

However, that cost might be lower for many people who are receiving Social Security benefits. Part B premiums can be automatically deducted from your Social Security benefit payment. If your Part B premiums are deducted from your Social Security benefit payments, the premium amount may be lower.

Deadlines For Enrolling In Medicare Part B

Here are some important dates to keep in mind for enrolling in Part B:

- Your 65th birthday. The initial enrollment period is a 7-month time span. It includes the month of your 65th birthday and the 3 months before and after. You can enroll in parts A and B at any point during this time.

- This is general enrollment. If you didnt enroll in Part B during Initial Enrollment, you can do so at this time. You may need to pay a late enrollment penalty.

- If you chose to enroll in Part B during general enrollment, you may add a Part D plan during this period.

- This is the open enrollment period. If you want to switch from original Medicare to a Part C plan, you can do so. You may also switch, add, or remove a Part D plan.

- Special enrollment. You may have employer-provided coverage in a group health plan. If so, you can sign up for parts A and B at any time during plan coverage or in the 8-month special enrollment period after leaving employment or the group health plan.

Recommended Reading: Will Medicare Pay For A Patient Lift

My Spouse And I Are Thinking Of Moving Out Of California Can We Keep Our Uc Plan

Theres a lot to think about if youre considering a move including what it might mean for your health insurance coverage. Its a good idea to talk to someone before you move.

If you and everyone you cover with UC insurance are in Medicare and you move to another U.S. state, youll transition to the Medicare Coordinator Program, administered by Via Benefits. You wont have the option to stay in your UC Medicare plan. Through the Medicare Coordinator Program, licensed Via Benefits advisors work with eligible UC retirees to find the Medicare medical and prescription drug plans available where they live that work best for them. These plans are not affiliated with UC.

Your enrollment in an individual medical plan through Via Benefits is paired with a Health Reimbursement Account , with a maximum annual contribution from UC of $3,000 per person. In many cases, the HRA funds provided by UC will cover the cost of the premiums as well as some additional out-of-pocket health care costs . Any costs above $3,000 are the enrollees responsibility and subject to the plans out-of-pocket limits.

Retirees must enroll through Via Benefits if all conditions below apply:

- You have a non-California home address on file

- You are eligible for UC retiree health insurance and receive a monthly retirement benefit

- All family members you cover by UC health insurance are at least 65 years old and eligible for Medicare.

Is There A Premium For Part B

Yes, and it tends to increase from year to year. For most enrollees, the 2022 Part B premium is $170.10/month.

The fairly significant increase in Part B premiums for 2022 is due to a variety of factors, including costs associated with COVID-19, the legislation that had limited Part B premiums for 2021 , and anticipated additional costs associated with infusion drugs that are administered in a clinic setting and covered under Part B.

Medicare Part B premiums can be covered by Medicaid if the beneficiary is eligible for both programs. And high-income enrollees pay more than the standard premiums for Part B.

Hold harmless provision limits Part B premium increases when Social Security COLA is small

Medicare Part B premiums for most enrollees are deducted from their Social Security checks. But theres a hold harmless rule that prevents net Social Security checks from declining from one year to the next, unless the person has an income of $91,000 or more .

So if the Part B premium increases by more than an enrollees Social Security cost of living adjustment , the persons Part B premium will be adjusted, and will end up being less than the standard amount.

As described below, however, that has not always been the case in recent years.

Small COLA in 2017 meant most enrollees paid less than the standard Part B premium

In 2018, most enrollees were still paying slightly less than the standard Part B premium

Most enrollees were paying the standard Part B premium by 2019

Don’t Miss: What Medicare Supplement Covers Hearing Aids

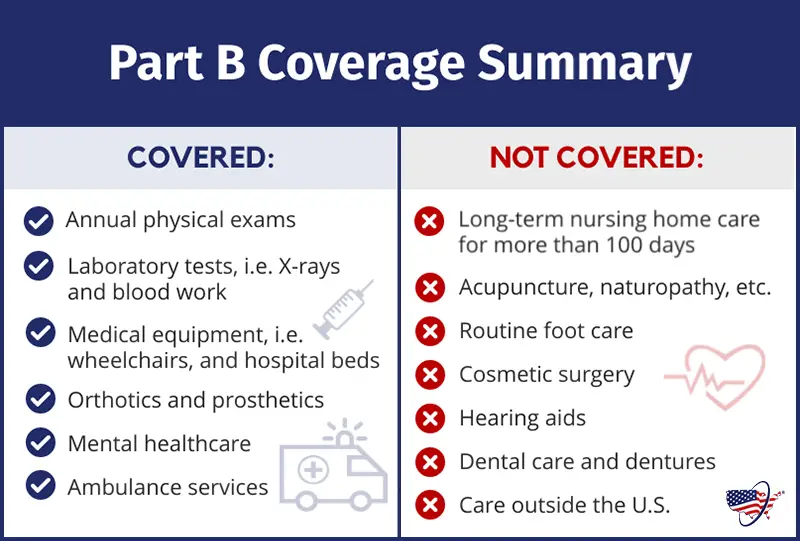

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

How Do Ucs Medicare Plans Work With Medicare

UC sponsors five Medicare plans for eligible retirees who live in California, and they work in different ways to increase your coverage over the standard 80% usually covered by Medicare.

Kaiser Permanente Senior Advantage and UC Medicare Choice are Medicare Advantage plans . The insurance company that offers the Medicare Advantage plan receives a set amount from Medicare to pay for and manage your care you pay a set copay for some services. Youll work directly with your physician and the plan if you have questions about whether a certain service or medication will be covered.

UC may refund a portion of the Part B premium you pay to Medicare if UCs contribution to your retiree medical benefits is more than the total cost of your premium. Youll see the exact amount on your retiree benefit statement under Medicare Part B Reimbursement.

UC High Option Supplement to Medicare, UC Medicare PPO and UC Medicare PPO without Prescription Drugs are Medicare Supplement plans your care is governed by Medicares rules. When you receive services, your provider submits claims to Medicare first, and then your claims are forwarded to your plan to cover even more of your costs.

Recommended Reading: How To Prevent Medicare Fraud

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrig’s disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If you’re eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you don’t sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didn’t enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicare’s website to find out more.

Should I Delay Part B Enrollment

If you have health insurance through your current employer, or through your spouses current employer, you may want to delay enrollment in Part B. Youll need to check with your employer or HR department to make sure that your employer-sponsored coverage will pick up where Medicare A leaves off, but assuming it does, you may want to delay enrolling in Medicare Part B, since it has a premium.

This article explains more about what you need to know before making the decision to delay Part B.

Coverage under a current employers plan allows you to delay Part B without a penalty

As long as you enroll in Part B either while you are still employed, or within eight months of the end of employment, youll be able to enroll in Part B without any penalty. This is regardless of what time of year it is, and regardless of how long ago you turned 65.

COBRA does not count as employer-sponsored coverage for the purpose of delaying Part B enrollment

If your employment ends, you may be eligible to continue your employer-sponsored coverage via COBRA. But coverage under COBRA does not have the same protections as far as access to Part B and the ability to enroll without a penalty. Once your employment ends, youve got eight months to sign up for Part B . You can have COBRA coverage during those eight months if you wish. But once its been more than eight months since your employment ended, you no longer have open access to Medicare Part B, even if youre still covered under COBRA.

Don’t Miss: What Is The Current Cost Of Medicare